3Sisters Shark Tank India Episode Review

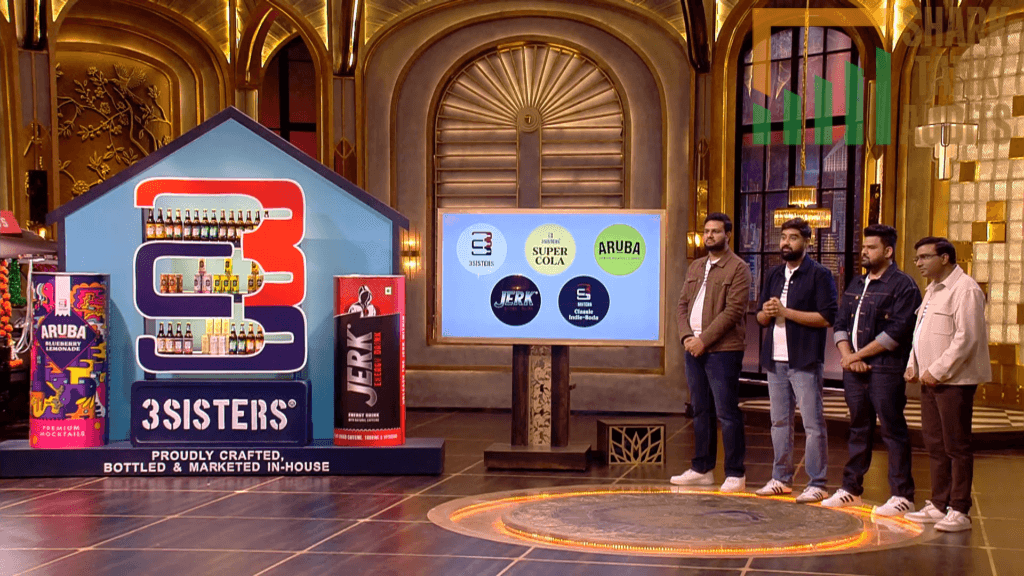

3Sisters appeared on Shark Tank India Season 5, Episode 30, with four Mumbai-based founders—Manish Kanunga (Chemical Engineer, product development), Akshay Solanki (CA, strategy), Nimish Solanki (CA, marketing), and Sanjay Prasad Bari (product crafter with “rags-to-riches” story moving from Benaras to Mumbai driving autorickshaw before building massive manufacturing plant from single soda stall impressing Sharks), seeking ₹3 Crore for 2.5% equity (₹120 Crore valuation) but left with no deal after all five Sharks opted out citing lack of focus and quality concerns.

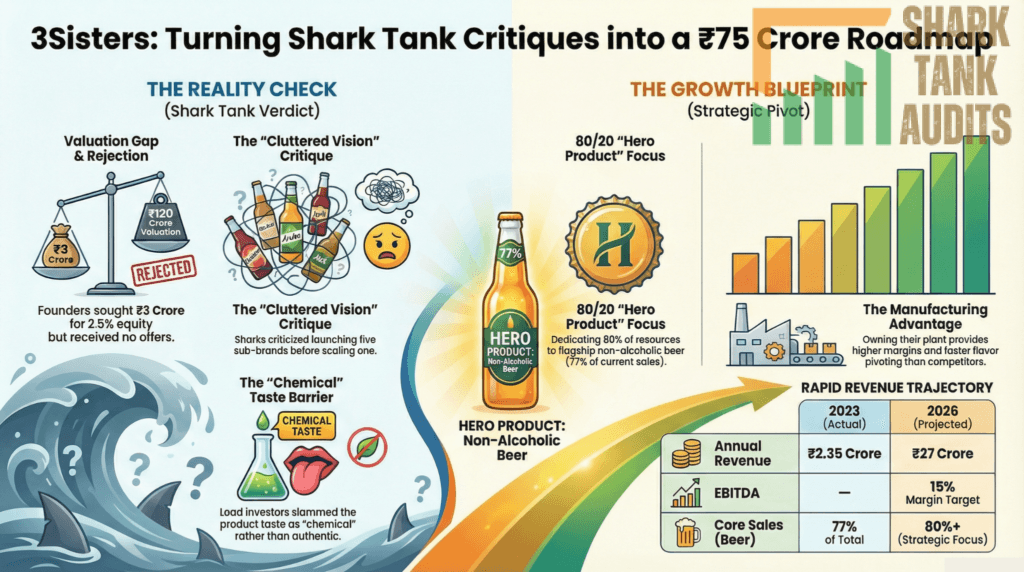

Incorporated 2021, the new-age beverage company targets “sober curious” Indian youth through non-alcoholic drinks (77% sales from non-alcoholic beers at ₹80/bottle under flagship brand Sanskari alongside sub-brands Aruba/Jerk/Super Cola) also offering Indie Soda (8%), Aruba Mocktails (10%), Jerk Energy Drink (4%), and Super Cola (1%), growing from ₹2.35 Crore (FY 23) to projected ₹27 Crore (FY 26) with ₹11.89 Crore revenue and positive ₹86 lakh EBITDA with 9,089 monthly organic visitors. Sharks reacted harshly—Namita slammed taste as “chemical” versus authentic, Varun/Viraj criticized “cluttered” vision launching too many sub-brands before scaling hero product, Vineeta labeled consumer brand a “distraction” from more successful manufacturing roots, and Kunal noted while team disciplined they lacked “laser focus” required for high-stakes investment.

Operating in Indian non-alcoholic beverage market valued at $34.71 billion (2025) growing 7.94% CAGR through 2034 with LNA (Low/No Alcohol) category seeing 10% annual growth within $700 million-$1.2 billion non-alcoholic beer/premium indie soda segment, 3Sisters targets Gen Z/millennials (21-35) in Tier 1/2 cities (Delhi NCR/Mumbai/Bangalore/Pune 30% market share)—50% college graduates with high disposable income prioritizing premiumization—who are health-conscious enjoying social drinking “ritual” without hangovers/high calories (43% seeking low-calorie beer per Mintel) amid 49% Gen Z reporting reducing alcohol as primary health goal, owning manufacturing plant providing better margins versus outsourcing competitors, planning “Hero Product” focus dedicating 80% resources to non-alcoholic beer line with clean label reformulation removing artificial aftertastes toward natural/Ayurvedic infusions (Ashwagandha-infused mixers), and ₹250-300 Crore Series A valuation target achieving ₹75+ Crore revenue with 15% EBITDA margin.

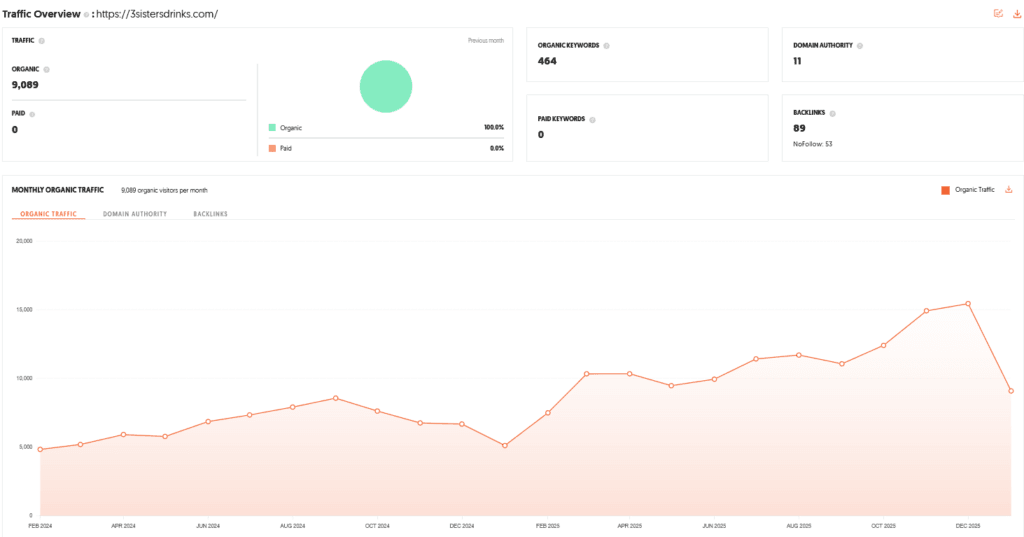

Website Information

- Website:- 3Sisters

- Build on Shopify

- Good SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 9089 visitors per month.

The Founders of 3 Sisters

- The 3Sisters leadership team consists of four Mumbai-based entrepreneurs: Manish Kanunga (a Chemical Engineer overseeing product development), Akshay Solanki (a CA focusing on strategy), Nimish Solanki (a CA handling marketing), and Sanjay Prasad Bari (the product crafter).

- A standout moment in the pitch was Sanjay’s “rags-to-riches” story; he moved from Benaras to Mumbai, drove an autorickshaw, and eventually built a massive manufacturing plant from a single soda stall, which impressed the Sharks.

Brand Overview of 3Sisters

- 3Sisters is a new-age beverage company specializing in the non-alcoholic drink market.

- Based in Mumbai and incorporated in 2021, the brand targets the “sober curious” youth of India.

- While the name suggested a female-led enterprise to the Sharks, the brand is actually managed by the four male co-founders.

- They operate under the flagship brand name Sanskari, alongside other sub-brands like Aruba, Jerk, and Super Cola.

Shark Tank India Appearance & Ask for 3Sisters

- The founders appeared in Season 5, Episode 30, seeking an investment of ₹3 Crore for 2.5% equity, valuing 3Sisters at a significant ₹120 Crore.

- They presented their vision of social drinking without the hangover, pitching their products as a lifestyle choice for health-conscious consumers and social gatherings.

Season and Episode Air Date

- Season: 05

- Episode: 30

- Episode Air Date: Friday, 13 February, 2026

Product Overview of 3Sisters

- The 3 Sisters product line is centered around non-alcoholic beers, which account for 77% of their sales. Their portfolio also includes:

- Indie Soda (8% of sales)

- Aruba Mocktails (10% of sales)

- Jerk Energy Drink (4% of sales)

- Super Cola (1% of sales) The beverages are priced at approximately ₹80 per bottle and are marketed as carbonated refreshments that replicate beer and soda profiles without alcohol content.

Investor Reactions to 3Sisters

- The Sharks were highly critical of the brand’s execution. Namita Thapar slammed the taste, stating it felt “chemical” rather than authentic.

- Varun Alagh and Viraj Bahl criticized the “cluttered” vision, arguing that the founders launched too many sub-brands before scaling their hero product.

- Vineeta Singh labeled the consumer brand a “distraction” from their more successful manufacturing roots, while Kunal Bahl noted that while the team was disciplined, they lacked the “laser focus” required for a high-stakes investment.

Customer Engagement Philosophy of 3Sisters

- 3Sisters focuses on “occasion-based consumption.”

- Their philosophy is to provide inclusive beverage experiences for younger consumers who want to participate in social rituals (like drinking beer) without the negative health effects of alcohol.

- They aim to bridge the gap between traditional soft drinks and alcoholic beverages through “flavor innovation.”

Product Highlights of 3Sisters

- Rapid Revenue Growth: Sales jumped from ₹2.35 Crore (FY 23) to a projected ₹27 Crore (FY 26).

- Manufacturing Prowess: The founders own their manufacturing plant, which serves as a “cash cow” to subsidize the brand.

- Market Traction: The brand has established a presence across e-commerce, modern retail, and hospitality sectors, showing strong momentum in urban markets.

Future Vision for 3Sisters

- The future vision for 3Sisters involves scaling their retail distribution across multiple Indian locations.

- However, the Sharks advised a “less is more” strategy.

- To succeed, the brand needs to refine its identity, potentially pivoting to focus solely on its high-performing non-alcoholic beer line or its manufacturing strengths, rather than spreading resources thin across multiple underperforming soda variants.

Deal Finalized or Not for 3Sisters

- No deal was finalized.

- Despite the impressive growth figures and the founders’ hard-working backgrounds, 3Sisters walked away without an offer.

- All five Sharks opted out, citing concerns over the brand’s lack of focus and the quality of the product.

| Parameter | Details |

|---|---|

| Website | 3Sisters |

| Platform | Shopify |

| SEO Performance | Good (Needs Improvement) |

| Organic Traffic | 9,089 visitors per month |

| Founded | 2021 |

| Headquarters | Mumbai, India |

| Industry | Non-Alcoholic Beverages / FMCG |

| Core Brand | Sanskari |

| Sub-Brands | Aruba, Jerk, Super Cola |

| Founding Team | Manish Kanunga (Chemical Engineer – Product), Akshay Solanki (CA – Strategy), Nimish Solanki (CA – Marketing), Sanjay Prasad Bari (Manufacturing & Operations) |

| Founder Story Highlight | Sanjay Prasad Bari – From autorickshaw driver to large-scale beverage manufacturer |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 30 |

| Initial Ask | ₹3 Crore for 2.5% Equity |

| Initial Valuation | ₹120 Crore |

| Pitch Theme | Social drinking without alcohol / “Sober Curious” lifestyle |

| Deal Outcome | ❌ No Deal |

| Reason for No Deal | Lack of focus, taste concerns, brand clutter |

| Shark Feedback – Taste | Namita Thapar criticized chemical taste |

| Shark Feedback – Strategy | Varun Alagh & Viraj Bahl flagged brand clutter |

| Shark Feedback – Focus | Vineeta Singh called brand a distraction |

| Shark Feedback – Execution | Kunal Bahl noted lack of laser focus |

| Core Product | Non-Alcoholic Beer |

| Product Revenue Split | Non-Alcoholic Beer (77%), Indie Soda (8%), Aruba Mocktails (10%), Jerk Energy (4%), Super Cola (1%) |

| Price Point | ~₹80 per bottle |

| Customer Philosophy | Occasion-based consumption (inclusive social drinking) |

| Target Consumer | Gen Z & Millennials (21–35 yrs) |

| Core Markets | Tier 1 & Tier 2 cities |

| FY23 Revenue | ₹2.35 Crore |

| FY26 Projected Revenue | ₹27 Crore |

| FY25 Revenue (Reported) | ₹11.89 Crore |

| EBITDA | ₹86 Lakh (Positive) |

| Manufacturing Model | Fully in-house owned plant |

| Key Advantage 1 | Strong manufacturing margins |

| Key Advantage 2 | Financial discipline with positive EBITDA |

| Key Challenge 1 | Taste consistency & repeat purchase |

| Key Challenge 2 | Overextended brand portfolio |

| Market Trend | “Zero-Proof” & Sober-Curious Movement |

| Gen Z Insight | 49% reducing alcohol for health |

| Indian Beverage Market Size | $34.71B (2025) |

| Market CAGR | 7.94% till 2034 |

| LNA Category Growth | ~10% YoY |

| TAM | ~$35B |

| SAM | $700M – $1.2B |

| SOM (3-Year Target) | ₹150–250 Crore |

| Distribution Channels | Quick Commerce, Modern Trade, HoReCa |

| Export Opportunity | Middle East & UK (Indian diaspora) |

| Digital Strategy | SEO + Influencer-led Neostalgia |

| SEO Focus Keywords | “Best non-alcoholic beer India”, “Healthy party drinks” |

| Performance Marketing | Inventory-aware ads on Blinkit & Zepto |

| Strategic Advice by Sharks | Focus on hero product |

| Recommended Pivot | Non-Alcoholic Beer OR Manufacturing-first model |

| Clean Label Strategy | Reformulation to remove chemical aftertaste |

| Innovation Direction | Natural / Ayurvedic infusions |

| Phase 1 Goal | ₹35 Cr revenue, brand consolidation |

| Phase 2 Goal | 5,000+ retail touchpoints |

| Phase 3 Goal | ₹75+ Cr revenue, 15% EBITDA |

| Long-Term Vision | Series A at ₹250–300 Cr valuation |

3Sisters Shark Tank India Episode Review

1. Market Potential & Statistical Foundation for 3Sisters

India Business Potential for 3Sisters

- The Sober-Curious Surge: In 2026, India’s beverage landscape is dominated by “Zero-Proof Drinking.” Nearly 49% of Gen Z consumers report that reducing alcohol is a primary health goal.

- Economic Tailwinds: The Indian non-alcoholic beverage market is valued at approximately $34.71 Billion in 2025, projected to grow at a CAGR of 7.94% through 2034.

- Segment Growth: Functional and non-alcoholic beer segments are outpacing traditional sodas, with the LNA (Low/No Alcohol) category seeing a 10% annual growth rate.

Total Addressable Market (TAM) for 3Sisters

- TAM (Total Beverage Market): Estimated at $35 Billion (2025/26).

- SAM (Serviceable Addressable Market): The non-alcoholic beer and premium “Indie Soda” segment is valued at $700 Million to $1.2 Billion.

- SOM (Serviceable Obtainable Market): With 3Sisters’ current manufacturing prowess, capturing 3-5% of the premium urban non-alcoholic beer market (~₹150–250 Crore) is a realistic 3-year target.

2. Ideal Target Audience & Demographics for 3Sisters

3Sisters Core Customer Profile

- Demographic: Age 21–35 (Gen Z and Millennials).

- Location: Tier 1 and Tier 2 cities (Delhi NCR, Mumbai, Bangalore, and Pune account for 30% of market share).

- Education & Income: 50% are college graduates with high disposable income, prioritizing “premiumization” over mass-market brands.

- Psychographic: Health-conscious individuals who enjoy the “ritual” of social drinking but want to avoid hangovers and high calorie counts (Mintel data shows 43% seek low-calorie beer).

3. Marketing & Digital Strategy for 3Sisters

3Sisters Content & Digital Marketing

- The “Neostalgia” Strategy: Use social media to blend nostalgic soda flavors (Indie Soda) with modern health benefits.

- Influencer Collaboration: Partner with “Health & Nightlife” micro-influencers to showcase 3Sisters at parties, gym sessions, and work brunches.

- SEO & Web Optimization: * Current Stat: 9,089 organic visitors/month.

- Strategy: Target high-intent keywords like “best non-alcoholic beer India” and “healthy party mixers.” Improve Shopify UI/UX to decrease cart abandonment by 15%.

- Performance Marketing: Utilize “Inventory-Aware” ads on Meta and Google that only trigger when stock is available on Quick-Commerce (Blinkit/Zepto) in the user’s specific zip code.

3Sisters Distribution Strategy

- Hybrid Model: Leverage the 77% sales of non-alcoholic beer via Quick-Commerce for instant gratification and HoReCa (Hotels, Restaurants, Cafes) for brand discovery.

- Export Potential: Following Shark Viraj Bahl’s advice, export the “Indie Soda” line to markets with high Indian diasporas (Middle East/UK) where marketing costs are lower.

4. Strategic Analysis: Advantages & Challenges for 3Sisters

3Sisters Core Advantages

- In-House Manufacturing: Unlike competitors who outsource, 3Sisters owns its plant, providing better margins and the ability to pivot flavors rapidly.

- Financial Discipline: Achieving ₹11.89 Crore revenue with a positive EBITDA (₹86 Lakh) demonstrates rare operational efficiency in the D2C space.

3Sisters Business Challenges

- Brand Clutter: Operating four sub-brands (Aruba, Jerk, etc.) dilutes marketing spend and confuses consumers.

- Taste Perception: Addressing “chemical” taste feedback is critical for repeat purchases.

5. Success Roadmap & Valuation Growth for 3Sisters

Why 3Sisters Can Be Successful

The brand’s success is rooted in its Founders’ Resilience. Sanjay Prasad Bari’s manufacturing expertise combined with the CAs’ strategic financial planning ensures the business won’t burn through cash recklessly.

Mitigation & Future Vision for 3Sisters

- Strategy Shift: Adopt a “Hero Product” focus. Dedicate 80% of resources to the non-alcoholic beer line (77% of current sales) and 20% to experimental R&D.

- Clean Label Initiative: Reformulate to remove artificial aftertastes, moving toward “Natural/Ayurvedic” infusions (e.g., Ashwagandha-infused mixers) which are trending in 2026.

Roadmap to Increase 3Sisters Valuation

- Phase 1 (Year 1): Consolidate sub-brands under the 3Sisters master brand to build brand equity. Target ₹35 Crore revenue.

- Phase 2 (Year 2): Secure 5,000+ premium retail touchpoints and dominate the Quick-Commerce “Sober Curious” category.

- Phase 3 (Year 3): Achieve ₹75+ Crore revenue with a 15% EBITDA margin.

- Goal: Re-pitch for a Series A funding round at a ₹250–300 Crore valuation, backed by proven repeat-customer data and a lean product portfolio.

3Sisters Shark Tank India Episode Review