Local All Natural Soda Shark Tank India Episode Review

Local All Natural Soda appeared on Shark Tank India Season 5, Episode 27, with husband-wife founders Zomawii Khiangte (returned to Mizoram from US in 2016) and Felipe Rodriguez seeking ₹50 lakh for 2% equity (₹25 Crore valuation) but left with no deal after declining Mohit Yadav’s revised offer of ₹1 Crore for 25% equity (₹4 Crore valuation, initially offered ₹1 Crore for 33%) citing excessive equity dilution misaligned with strategic goals.

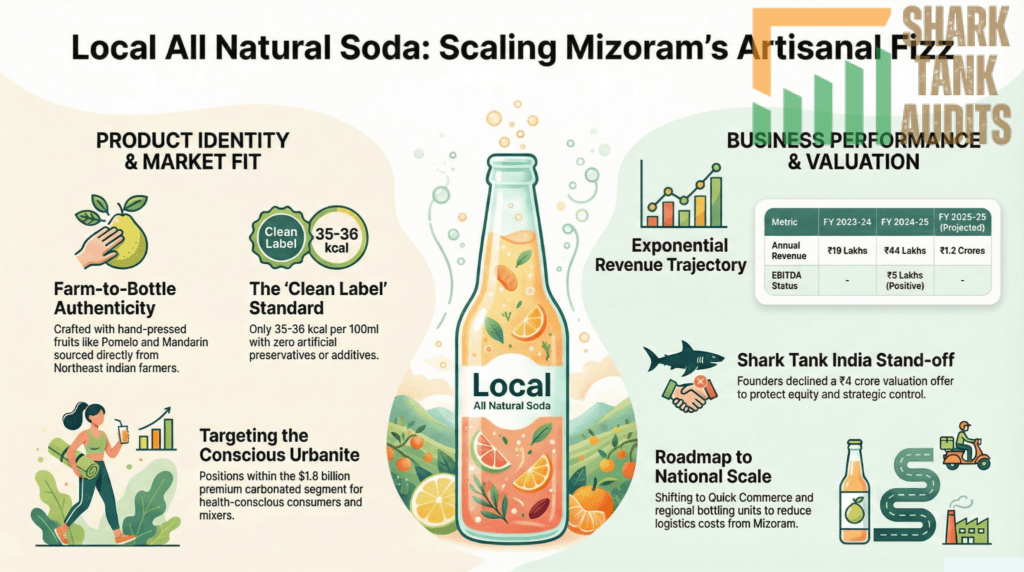

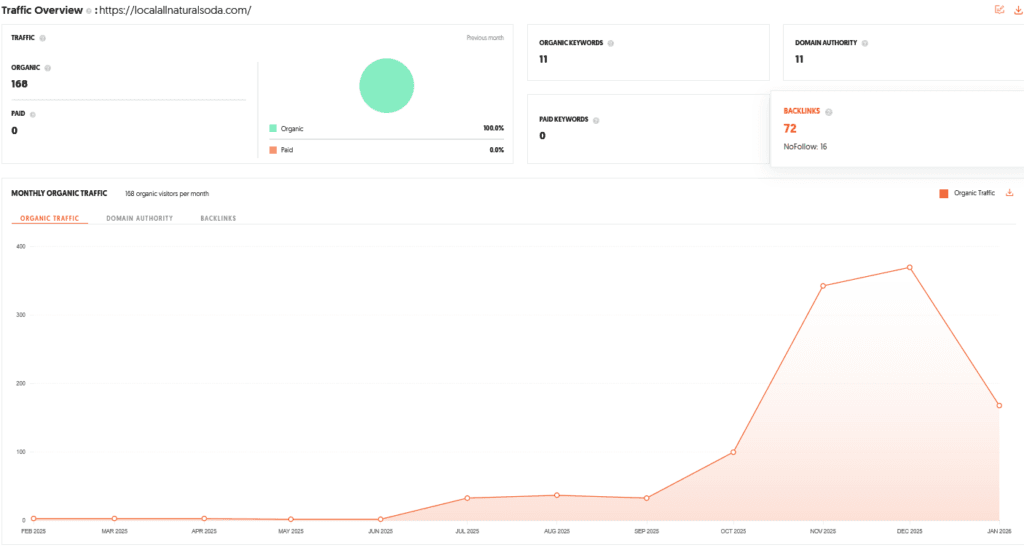

The Mizoram-rooted farm-to-bottle craft beverage company (established 2021 under Tui Bon Natural Private Limited after initial venture Local Beer closed due to regulatory shifts) offers artisanal sodas with regional flavors (Pomelo, Ginger Ale, Mandarin Orange) at ₹120/bottle featuring 35-36 kcal per 100ml using hand-pressed fruits from Northeast farmers with no artificial preservatives/additives, growing from ₹19 lakh (FY 23-24) to ₹44 lakh (FY 24-25) projecting ₹1.2 Crore (FY 25-26) achieving ₹5 lakh EBITDA positivity YTD with 168 monthly organic visitors requiring SEO improvement. Sharks reacted critically—Anupam praised quality but cited fragmented distribution suggesting Quick Commerce focus, Aman doubted high ₹120 price point lacking “investor-founder fit,” Kanika unconvinced by aggressive expansion drive, Kunal advised bringing more distribution energy, while Mohit appreciated journey offering “third partner” role though equity requirements too steep.

Operating in Indian non-alcoholic beverage market valued at $34.71 billion (2025) projected to reach $69.04 billion by 2034 (7.94% CAGR) with soft drink market at $11.7 billion (2025) and premium/health-conscious carbonated segment at $1.8 billion (artisanal/craft sodas fastest-growing sub-sector), Local targets “Conscious Urbanites” (22-40, Tier 1 cities) valuing “Origin Stories,” supporting “Vocal for Local,” and prioritizing health over cost—socialites using craft soda as premium spirit mixers and fitness enthusiasts seeking 35-kcal refreshment—within 70% urban Indian consumers preferring “Clean Label” drinks, planning regional bottling/co-packing units to reduce Mizoram transport costs and product expansion (Local Zero sugar-free, functional sodas with vitamins/electrolytes) positioning for potential FMCG giant acquisition (Tata Consumer Products/Coca-Cola).

Website Information

- Website:- Local All Natural Soda

- Build on JavaScript frameworks React

- Poor SEO Performance, SEO Improvement needed.

- ORGANIC TRAFFIC: 168 visitors per month.

The Founders of Local All Natural Soda

- Local All Natural Soda was established by the husband-and-wife duo Zomawii Khiangte and Felipe Rodriguez (also referred to as Phillipe Rodrigue).

- Zomawii returned to Mizoram from the United States in 2016 with a vision to build a local business.

- After their initial venture, Local Beer, was forced to close due to regulatory shifts, they pivoted in 2021 to create Tui Bon Natural Private Limited, the corporate entity behind their artisanal beverage brand.

Brand Overview of Local All Natural Soda

- Rooted in Mizoram, Local All Natural Soda is a farm-to-bottle craft beverage company dedicated to honoring the agricultural heritage of Northeast India.

- The brand focuses on creating premium, fizzy drinks using real fruit juices and indigenous ingredients.

- By avoiding artificial preservatives and high sugar content, the brand positions itself as a healthy, sophisticated alternative to mass-market soft drinks.

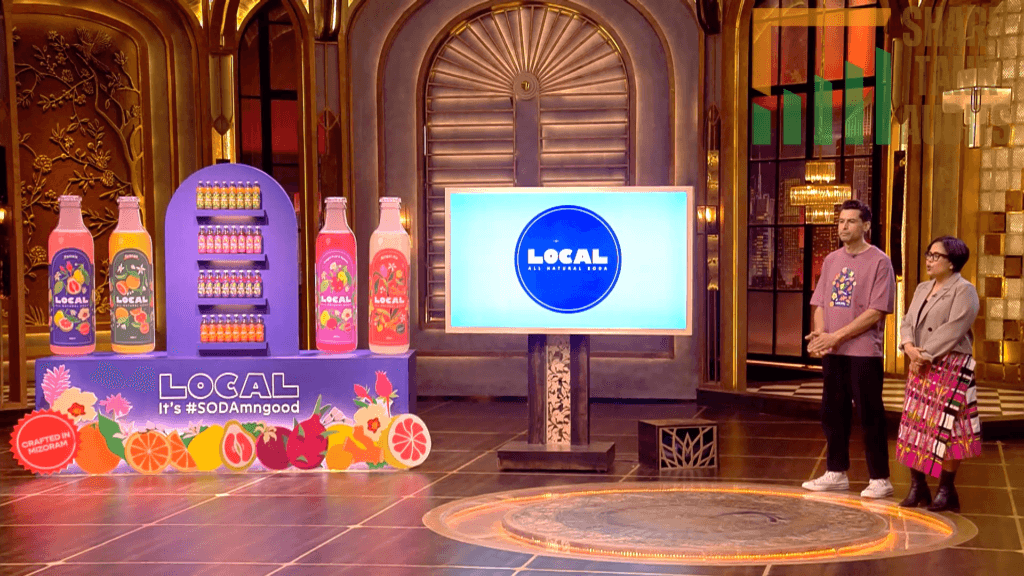

Shark Tank India Appearance and Ask for Local All Natural Soda

- The founders appeared on Shark Tank India Season 5, Episode 27, presenting a pitch centered on authenticity and mission-driven entrepreneurship.

- They highlighted their transition from high-level international careers to building a sustainable business in Mizoram.

- The founders of Local All Natural Soda initially asked for ₹50 Lakhs in exchange for 2% equity, valuing the company at ₹25 Crores.

Season and Episode Air Date

- Season: 05

- Episode: 27

- Episode Air Date: Tuesday, 10 February, 2026

Product Overview of Local All Natural Soda

- Local All Natural Soda offers a range of artisanal sodas featuring unique regional flavors such as Pomelo, Ginger Ale, and Mandarin Orange.

- Each bottle contains approximately 35-36 kcal per 100ml, emphasizing a low-sugar profile.

- The products are crafted using fresh, hand-pressed fruits sourced directly from Northeast Indian farmers, ensuring a “clean label” with no artificial additives.

Investor Reactions to Local All Natural Soda

The Sharks had mixed reactions regarding the scalability and financial health of Local All Natural Soda:

- Anupam Mittal: Praised the product quality but expressed concern over the fragmented distribution channels, suggesting a focus on Quick Commerce.

- Aman Gupta: Doubted the high price point (₹120/bottle) and felt there wasn’t a strong “investor-founder fit.”

- Kanika Mann: Was not convinced by the founders’ aggressive drive for expansion.

- Kunal Bahl: Advised the founders to bring more energy to their distribution strategy.

- Mohit Yadav: Appreciated the brand’s journey and offered to become a “third partner,” though his equity requirements were too steep for the founders.

Customer Engagement Philosophy of Local All Natural Soda

- The core philosophy of Local All Natural Soda is built on cultural storytelling and transparency.

- They engage customers by positioning each bottle as a direct link to smallholder farmers in the Northeast.

- By eliminating intermediaries, they ensure traceability and appeal to the modern, health-conscious consumer who values ethical sourcing, sustainability, and genuine regional identity.

Product Highlights of Local All Natural Soda

- Farm-to-Bottle: Direct collaboration with indigenous farmers to reduce agricultural waste.

- Low Calorie: Only 35-36 kcal per 100ml, making it a “guilt-free” carbonated choice.

- Premium Pricing: Retails at ₹120 per bottle, targeting the HORECA (Hotels, Restaurants, Cafes) and high-end retail segments.

- Revenue Growth: Projected to jump to ₹1.2 Crores in FY 25-26 from ₹44 Lakhs in the previous year.

Future Vision for Local All Natural Soda

- The future vision for Local All Natural Soda involves leveraging the national exposure from Shark Tank India to increase market penetration in major urban hubs.

- The brand aims to optimize its unit economics and strengthen its retail alliances.

- By focusing on operational efficiency and expanding production, the founders intend to prove that a mission-driven, artisanal brand from Mizoram can successfully compete in the national beverage market.

Deal Finalized or Not for Local All Natural Soda

- No deal was finalized. Although Shark Mohit Yadav showed significant interest, the founders ultimately declined his offer.

- Mohit initially proposed ₹1 Crore for 33% equity and later revised it to ₹1 Crore for 25% equity (a ₹4 Crore valuation).

- The founders decided that the equity dilution was too high and did not align with their current strategic goals, choosing to maintain greater control over their company.

| Parameter | Details |

|---|---|

| Website | Local All Natural Soda Shark Tank India |

| Website Technology | Built on React (JavaScript framework) |

| SEO Status | Poor SEO performance – needs improvement |

| Organic Traffic | 168 visitors per month |

| Founders | Zomawii Khiangte & Felipe Rodriguez |

| Founder Background | Returned from the US in 2016 to build a business in Mizoram |

| Previous Venture | Local Beer (closed due to regulatory shifts) |

| Parent Entity | Tui Bon Natural Private Limited (Founded 2021) |

| Brand Origin | Mizoram, Northeast India |

| Brand Category | Farm-to-bottle craft beverage |

| Brand Positioning | Premium, low-calorie, clean-label soda |

| Core Philosophy | Cultural storytelling, farmer transparency, ethical sourcing |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 27 |

| Episode Air Date | Tuesday, 10 February 2026 |

| Initial Ask | ₹50 Lakhs for 2% equity |

| Asked Valuation | ₹25 Crores |

| Product Type | Artisanal natural sodas |

| Key Flavors | Pomelo, Ginger Ale, Mandarin Orange |

| Calorie Count | 35–36 kcal per 100ml |

| Key Differentiator | No artificial preservatives, low sugar |

| Retail Price | ₹120 per bottle |

| Target Segment | HORECA & premium retail |

| Revenue FY 23-24 | ₹19 Lakhs |

| Revenue FY 24-25 | ₹44 Lakhs |

| Projected FY 25-26 | ₹1.2 Crores |

| EBITDA Status | ₹5 Lakhs positive (YTD) |

| Shark Reaction | Mixed feedback; concerns about scalability & distribution |

| Mohit Yadav Offer 1 | ₹1 Crore for 33% equity |

| Mohit Yadav Offer 2 | ₹1 Crore for 25% equity (₹4 Cr valuation) |

| Deal Status | No deal finalized |

| Reason for No Deal | Founders declined due to high equity dilution |

| Business Model | Premium craft soda transitioning to scalable D2C/HORECA |

| Target Audience | Urban millennials (22–40), Tier-1 cities |

| Psychographic Profile | Health-conscious, origin-driven, premium consumers |

| TAM | $11.7 Billion (Indian Soft Drink Market 2025) |

| SAM | ~$1.8 Billion (Premium carbonated segment) |

| SOM | ₹500–700 Crores (Tier-1 HORECA focus) |

| Market Trend | Premiumization & clean-label shift |

| Major Challenge | Distribution & logistics from Mizoram |

| Pricing Risk | 3–4x cost of regular sodas |

| Distribution Strategy | Quick Commerce + HORECA partnerships |

| SEO Strategy | Implement SSR via Next.js for crawlability |

| Marketing Focus | Farm-to-bottle storytelling & mixology content |

| Key Advantage | Northeast India flavor differentiation |

| Expansion Roadmap Year 1 | ₹2 Cr revenue, 3 metro dominance |

| Expansion Roadmap Year 2 | Launch Zero Sugar & functional soda |

| Expansion Roadmap Year 3 | ₹10 Cr+ ARR target |

| Exit Potential | Acquisition by Tata Consumer or Coca-Cola |

Local All Natural Soda Shark Tank India Business Plan

1. Logical Business Plan and Stats for Local All Natural Soda

The business model for Local All Natural Soda transitions from a “niche regional craft” to a “premium scalable D2C/HORECA” model.

- Revenue Trajectory: FY 23-24 (₹19L) to FY 24-25 (₹44L). Projected FY 25-26: ₹1.2 Crores.

- Unit Economics: Retail Price is ₹120/bottle. With a target gross margin of 60-65%, the brand must focus on reducing logistics costs from Mizoram.

- Key Fact: The brand has already achieved EBITDA positivity (₹5L YTD), proving the viability of its premium pricing even at a small scale.

2. Business Potential in India for Local All Natural Soda

The Indian beverage landscape is undergoing a “Premiumization Wave.”

- Health Shift: 70% of urban Indian consumers now prefer “Clean Label” drinks over traditional sugary sodas.

- Market Growth: The Indian non-alcoholic beverage market is valued at $34.71 Billion (2025) and is projected to reach $69.04 Billion by 2034 (CAGR: 7.94%).

- Craft Segment: The artisanal and craft soda segment in India is the fastest-growing sub-sector, as consumers seek “sophistication without alcohol.”

3. Total Addressable Market (TAM) for Local All Natural Soda

- TAM (Total Addressable Market): The overall Indian Soft Drink Market – $11.7 Billion (2025).

- SAM (Serviceable Addressable Market): The Premium/Health-conscious Carbonated Drink segment – approximately $1.8 Billion.

- SOM (Serviceable Obtainable Market): Targeted Tier-1 urban millennials and HORECA partnerships – estimated at ₹500-700 Crores within the next 5 years.

4. Ideal Target Audience and Demographics for Local All Natural Soda

Local All Natural Soda appeals to the “Conscious Urbanite.”

- Primary Demographics: Age 22–40, residing in Tier-1 cities (Delhi NCR, Mumbai, Bangalore, Pune).

- Psychographics: Individuals who value “Origin Stories,” support “Vocal for Local,” and prioritize health (low calorie) over cost.

- User Persona: The “Socialite” who uses craft soda as a mixer for premium spirits, and the “Fitness Enthusiast” looking for a 35-kcal refreshment.

5. Marketing and Content Strategy for Local All Natural Soda

The marketing for Local All Natural Soda must be visual and story-driven.

- The “Farm-to-Bottle” Narrative: Create video content showing the harvest of Pomelos and Ginger in Mizoram to build trust.

- Content Pillars: * Sourcing: Highlight Mizoram farmers.

- Usage: “Local Mixology” — recipes for cocktails/mocktails.

- Transparency: Show the “Zero Artificial” production process.

- Influencer Alignment: Partner with travel vloggers and “clean-eating” influencers to validate the brand’s authenticity.

6. Digital Marketing Strategy for Local All Natural Soda

Given the 168 monthly visitors and poor SEO, Local All Natural Soda needs a technical overhaul.

- SEO Improvement (React Framework): Implement Server-Side Rendering (SSR) using Next.js to make the JavaScript-heavy site crawlable by Google.

- Keyword Targeting: Optimize for “best ginger ale India,” “artisanal soda,” and “low calorie mixer.”

- Paid Media: Focus on Meta (Instagram) Ads targeting high-affordability pin codes in South Mumbai and South Delhi.

7. Distribution Strategy for Local All Natural Soda

The Sharks identified distribution as the primary hurdle for Local All Natural Soda.

- Quick Commerce: Immediate listing on Blinkit, Zepto, and Swiggy Instamart is mandatory for the ₹120/bottle price point.

- HORECA Focus: Partner with 5-star hotels and boutique cafes (e.g., Blue Tokai, Third Wave) where customers already pay a premium.

- D2C Subscriptions: Offer a “Monthly Northeast Refreshment Box” to stabilize recurring revenue.

8. Advantages of Local All Natural Soda

- First-Mover Advantage: Limited national brands represent Northeast Indian flavors (Pomelo, Mandarin).

- Clean Label: Genuine “All Natural” status is a massive moat against “Fruit-Flavored” chemical competitors.

- Founder Story: The authentic journey of Zomawii and Felipe adds a layer of “Social Capital” that attracts modern Gen-Z buyers.

9. Challenges for Local All Natural Soda

- Logistics: Sourcing from Mizoram to the rest of India creates high “Food Miles” and shipping costs.

- Price Sensitivity: At ₹120, it is 3x-4x the price of mass-market sodas.

- Shelf Life: Natural products often have shorter shelf lives, complicating traditional retail distribution.

10. Success Reasons and Mitigation Strategies for Local All Natural Soda

- Why it can Succeed: It taps into the $50 Billion Indian alcohol market as a premium, healthy mixer.

- Mitigation (Cost): Set up regional bottling/co-packing units in Western or Southern India to reduce transport costs from the Northeast.

- Mitigation (Visibility): Use the “Shark Tank India” logo on all packaging and digital assets to leverage the episode’s 2026 air date and credibility.

11. Future Business and Roadmap to Increase Valuation for Local All Natural Soda

To achieve the ₹25 Crore valuation requested on Shark Tank, Local All Natural Soda must hit these milestones:

- Year 1 (National Footprint): Achieve ₹2 Cr revenue by dominating Quick Commerce in 3 major metros.

- Year 2 (Product Expansion): Launch “Local Zero” (Zero sugar version) and functional soda (added vitamins/electrolytes).

- Year 3 (Valuation Leap): Reach ₹10 Cr+ ARR. Investors in 2026 value D2C brands at 3x–5x revenue if EBITDA is positive.

- Exit Potential: Position for acquisition by FMCG giants like Tata Consumer Products or Coca-Cola (as part of their “niche/organic” portfolio).

Local All Natural Soda Shark Tank India Episode Review