Awayddings Shark Tank India Episode Review

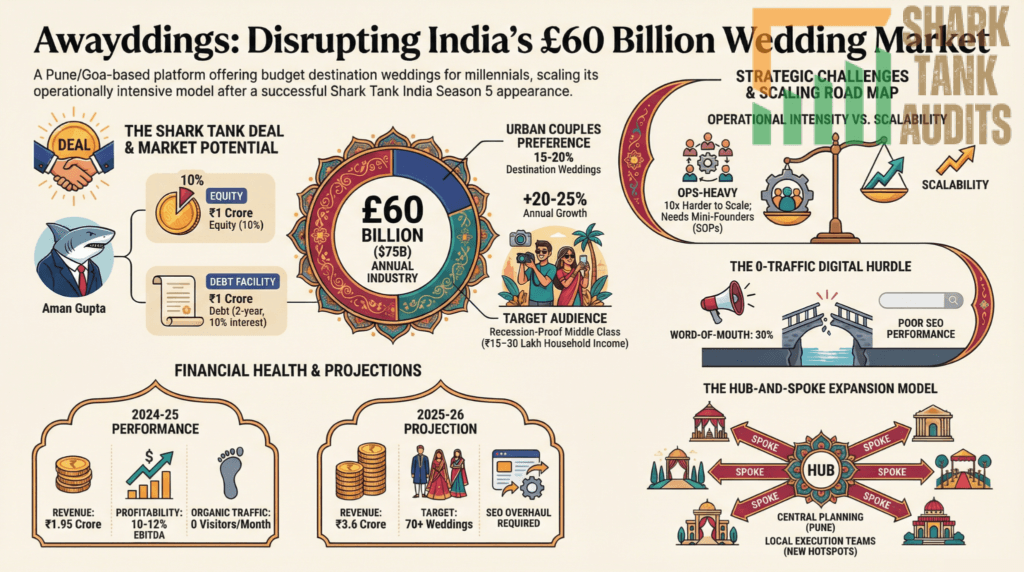

Awayddings appeared on Shark Tank India Season 5, Episode 17, with co-founders Ashish Godghate (CEO, ex-OYO Weddingz.in from Pune) and Vijay Kumar (COO, met in Goa) seeking ₹2 Crore for 5% equity (₹40 Crore valuation) and successfully closed a deal for ₹1 Crore for 10% equity + ₹1 Crore debt at 10% interest for 2 years with Shark Aman Gupta, who insisted his name not be featured in operations citing past “burnt hand” in similar business.

The Pune/Goa-based destination wedding planning platform launched 2021 with ₹42 lakh joint investment specializes in affordable destination weddings (₹10-15 lakh for 80 guests, 3 days) expanding to ₹2 Crore high-end packages, achieving ₹1.95 Crore revenue (2024-25) with 10-12% EBITDA and projecting ₹3.6 Crore (2025-26, 70+ weddings) with 0 organic visitors requiring SEO improvement and 30% word-of-mouth marketing praised by Namita.

Entering with dhol beats, founders faced scrutiny over cap table showing previous investor (Kesari Tours) took 50% equity for ₹1.23 Crore (Anupam called it “taking away identity”) before restructuring to 75-25 founder favor, while Sharks cited “ops-heavy” challenges—Anupam noted OYO struggled with “thankless” model, Kunal said city-by-city scaling is “10x harder,” Namita worried about seasonality and need for “mini-founders” managing multiple simultaneous weddings. Operating in India’s $75 billion wedding industry (20-25% YoY growth) with 15-20% urban couples preferring destination weddings from 10 million annual marriages ($15 billion organized planning potential), Awayddings targets millennials/Gen Z (25-35) in Tier 1 cities with ₹15-30 lakh household income seeking “Instagrammable” experiences without logistical hassles within 90% unorganized sector.

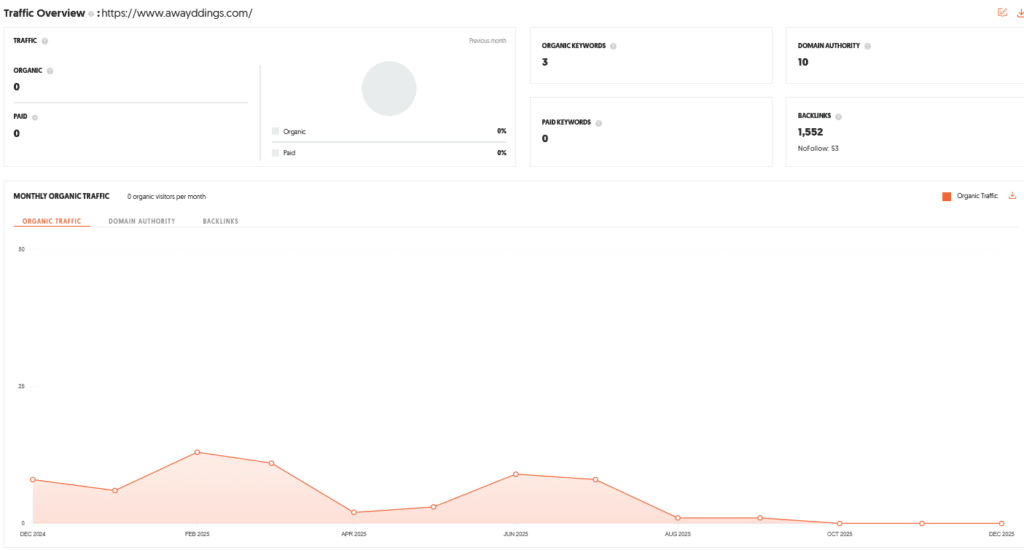

Website Information

- Website:- Awayddings

- Build on JavaScript frameworks Nuxt.js Vue.js

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 0 visitor per month

The Founder

- The brand was co-founded by Ashish Godghate (CEO) and Vijay Kumar (COO).

- Ashish, a native of Pune, previously gained industry experience working with OYO’s wedding vertical, Weddingz.in.

- He met Vijay in Goa, where a casual exchange of ideas led to a partnership.

- In 2021, the duo officially launched the business with an initial joint investment of Rs 42 lakhs.

Brand Overview

- Awayddings is a Pune and Goa-based destination wedding planning platform.

- It positions itself as a modern solution for millennial and Gen-Z couples who view weddings as a travel experience rather than just a traditional event.

- The company operates as a one-stop shop, managing everything from venue selection and research to catering and décor.

Shark Tank India Appearance & Ask

- The founders made a festive, high-energy entry into the Tank accompanied by the beats of a dhol.

- Initial Ask: Rs 2 crores for 5% equity.

- Valuation: Rs 40 crores. During the pitch, the Sharks expressed concern over the company’s cap table, noting that a previous investor (Kesari Tours) had initially taken 50% equity for Rs 1.23 crores—a move Anupam Mittal described as “taking away their identity.” However, the founders clarified they had since restructured the equity to a 75-25 split in favor of the founders.

Season and Episode Air Date

- Season: 05

- Episode: 17

- Episode Air Date: Tuesday, 27 January 2026

Product Overview

- Awayddings specializes in affordable destination weddings, specifically targeting the “budget” segment with packages starting between Rs 10–15 lakhs for approximately 80 guests over three days.

- They have also expanded to cater to high-end clients with budgets reaching up to Rs 2 crores.

- Their service model is designed to bring organization to the largely unorganized wedding sector.

Investor Reactions

The Sharks were largely hesitant due to the “ops-heavy” nature of the business:

- Anupam Mittal: Noted that OYO struggled with this model because it is “thankless” and difficult to standardize.

- Kunal Bahl: Opted out because the physical effort and complexity of scaling city-by-city are “10x” harder than they appear.

- Namita Thapar: Worried about seasonality and the lack of “mini-founders” to manage multiple weddings on the same date.

- Mohit Yadav: Acknowledged the interesting category but felt it was too early to invest given the operational challenges.

Customer Engagement Philosophy

- The brand focuses on a hassle-free, seamless experience for the couple.

- They aim to handle the “khit-pit” (trivial stressors) of wedding planning so families can focus on the celebration.

- Interestingly, 30% of their marketing comes from word-of-mouth, which earned praise from Namita Thapar for building strong client loyalty.

Product Highlights

- Standardization: Offers a complete end-to-end solution including location scouting, cuisine, and décor.

- Budget Accessibility: Makes upscale locations like Goa and Jaipur accessible for weddings under Rs 15 lakh.

- Financial Health: The company reported a revenue of Rs 1.95 crores in 2024-25 with a 10-12% EBITDA, showing profitability despite being operationally intensive.

Future Vision

- Awayddings aims to dominate the budget destination wedding market by expanding beyond Goa and Jaipur into locations like Varanasi and Rishikesh.

- For the 2025-26 fiscal year, they project a revenue of Rs 3.6 crores by hosting over 70 weddings.

- Their ultimate goal is to become the primary platform for destination wedding bookings in India.

Deal Finalized or Not

- Yes, a deal was finalized.

- Aman Gupta was the only Shark to make an offer. After negotiations, the founders accepted the following deal:

- Final Deal: Rs 1 crore for 10% equity and Rs 1 crore as debt (at 10% interest for 2 years) with Shark Aman Gupta.

- The Condition: Aman Gupta insisted that his name must not be featured or mentioned in the business operations.

- He cited a past “burnt hand” in a similar business and wanted to avoid being personally contacted by customers over operational hiccups like missing towels or service delays.

| Parameter | Details |

|---|---|

| Website | Awayddings |

| Website Technology | Built on Nuxt.js and Vue.js (JavaScript frameworks) |

| SEO Status | Poor SEO performance, improvement needed |

| Organic Traffic | 0 visitors per month |

| Founders | Ashish Godghate, Vijay Kumar |

| Founder Roles | Ashish Godghate (CEO), Vijay Kumar (COO) |

| Founder Background | Ashish is ex-OYO Weddingz.in; Vijay met Ashish in Goa |

| Year Founded | 2021 |

| Initial Investment | ₹42 Lakhs (joint founder investment) |

| Headquarters | Pune and Goa |

| Brand Category | Destination wedding planning |

| Brand Positioning | Affordable destination weddings for millennials and Gen-Z |

| Core Offering | End-to-end wedding planning platform |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 17 |

| Episode Air Date | Tuesday, 27 January 2026 |

| Entry Style | Festive entry with dhol beats |

| Initial Ask | ₹2 Crores for 5% equity |

| Initial Valuation | ₹40 Crores |

| Cap Table Issue | Kesari Tours earlier took 50% equity for ₹1.23 Crores |

| Equity Restructure | Reworked to 75–25 in favor of founders |

| Flagship Service | Budget destination wedding packages |

| Budget Package Range | ₹10–15 Lakhs for 80 guests over 3 days |

| Premium Package Range | Up to ₹2 Crores |

| Revenue FY 2024–25 | ₹1.95 Crores |

| EBITDA Margin | 10–12% |

| Revenue Projection FY 2025–26 | ₹3.6 Crores |

| Weddings Target FY 2025–26 | 70+ weddings |

| Marketing Mix | 30% word-of-mouth |

| Customer Philosophy | Stress-free planning and handling “khit-pit” |

| Target Audience | Millennials and Gen-Z couples |

| Target Age Group | 25–35 years |

| Target Cities | Tier-1 cities |

| Income Bracket | ₹15–30 Lakhs household income |

| Industry Size | $75 Billion Indian wedding industry |

| Industry Growth Rate | 20–25% YoY |

| Destination Wedding Trend | 15–20% urban couples prefer destination weddings |

| Anupam Mittal Concern | Ops-heavy and “thankless” business |

| Kunal Bahl Concern | City-by-city scaling is 10x harder |

| Namita Thapar Concern | Seasonality and lack of mini-founders |

| Mohit Yadav View | Interesting category but too early |

| Investing Shark | Aman Gupta |

| Final Deal Status | Deal finalized |

| Final Equity Deal | ₹1 Crore for 10% equity |

| Debt Component | ₹1 Crore debt at 10% interest for 2 years |

| Final Valuation | ₹10 Crores (equity component) |

| Special Condition | Aman Gupta’s name not to be used in operations |

| Reason for Condition | Past bad experience in similar business |

| Competitive Advantage | Budget destination weddings in organized format |

| Key Challenge | Operational scalability and seasonality |

| Expansion Plan | Goa, Jaipur, Varanasi, Rishikesh |

| Long-Term Vision | Become India’s leading destination wedding platform |

Awayddings Shark Tank India Business Plan

1. Awayddings Business Potential in India: Market Facts and Data

- The Big Fat Indian Wedding Market: The Indian wedding industry is valued at approximately $75 billion annually and is growing at a rate of 20–25% year-on-year.

- Destination Shift: There is a massive shift toward “intimate” destination weddings. Approximately 15–20% of urban couples now prefer destination weddings over local banquet halls.

- Awayddings Economic Resilience: Unlike luxury planners, Awayddings taps into the “recession-proof” middle-class segment, where families prioritize wedding spending regardless of economic fluctuations.

- Unorganized Sector Gap: Over 90% of the wedding planning market in India is unorganized; Awayddings has the potential to become a top-of-mind organized aggregator.

2. Awayddings Total Addressable Market (TAM): Statistics and Scope

- Total Addressable Market (TAM): With ~10 million weddings in India annually, the potential market for organized planning is roughly $15 billion.

- Serviceable Addressable Market (SAM): Awayddings targets the upper-middle-class and millennial segment (approx. 1.5 million weddings annually) specifically looking for professional coordination.

- Serviceable Obtainable Market (SOM): By focusing on the Rs 10–15 lakh budget, Awayddings can realistically capture 0.5% of the market in the next 3 years, representing 7,500 weddings annually.

3. Awayddings Ideal Target Audience and Demographics

- Primary Demographic: Millennials and Gen-Z (Ages 25–35) residing in Tier-1 cities like Mumbai, Pune, Bangalore, and Delhi.

- Psychographics: Couples seeking “Instagrammable” experiences without the logistical headache (khit-pit).

- Income Bracket: Households with an annual income of Rs 15–30 lakhs who desire a “luxury feel” on a mid-range budget.

- Awayddings User Persona: Working professionals who value their time and prefer a “one-stop-shop” over negotiating with individual vendors.

4. Awayddings Marketing and Digital Strategy: Solving the 0 Traffic Problem

- Search Engine Optimization (SEO) Overhaul: Since Awayddings currently has 0 organic visitors, the immediate priority is optimizing the Nuxt.js/Vue.js site for keywords like “Budget Destination Wedding Goa” and “Affordable Wedding Planner Jaipur.”

- Content Marketing Strategy: Launch an Awayddings blog focusing on “Cost-saving hacks for destination weddings” and “Top 10 offbeat venues in Rishikesh” to drive organic top-of-funnel traffic.

- Social Media Power: Leverage Instagram Reels and TikTok-style content showcasing “Behind the Scenes” of successful weddings to build trust and visual proof.

- Paid Performance Marketing: Execute hyper-targeted Meta (Facebook/Instagram) ads aimed at users with “Recently Engaged” relationship statuses in specific high-income pin codes.

5. Awayddings Distribution and Operational Strategy

- The Hub-and-Spoke Model: Awayddings will maintain central planning hubs in Pune while establishing local “Execution Teams” in destination hotspots like Goa, Jaipur, Varanasi, and Rishikesh.

- Tech-Driven Distribution: Use the Awayddings platform to allow clients to track their wedding progress in real-time, reducing the need for constant phone calls.

- B2B Partnerships: Partner with travel agencies and airline aggregators to offer bundled flight-plus-wedding guest packages.

6. Awayddings Advantages and Challenges

- Awayddings Advantages: * First-Mover in Budget Destination: Most planners focus on the Rs 50L+ segment; Awayddings owns the Rs 10–15L space.

- Profitability: Already maintaining a 10-12% EBITDA, proving the unit economics work.

- Awayddings Challenges: * Scalability: As noted by the Sharks, maintaining quality across multiple cities simultaneously is difficult.

- Seasonality: Revenue is heavily concentrated in the traditional Indian wedding months (Nov–Feb and April–July).

7. Awayddings Success Factors and Risk Mitigation Strategies

- Why Awayddings Will Succeed: It solves the “Trust Deficit” in the wedding industry through standardized pricing and professional management.

- Mitigation Strategy for “Ops-Heavy” Risks: Develop an Awayddings Standard Operating Procedure (SOP) manual so “Mini-Ashish” or “Mini-Vijay” managers can run weddings without the founders being present.

- Mitigation Strategy for Payment Issues: Implement a strict 40-40-20 payment structure (40% booking, 40% pre-event, 20% on arrival) to avoid the “switching off lights” scenario mentioned on Shark Tank.

8. Awayddings Future Business Roadmap and Valuation Growth

- Year 1 (The Expansion): Scale from Goa/Jaipur to Varanasi and Rishikesh; target Rs 3.6 crore revenue.

- Year 2 (The Tech Pivot): Launch the Awayddings DIY App, a SaaS tool for couples to plan their own wedding using Awayddings-verified vendors for a subscription fee.

- Year 3 (The Multiplier): Enter the “NRI Wedding” market, which brings 3x higher margins.

- Roadmap to Increase Valuation: 1. Improve SEO: Transition from 0 to 100k+ monthly organic visitors. 2. Asset-Light Model: Shift toward a marketplace model where Awayddings takes a commission from vendors while providing the “Trust Seal.” 3. High-Value Deal Flow: Balance the budget weddings with 10% high-end (Rs 1Cr+) weddings to boost overall EBITDA and brand prestige.

Awayddings Shark Tank India Episode Review