Get Snappy Shark Tank India Episode Review

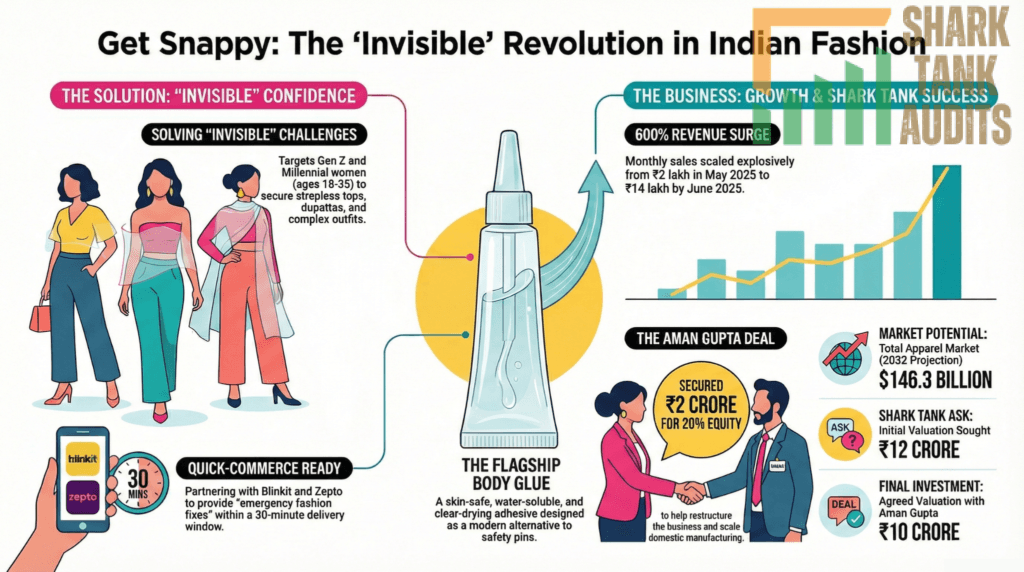

Get Snappy appeared on Shark Tank India Season 5, Episode 17, with founders Parikshit Batra, Jashanjot Singh Bindra, Dev Sharma (who also run Pure Flow Tape), and Harshita Joshi (met at Goa bar) seeking ₹60 lakh for 5% equity (₹12 Crore valuation) and successfully closed a deal for ₹2 Crore for 20% equity (₹10 Crore valuation) with Shark Aman Gupta after other Sharks declined.

The fashion-fix brand offers Snappy Body Glue—an all-purpose skin-safe, water-soluble, clear-drying adhesive keeping clothing/accessories in place as alternative to safety pins, scaling explosively from ₹2 lakh (May 2025) to ₹14 lakh (June 2025) maintaining ₹14-16 lakh monthly through September with 711 organic visitors. Pitching two brands simultaneously surprised Sharks—Namita disapproved of dual businesses questioning retention, Kunal viewed it as “product-selling” not sustainable brand, Mohit labeled it “dropshipping,” Anupam advised against being “opportunistic,” while Aman empathized with entrepreneurial “trial and error” offering restructuring help.

Operating in India’s $109.5 billion apparel market (2025) growing to $146.3 billion by 2032 (9% CAGR) within $35.92 billion BPC D2C market by 2032, Get Snappy targets Gen Z/millennial women (18-35) in Tier 1/2 cities addressing wardrobe malfunctions for strapless tops, dupattas, and complex outfits within 461 million urban dwellers, 16.8% rising female workforce, and $50 billion Indian wedding industry representing massive seasonal peaks.

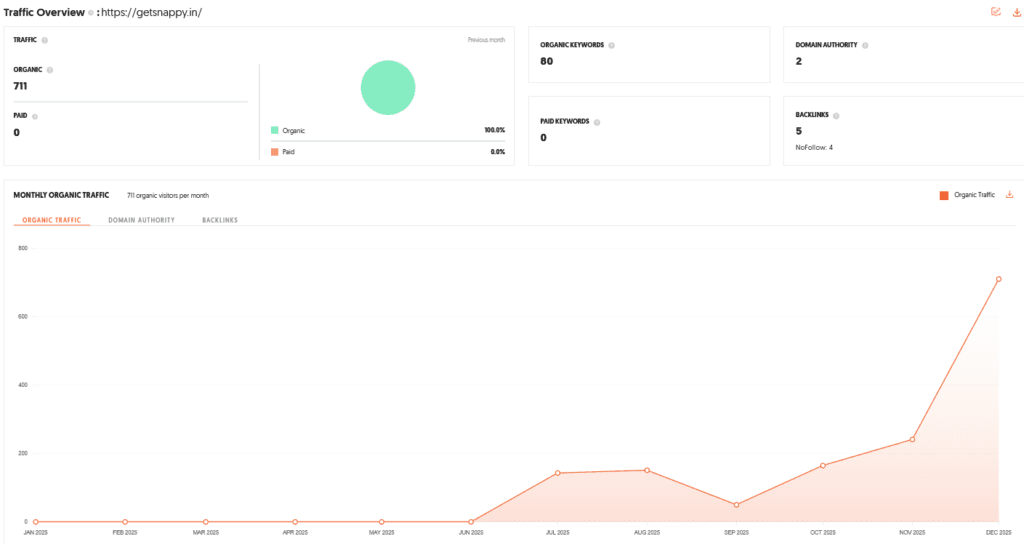

Website Information

- Website:- Get Snappy

- Build on Shopify

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 711 visitor per month.

Founders

- The brand was established by a team of four entrepreneurs: Parikshit Batra, Jashanjot Singh Bindra, Dev Sharma, and Harshita Joshi.

- Interestingly, the three male founders, who also run another brand called Pure Flow Tape. met Harshita at a bar in Goa.

- What began as a casual conversation evolved into a formal business partnership, leading to Harshita joining the team for this specific venture.

Brand Overview

- Get Snappy is an innovative Indian fashion-fix brand operating under the same parent company as Pure Flow Tape.

- The brand focuses on solving “invisible” wardrobe challenges that many people face but often ignore.

- It positions itself at the intersection of personal care and styling, aiming to provide confidence through simple, effective, and daring lifestyle solutions.

Shark Tank India Appearance & Ask

- The founders made a unique appearance by pitching two separate brands simultaneously.

- For Get Snappy, they initially requested Rs 60 lakhs for 5% equity, which placed the company’s valuation at Rs 12 crores.

- During the pitch, Harshita was kept on standby while the primary trio presented the dual-brand strategy, a move that surprised the Sharks and led Aman Gupta to remark on the unconventional nature of the presentation.

Season and Episode Air Date

- Season: 05

- Episode: 17

- Episode Air Date: Tuesday, 27 January 2026

Product Overview

- The flagship product is Snappy Body Glue, an all-purpose adhesive designed to keep clothing and accessories in place.

- It serves as a modern alternative to safety pins or traditional fashion tapes. The product is designed to be:

- Skin-Safe: Formulated for direct application on clean, dry skin.

- Long-Lasting: Engineered to provide a reliable hold for several hours.

- Water-Soluble: Easily removable with water, leaving no sticky residue behind.

- Clear-Drying: Maintains a seamless, invisible look once applied.

Investor Reactions

The reaction from the panel was largely skeptical due to the lack of “founder focus”:

- Namita Thapar: Disapproved of the founders running two businesses at once and questioned the customer retention rates.

- Kunal Bahl: Viewed the venture as a “product-selling” business rather than a long-term brand.

- Mohit: Backed out, labeling the business model as simple dropshipping.

- Anupam Mittal: Declined to invest, advising the founders to stop being opportunistic and focus on a single brand.

- Aman Gupta: Took a contrarian view, empathizing with the “trial and error” phase of entrepreneurship and offering to help fix the business structure.

Customer Engagement Philosophy

- Get Snappy follows a philosophy of practical problem-solving.

- The brand engages with its audience, primarily women, by addressing the anxiety associated with strapless tops, dupattas, and complex outfits.

- By offering a product that grants “freedom from wardrobe malfunctions,” the brand builds a relationship based on trust and functionality.

Product Highlights

- The brand demonstrated explosive financial growth in a very short period, highlighting strong market demand:

- Rapid Scaling: Sales jumped from Rs 2 Lakhs in May 2025 to Rs 14 Lakhs by June 2025.

- Steady Momentum: Maintained a consistent revenue stream of approximately Rs 14–16 Lakhs per month through September 2025.

- Market Need: The product successfully tapped into a niche for “fashion-fix” solutions that combine functionality with style.

Future Vision

- With the mentorship and investment from Aman Gupta, Get Snappy aims to transition from a high-growth “dropshipping” model to a structured, sustainable consumer brand.

- The long-term vision is to expand their portfolio of problem-solving products and eventually move toward domestic manufacturing in India, replicating the successful trajectory of major brands like Boat.

Deal Finalized or Not

- Yes, a deal was finalized.

- While the other Sharks declined, Aman Gupta saw potential in the business.

- After a round of negotiations and a counter-offer from the founders, a deal was locked with Shark Aman Gupta at Rs 2 crores for 20% equity, valuing the company at Rs 10 crores.

- This was a significant pivot from the original ask, providing the founders with more capital but at a higher equity cost.

| Parameter | Details |

|---|---|

| Website | Get Snappy |

| Website Platform | Built on Shopify |

| SEO Status | Poor SEO performance, improvement needed |

| Organic Traffic | 711 visitors per month |

| Founders | Parikshit Batra, Jashanjot Singh Bindra, Dev Sharma, Harshita Joshi |

| Founder Background | Three founders also run Pure Flow Tape |

| Origin Story | Founders met at a bar in Goa and formed a partnership |

| Brand Category | Fashion-fix and personal styling solutions |

| Brand Positioning | Solves invisible wardrobe and styling problems |

| Parent Company | Same parent company as Pure Flow Tape |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 17 |

| Episode Air Date | Tuesday, 27 January 2026 |

| Initial Ask | ₹60 Lakhs for 5% equity |

| Initial Valuation | ₹12 Crores |

| Deal Closed | Yes |

| Final Deal | ₹2 Crores for 20% equity |

| Final Valuation | ₹10 Crores |

| Investing Shark | Aman Gupta |

| Pitch Highlight | Two brands pitched simultaneously |

| Flagship Product | Snappy Body Glue |

| Product Type | Skin-safe fashion adhesive |

| Product Function | Keeps clothing and accessories in place |

| Alternative To | Safety pins and fashion tape |

| Skin Safety | Safe for direct skin application |

| Durability | Long-lasting hold for several hours |

| Removability | Water-soluble, no residue |

| Visual Finish | Clear-drying and invisible |

| Revenue Growth | ₹2 Lakhs (May 2025) to ₹14 Lakhs (June 2025) |

| Monthly Run Rate | ₹14–16 Lakhs per month |

| Market Segment | Indian fashion-fix and apparel accessories |

| Market Size | $109.5 Billion Indian apparel market (2025) |

| Growth Outlook | Market projected to reach $146.3 Billion by 2032 |

| Target Audience | Women aged 18–35 |

| Target Cities | Tier 1 and Tier 2 Indian cities |

| Key Use Cases | Strapless tops, dupattas, complex outfits |

| Customer Philosophy | Freedom from wardrobe malfunctions |

| Namita Thapar Feedback | Concerned about founder focus and retention |

| Kunal Bahl Feedback | Viewed as product-selling, not a brand |

| Mohit Feedback | Labeled business as dropshipping |

| Anupam Mittal Feedback | Warned against opportunistic approach |

| Aman Gupta View | Empathized with trial-and-error entrepreneurship |

| Competitive Advantage | First-mover in fashion-fix niche |

| Product Benefit | Solves high-friction styling problems |

| Business Challenge | High CAC and dropshipping perception |

| Distribution Model | Direct-to-consumer and marketplaces |

| Marketplace Strategy | Nykaa, Myntra, Amazon |

| Quick-Commerce Plan | Blinkit and Zepto partnerships |

| Marketing Strategy | Influencer-led fashion demonstrations |

| SEO Strategy | Target long-tail fashion-fix keywords |

| Future Vision | Transition to structured consumer brand |

| Manufacturing Plan | Move toward Make in India |

| Roadmap Phase 1 | Stabilize supply chain and scale revenue |

| Roadmap Phase 2 | Launch styling kits |

| Roadmap Phase 3 | 100% domestic manufacturing |

| Valuation Goal | ₹100 Crore valuation in future rounds |

Get Snappy Shark Tank India Business Plan

1. Get Snappy: Business Potential in India

- The Indian apparel market is valued at approximately $109.5 Billion in 2025, with the personal accessories and fashion-fix segment growing at a CAGR of 9%.

- Fact: India is witnessing a “Fashion-Fix” revolution as Western wear adoption increases by 15% annually.

- Stat: The Beauty and Personal Care (BPC) D2C market is expected to reach $35.92 Billion by 2032, providing a massive tailwind for Get Snappy.

- Data: Urbanization (461 million city dwellers) and a rising female workforce (up 16.8% in 2023) create a consistent demand for “fail-proof” styling solutions like Get Snappy.

2. Get Snappy: Total Addressable Market (TAM)

- TAM: The overall Indian apparel and fashion accessories market, projected to reach $146.3 Billion by 2032.

- SAM (Serviceable Addressable Market): The $2.5 Billion Indian adhesive and fashion-tape niche within the urban D2C BPC sector.

- SOM (Serviceable Obtainable Market): Targeting 5-7% of the urban Gen Z and Millennial women population who shop online for premium styling products, representing an immediate opportunity for Get Snappy to hit ₹50+ Crores in annual revenue.

3. Get Snappy: Ideal Target Audience and Demographics

- Primary Demographic: Women aged 18–35 (Gen Z and Millennials) residing in Tier 1 and Tier 2 cities (Mumbai, Delhi, Bangalore, etc.).

- Psychographics: Fashion-conscious individuals, influencers, and working professionals who prioritize “seamless” looks and convenience.

- User Behavior: Frequent shoppers on Myntra and Nykaa who value “social currency” and are willing to pay for “micro-luxuries” that solve specific pain points.

- Events: Brides, bridesmaids, and attendees of the $50 Billion Indian wedding industry represent a seasonal but massive peak for Get Snappy.

4. Get Snappy: Marketing & Content Strategy

- Get Snappy Content Strategy: Focus on “Problem-Agitation-Solution” videos. Short-form Reels showing the “Before vs. After” of using Body Glue with backless dresses or heavy dupattas.

- Get Snappy Influencer Strategy: Partner with “GRWM” (Get Ready With Me) creators and fashion stylists who can demonstrate the product’s skin-safety and invisibility.

- Get Snappy Performance Marketing: Use Meta and Google Ads targeting “Occasion Wear” and “Wedding Fashion” keywords to drive high-intent traffic.

5. Get Snappy: Digital Marketing & SEO Strategy

- Get Snappy SEO Overhaul: Transitioning from 711 monthly visitors to 50k+ by targeting long-tail keywords like “best body glue for strapless dresses” and “how to fix falling straps.”

- Get Snappy Shopify Optimization: Improving site load speed and mobile UI to reduce bounce rates.

- Get Snappy Social Commerce: Integrating Instagram Shopping and YouTube “Product Tags” to enable 1-click purchases directly from viral videos.

6. Get Snappy: Distribution Strategy

- D2C Excellence: Using the Get Snappy Shopify store as the primary hub for first-party data.

- Marketplace Expansion: Rapid listing on Nykaa, Myntra, and Amazon to leverage their existing trust and logistics.

- Quick-Commerce (Q-Comm): Partnering with Blinkit and Zepto for “Emergency Fashion Fixes”—targeting the 30-minute delivery window for party-goers who need Get Snappy instantly.

7. Get Snappy: Advantages & Challenges

- Get Snappy Advantages: First-mover advantage in a niche category, strong skin-safe formulation (water-soluble/clear-drying), and high gross margins.

- Get Snappy Challenges: High customer acquisition cost (CAC) in the BPC segment, the “dropshipping” perception by critics, and the need for constant consumer education.

8. Get Snappy: Success Factors & Mitigation Strategies

- Reason for Success: The product solves a high-friction problem (wardrobe malfunctions) with a low-cost, high-impact solution.

- Mitigation Strategy (Focus): To counter the “dual-brand” concern, the founders must create a shared backend (logistics/HR) while keeping Get Snappy‘s front-facing brand identity distinct and specialized.

- Mitigation Strategy (Retention): Launching subscription models and “travel-sized” variants to increase the Repeat Purchase Rate (RPR).

9. Get Snappy: Future Business Roadmap & Valuation

- Phase 1 (Year 1): Stabilize supply chain and achieve ₹20 Lakhs/month run rate with Aman Gupta’s mentorship.

- Phase 2 (Year 2): Launch Get Snappy “Styling Kits” (Glue + Tape + Pasties) to increase Average Order Value (AOV).

- Phase 3 (Year 3): Transition to 100% “Make in India” to improve margins and supply chain control.

- Roadmap to ₹100Cr Valuation: Achieving a ₹2.5Cr+ monthly revenue with a healthy 25% EBITDA margin will allow Get Snappy to command a 4x–5x revenue multiple for the next funding round.

Get Snappy Shark Tank India Episode Review