Shark Tank India Season 5 Episode 15 Review

Episode 15 of Shark Tank India Season 5 delivered one of the most competitive and youth-focused episodes of the season, featuring businesses at the intersection of culture, technology, and creative empowerment. From sneakers as cultural expression to AI-powered virtual wardrobes and creator economy lighting solutions, this episode showcased how Indian entrepreneurs are building for India’s digital-native generation demanding authenticity, convenience, and quality.

The episode created rare “all-Shark interest” moments with competitive bidding wars, demonstrated Aman Gupta’s continued dominance in youth-focused investing, and featured founders from diverse backgrounds—ex-JP Morgan engineers, IIT Delhi alumni, and Bihar entrepreneurs—all targeting Gen Z and millennial consumers. With three successful deals totaling ₹1.9 crore equity plus ₹40 lakh debt, Episode 15 proved that businesses authentically serving India’s 800+ million internet users through culture-led branding, technological convenience, or creator enablement can command premium valuations and intense Shark competition.

Episode Summary

Total Pitches: 3

Successful Deals: 3 (100% deal closure rate)

Total Investment Made: ₹1.9 Crore equity + ₹40 Lakh debt (₹2.3 Crore total capital)

Featured Sharks: Aman Gupta (swept all three deals), Anupam Mittal, Kanika Tekriwal, Kunal Bahl

Pitch 1

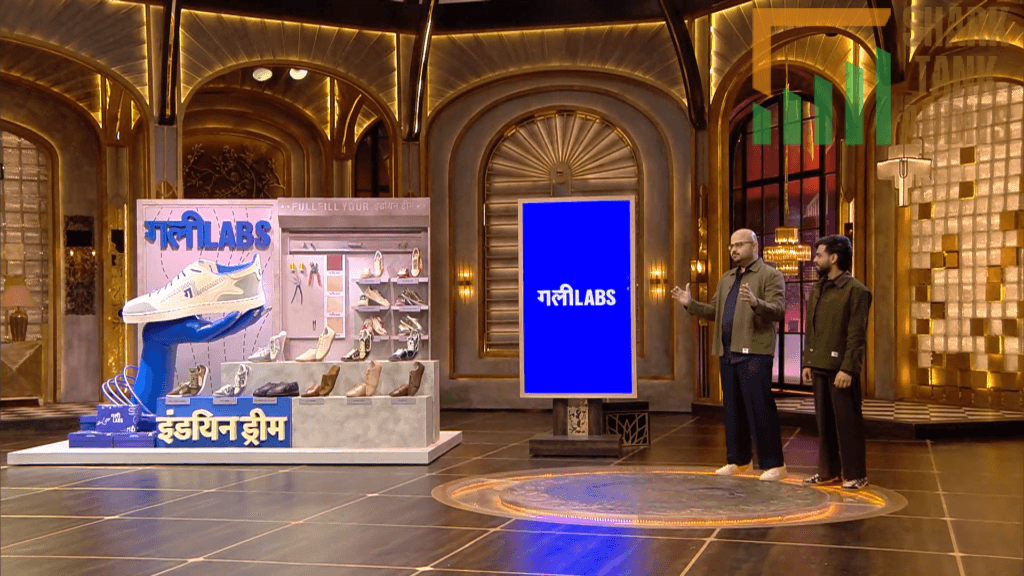

Gully Labs Shark Tank India Episode Review

Gully Labs appeared on Shark Tank India Season 5, Episode 15, with co-founders Arjun Singh (ex-JP Morgan Sydney engineer who experimented with m8buy and Slow Dating via Antler venture program) and Animesh Mishra (ex-Bain US, dedicated sneakerhead) seeking ₹1 Crore for 0.5% equity (₹200 Crore valuation) and successfully closed a deal for ₹1 Crore for 0.57% equity (₹175 Crore valuation) with Shark Aman Gupta after all Sharks showed interest in rare “all-Shark” offer scenario.

The Delhi NCR-based culture-led sneaker brand established August 2023 produces “hand-lasted” sneakers blending Indian street aesthetics with international quality in ₹3,000-₹8,000 mass-premium segment, growing explosively from ₹20 lakh (FY 23-24) to projected ₹9 Crore YTD with ₹1.85 Crore monthly revenue (November 2025) and 52,328 monthly organic visitors. With prior backing from Saama Capital and Atrium Ventures, they use limited “drops” culture (Onam, Phulkari themes), sustainable materials, and ethical production to maintain exclusivity versus fast-fashion while focusing on breathable fabrics, superior grip, and cushioning.

Operating in Indian sneaker market valued at $3.98 billion (2025) projected to reach $6.53 billion by 2034 (5.65% CAGR) within India’s $18.26 billion footwear market (2029), Gully Labs targets Gen Z/millennials (18-35) in Tier 1/2 cities viewing sneakers as self-expression, prioritizing “Authentic Indian Stories” and sustainability over mass-produced fashion in strategic whitespace between international giants (Nike/Adidas >₹10,000) and unbranded (<₹1,500).

Pitch 2

Twin Shark Tank India Episode Review

Twin Shop AI appeared on Shark Tank India Season 5, Episode 15, with founder Aseem Khanduja (IIT Delhi alumnus from Gurgaon) seeking ₹60 lakh for 1% equity (₹60 Crore valuation) and successfully closed a deal for ₹80 lakh for 2% equity (₹40 Crore valuation) with Shark Aman Gupta after competing offers from Anupam Mittal and Kanika Tekriwal.

The fashion-tech platform revolutionizes e-commerce through AI-powered virtual try-on technology creating digital avatars from 3 selfies and 2 full-body photos, allowing users to test thousands of apparel items, shoes, and accessories across multiple brands in an “Endless Wardrobe” interface including external links from Instagram. Targeting 1 million users in 6 months and 5 million within a year with 125 monthly organic visitors requiring SEO improvement, Twin addresses India’s e-commerce return crisis (15-20% overall, 35-50% in apparel) where fit/sizing issues cause 53% of global returns.

Operating in Indian fashion retail market valued at $70-$80 billion (₹6.18-6.86 lakh crore, 24%+ e-commerce CAGR) with virtual try-on market growing 25.8% CAGR globally (30%+ India, fastest Asia-Pacific region), Twin targets Gen Z/millennials (18-35, 40% of e-retail shoppers) in Tier 1/2 cities with 950 million broadband users and 85%+ smartphone penetration, as 71% of consumers shop more with AR-integrated brands within India’s $9.85 billion luxury fashion market.

Pitch 3

RCX Light Shark Tank India Episode Review

RCX Light appeared on Shark Tank India Season 5, Episode 15, with founders Prince Kumar, Ravi Chand Sharma, and Ravi Kumar from Chapra, Bihar seeking ₹50 lakh for 5% equity (₹10 Crore valuation) and successfully closed a deal for ₹10 lakh for 5% equity + ₹40 lakh debt at 12% interest for 3 years (₹2 Crore valuation) with Shark Aman Gupta after other Sharks opted out despite being impressed.

The modern Indian lighting brand specializes in studio/video lighting solutions for the creator economy, bridging the gap between amateur equipment and expensive international professional gear with LED lights, panels, and accessories featuring balanced brightness preventing harsh shadows, sturdy construction, and functional design without unnecessary complexity.

Growing exponentially from ₹19 lakh (FY 22-23) to ₹26 lakh (FY 23-24) to ₹66 lakh (current FY YTD, ~150% growth) with 0 organic visitors requiring SEO overhaul, they demonstrated “Digital Display Project” impressing Kunal Bahl who noted high quality and clean minimalist style. Operating in India’s creator economy valued at ₹4,500 Crore (2025) projected to impact $1 trillion commerce by 2030 with 806 million internet users and India LED lighting market at $12.54 billion (2026, 7.77% CAGR), RCX targets 2-2.5 million active digital creators (Gen Z/millennials 16-35) in Tier 2/3 cities including nano/micro-influencers, D2C founders, and freelance videographers as 45% of digital marketing budgets shift toward regional markets.

Episode Highlights:

- Perfect closure rate: 100% deal success (second time this season after Episode 8)

- Aman sweep: Single Shark winning all three investments in one episode

- Highest successful valuation: Gully Labs at ₹175 Cr (₹200 Cr ask neighborhood)

- All-Shark interest: Rare moment where every Shark wanted to invest (Gully Labs)

- Culture-led premium: Indian street aesthetics commanding international quality prices

- AR/AI fashion-tech: Virtual try-on addressing 35-50% apparel return crisis

- Creator economy enablement: Bihar founders building for India’s 2-2.5M creators

- Hybrid financing continues: Fourth equity+debt deal this season (RCX Light)

Key Lessons:

- Cultural authenticity + quality execution can command ₹175 Cr+ valuations in mass markets

- “All-Shark interest” scenarios allow founders to negotiate from strength (Gully Labs)

- Prior institutional funding (Saama Capital, Atrium) validates model for Sharks

- Virtual try-on solving real pain point (35-50% apparel returns) attracts competitive offers

- Creator economy tools from Tier 2/3 cities can secure funding despite 0 organic traffic

- Limited “drops” culture maintains exclusivity while building brand mystique

- Hybrid debt structures appropriate for capital-efficient hardware businesses (lighting)

- Product demonstration (RCX’s display project) overcomes digital marketing weakness

Deal Structure Analysis:

Gully Labs:

- Asked: ₹1 Cr for 0.5% (₹200 Cr valuation)

- Got: ₹1 Cr for 0.57% (₹175 Cr valuation)

- Equity increase: Minimal (0.5% to 0.57% = 14% increase)

- Outcome: Maintained premium valuation despite all-Shark competition

- Rationale: Explosive growth (₹20L → ₹9 Cr), prior funding validation, cultural positioning

Twin Shop AI:

- Asked: ₹60L for 1% (₹60 Cr valuation)

- Got: ₹80L for 2% (₹40 Cr valuation)

- Changes: +₹20L investment, 2x equity (1% to 2%)

- Valuation: 33% reduction (₹60 Cr to ₹40 Cr)

- Rationale: Early stage (125 organic visitors), competitive AR/AI landscape, execution risk

RCX Light:

- Asked: ₹50L for 5% (₹10 Cr valuation)

- Got: ₹10L equity for 5% + ₹40L debt at 12% for 3 years (₹2 Cr equity valuation)

- Valuation: 80% reduction (₹10 Cr to ₹2 Cr on equity component)

- Rationale: Early stage (₹66L revenue), 0 organic traffic, capital-efficient hardware model

Strategic Patterns:

- Aman’s Youth Dominance: Swept all three Gen Z/millennial-focused businesses in single episode

- Culture Commands Premium: Gully Labs’ Indian street aesthetics maintaining ₹175 Cr valuation

- Prior Funding Matters: Institutional backing (Saama, Atrium) reduced Shark risk perception

- Problem-Solution Clarity: Twin addressing 35-50% return crisis created urgency

- Tier 2/3 Opportunity: RCX from Chapra showing creator economy democratization beyond metros

Market Context:

- Sneaker Market: $3.98B (2025) → $6.53B (2034) at 5.65% CAGR within $18.26B footwear

- Fashion Retail: $70-$80B (₹6.18-6.86L Cr) with 24%+ e-commerce CAGR

- Virtual Try-On: 25.8% CAGR globally, 30%+ in India (fastest Asia-Pacific)

- Creator Economy: ₹4,500 Cr (2025) → $1T commerce impact by 2030

- LED Lighting: $12.54B (2026) at 7.77% CAGR

- Active Creators: 2-2.5M in India with 45% marketing budgets to regional markets

- Internet Users: 806M-950M broadband users with 85%+ smartphone penetration

The “All-Shark Interest” Phenomenon:

Gully Labs achieved rare status where every Shark wanted to invest:

Factors Creating Universal Appeal:

- Explosive growth: ₹20L → ₹9 Cr YTD (45x in ~16 months)

- Strong organic traffic: 52,328 monthly visitors without heavy ad spend

- Institutional validation: Saama Capital + Atrium Ventures backing

- Cultural resonance: Authentic Indian stories in premium segment

- Strategic positioning: Whitespace between Nike/Adidas (>₹10K) and unbranded (<₹1.5K)

- Sustainable model: Limited drops maintaining exclusivity vs. fast fashion

- Founder pedigree: Ex-JP Morgan + ex-Bain credentials

- Market timing: Gen Z sneaker culture explosion in India

Result: Aman won but from position of competition, not monopoly, allowing Gully Labs to maintain valuation.

Cultural Authenticity Premium:

Gully Labs demonstrated how “Authentic Indian Stories” command international pricing:

Traditional Model:

- Copy Western designs

- Compete on price (<₹1,500 unbranded)

- Race to bottom on margins

- No brand equity or storytelling

Gully Labs Model:

- Celebrate Indian aesthetics (Onam, Phulkari themes)

- Premium pricing (₹3,000-₹8,000) with quality justification

- Limited drops creating scarcity and collectibility

- Building brand cult following vs. mass distribution

Result: Gen Z willing to pay 2-5x price for cultural connection + quality vs. generic alternatives.

Virtual Try-On Business Case:

Twin’s pitch crystallized e-commerce’s hidden cost problem:

The Return Crisis:

- Overall e-commerce: 15-20% return rate

- Apparel category: 35-50% return rate (catastrophic)

- Primary cause: 53% due to fit/sizing issues

- Hidden costs: Reverse logistics, restocking, discounts, customer service, environmental waste

Twin’s Solution Value:

- Reduces uncertainty pre-purchase through virtual try-on

- Potential to cut 35-50% returns to 20-25% (30-40% improvement)

- Savings for ₹10,000 Cr apparel e-commerce = ₹1,500-2,000 Cr annual impact

- Win-win: Consumers gain confidence, retailers reduce costs, environment benefits

Technology Moat: Creating accurate digital avatars from 5 photos, rendering realistic garment draping across body types, integrating multiple brands and Instagram links requires sophisticated AI—not easily replicable.

Creator Economy Democratization:

RCX Light exemplified how Tier 2/3 cities are building for creator economy:

Traditional Creator Equipment Challenges:

- Amateur gear: Poor quality, unprofessional results

- Professional gear: International brands at ₹50,000-₹2,00,000 (unaffordable for nano/micro-creators)

- Gap: No quality Indian middle option for ₹5,000-₹20,000 range

RCX Light’s Positioning:

- Quality comparable to international brands

- Pricing accessible for emerging creators

- Understanding Indian creator needs (balanced brightness for skin tones, sturdy for travel)

- Targeting 2-2.5M active creators (mostly in Tier 2/3 cities)

Market Opportunity: 45% of marketing budgets shifting to regional markets means Tier 2/3 creators need professional equipment without metro prices.

Episode Thematic Coherence:

All three pitches served India’s digital-native generation:

- Gully Labs: Cultural expression through sneakers (identity)

- Twin: Convenience through virtual try-on (technology)

- RCX Light: Creative empowerment through lighting (tools)

Success formula: Authenticity (culture) + Convenience (tech) + Enablement (tools) = investor appeal for Gen Z businesses.

Aman Gupta’s Strategic Sweep:

Aman winning all three deals wasn’t coincidence—strategic alignment:

Gully Labs Fit:

- boAt’s youth brand equity applies to sneaker culture

- Understanding “drops” limited edition strategy

- Gen Z marketing expertise transferable

Twin Shop AI Fit:

- E-commerce technology platform aligns with boAt’s D2C evolution

- Understanding virtual experiences (gaming, metaverse adjacency)

- Fashion-tech intersection relevant for lifestyle brand portfolio

RCX Light Fit:

- Creator economy tools complement boAt’s influencer marketing

- Understanding affordable premium quality (boAt’s positioning)

- Supporting India’s content creation infrastructure

Result: Aman building ecosystem around Gen Z lifestyle, technology, and creation—with these three as complementary portfolio companies.

Hybrid Financing Evolution:

RCX Light marked the fourth equity+debt hybrid deal this season:

- RIDEV (Ep 10): ₹1 Cr equity + ₹5 Cr debt at 14.5%

- Cinefai (Ep 12): ₹50L equity + ₹50L debt at 9%

- Uprear (Ep 14): ₹1 Cr equity + ₹1 Cr debt at 10%

- RCX Light (Ep 15): ₹10L equity + ₹40L debt at 12%

Pattern Emerging:

- Asset-heavy or hardware businesses get debt component

- Sharks protect downside through interest payments

- Founders maintain higher equity ownership

- Debt appropriate for predictable revenue businesses

SEO Weakness Paradox:

Episode 15 continued season’s digital marketing challenges:

- Gully Labs: 52,328 monthly visitors (excellent outlier)

- Twin: 125 monthly visitors (requiring significant improvement)

- RCX Light: 0 monthly visitors (complete overhaul needed)

Yet all three secured funding, proving:

- Product quality + founder vision > current digital presence

- Sharks willing to fund SEO/marketing post-investment

- B2B, community, or drops culture can substitute for SEO initially

Comparative Episode Analysis:

Episode 15’s 100% deal rate and ₹2.3 Cr total capital ranks exceptionally:

- Only second 100% success rate (after Episode 8)

- Aman’s single-Shark sweep unprecedented this season

- Highest successful asking valuation (Gully Labs ₹200 Cr neighborhood)

- All-Shark interest moment rare (previously seen in Episode 3 SaveSage)

Future Implications:

- Cultural Authenticity Validated: Indian stories commanding premium prices = trend for other categories

- Virtual Try-On Normalization: Twin’s funding signals Shark appetite for AR/AI commerce solutions

- Creator Economy Infrastructure: RCX shows equipment/tools sector investable beyond content platforms

- Aman’s Youth Monopoly: Positioning as go-to Shark for Gen Z businesses strengthened

- Tier 2/3 Creator Focus: Regional creator economy beyond metros attracting attention

Episode Significance:

Episode 15 will be remembered for achieving perfect deal closure while demonstrating that businesses authentically serving India’s digital-native generation—through cultural expression (Gully Labs), technological convenience (Twin), or creative enablement (RCX)—can command premium valuations and intense investor competition. Aman Gupta’s clean sweep showed strategic portfolio building around interconnected Gen Z ecosystem rather than random opportunistic investing. Gully Labs’ ₹175 crore valuation proved that cultural authenticity combined with execution excellence can compete with—and potentially exceed—purely technology-driven or international brands. The episode validated that India’s next wave of valuable consumer businesses will likely emerge from founders who deeply understand local culture, leverage technology for convenience, and empower rather than just sell to their customers.

Closing Reflection:

Episode 15 taught that winning in India’s youth market requires triple alignment: Cultural Authenticity (Gully Labs celebrating Indian street culture), Technological Innovation (Twin solving fit crisis through AI), and Democratic Access (RCX providing creator tools to Tier 2/3). The episode’s success stories shared common thread of serving underserved needs: Gen Z seeking cultural expression through fashion, online shoppers wanting confidence in fit, and regional creators needing affordable professional equipment. Most importantly, the “all-Shark interest” moment for Gully Labs demonstrated that when a business truly nails product-market fit with explosive growth and cultural resonance, investors compete for access rather than founders competing for capital—reversing traditional power dynamics. The lesson: Build something India’s 800+ million internet users genuinely need, wrap it in authentic cultural packaging or technological convenience, and demonstrate execution through metrics—then let investors compete for you.

Leave feedback about this

You must be logged in to post a comment.