Shark Tank India Season 5 Episode 27 Review

Aired on Tuesday, February 10, 2026, Episode 27 of Shark Tank India Season 5 was a masterclass in the “Three Fs”: Finance, Flavours, and Future Minds. The Tank welcomed a diverse group of entrepreneurs, ranging from seasoned serial founders with IIM and IIT pedigrees to a husband-wife duo bringing the spirit of Mizoram to the national stage.

The episode highlighted the stark contrast between the booming Indian SaaS/Fintech landscape and the more traditional, yet equally challenging, FMCG sector. With Sharks like Anupam Mittal and Kunal Bahl looking for high-tech scalability, and others like Mohit Yadav searching for brand “energy,” the pitchers had to navigate heavy technical scrutiny and high valuation expectations. From AI-powered childhood companions to programmable digital currency, the stakes were high as the Sharks looked for the next “Soonicorn.”

Summary: The Episode Breakdown

Episode 27 was a tale of strategic pivots and valuation stalemates. While the fintech sector saw a massive “ultimate showdown” between the Sharks, the consumer goods and ed-tech sectors faced harder questions about defensibility and price points.

Pitch 1

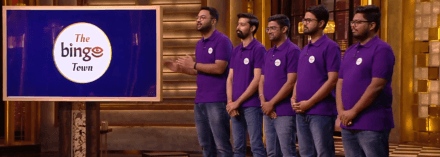

MyWonder Shark Tank India Episode Review

MyWonder appeared on Shark Tank India Season 5, Episode 27, with co-founders Chandramouli Kasinathan (engineer overseeing core technology/AI integration) and Venkata Srinivasa Murali Potluri (IIM Bangalore alumnus, serial entrepreneur who co-founded Sellerworx successfully acquired by Capillary Technologies in 2017) seeking ₹80 lakh for 1% equity (₹80 Crore valuation) but left with no deal despite Sharks appreciating vision and founder pedigree citing high valuation and competitive toy/ed-tech landscape.

The screen-free conversational AI learning companion for children (ages 3-10) offers physical AI-powered device operating via Wi-Fi with 200+ interactive cards categorized by age (Companion Talk Cards for two-way conversations with AI mentors, Content Narration Cards for one-way storytelling/mythology/science) featuring sophisticated voice recognition, adaptive learning evolving with child’s curiosity, parental insights app, and curated global publisher content with 120 monthly organic visitors requiring SEO improvement. Sharks raised concerns over defensibility against giants (Amazon Alexa/Google Home), scalability of hardware-heavy model versus pure software, and whether children would use independently without parental intervention, while founders defended positioning as “Companion” for emotional/educational growth versus “Assistant” for task execution.

Operating in India’s ₹1.5 trillion children’s product market (12-15% annual growth) with toy market projected at $4.74 billion by 2034 amid digital addiction crisis (urban Indian children averaging 3-6 hours daily screen time per Economic Survey 2026), MyWonder targets 120 million urban children within 300 million Indian children (ages 0-14, highest globally) specifically focusing on 35-40 million middle/upper-middle-class urban households (3-10 years) among millennial/Gen X parents (28-45, ₹12 lakh+ annual household income) who are tech-savvy yet “screen-wary” seeking holistic development and Montessori-style cognitive growth over passive content consumption.

Pitch 2

CotoPay Shark Tank India Episode Review

CotoPay appeared on Shark Tank India Season 5, Episode 27, with co-founders Aviral Gupta (CEO, London Business School, founding member BharatPe, National Health Authority working on CoWIN/e-RUPI framework), Vidit Sidana (CBO, IIM Ahmedabad, ex-ITC Brand Manager managing ₹7,000 Crore Sunfeast portfolio), and Uzair Syed Ahmed (CTO, 20 years experience, original Aadhaar team member, designed CoWIN architecture) seeking ₹50 lakh for 1% equity (₹50 Crore valuation) and successfully closed a deal for ₹75 lakh for 2% equity + 1% advisory (3% total) with Sharks Anupam Mittal and Kunal Bahl after intense negotiations with four Sharks making matching offers.

The fintech platform revolutionizes enterprise expense management using NPCI’s e-RUPI infrastructure to issue programmable digital UPI vouchers (appearing in existing Google Pay/PhonePe apps without new downloads) allowing business owners to control spending with category locking (fuel/meals/travel restrictions), time-bound expiration keeping unused funds in company account, real-time audit tracking with merchant details/digital receipts, and seamless integration with five major banks, solving “leakage” and visibility problems with 0 organic visitors requiring SEO improvement. Sharks praised founders’ “underachiever” credentials (sarcastic compliment regarding Aadhaar/CoWIN work) calling apps “well-made” and “solid assets”—Aman opted out fearing “long and painful” HR/Admin sales cycles, while Anupam/Kunal recognized massive fleet management/logistics potential seeing synergies with portfolio companies (Rapido, Zingbus).

Operating in India’s digital payments market projected at $10 trillion by 2026 (UPI 75%+ transaction volumes) within global corporate expense management valued at $9.09 billion (2026, India fastest-growing region) and India’s $380+ billion logistics market, CotoPay targets 6.3 crore registered MSMEs (top 10% digitally active) specifically fleet owners/logistics companies (50+ drivers), event management firms, and corporate finance/HR heads (30-55, Tier 1/2 hubs) addressing estimated 15-20% annual travel/field budget losses from inefficient tracking, lost receipts, and cash misuse, planning expansion into ERP integration (SAP/Oracle) for MNCs and “CotoPay Credit” offering working capital loans targeting “Soonicorn” (₹1,000+ Crore) valuation by 2028.

Pitch 3

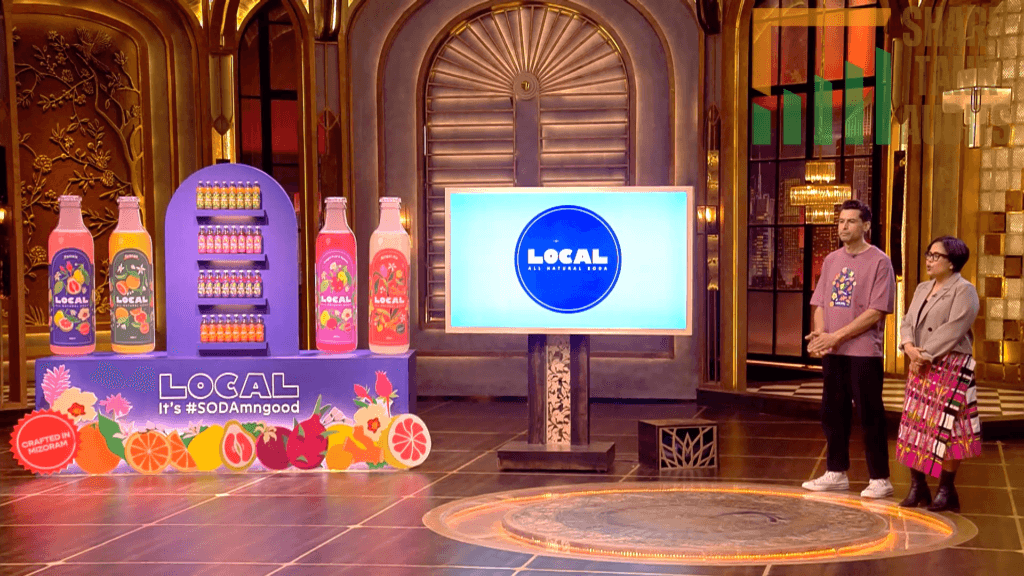

Local All Natural Soda Shark Tank India Episode Review

Local All Natural Soda appeared on Shark Tank India Season 5, Episode 27, with husband-wife founders Zomawii Khiangte (returned to Mizoram from US in 2016) and Felipe Rodriguez seeking ₹50 lakh for 2% equity (₹25 Crore valuation) but left with no deal after declining Mohit Yadav’s revised offer of ₹1 Crore for 25% equity (₹4 Crore valuation, initially offered ₹1 Crore for 33%) citing excessive equity dilution misaligned with strategic goals.

The Mizoram-rooted farm-to-bottle craft beverage company (established 2021 under Tui Bon Natural Private Limited after initial venture Local Beer closed due to regulatory shifts) offers artisanal sodas with regional flavors (Pomelo, Ginger Ale, Mandarin Orange) at ₹120/bottle featuring 35-36 kcal per 100ml using hand-pressed fruits from Northeast farmers with no artificial preservatives/additives, growing from ₹19 lakh (FY 23-24) to ₹44 lakh (FY 24-25) projecting ₹1.2 Crore (FY 25-26) achieving ₹5 lakh EBITDA positivity YTD with 168 monthly organic visitors requiring SEO improvement. Sharks reacted critically—Anupam praised quality but cited fragmented distribution suggesting Quick Commerce focus, Aman doubted high ₹120 price point lacking “investor-founder fit,” Kanika unconvinced by aggressive expansion drive, Kunal advised bringing more distribution energy, while Mohit appreciated journey offering “third partner” role though equity requirements too steep.

Operating in Indian non-alcoholic beverage market valued at $34.71 billion (2025) projected to reach $69.04 billion by 2034 (7.94% CAGR) with soft drink market at $11.7 billion (2025) and premium/health-conscious carbonated segment at $1.8 billion (artisanal/craft sodas fastest-growing sub-sector), Local targets “Conscious Urbanites” (22-40, Tier 1 cities) valuing “Origin Stories,” supporting “Vocal for Local,” and prioritizing health over cost—socialites using craft soda as premium spirit mixers and fitness enthusiasts seeking 35-kcal refreshment—within 70% urban Indian consumers preferring “Clean Label” drinks, planning regional bottling/co-packing units to reduce Mizoram transport costs and product expansion (Local Zero sugar-free, functional sodas with vitamins/electrolytes) positioning for potential FMCG giant acquisition (Tata Consumer Products/Coca-Cola).

Deal Tracker: Who Swam and Who Sank?

| Pitch | Brand | Ask | Result | Shark(s) Involved |

| Pitch 1 | MyWonder | ₹80 Lakh for 1% | No Deal | Sharks felt the ₹80 Cr valuation was too high for a hardware-heavy toy model. |

| Pitch 2 | CotoPay | ₹50 Lakh for 1% | ₹75 Lakh for 3% | Anupam Mittal & Kunal Bahl teamed up after a four-Shark battle. |

| Pitch 3 | Local Soda | ₹50 Lakh for 2% | No Deal | Founders rejected Mohit Yadav’s offer due to excessive equity dilution. |

Key Highlights

- The Showdown: CotoPay was the star of the night. Featuring a founding team with “Aadhaar” and “CoWIN” credentials, they sparked an intense negotiation. Ultimately, Anupam and Kunal secured the deal, eyeing a future in logistics and corporate expense automation.

- Valuation Reality Check: MyWonder impressed with their “screen-free” AI mission, but the Sharks were wary of the “Amazon Alexa” threat and the difficulty of scaling physical AI hardware.

- The Equity Deadlock: Local All Natural Soda brought incredible flavor and a positive EBITDA, but the gap between the founders’ 2% offer and Mohit Yadav’s 25% requirement was simply too wide to bridge.

Leave feedback about this

You must be logged in to post a comment.