Shark Tank India Season 5 Episode 29 Review

Episode 29 of Shark Tank India Season 5 delivered one of the season’s most brutally honest episodes, featuring passionate founders facing harsh personal criticisms, businesses with strong metrics being rejected for fundamental positioning concerns, and the clearest articulation of when “commodity plays” fail despite operational excellence. From nationalism-inspired fashion achieving ₹20 crore sales but criticized as discount marketing, to a real-time social platform aiming to combat doom-scrolling yet facing “stupidest scaling logic” verdict, and a college dropout’s book marketplace being called “khula saand” (loose bull) for ignoring market realities, this episode showcased entrepreneurship’s unforgiving nature when execution excellence cannot overcome positioning flaws, temperament concerns, or business model skepticism.

The episode raised critical questions about whether patriotic fashion can build aspirational brands or inevitably becomes commoditized discount apparel, if Indian social networks can compete with Meta’s dominance despite cultural differentiation, and when founder stubbornness crosses from conviction to close-mindedness preventing necessary adaptation. With only ₹75 lakh deployed despite impressive metrics across pitches, Episode 29 proved that unit economics and operational efficiency mean nothing without aspirational brand positioning, defensible network effects, or founder temperament signaling coachability and market awareness.

Episode Summary

Total Pitches: 3

Successful Deals: 1

Total Investment Made: ₹75 Lakh equity (with 1.5x royalty until recovery)

Featured Sharks: Vineeta Singh, Aman Gupta, Peyush Bansal, Anupam Mittal, Kunal Bahl, Namita Thapar, Varun Alagh

Pitch 1

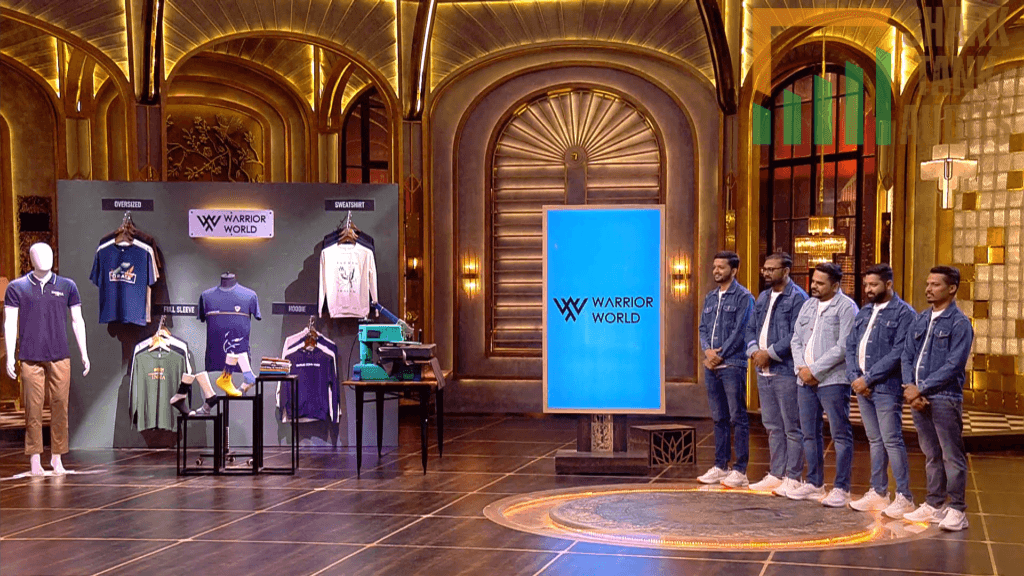

Warrior World Shark Tank India Episode Review

Warrior World appeared on Shark Tank India Season 5, Episode 29, with founders Uday Patel, Keyur Nagani (Kevo), Dharmin Savaliya, Kapil Jyani, and Jigar Khatrani from Surat (who successfully exited women’s ethnic wear brand Bavgi for ₹1.5 Crore in 2023) seeking ₹75 lakh for 1% equity (₹75 Crore valuation) and successfully closed a deal for ₹75 lakh for 1% equity + 1.5% royalty until ₹1.125 Crore recouped (1.5x investment) with Shark Vineeta Singh who saw value in operational efficiency despite other Sharks opting out.

Operating under Flivaa Lifestyle Pvt. Ltd. since 2024, the D2C “Nationalism Fashion” brand specializes in Indian Armed Forces-inspired apparel (Army/Navy/Air Force) offering 900+ designs across T-shirts, polo shirts, hoodies, sweatshirts, and oversized tees (₹399 starting price) using 180 GSM 100% cotton bio-washed fabrics with in-house Direct-to-Film (DTF) printing technology and Made-to-Order model eliminating inventory risk, achieving ₹20 Crore total sales in 1.5 years with 15% EBITDA, 82% revenue from Army-inspired designs, 98% D2C website sales, ₹230 CAC, ₹940 AOV, 24% repeat customer rate, and 13,560 monthly organic visitors. Sharks reacted mixed—impressed by unit economics and Made-to-Order supply chain eliminating inventory risk, but Aman/Peyush criticized positioning as “performance marketing/commodity play” versus aspirational lifestyle brand fearing “Buy 5 for ₹999” marketing cheapened “Warrior” identity.

Operating in Indian apparel market projected at $105 billion by 2027 (D2C segment 19% CAGR) within $43 billion online fashion market (2026) and ₹5,000 Crore patriotic/graphic apparel niche leveraging Surat’s cheapest high-quality textile manufacturing advantage providing double industry-average margins, Warrior World targets patriotic core (82% revenue, males 18-45 in Tier 2/3 cities/rural belts—defense aspirants, NCC cadets, servicemen families) and Gen Z trendsetters (16-25 urban seeking oversized tees/aesthetic streetwear with meaningful slogans) concentrated in North India (Punjab/Haryana/UP/Rajasthan) and Maharashtra, planning marketplace expansion (Amazon/Myntra/Ajio), category launches (Warrior World Kids/Women’s), premium line (220+ GSM), and ₹100 Crore ARR targeting ₹500 Crore Series A valuation building 1 million+ “Warriors” community.

Pitch 2

Currently Social Shark Tank India Episode Review

Currently Social appeared on Shark Tank India Season 5, Episode 29, with founder Mitesh Sethwala (serial entrepreneur with decade+ experience, IT Engineering degree, MBA Marketing, multiple successful ventures/exits in IT outsourcing, fashion e-commerce, service sectors including Friendly and Hi Name companies) seeking ₹1.2 Crore for 1% equity (₹120 Crore valuation) but left with no deal after all five Sharks declined citing valuation concerns and business model skepticism.

The Ahmedabad-based real-time activity-sharing platform combats “doom-scrolling” and curated social media targeting Gen Z through “post-to-view” model featuring live camera-only (no gallery uploads), mandatory activity tagging (eating/traveling/pitching), proximity alerts encouraging offline meetups, and controversial “consented stalking” opt-in instant notifications, achieving 11,000 daily posts with 17,000 active Ahmedabad users and significant clusters in Surat/Rajkot with 1,212 monthly organic visitors requiring SEO improvement. Sharks reacted critically—Anupam called scaling logic “stupidest thing” though emotionally desired Indian social network success, Kunal challenged virality claims noting effective virality likely below 1 after retention factoring, Vineeta questioned core value lacking data proving actual offline meetings, Namita doubted cultural fit arguing India already has strong informal networks (WhatsApp/family circles), and Varun remained skeptical of ad-based monetization competing with Meta.

Operating in global social media market projected at $234.34 billion (2026) with 500+ million active Indian users within Indian advertising market reaching ₹1.30 lakh crore (2026, 60-70% digital) and growing “anti-Instagram” trend (73% users shifting toward human-generated raw content), Currently Social targets Gen Z (16-24) and younger millennials (25-28) valuing “radical authenticity” experiencing social media fatigue from curated content within 250 million Gen Z population seeking 10-15 million urban users in Tier 1/2 cities amid 1-in-7 global shoppers primarily shopping via social media enabling “hyperlocal commerce” meetups, planning city-by-city rollout establishing 20,000+ user “critical mass,” hyperlocal ad tech for local businesses bidding on activity tags, and social ledger split-payment fintech revenue stream targeting Unicorn status.

Pitch 3

AnjaniBooks Shark Tank India Episode Review

AnjaniBooks appeared on Shark Tank India Season 5, Episode 29, with founder Kaushik Gupta (Lucknow entrepreneur who dropped out of college with ₹2,000 investment in 2019 inspired by Jeff Bezos/Mark Zuckerberg despite stable family garment business background) seeking ₹10 lakh for 10% equity (₹1 Crore valuation) but left with no deal after all five Sharks opted out citing founder’s temperament, low traction, and lack of scalable competitive advantage.

The e-commerce platform specializing in new/pre-owned books targets students and readers offering academic textbooks (CBSE/ICSE/State Boards), professional course materials (Engineering/Medical/B.Com), competitive exam guides, novels, and stationery at affordable prices through hybrid marketplace model where independent bookshops list inventory, operating with ₹249 contribution margin per order, 10% RTO ratio, 3,500 titles listed, and 3,263 monthly organic visitors requiring SEO improvement. Sharks reacted harshly—Anupam famously labeled founder “khula saand” (loose bull) for ignoring market realities gifting Ego is the Enemy book suggesting rigidity hindered success, Varun questioned competing directly with Amazon versus selling through them joking low ₹15,000 monthly profit would make marriage difficult, while Vineeta/Namita expressed concerns over “closed-mindedness” questioning if founder possessed necessary “hunger” to scale beyond hobby.

Operating in Indian book market valued at $12 billion (including educational/trade/professional segments) with online book-buying population at $2.5 billion and pre-owned academic/competitive exam books niche at $400-500 million within growing second-hand goods market (15%+ CAGR) and 800+ million internet users accelerating shift from physical to online platforms in Tier 2/3 cities, AnjaniBooks targets students (15-28 preparing for Board Exams/Competitive Exams like JEE/NEET/UPSC), parents in Tier 2/3 cities reducing annual school set financial burden, and bibliophiles/voracious readers (18-45) within 250+ million school-going students (world’s largest) amid rising private-publisher textbook costs making pre-owned value proposition highly attractive to middle/lower-income households, planning micro-warehousing dark stores for 5-6 hour delivery vision, seller ecosystem expansion to 500+ vendors, mobile app launch, subscription model for competitive exam libraries, and ₹10 Crore+ Series A valuation by 2028.

Episode Highlights:

- “Khula saand” criticism: Anupam’s brutal personal assessment of stubborn founder

- “Stupidest thing” verdict: Harsh rejection of social media scaling logic

- Ego is the Enemy gift: Physical book given to founder addressing temperament concerns

- Commodity vs. brand debate: Aman/Peyush criticizing “Buy 5 for ₹999” cheapening Warrior identity

- Proven exit credentials: Warrior World founders’ ₹1.5 Cr Bavgi sale unable to guarantee current success

- ₹20 Cr sales rejected: Impressive revenue insufficient without aspirational brand positioning

- Serial entrepreneur declined: Decade+ experience cannot overcome fundamental business model skepticism

- Made-to-Order validation: Vineeta seeing value in zero-inventory risk manufacturing model

Key Lessons:

- Past exits (₹1.5 Cr Bavgi) don’t guarantee future investment if current positioning flawed

- Operational excellence (Made-to-Order, ₹230 CAC vs ₹940 AOV) insufficient without brand aspiration

- Discount marketing (“Buy 5 for ₹999”) prevents premium brand building in fashion

- Social networks need viral coefficient > 1 after retention factoring, not just gross user adds

- Founder temperament matters more than business metrics when stubbornness prevents adaptation

- “Commodity play” designation = death sentence despite strong unit economics

- India’s informal networks (WhatsApp, family) create high bar for dedicated social platforms

- Competing with Amazon directly (vs. selling through them) requires extraordinary advantage

Deal Structure Analysis:

Warrior World:

- Asked: ₹75L for 1% (₹75 Cr valuation)

- Got: ₹75L for 1% + 1.5% royalty until ₹1.125 Cr recouped (₹75 Cr valuation maintained)

- Equity: None changed (maintained 1%)

- Protection: 1.5% royalty until 1.5x recovery (₹1.125 Cr total)

- Investor: Vineeta (seeing Made-to-Order operational value despite brand concerns)

- Rationale: Strong metrics but royalty protects against commodity positioning risk

Currently Social:

- Asked: ₹1.2 Cr for 1% (₹120 Cr valuation)

- Got: No deal

- Reasons: “Stupidest scaling logic,” virality < 1, no offline meeting proof, WhatsApp competition, Meta monetization dominance, cultural misfit

- Fatal Flaw: Network effects don’t compound; growth requires constant paid acquisition

AnjaniBooks:

- Asked: ₹10L for 10% (₹1 Cr valuation)

- Got: No deal

- Reasons: “Khula saand” founder temperament, closed-mindedness, ego preventing adaptation, competing with Amazon directly, ₹15K monthly profit unsustainable, lack of hunger/coachability

- Fatal Flaw: Founder rigidity preventing necessary strategy pivots and market acknowledgment

Strategic Patterns:

- Exit Credentials Insufficient: Past success (Bavgi ₹1.5 Cr) can’t overcome current positioning concerns

- Operational vs. Aspirational: Made-to-Order excellence < brand building for venture returns

- Network Effects Required: Social platforms needing viral coefficient > 1 post-retention

- Founder Temperament Critical: Stubbornness (“khula saand”) disqualifying despite business potential

- Commodity Death Sentence: Discount marketing preventing premium brand regardless of category

Market Context:

- Indian Apparel: $105B by 2027 (D2C 19% CAGR); $43B online fashion (2026)

- Patriotic/Graphic Apparel: ₹5,000 Cr niche with strong Tier 2/3 demand

- Surat Manufacturing: Cheapest high-quality textiles providing 2x industry margins

- Social Media Global: $234.34B (2026) with 500M+ active Indian users

- Indian Advertising: ₹1.30L Cr (2026), 60-70% digital

- Anti-Instagram Trend: 73% users shifting to human-generated raw content

- Book Market India: $12B total; $2.5B online; $400-500M pre-owned academic niche

- Second-Hand Goods: 15%+ CAGR with affordability driving adoption

- Student Population: 250M+ school-going (world’s largest) creating massive textbook demand

The Commodity vs. Aspiration Debate:

Warrior World exposing fundamental tension in patriotic fashion:

Aman/Peyush’s Critique:

- “Buy 5 for ₹999” marketing = commodity positioning

- Volume discounts cheapen “Warrior” brand identity

- Patriotism deserves premium, not bargain bin treatment

- Performance marketing focus prevents emotional brand connection

- Competing on price destroys ability to charge premium later

Founders’ Counter (Implied):

- Tier 2/3 customers price-sensitive requiring accessible entry

- Volume discounts drive customer acquisition and trials

- Made-to-Order allows profitability even at discount prices

- Market share capture now, premium later strategy

- ₹20 Cr sales prove model works commercially

The Reality:

- Fashion brands face uphill battle transitioning from discount to premium

- Once positioned as commodity (“Buy 5 for ₹999”), customer perception sticky

- Patriotic theme could justify ₹1,500-₹2,000 premium positioning

- But current ₹399-₹999 pricing trains customers to expect deals

- Vineeta invested despite concerns, betting operational excellence overcomes positioning

Lesson: In fashion, how you position initially (discount vs. premium) determines brand trajectory forever. Hard to escape commodity perception once established.

The Social Network Scaling Paradox:

Currently Social facing brutal reality check on network effects:

Anupam’s “Stupidest Thing” Critique:

- Scaling logic fundamentally flawed

- Assuming linear user growth compounds into network value

- Reality: Network effects require viral coefficient > 1 AFTER retention

- Without true virality, growth requires constant expensive marketing

- Can’t build venture-scale business on paid acquisition alone

Kunal’s Virality Math:

- Claimed virality likely < 1 after factoring churn

- If 1 user brings 2 new users but 50% churn monthly

- Effective viral coefficient = 2 * 0.5 = 1 (break-even, not growth)

- Real network effects need organic compound growth

- Currently Social apparently lacking this fundamental dynamic

Vineeta’s Value Proof Demand:

- Core promise: Activity sharing leads to offline meetups

- But where’s data proving users actually meet?

- If just consuming feeds like Instagram/Facebook

- Then not differentiated from existing platforms

- Value proposition collapses without offline conversion proof

Namita’s Cultural Fit:

- Indians already hyper-connected through WhatsApp

- Family groups, neighborhood networks, friend circles

- Why need dedicated activity-sharing app?

- Social connectivity already abundant, not scarce

- Platform solving problem that doesn’t exist in India

The “Khula Saand” Founder Criticism:

AnjaniBooks receiving season’s most personal assessment:

Anupam’s Brutal Honesty:

- “Khula saand” (loose bull) = uncontrollable stubborn

- Ignoring market realities (Amazon dominance)

- Refusing to acknowledge competitive disadvantages

- Rigidity preventing necessary adaptations

- Ego blocking learning and feedback reception

The Book Gift:

- “Ego is the Enemy” by Ryan Holiday

- Physical manifestation of founder problem diagnosis

- Message: Your stubbornness prevents success more than capability

- Powerful symbolic gesture showing temperament > tactics

Varun’s Reality Check:

- ₹15,000 monthly profit = unsustainable

- Marriage joke highlighting income inadequacy

- Can’t build life, let alone venture-scale business

- Competing with Amazon without advantage = futile

- Should sell through Amazon, not against them

Vineeta/Namita’s Concern:

- “Closed-mindedness” preventing growth

- Lack of “hunger” suggesting comfort with mediocrity

- Unwilling to question assumptions or pivot strategy

- Coachability essential for venture backing

- Technical competence useless without adaptability

The Diagnosis: Not that business model impossible (pre-owned books have demand), but founder temperament makes scaling with him impossible. Investors need confidence founder can:

- Receive feedback without defensiveness

- Acknowledge when wrong and pivot

- Learn continuously from market signals

- Adapt strategy based on competitive realities

Kaushik apparently failed all tests, making investment untenable regardless of business metrics.

Episode Thematic Coherence:

All three pitches tested different scale hypotheses:

- Warrior World: Discount volume vs. premium brand (operational efficiency vs. aspiration)

- Currently Social: Network effects (viral growth vs. paid acquisition)

- AnjaniBooks: Founder temperament (coachability vs. stubbornness)

Success pattern: Operational excellence with defensible protection (Warrior World’s Made-to-Order + royalty) beats flawed network effects (Currently Social’s virality < 1) and founder rigidity (AnjaniBooks’ “khula saand” temperament).

Comparative Episode Analysis:

Episode 29’s 33% deal rate and ₹75L deployment continues season’s harsh late-stage pattern:

- Matches Episodes 4, 9, 11, 26, 28 for lowest success rates

- Only ₹75L deployed despite three pitches with respectable fundamentals

- Features season’s harshest personal founder criticism (“khula saand”)

- Most brutal business logic assessment (“stupidest thing”)

- Clearest commodity vs. aspiration brand distinction

Future Implications:

- Past Exits Don’t Guarantee: Previous success (Bavgi ₹1.5 Cr) can’t overcome current execution concerns

- Discount Positioning Sticky: “Buy 5 for ₹999” marketing permanently commoditizes brand

- Network Effects Scrutinized: Social platforms requiring proof of viral coefficient > 1

- Founder Temperament Paramount: Stubbornness/ego now disqualifying despite business metrics

- WhatsApp Baseline: Indian social platforms competing against ubiquitous informal networks

Episode Significance:

Episode 29 will be remembered for exposing that impressive metrics—₹20 crore sales (Warrior World), serial entrepreneur pedigree (Currently Social), or clear market need (AnjaniBooks pre-owned books)—cannot overcome fundamental positioning flaws (commodity discount marketing), scaling logic failures (network effects < 1), or founder temperament concerns (stubbornness preventing adaptation). Warrior World’s partial success despite brand concerns validated Made-to-Order operational model while highlighting how Vineeta’s royalty protection hedged against commodity positioning risk. Currently Social’s complete rejection despite passionate founder and interesting features demonstrated that social network ambitions require demonstrable viral growth, not just user acquisition. Most significantly, AnjaniBooks’ brutal “khula saand” verdict taught that founder temperament—specifically willingness to receive feedback, acknowledge competitive realities, and adapt strategy—matters infinitely more than business model when investors need confidence in coachability and market awareness preventing necessary pivots.

Closing Reflection:

Episode 29 taught three harsh entrepreneurial truths wrapped in brutally honest Shark feedback: First, operational excellence cannot overcome brand positioning mistakes—Warrior World’s impressive Made-to-Order model and ₹230 CAC vs ₹940 AOV unit economics couldn’t escape Aman/Peyush’s verdict that “Buy 5 for ₹999” discount marketing permanently commoditizes what should be aspirational patriotic brand, with Vineeta’s investment including protective royalty acknowledging this risk. Second, network effects require mathematical proof not aspirational claims—Currently Social’s interesting features (live-only posting, proximity alerts, consented stalking) collapsed under Kunal’s virality math showing coefficient < 1 post-retention and Vineeta’s demand for offline meeting data proving core value proposition, exposing that Indian social platforms face impossibly high bar competing against WhatsApp’s ubiquitous informal networks. Third, founder temperament disqualifies faster than business model—AnjaniBooks’ reasonable pre-owned books concept became uninvestable when Kaushik’s “khula saand” stubbornness signaled inability to receive feedback, acknowledge Amazon’s competitive advantage, or adapt strategy, with Anupam’s “Ego is the Enemy” book gift powerfully symbolizing that rigidity prevents success more than lack of capability or market opportunity.

The episode demolished comforting myths that past success (Bavgi exit), entrepreneurial pedigree (serial ventures), or inspirational role models (Bezos/Zuckerberg dropouts) automatically warrant current investment. Instead, revealed mature market where positioning determines brand trajectory forever (discount → commodity, premium → aspiration), network effects require mathematical verification not faith (viral coefficient > 1 post-retention), and founder coachability matters more than domain passion when stubbornness blocks necessary market acknowledgment and strategic pivots. The brutal lesson: Build with brand aspiration from day one because repositioning from commodity impossible, prove network effects mathematically not anecdotally because investors won’t believe viral stories without retention math, and demonstrate coachability through feedback reception because stubbornness makes you unfundable regardless of business quality. Vineeta funded operational excellence despite brand concerns, betting Made-to-Order moat overcomes positioning risk. Currently Social proved social ambitions require WhatsApp-level utility or Meta-proof differentiation. AnjaniBooks learned ego kills opportunities faster than competition does. In mature venture markets, excellence isn’t enough—requires brand wisdom, mathematical honesty, and temperamental humility to convert metrics into capital.

Leave feedback about this

You must be logged in to post a comment.