Madrasi Kaapi House Shark Tank India Episode Review

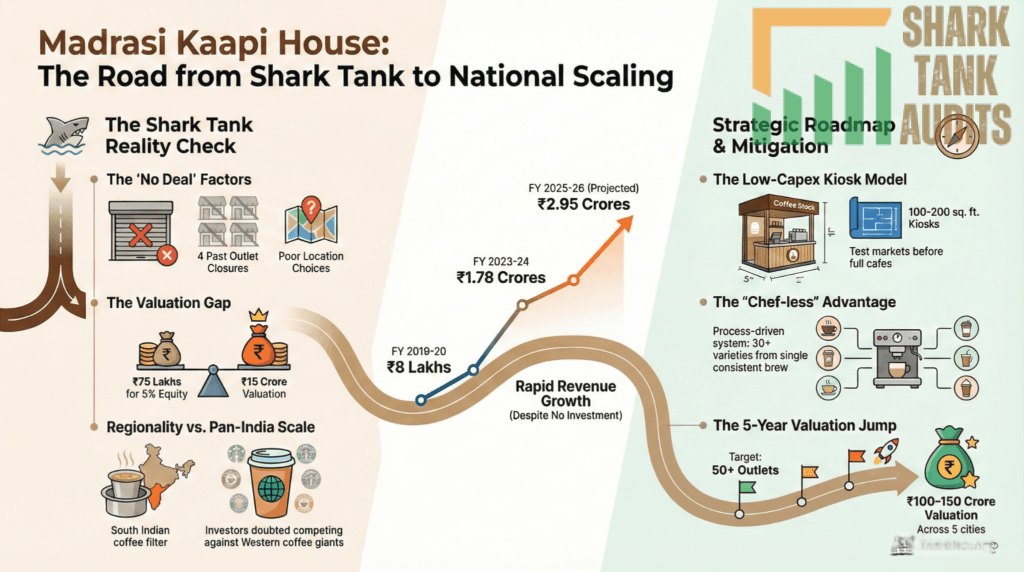

In Shark Tank India Season 5, Episode 24, the Mumbai-based QSR chain Madrasi Kaapi House, founded by neighbors Venkata Shiva, Simran Venkat, and Smita Rohan Alke, pitched their vision to take authentic South Indian filter coffee national. Seeking an investment of ₹75 lakhs for 5% equity at a ₹15 crore valuation, the founders showcased a “chef-less” operational model capable of producing 30+ beverage varieties from a single brew.

Despite impressive revenue growth (projected at ₹2.95 crores for FY 25-26) and a standardized process-driven system, the startup did not secure a deal. The Sharks, including Anupam Mittal and Namita Thapar, expressed significant concerns regarding the brand’s past failure (having closed four previous outlets), poor location choices, and the immense difficulty of scaling a local coffee chain into a pan-India powerhouse against established Western competitors.

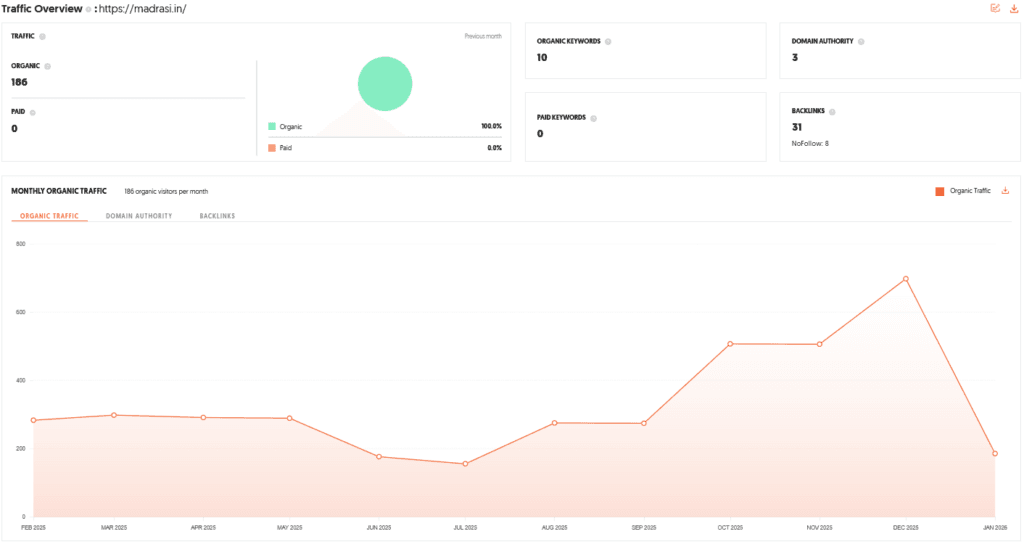

Website Information

- Website:- Madrasi Kaapi House

- Build on JavaScript libraries jQuery 1.11.1 jQuery UI 1.11.2 Masonry

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 186 visitors per month

The Founders of Madrasi Kaapi House

- The brand was established in 2019 by a team of neighbors-turned-business partners: Venkat Shiva, Simran Venkat, and Smita Rohan Alke.

- Driven by a shared passion for South Indian traditions, the founders combined their diverse strengths to challenge the dominance of Western coffee chains and bring the authentic “Kaapi” experience to the mainstream urban market.

Madrasi Kaapi House Brand Overview

- Madrasi Kaapi House is a Mumbai-based Quick Service Restaurant (QSR) chain dedicated to serving authentic South Indian filter coffee and snacks.

- The brand operates through a contemporary cafe-style environment that blends heritage with modern retail vibes.

- With five outlets currently established across Mumbai, the brand positions itself as a culturally grounded alternative to international espresso-based chains, focusing on the second most consumed coffee style in the world.

Madrasi Kaapi House Shark Tank India Appearance & Ask

- Appearing in Season 5, Episode 24, the founders presented their vision of taking Indian coffee culture national.

- They sought an investment of ₹75 lakh in exchange for 5% equity, valuing the company at ₹15 crore.

- The pitch emphasized their readiness to scale and their mission to provide a standardized, organized platform for traditional filter coffee.

Season and Episode Air Date

- Season: 05

- Episode: 24

- Episode Air Date: Thursday, 05 February, 2026

Madrasi Kaapi House Product Overview

- The brand specializes in traditional South Indian filter coffee (kaapi), characterized by its robust flavor and rich aroma.

- Alongside their signature brews, they serve a variety of authentic South Indian snacks.

- The menu is designed to cater to both traditionalists and modern urban consumers, offering a “fast-food” efficiency while maintaining the soul of a traditional South Indian kitchen.

Madrasi Kaapi House Investor Reactions

The Sharks expressed several concerns regarding the business’s current state and scalability:

- Anupam Mittal: Noted that the business lacked the clear scaling potential seen in giants like Domino’s and opted out.

- Namita Thapar: Questioned the ability of local chains to go Pan-India, specifically highlighting the concern that the brand had already closed four previous outlets.

- Vineeta Singh: Advised the founders to focus on increasing revenue per outlet (targeting ₹10-15 lakhs) before seeking national expansion.

- Aman Gupta: Criticized the founders’ judgment regarding outlet locations.

- Kanika Mann: Acknowledged the potential of filter coffee but felt the brand lacked a focused vision.

Madrasi Kaapi House Customer Engagement Philosophy

- The brand’s philosophy centers on consistency, speed, and accessibility.

- By creating relaxed, outdoor-oriented spaces, Madrasi Kaapi House aims to engage both younger generations and seasoned coffee drinkers.

- They strive to make authentic cultural experiences affordable and convenient, ensuring that the “Kaapi” tradition remains relevant in a fast-paced urban setting.

Madrasi Kaapi House Product Highlights

- Chef-less Model: The brand utilizes a process-driven system that removes dependency on specific chefs or baristas, ensuring taste consistency across all locations.

- Versatile Brewing: They impressively produce 30+ beverage varieties from a single filter coffee brew.

- Operational Efficiency: The model is built for speed and high-volume service, ideal for the QSR format.

- Revenue Growth: The brand showed significant growth, moving from ₹8 lakhs in FY 19-20 to a projected ₹2.95 crores for FY 25-26.

Madrasi Kaapi House Future Vision

- The future vision for Madrasi Kaapi House involves leveraging their Shark Tank visibility to boost brand recall and consumer confidence.

- They aim to refine their unit economics and profitability to attract future institutional funding.

- Their long-term goal remains to challenge Western coffee dominance by expanding their footprint through a managed franchise model and strategically opening new company-owned stores across major Indian cities.

Madrasi Kaapi House Deal Finalized or Not

- No deal was finalized.

- Despite the Sharks enjoying the product, all five investors chose to opt out for various strategic and financial reasons.

- Madrasi Kaapi House exited the tank without securing the requested investment.

| Category | Details |

|---|---|

| Website | Madrasi Kaapi House |

| Website Technology | JavaScript libraries (jQuery 1.11.1, jQuery UI 1.11.2, Masonry) |

| SEO Performance | Poor SEO performance; urgent improvement needed |

| Organic Traffic | ~186 visitors/month |

| Year Established | 2019 |

| Headquarters | Mumbai, India |

| Founders | Venkata Shiva, Simran Venkat, Smita Rohan Alke |

| Founder Background | Neighbors-turned-entrepreneurs passionate about South Indian culture |

| Brand Category | QSR (Quick Service Restaurant) – Coffee & Snacks |

| Core Offering | Authentic South Indian filter coffee (Kaapi) |

| Brand Positioning | Cultural Indian alternative to Western coffee chains |

| Number of Outlets | 5 outlets (Mumbai) |

| Core Philosophy | Consistency, speed, accessibility & cultural authenticity |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 24 |

| Shark Tank Ask | ₹75 Lakhs for 5% equity |

| Implied Valuation | ₹15 Crores |

| Pitch Objective | Take Indian filter coffee culture pan-India |

| Primary Product | South Indian Filter Coffee (Kaapi) |

| Secondary Products | Authentic South Indian snacks |

| Service Model | Cafe-style QSR with fast-food efficiency |

| Unique Brewing Capability | 30+ beverages from a single filter brew |

| Operational Model | Chef-less, process-driven system |

| Operational Advantage | High taste consistency across outlets |

| Revenue FY 19–20 | ₹8 Lakhs |

| Revenue FY 23–24 | ₹1.78 Crores |

| Projected Revenue FY 25–26 | ₹2.95 Crores |

| Target AOV | ₹180 |

| Target Store-Level EBITDA | 15–20% |

| Anupam Mittal’s Feedback | Lacked clear Domino’s-like scalability |

| Namita Thapar’s Feedback | Concerned about pan-India scalability & outlet closures |

| Vineeta Singh’s Feedback | Advised increasing per-outlet revenue before expansion |

| Aman Gupta’s Feedback | Criticized outlet location decisions |

| Kanika Tekriwal’s Feedback | Felt brand lacked a sharp, focused vision |

| Deal Status | ❌ No Deal |

| Reason for No Deal | Scalability doubts, unit economics, outlet closures |

| Customer Experience Strategy | Relaxed, outdoor-oriented, quick-service cafés |

| Target Consumer Emotion | Affordable nostalgia with modern convenience |

| Key Product Highlight | Authentic kaapi with QSR speed |

| Major Competitive Advantage | Affordable premium positioning |

| Indian QSR Market Size | ~$30.37 Billion by 2026 |

| QSR Market CAGR | 9.26% |

| Indian Coffee Market Size | ~$1.91 Billion (2024) |

| Coffee Consumption Trend | Shift from instant to brewed coffee |

| TAM | Total Indian coffee market |

| SAM | Chained cafe & QSR coffee market ($450–500M) |

| SOM Target | ₹100–300 Crores in 5 years |

| Primary Target Audience | Millennials & Gen Z (18–35) |

| Secondary Target Audience | Office professionals & traditionalists (35–55) |

| Psychographic Profile | Value-conscious, culture-curious |

| SEO Priority | Local & intent-based keywords |

| SEO Keywords to Target | Best filter coffee in Mumbai, South Indian snacks near me |

| Content Strategy | ASMR-style kaapi brewing videos |

| Local SEO Strategy | Google My Business optimization for each outlet |

| Discovery Source | 60% via “near me” searches |

| Current Sales Mix | 76% Offline / 24% Online |

| Online Growth Strategy | Swiggy & Zomato partnerships |

| Expansion Model | Hub-and-spoke with central kitchens |

| Preferred Locations | Metro stations, airports, corporate parks |

| Key Advantage | Low dependency on chefs |

| Key Challenge | High real estate costs |

| Secondary Challenge | Scaling regional authenticity nationally |

| Risk Identified by Sharks | Outlet closures & inconsistent performance |

| Mitigation Strategy | Low-capex kiosk model (100–200 sq ft) |

| Short-Term Goal | ₹15 Lakhs/month revenue per outlet |

| Medium-Term Goal | Franchise-ready operating model |

| Long-Term Vision | Challenge Western coffee dominance |

| 5-Year Expansion Plan | 50+ outlets across 5 cities |

| Revenue Milestone Target | ₹50+ Crores |

| Valuation Potential | ₹100–150 Crores |

| Potential Acquirers | Tata Consumer Products, FMCG majors |

Madrasi Kaapi House Shark Tank India Business Plan

1. Madrasi Kaapi House Logical Business Plan & Stats

The core objective is to shift Madrasi Kaapi House from “location-dependent” to “process-dependent” while optimizing unit economics.

- Revenue Performance: FY 23-24 revenue stood at ₹1.78 Crores, with a FY 25-26 projection of ₹2.95 Crores.

- Target Average Order Value (AOV): Current urban QSR coffee AOV ranges from ₹150 to ₹250. Madrasi Kaapi House should aim for ₹180.

- Unit Economics Goal: Achieve a 15–20% Store Level EBITDA by optimizing rent-to-revenue ratios (targeting under 15% of revenue).

2. Madrasi Kaapi House Business Potential in India

- The “Kaapi” Opportunity: South Indian filter coffee is the 2nd most consumed coffee style globally. In India, while espresso chains (Starbucks, Third Wave) dominate the premium segment, the “Authentic Filter Coffee” QSR space is highly fragmented.

- Market Growth: The Indian QSR market is projected to reach $30.37 Billion by 2026, growing at a CAGR of 9.26%.

- Coffee Shift: There is a clear “Premiumization” trend where consumers are moving from instant coffee to authentic, brewed “Roasted & Ground” varieties.

3. Madrasi Kaapi House Total Addressable Market (TAM)

- TAM (Total Coffee Market): The Indian coffee market is valued at approximately $1.91 Billion (2024) and is growing steadily.

- SAM (Serviceable Addressable Market): The Chained Cafe & QSR Coffee market in India, valued at roughly $450–500 Million.

- SOM (Serviceable Obtainable Market): Madrasi Kaapi House can realistically target the ₹100–300 Crore segment within the next 5 years by capturing urban commuters and office clusters in Tier-1 and Tier-2 cities.

4. Madrasi Kaapi House Ideal Target Audience & Demographics

- Primary Demographic: Urban Millennials and Gen Z (ages 18–35) seeking “Instagrammable” yet affordable authentic experiences.

- Secondary Demographic: Traditionalists and Office Professionals (ages 35–55) who prioritize the ritual of a morning/evening authentic filter coffee.

- Psychographics: “Value-conscious” but “culture-curious.” They want the hygiene of a café with the soul of a Udupi restaurant.

5. Madrasi Kaapi House Marketing & Digital Strategy

- SEO Improvement (Urgent): The current 186 monthly visitors is critically low. Madrasi Kaapi House must transition from JavaScript-heavy frameworks (like basic Astro/Vue) to an SEO-optimized structure focusing on keywords like “Best Filter Coffee in Mumbai” and “South Indian Snacks near me.”

- Content Strategy: Use ASMR-style “Brewing Ritual” videos on Instagram/Reels to highlight the “froth” and “pour” of Madrasi Kaapi.

- Local SEO: Claim and optimize Google My Business (GMB) profiles for every outlet to capture “near me” search traffic, which accounts for ~60% of QSR discovery.

6. Madrasi Kaapi House Distribution Strategy

- Hub & Spoke Model: Establish a central kitchen in new cities (like Pune or Bangalore) to supply the “Single Filter Brew” base to smaller kiosks.

- Channel Split: Current split is 76% Offline / 24% Online. The brand should target a 35% Online share through strategic partnerships with Swiggy/Zomato to maximize “at-home” consumption.

- Strategic Locations: Focus on Transit Hubs (Metros, Airports) and Corporate Parks where speed and consistency are valued over long-form seating.

7. Madrasi Kaapi House Advantages & Challenges

- Advantages: * Chef-less Model: High consistency across outlets.

- Versatility: 30+ drinks from 1 brew minimizes inventory waste.

- Challenges:

- High Real Estate Costs: Rent in Mumbai/Bangalore can exceed 25% of revenue if locations are poorly chosen.

- Scaling Regionality: Translating “South Indian” authenticity to North Indian markets without losing the “soul.”

8. Madrasi Kaapi House Success Reasons & Mitigation

- Why Success is Likely: There is a massive “white space” between high-end expensive cafes and unorganized street vendors. Madrasi Kaapi House sits in the “Affordable Premium” sweet spot.

- Mitigation Strategy: To prevent the closure of future outlets (as noted by Namita Thapar), implement a “Low-Capex Kiosk Model” (100–200 sq. ft) for new locations to test the market before committing to full-scale cafes.

9. Madrasi Kaapi House Future Vision & Roadmap to Valuation

- Year 1 (Optimization): Fix SEO, reach ₹15 Lakh/month revenue per outlet, and achieve positive EBITDA across all 5 stores.

- Year 2 (Franchise-Ready): Launch the “Managed Franchise Model” to scale without heavy capital expenditure.

- Year 3-5 (Valuation Jump): Expand to 50+ outlets across 5 major cities. A revenue of ₹50+ Crores with healthy margins would push the Madrasi Kaapi House valuation toward ₹100–150 Crores, making it an attractive acquisition target for FMCG giants like Tata Consumer Products.

Madrasi Kaapi House Shark Tank India Episode Review