RIDEV Shark Tank India Episode Review

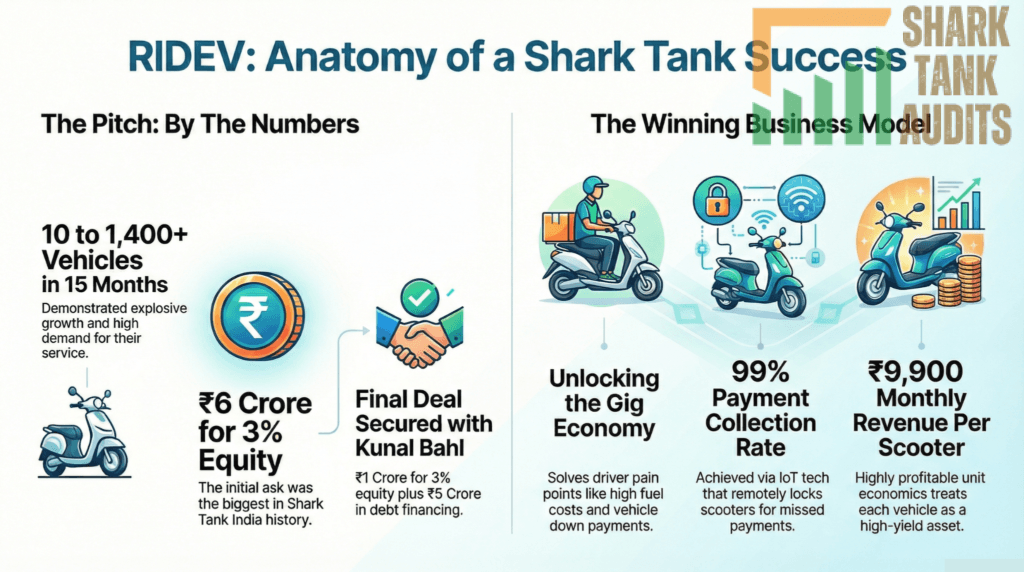

RIDEV EV appeared on Shark Tank India Season 5, Episode 10, with founders Manish Kumar Jain (CA, business growth expert) and Siddharth Jain seeking ₹6 Crore for 3% equity (₹200 Crore valuation, called “biggest ask in Shark Tank India history” by Vineeta) and successfully closed a deal for ₹1 Crore for 3% equity + ₹5 Crore debt at 14.5% interest with Shark Kunal Bahl. The Hyderabad-based startup provides full-stack EV leasing infrastructure targeting gig economy delivery partners (Swiggy, Zomato, Zepto) with commercial-grade electric scooters (₹1.2-1.3 lakh value) requiring only ₹3,000 deposit versus ₹20,000-30,000 traditional financing.

Growing from 10 to 1,400+ vehicles in 15 months with 80+ fast-charging stations, they generated ₹82 lakh net sales and ₹50 lakh EBITDA in September 2025 alone, with ₹9,900 monthly revenue per vehicle. Their strict ₹200 weekly rent model uses IoT remote locking for non-payment, achieving 99% collection rate and 99% vehicle return quality with 60% renewal rate. While Vineeta questioned harsh remote disabling and Namita worried about capital-intensive depreciating assets, Kunal saw high-yield asset management. Operating in India’s 13 million gig workers market with ₹45,000 Crore TAM by 2030, RIDEV offers 6x fuel savings (₹0.50/km vs ₹2.5-3.0/km petrol) targeting 4.5 million active delivery riders.

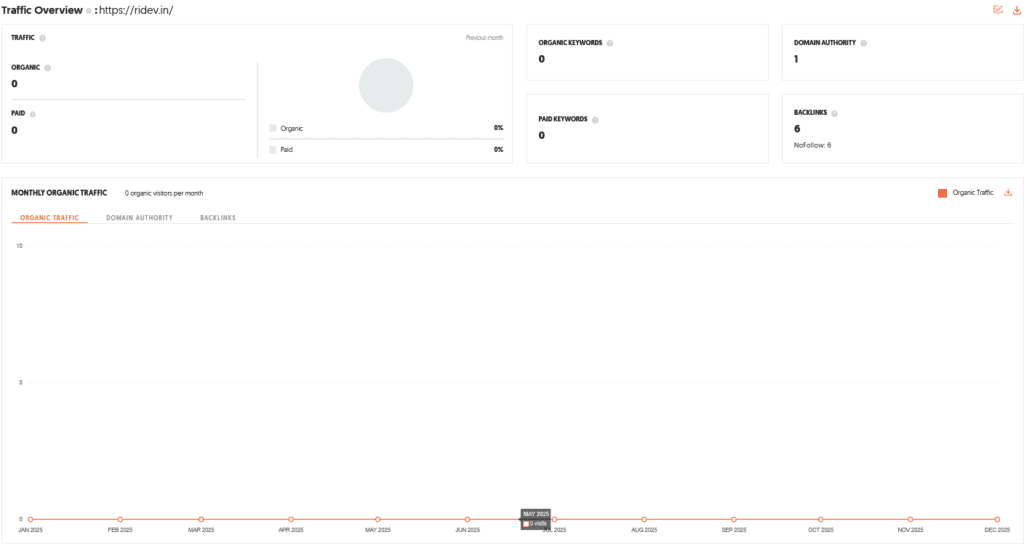

RIDEV Website Information

- Website:- RIDEV

- Build on CMS WordPress

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 0 visitor per month.

RIDEV Founders

- Manish Kumar Jain: A seasoned Chartered Accountant and entrepreneur with over a decade of experience in business growth. He is the primary visionary behind the “full-stack” EV leasing model.

- Siddharth Jain: Co-founder who oversees the operational scaling and management of the rapidly growing fleet. Together, they have grown the business from just 10 vehicles in mid-2024 to over 1,400 vehicles by late 2025.

RIDEV Brand Overview

- RIDEV Green Electric Vehicle is a Hyderabad-based startup that doesn’t just sell scooters; it provides a comprehensive infrastructure.

- brand targets the gig economy (delivery partners for Swiggy, Zomato, Zepto, etc.) who face barriers like high upfront costs, lack of documentation for loans, and high maintenance downtime.

- Their ecosystem includes a proprietary leasing platform and a network of 80+ fast-charging stations.

RIDEV Shark Tank India Appearance & Ask

- Initial Ask: ₹6 Crore for 3% Equity.

- Initial Valuation: ₹200 Crore.

- The Pitch: The founders showcased explosive growth, highlighting that their fleet generated ₹82 Lakh in net sales with a ₹50 Lakh EBITDA in the single month of September 2025.

RIDEV Season and Episode Air Date

- Season: 05

- Episode: 10

- Episode Air Date: Friday, 16 January 2026

RIDEV Product Overview

RIDEV provides branded, high-performance electric two-wheelers valued between ₹1.2 Lakh and ₹1.3 Lakh. These are “commercial-grade” scooters built for 10+ hours of daily use.

- Infrastructure: They have deployed 80+ fast-charging stations (setup cost approx. ₹70,000 each) to ensure riders have minimal “charging downtime,” which is critical for delivery professionals.

RIDEV Investor Reactions

- Vineeta Singh: Initially skeptical, she called the ₹6 Crore ask the “biggest in Shark Tank India history.” She also questioned if the “remote disabling” feature was too harsh for workers.

- Namita Thapar: Concerned about the capital-intensive nature of the business, noting that owning thousands of depreciating assets requires constant, massive infusions of cash.

- Kunal Bahl: Impressed by the unit economics—specifically that each vehicle generates roughly ₹9,900 in monthly revenue—he saw it as a high-yield asset-management play rather than just a “scooter company.”

RIDEV Customer Engagement Philosophy

RIDEV operates on a “Discipline-Driven Affordability” model:

- Accessibility: A worker can start their job with just a ₹3,000 deposit, compared to the ₹20,000–₹30,000 down payment usually required for vehicle financing.

- Strict Accountability: The ₹200 weekly rent is non-negotiable. Using IoT technology, the scooter is remotely locked if payment is missed. This ensures a 99% collection rate and maintains high vehicle quality.

RIDEV Product Highlights

- Scalability: From 10 to 1,400+ scooters in 15 months.

- Renewal Rate: 60% of riders choose to renew their lease weekly, showing high product-market fit.

- Asset Care: 99% of vehicles are returned in good condition, debunking fears of “rental abuse.”

- High Utilization: Integration with fast-charging hubs allows riders to stay on the road longer than those using standard home-charging EVs.

RIDEV Future Vision

- The founders aim to scale to tens of thousands of vehicles across major Indian metros.

- Their goal is to become the backbone of India’s carbon-free logistics sector, eventually transitioning from a leasing company to a massive data and energy infrastructure provider for the entire EV industry.

RIDEV Deal Finalized or Not

Yes, a deal was finalized. After intense debating over the high valuation and capital requirements, the founders accepted a structured offer from Shark Kunal Bahl.

- Final Deal: ₹1 Crore for 3% equity + ₹5 Crore in debt (at 14.5% interest).

- Impact: This deal provided the massive liquidity needed to purchase more assets while allowing the founders to retain more equity than a pure cash-for-equity deal would have required at a lower valuation.

| Item | Details |

|---|---|

| Website | RIDEV |

| Platform | Built on CMS WordPress |

| SEO Performance | Poor SEO performance, improvement needed |

| Organic Traffic | 0 visitors per month |

| Founder | Manish Kumar Jain |

| Co-Founder | Siddharth Jain |

| Founder Background | Chartered Accountant with 10+ years of business experience |

| Co-Founder Role | Handles operations and fleet scaling |

| Business Growth | Expanded from 10 vehicles to 1,400+ vehicles in 15 months |

| Brand Location | Hyderabad, India |

| Brand Category | Electric vehicle leasing and infrastructure |

| Business Model | Full-stack EV leasing for gig economy |

| Target Customers | Delivery partners of Swiggy, Zomato, Zepto, Amazon |

| Core Problem Solved | High upfront cost, loan access, maintenance downtime |

| Product Offering | Commercial-grade electric two-wheelers |

| Vehicle Price Range | ₹1.2–₹1.3 lakh per scooter |

| Usage Design | Built for 10+ hours of daily commercial use |

| Charging Infrastructure | 80+ fast-charging stations |

| Charging Setup Cost | Approx. ₹70,000 per station |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 10 |

| Episode Air Date | Friday, 16 January 2026 |

| Initial Investment Ask | ₹6 crore for 3% equity |

| Initial Valuation | ₹200 crore |

| Pitch Highlight | ₹82 lakh net sales in September 2025 |

| EBITDA Highlight | ₹50 lakh EBITDA in September 2025 |

| Vineeta Singh Feedback | Questioned large ask and remote lock feature |

| Namita Thapar Concern | Capital-intensive asset ownership |

| Kunal Bahl View | High-yield asset management business |

| Customer Philosophy | Discipline-driven affordability |

| Entry Deposit | ₹3,000 to start working |

| Weekly Rent | ₹200 per week |

| Payment Enforcement | Remote locking via IoT |

| Collection Rate | 99% payment collection |

| Renewal Rate | 60% weekly lease renewals |

| Asset Condition Return | 99% vehicles returned in good condition |

| Monthly Revenue per Vehicle | Approx. ₹9,900 |

| Utilization Advantage | Fast charging reduces rider downtime |

| Scalability Proof | Rapid fleet expansion |

| Core Differentiator | Integrated leasing + charging ecosystem |

| Future Vision | Backbone of carbon-free logistics |

| Long-Term Goal | Transition to data and energy infrastructure |

| Deal Status | Deal finalized |

| Final Deal Structure | ₹1 crore for 3% equity |

| Debt Component | ₹5 crore debt at 14.5% interest |

| Strategic Impact | Enabled asset expansion with limited dilution |

| Gig Economy Size | 13+ million workers in India |

| Quick-Commerce Growth | 32% CAGR |

| Operating Cost Advantage | EV cost < ₹0.50 per km |

| Petrol Cost Comparison | ₹2.5–₹3.0 per km |

| Government Scheme | PM E-DRIVE replacing FAME-II |

| Government Allocation | ₹10,000+ crore for EV adoption |

| Total Addressable Market | ₹45,000 crore EV leasing market |

| Serviceable Market | 4.5 million delivery riders |

| Obtainable Market Goal | 5–10% urban delivery fleet |

| Rider Age Group | 18–45 years |

| Monthly Income Profile | ₹15,000–₹35,000 |

| Key Rider Pain Points | Fuel cost, downtime, loan rejection |

| Marketing Strategy | Hyper-local Reels and YouTube content |

| SEO Strategy | Target EV rental intent keywords |

| B2B Marketing | LinkedIn logistics case studies |

| Distribution Model | Hub-and-spoke near dark stores |

| Infrastructure Expansion | 500+ charging stations by 2027 |

| Competitive Advantage | Low deposit and strict collections |

| Major Challenge | High capital intensity |

| Technology Risk | Battery degradation |

| Risk Mitigation | A-grade batteries with warranties |

| Financial Discipline Tool | IoT-based vehicle locking |

| Diversification Plan | Multiple white-label EV models |

| Phase 1 Goal | Grow fleet to 5,000 vehicles |

| Phase 2 Goal | Launch Energy-as-a-Service |

| Phase 3 Goal | Build credit scoring using IoT data |

| Valuation Target | ₹800–₹1,000 crore Series B |

RIDEV Shark Tank India Business Plan

1. RIDEV Business Potential in India: Facts & Data

- The Quick-Commerce Boom: As of 2026, India’s gig economy has surpassed 13 million workers, with quick-commerce (Blinkit, Zepto, Swiggy Instamart) growing at a 32% CAGR.

- Fuel Cost Disparity: Traditional petrol scooters cost approx. ₹2.5–₹3.0 per km to operate, while RIDEV scooters operate at less than ₹0.50 per km, offering a 6x saving for high-mileage delivery partners.

- Government Support: The PM E-DRIVE scheme (replacing FAME-II) has allocated over ₹10,000 Crore specifically for commercial EV adoption and charging infrastructure, directly benefiting RIDEV’s asset-heavy model.

2. RIDEV Total Addressable Market (TAM): Facts & Data

- Total Addressable Market (TAM): Estimated at ₹45,000 Crore ($5.4 Billion) by 2030 for EV leasing in India.

- Serviceable Addressable Market (SAM): The 2-wheeler commercial delivery segment, currently comprising 4.5 million active daily riders across Tier-1 and Tier-2 cities.

- Serviceable Obtainable Market (SOM): RIDEV aims to capture 5-10% of the urban delivery fleet market (approx. 250,000–500,000 vehicles) within the next 5 years.

3. RIDEV Ideal Target Audience & Demographics

- Primary Segment: Male and Female delivery partners (Aged 18–45) working for Zepto, Zomato, Swiggy, and Amazon.

- Economic Profile: Individuals with monthly earnings between ₹15,000 and ₹35,000 who lack the credit score or documentation required for traditional bank loans.

- Pain Points: High daily petrol costs (₹200–₹300/day), vehicle maintenance downtime, and high upfront down payments (₹20,000+).

4. RIDEV Marketing & Digital Strategy

- Hyper-Local Digital Strategy: Use YouTube and Instagram Reels featuring “Day in the Life” content of delivery partners saving ₹8,000/month using RIDEV, targeting users based on location (near delivery hubs).

- Search Engine Optimization (SEO): Transition the RIDEV Shopify store from 0 organic traffic by targeting high-intent keywords like “EV scooter for rent in Hyderabad” and “Electric scooter on weekly rent.”

- B2B Content: Create LinkedIn case studies for logistics companies showing how RIDEV reduces their “Last Mile” carbon footprint and operational costs.

5. RIDEV Distribution & Infrastructure Strategy

- Hub-and-Spoke Model: Establishing RIDEV Experience Centers near major dark stores (Zepto/Blinkit warehouses) for easy vehicle pickup and maintenance.

- Energy Network: Scaling the current 80+ fast-charging stations to 500+ by 2027 to eliminate “range anxiety” for commercial riders.

6. RIDEV Advantages & Challenges

| RIDEV Advantages | RIDEV Challenges |

| Low Barrier to Entry: Only ₹3,000 deposit vs. ₹25,000 for competitors. | Capital Intensity: High cost of owning assets (₹1.2L per scooter). |

| Unit Economics: ₹9,900 monthly revenue per bike is highly lucrative. | Regulatory Shifts: Frequent changes in GST or EV subsidies. |

| Tech-Lock: Remote disabling ensures nearly 100% payment collection. | Battery Degradation: Long-term risk of high-usage battery failure. |

7. RIDEV Mitigation & Success Strategies

- Mitigation of Asset Risk: Use the ₹5 Crore debt from Shark Kunal Bahl to finance only “A-grade” battery tech with 3-year warranties.

- Financial Discipline: Maintaining the strict remote-lock feature to prevent bad debts, a strategy that has already yielded a 99% collection rate.

- Diversification: Reducing dependence on a single manufacturer by white-labeling multiple durable EV models under the RIDEV brand.

8. RIDEV Future Business Roadmap & Valuation Growth

- Phase 1 (2026): Deploy Shark Tank funds to grow from 1,400 to 5,000 vehicles in Hyderabad and Bangalore.

- Phase 2 (2027): Launch RIDEV Energy-as-a-Service, allowing non-RIDEV riders to use their fast-charging network for a fee.

- Phase 3 (2028): Transition to a Data-Driven Valuation. Use IoT data from millions of kilometers driven to provide “Credit Scoring” for delivery partners, creating a fintech layer.

- Valuation Target: By reaching a fleet size of 20,000 vehicles with 60% EBITDA margins, RIDEV can aim for a Series B valuation of ₹800–₹1,000 Crore.

RIDEV Shark Tank India Episode Review