MYPB Shark Tank India Episode Review

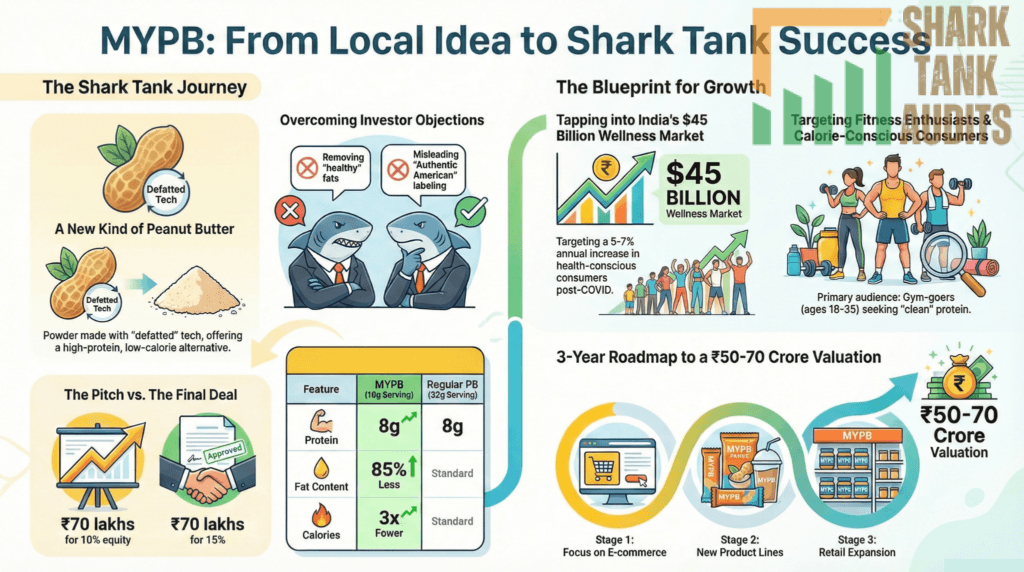

MYPB appeared on Shark Tank India Season 5, Episode 7, with founder Pujan Kachhadia seeking ₹70 lakh for 10% equity (₹7 Crore valuation) and successfully closed a deal for ₹70 lakh for 15% equity (₹4.67 Crore valuation) with Sharks Namita Thapar, Varun Alagh, and Vineeta Singh. The Amreli, Gujarat-based brand offers powdered peanut butter using defatted cold-press technology that prepares in 7 seconds with 85% less fat, 3x fewer calories, and double the protein versus regular peanut butter. Founded by BSc Chemistry graduate Pujan during COVID-19 lockdown, the 100% natural product sources local peanuts and targets India’s 50 million fitness enthusiasts. While Viraj Bahl criticized removing healthy fats as leaving “dry leftovers” and Vineeta/Varun questioned “Authentic American PB” labeling for a Gujarat product, Namita defended its dietary utility. Already EBITDA positive (8%) with ₹1 Crore revenue in India’s $162 million peanut butter market growing at 11.2% CAGR.

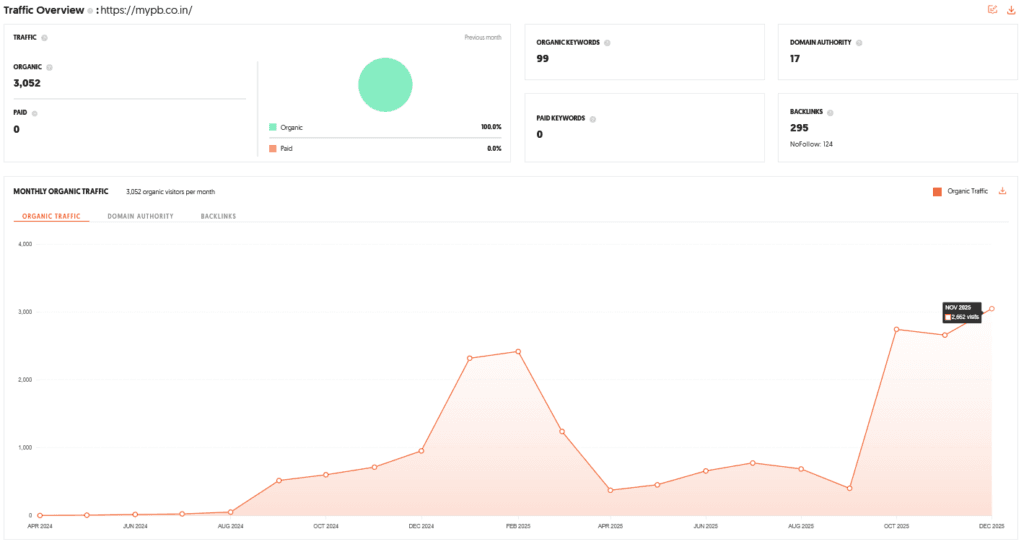

MYPB Website Information

- Website:- MYPB

- Build on Shopify

- Average SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 3502 visitor per month.

MYPB Founder

- The brand was founded by Pujan Jayantibhai Kachhadia, a BSc Chemistry graduate from Amreli, Gujarat.

- After spending three years preparing for state civil services, Poojan pivoted to entrepreneurship during the COVID-19 lockdown, inspired by his brother and the local agricultural abundance of peanuts in his region.

MYPB Brand Overview

- MYPB is a health-focused food brand that specializes in powdered peanut butter. The brand aims to provide a high-protein, low-calorie alternative to traditional peanut butter by using a specialized “defatted” process.

- Based in Amreli, the company sources raw peanuts locally and leverages the founder’s chemistry background to maintain nutritional integrity.

MYPB Shark Tank India Appearance & Ask

- Pujan appeared on Shark Tank India seeking ₹70 lakhs for 10% equity (at a valuation of ₹7 crores).

- His primary goal was to secure his first round of funding from the Sharks to scale his dream project.

MYPB Season and Episode Air Date

- Season: 05

- Episode: 08

- Episode Air Date: Wednesday, 14 January 2026

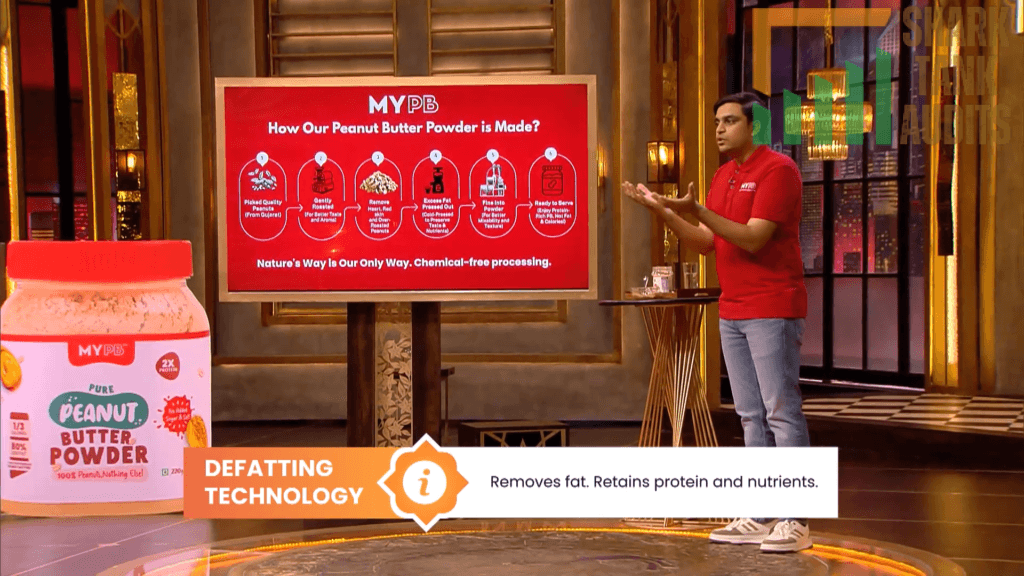

MYPB Product Overview

- The flagship product is a High-Protein Peanut Butter Powder.

- Unlike traditional jars of peanut butter that are dense and oily, this product requires the user to mix the powder with a little water.

- Preparation Time: Approximately 7 seconds.

- Technology: Uses a “defatted cold-press technology” to extract oil while keeping nutrients intact.

- Ingredients: 100% natural, free from emulsifiers, preservatives, and artificial flavors.

MYPB Product Highlights

- Calorie Reduction: Contains three times fewer calories than regular peanut butter.

- Fat Content: Up to 85% less fat compared to standard spreads.

- Protein Density: Provides double the protein per gram; specifically, 8g of protein in a 16g serving (whereas regular PB requires 32g for the same protein).

- Texture: Described by the founder as having perfect consistency and a taste that is “not too sweet.”

MYPB Investor Reactions

The Sharks had a polarized reaction to the pitch:

- Viraj Bahl (Strong Objection): He criticized the founder for “demonizing” healthy fats found in natural peanut butter. He argued that the most valuable part of the peanut (the oil) was being removed and sold to mills, leaving consumers with “dry leftovers.”

- Vineeta Singh & Varun Alagh: They raised concerns regarding the labeling, specifically the “Authentic American PB” claim for a product made in Gujarat, noting it could be a misclaim.

- Namita Thapar: She saw value for specific consumers who want protein without the added oil/fats, defending the product’s utility for specific dietary preferences.

MYPB Customer Engagement Philosophy

- The brand’s philosophy is rooted in honesty and local sourcing.

- By using locally grown peanuts from Amreli and avoiding the “hidden” fats and preservatives found in commercial brands, MYPB positions itself as a transparent alternative for the fitness-conscious Indian consumer.

- The founder’s approach is to simplify health, making a high-protein snack accessible and quick to prepare.

MYPB Future Vision

- Pujan intends to establish MYPB as a leader in the functional foods category in India.

- Following his research into the US market (where powdered peanut butter is a top-seller on platforms like Amazon), he envisions scaling the brand from its current ₹1 crore total revenue to a household name.

- With the brand already achieving 8% EBITDA positivity, the focus is now on expansion and correcting brand messaging to match its Indian roots.

MYPB Deal Finalized or Not

- Yes, the deal was finalized. After a series of negotiations and discussions regarding the market size and product claims, a combined offer was made.

- Pujan closed the deal with Namita Thapar, Varun Alagh, and Vineeta Singh for ₹70 lakhs for 15% equity, resulting in a valuation of ₹4.67 crores.

| Item | Details |

|---|---|

| Website Name | MYPB |

| Website Platform | Built on Shopify |

| SEO Status | Average SEO performance, improvement needed |

| Organic Traffic | 3,502 visitors per month |

| Founder Name | Pujan Jayantibhai Kachhadia |

| Founder Education | BSc Chemistry graduate |

| Founder Origin | Amreli, Gujarat |

| Founder Background | Prepared 3 years for state civil services |

| Entrepreneurial Shift | Pivoted during COVID-19 lockdown |

| Inspiration Source | Brother and local peanut farming ecosystem |

| Brand Category | Health-focused functional food brand |

| Core Product | Powdered peanut butter |

| Processing Method | Defatted cold-press technology |

| Nutritional Focus | High protein, low calorie |

| Manufacturing Base | Amreli, Gujarat |

| Raw Material Sourcing | Locally sourced peanuts |

| Science Backbone | Chemistry-based formulation approach |

| Shark Tank Ask | ₹70 lakhs for 10% equity |

| Ask Valuation | ₹7 crores |

| Funding Objective | First external funding to scale |

| Flagship Product | High-protein peanut butter powder |

| Product Format | Powder mixed with water |

| Preparation Time | Approx. 7 seconds |

| Ingredient Quality | 100% natural |

| Additive Policy | No emulsifiers or preservatives |

| Artificial Flavors | None |

| Calorie Comparison | 3x fewer calories than regular PB |

| Fat Reduction | Up to 85% less fat |

| Protein Density | 8g protein per 16g serving |

| Regular PB Comparison | 32g needed for same protein |

| Texture Description | Smooth, balanced, not too sweet |

| Viraj Bahl View | Strong objection on fat removal |

| Viraj Bahl Concern | Oil is the most valuable part |

| Vineeta Singh Concern | Misleading “Authentic American PB” claim |

| Varun Alagh Concern | Labeling authenticity issue |

| Namita Thapar View | Useful for specific dietary needs |

| Brand Philosophy | Honesty and transparency |

| Sourcing Philosophy | Locally grown peanuts |

| Consumer Focus | Fitness-conscious Indians |

| Health Positioning | Clean protein without hidden fats |

| Ease of Use | Quick and simple preparation |

| Founder Vision | Leadership in functional foods |

| US Market Insight | Powdered PB is top-selling |

| Current Revenue | ₹1 crore |

| Profitability Status | 8% EBITDA positive |

| Messaging Focus | Align branding with Indian roots |

| Deal Status | Deal finalized |

| Final Investors | Namita Thapar, Varun Alagh, Vineeta Singh |

| Final Deal Amount | ₹70 lakhs |

| Final Equity | 15% |

| Final Valuation | ₹4.67 crores |

| India PB Market Size | $162 million (2026) |

| Market Growth Rate | 11.2% CAGR |

| Wellness Market Size | $45 billion by 2026 |

| Functional Food Trend | Fastest-growing food segment |

| E-commerce Opportunity | $25 billion by 2026 |

| Global PB Powder Market | $2.26 billion |

| India TAM Base | 300 million urban consumers |

| SAM Size | 50 million fitness users |

| SOM Target | 2–3% market share |

| Revenue Target (3 yrs) | ₹25–30 crores |

| Primary Audience | Gym-goers & bodybuilders |

| Primary Age Group | 18–35 years |

| Secondary Audience | Weight-watchers |

| Secondary Age Group | 25–45 years |

| Tertiary Audience | Parents & children |

| Consumer Segment | SEC A & B |

| Content Strategy | Educational fitness reels |

| Viral Concept | “7-Second PB Challenge” |

| Comparison Content | Fat & calorie comparison charts |

| Brand Storytelling | Founder’s Shark Tank journey |

| SEO Focus Keywords | Low-calorie PB, defatted peanut powder |

| Influencer Strategy | Fitness creators & nutritionists |

| Paid Ads | Meta & Google retargeting |

| D2C Channel | Shopify website |

| Marketplace Presence | Amazon, Flipkart |

| Quick-Commerce | Blinkit, Zepto |

| Offline Expansion | Gyms & health cafés |

| Key Advantage | 85% less fat |

| Cost Advantage | Local sourcing |

| Profit Advantage | EBITDA positive |

| Key Challenge | Consumer education |

| Branding Risk | “American PB” claim |

| Fat Debate | Healthy fat perception |

| Success Driver | India’s protein deficiency |

| Branding Mitigation | Indian science-led positioning |

| Flavor Mitigation | Chocolate & caramel variants |

| Year 1 Goal | ₹3–5 Cr revenue |

| Year 2 Expansion | Protein bars & shakes |

| Year 3 Scale | 10,000+ retail points |

| Long-term Valuation | ₹50–70 Cr |

MYPB Shark Tank India Business Plan

1. MYPB Business Potential in India (Facts & Data)

- India Peanut Butter Market: The domestic market is valued at approximately $162 million in 2026, growing at a robust CAGR of 11.2%.

- Health & Wellness Surge: India’s wellness market is projected to reach $45 billion by 2026, driven by a 5-7% annual increase in health-conscious consumers post-COVID.

- Functional Food Demand: Powdered supplements and functional foods are the fastest-growing segments, with India expected to post the fastest growth in Asia-Pacific for functional ingredients.

- E-commerce Growth: Online grocery and health-food sales in India are expected to hit $25 billion by 2026, providing a massive runway for MYPB’s Shopify-based model.

2. MYPB Total Addressable Market (TAM)

- TAM (Total Addressable Market): The global peanut butter powder market is valued at $2.26 billion in 2026. In India, the potential reach includes the 300 million middle-to-high income urban population.

- SAM (Serviceable Addressable Market): Approximately 50 million active gym-goers and fitness enthusiasts in Tier 1 & 2 cities who prioritize protein intake.

- SOM (Serviceable Obtainable Market): Aiming for a 2-3% market share of the Indian peanut butter segment, targeting ₹25–30 crore in annual revenue within 3 years.

3. MYPB Ideal Target Audience & Demographics

- Primary Audience: Fitness enthusiasts, gym-goers, and bodybuilders (Ages 18–35) seeking “clean” protein without the caloric load of fats.

- Secondary Audience: Weight-watchers and calorie-conscious urban professionals (Ages 25–45) who want healthy breakfast alternatives.

- Tertiary Audience: Parents seeking high-protein, low-sugar snacks for children, moving away from traditional oily spreads.

- Demographics: Urban/Semi-urban dwellers, SEC A & B, with a preference for “Natural” and “Made in India” labels.

4. MYPB Marketing & Digital Strategy

Content Strategy

- Educational Reels: “7-Second PB Challenge” showing the quick transition from powder to paste.

- Comparison Graphics: Side-by-side calorie/fat charts of MYPB vs. Regular Peanut Butter.

- Founder’s Story: Highlighting Poojan’s journey from Amreli to Shark Tank to build trust through authenticity.

Digital & SEO Strategy

- SEO Overhaul: Targeted keywords like “Low-calorie peanut butter India,” “Protein powder for weight loss,” and “Defatted peanut powder.”

- Influencer Marketing: Partnering with Tier 2/3 fitness influencers and nutritionists to validate the “defatted technology.”

- Performance Marketing: Meta and Google Ads retargeting visitors who abandon carts on the MYPB Shopify store.

5. MYPB Distribution Strategy

- Direct-to-Consumer (D2C): Optimizing the MYPB website (Shopify) for better conversion and subscriptions.

- Marketplaces: Aggressive presence on Amazon, Flipkart, and Zepto/Blinkit (Quick-commerce is vital for healthy snacks).

- Institutional Sales: Partnering with premium gyms, yoga studios, and health cafes in Gujarat and Maharashtra initially.

6. MYPB Advantages & Challenges

| MYPB Advantages | MYPB Challenges |

| Nutritional Edge: 85% less fat and 3x fewer calories. | Market Education: Explaining “powdered” PB to a habituated “creamy/crunchy” market. |

| Local Sourcing: Raw materials from Amreli reduce supply chain costs. | Labeling Disputes: Addressing Shark Tank concerns over “Authentic American” branding. |

| EBITDA Positive: Already profitable at a small scale (8% EBITDA). | Fat Perception: Overcoming the argument that “peanut fats are healthy.” |

7. MYPB Success Reasons & Mitigation Strategies

- Why Success is Likely: High protein density (8g per 16g serving) meets India’s protein deficiency gap perfectly.

- Mitigation (Branding): Rebrand from “American PB” to “Amreli’s Finest” or “Science-Backed Indian PB” to lean into local authenticity.

- Mitigation (Flavor): Launch flavored variants (Chocolate, Salted Caramel) to mask the “dryness” associated with defatted products.

8. MYPB Future Business & Roadmap to Valuation

- Year 1 (Scale): Utilize ₹70 lakhs to optimize SEO, fix labeling, and enter Quick-commerce (Blinkit/Instamart). Target: ₹3–5 Cr Revenue.

- Year 2 (Product Extension): Launch MYPB protein bars and ready-to-drink high-protein shakes using the same defatted base.

- Year 3 (Valuation Leap): Expand to 10,000+ retail touchpoints. Target: ₹15–20 Cr Revenue with a projected valuation of ₹50–70 Cr for the next funding round.

MYPB Shark Tank India Episode Review