Shark Tank India Season 5 Episode 30 Review

Episode 30 of Shark Tank India Season 5 delivered a profound exploration of focus versus diversification, showcasing the razor-thin line between building cultural legacies and losing competitive battles, between technological innovation and market timing, and between passion-driven impact and sustainable business models.

From a fashion quick-commerce pioneer facing inevitable giant competition, to India’s largest culture-tech platform earning a historic four-Shark partnership, to a beverage company criticized for launching “too many brands too fast,” this episode examined when betting early pays off, when artisan empowerment becomes investable at scale, and when lack of focus kills promising ventures. Featuring both the inspiring “rags-to-riches” story of an autorickshaw driver building a manufacturing empire and the harsh reality that even impressive growth can’t overcome strategic scatter.

Episode Summary

Success Rate: 1 out of 3 deals closed

Total Investment: ₹1 Crore deployed through unprecedented four-Shark partnership

Key Theme: The episode centered on the strategic imperative of focus—when does diversification signal opportunity exploration, and when does it reveal inability to commit to winning in one category?

Pitch 1

Booon Shark Tank India Episode Review

Booon appeared on Shark Tank India Season 5, Episode 30, with founder Arun Kumar (robust professional background at Myntra/Raymond, IIM Calcutta/NIFT academic pedigree operating under Piku Mike Ecommerce India Private Limited) seeking ₹1 Crore for 2% equity (₹50 Crore valuation) but left with no deal after all Sharks declined citing various concerns.

The innovative fashion quick-commerce platform challenges traditional 2-3 day delivery offering curated outfits/accessories within 2-hour window through hyperlocal model with mobile-optimized minimal seamless interface, limited high-velocity inventory from nearby fulfillment centers, and ₹4 lakh GMV (Sep 25) with 1,521 monthly organic visitors requiring SEO improvement. Sharks reacted cautiously—Namita questioned differentiation noting “curation” alone might not create moat against established players, Viraj opted out calling business too early-stage with financials not justifying ₹50 Crore valuation, Varun declined citing lack of structured core team creating high execution risk, Kunal appreciated concept but passed due to portfolio company conflict, and Vineeta loved “fabulous” idea but feared “funding battle” once giants like Myntra enter 2-hour delivery within year.

Operating in Indian quick-commerce market valued at $3.65 billion (2026) projected to reach $6.64 billion by 2031 (12.74% CAGR) with non-grocery categories growing 1.6x faster and fashion orders surging 340% year-on-year within $160 billion e-retail market (350 million online shoppers) where fashion commands 31.67% (largest single category) and ₹64,000+ Crore GMV Q-commerce sector expected to triple by 2028, Booon targets “Instant Generation” Gen Z/millennials (18-35) in Tier 1 metros (Mumbai/Delhi-NCR/Bengaluru/Kolkata)—middle to affluent class with $13-$45+ daily spend capacity including professionals with hectic lifestyles, students with spontaneous plans, and last-minute gifters (76.42% shopping exclusively via smartphones during work breaks/commutes)—within India’s $5.2 trillion projected GDP (2026), $3.2 trillion private consumption, and $249 billion lifestyle retail market, planning dark store network expansion, high-velocity trending SKU focus versus vast catalog, gig-fleet integration (Shadowfax/Borzo), private label launch increasing gross margins from 30% to 55%, and AR/AI virtual try-ons reducing 25-30% fashion return rates by 40%.

Pitch 2

MeMeraki Shark Tank India Episode Review

MeMeraki appeared on Shark Tank India Season 5, Episode 30, with founder/CEO Yosha Gupta (15+ years experience at World Bank Group, Gates Foundation, IDEO combining financial inclusion/technology expertise with Indian heritage passion) seeking ₹50 lakh for 1.67% equity (₹30 Crore valuation) and successfully closed a deal for ₹1 Crore for 4% equity (₹25 Crore valuation) with four Sharks—Varun Alagh, Namita Thapar, Kunal Bahl, and Viraj Bahl—after founder proposed all join forces following two separate offers.

Established 2019 in Gurugram as India’s largest culture-tech platform, the managed marketplace bridges traditional Indian artisans and global audiences through zero-inventory made-on-demand model offering 10,000+ handcrafted items across 300+ art forms (hand-painted apparel/accessories, home décor, traditional paintings, interior installations, live/recorded artisan masterclasses, bespoke murals/cultural advisory for corporate clients) with 50% gross margin, ₹20,000 AOV, 500+ master artisan network, 60% B2C/40% B2B revenue split, 25% international sales across 40+ countries, 25-30% customer repeat rate, and exceptional 194,831 monthly organic visitors. Sharks highly impressed by Yosha’s clarity and disciplined scaling—Varun specifically lauded passion/business acumen noting she’s ideal partner for global stage—particularly moved by rare impact-led business maintaining high margins with 50% unit economics going directly to artists ensuring fair sustainable livelihoods through “content-led discovery” philosophy selling artist stories versus just products using AR visualization and digital storytelling.

Operating in India’s handicraft market projected at $71.3 billion by 2030 (6.9% CAGR) within global handicrafts market valued at $1.1 trillion (2024) expected to double by 2032, Indian luxury market crossing $15 billion by 2026 (outpacing Europe/China), and multi-million dollar creative hobby/masterclass segment amid government initiatives (National Handicraft Development Programme ₹837 Crore outlay) and growing “Slow Fashion/Sustainable Decor” trend among urbanites versus mass-produced plastic, MeMeraki targets premium conscious consumers (25-55, Tier 1 cities), “HENRY” segment (High Earners Not Rich Yet—young professionals with high disposable income seeking unique storytelling-led products), global Indian diaspora (NRIs in USA/UK/UAE/Australia wanting tangible roots connection), and B2B/enterprise (corporates, luxury hotels like Oberoi, public institutions) within 64+ lakh registered artisans and 806+ million internet users, planning technology strengthening (digital backbone/AR tools enhancement), B2B vertical expansion (GMR Airports/Apollo Hospitals-style partnerships), artisan onboarding/research-led documentation preserving dying art forms, and “Culture-Tech Infrastructure” transition where brands use MeMeraki’s artisan network for design needs (B2B SaaS/API for Heritage Design) targeting ₹100+ Crore valuation and 40% international revenue.

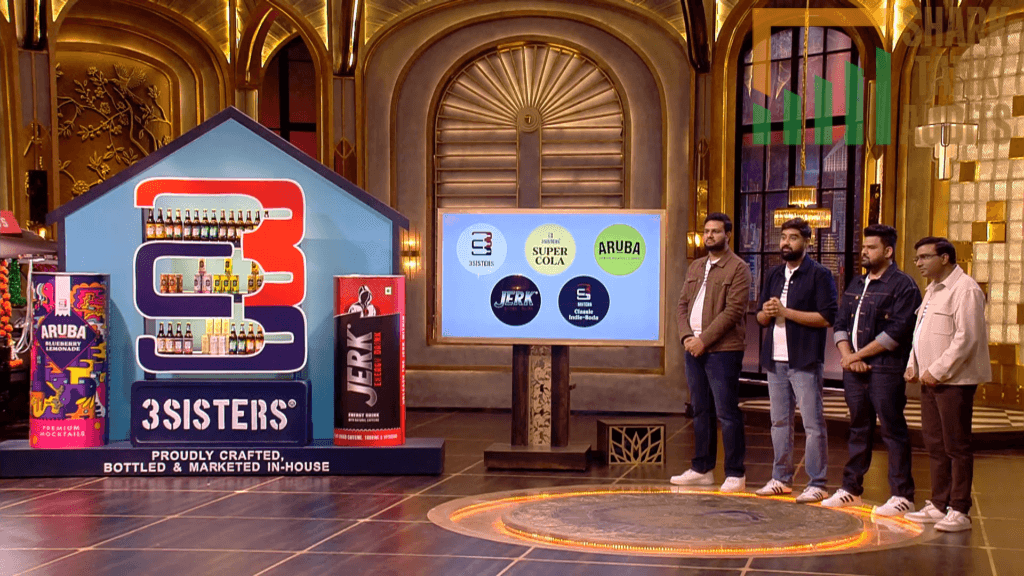

Pitch 3

3Sisters Shark Tank India Episode Review

3Sisters appeared on Shark Tank India Season 5, Episode 30, with four Mumbai-based founders—Manish Kanunga (Chemical Engineer, product development), Akshay Solanki (CA, strategy), Nimish Solanki (CA, marketing), and Sanjay Prasad Bari (product crafter with “rags-to-riches” story moving from Benaras to Mumbai driving autorickshaw before building massive manufacturing plant from single soda stall impressing Sharks), seeking ₹3 Crore for 2.5% equity (₹120 Crore valuation) but left with no deal after all five Sharks opted out citing lack of focus and quality concerns.

Incorporated 2021, the new-age beverage company targets “sober curious” Indian youth through non-alcoholic drinks (77% sales from non-alcoholic beers at ₹80/bottle under flagship brand Sanskari alongside sub-brands Aruba/Jerk/Super Cola) also offering Indie Soda (8%), Aruba Mocktails (10%), Jerk Energy Drink (4%), and Super Cola (1%), growing from ₹2.35 Crore (FY 23) to projected ₹27 Crore (FY 26) with ₹11.89 Crore revenue and positive ₹86 lakh EBITDA with 9,089 monthly organic visitors. Sharks reacted harshly—Namita slammed taste as “chemical” versus authentic, Varun/Viraj criticized “cluttered” vision launching too many sub-brands before scaling hero product, Vineeta labeled consumer brand a “distraction” from more successful manufacturing roots, and Kunal noted while team disciplined they lacked “laser focus” required for high-stakes investment.

Operating in Indian non-alcoholic beverage market valued at $34.71 billion (2025) growing 7.94% CAGR through 2034 with LNA (Low/No Alcohol) category seeing 10% annual growth within $700 million-$1.2 billion non-alcoholic beer/premium indie soda segment, 3Sisters targets Gen Z/millennials (21-35) in Tier 1/2 cities (Delhi NCR/Mumbai/Bangalore/Pune 30% market share)—50% college graduates with high disposable income prioritizing premiumization—who are health-conscious enjoying social drinking “ritual” without hangovers/high calories (43% seeking low-calorie beer per Mintel) amid 49% Gen Z reporting reducing alcohol as primary health goal, owning manufacturing plant providing better margins versus outsourcing competitors, planning “Hero Product” focus dedicating 80% resources to non-alcoholic beer line with clean label reformulation removing artificial aftertastes toward natural/Ayurvedic infusions (Ashwagandha-infused mixers), and ₹250-300 Crore Series A valuation target achieving ₹75+ Crore revenue with 15% EBITDA margin.

Episode Highlights

The Inevitable Giant Problem

Booon’s First-Mover Dilemma:

The Innovation: Arun Kumar (ex-Myntra/Raymond, IIM Calcutta/NIFT) launched fashion quick-commerce delivering curated outfits/accessories within 2-hour window—challenging traditional 2-3 day delivery through hyperlocal fulfillment model.

The Current Traction:

- ₹4 lakh GMV (September 2025)

- 1,521 monthly organic visitors

- Mobile-optimized minimal interface

- Limited high-velocity inventory strategy

- Nearby fulfillment centers for 2-hour delivery

Vineeta’s Prophetic Warning: Loved the “fabulous” idea but feared inevitable “funding battle” once giants like Myntra enter 2-hour fashion delivery within the next year.

The Sharks’ Unanimous Concern:

Namita’s Differentiation Question: “Curation” alone might not create defensible moat against established players with:

- Existing customer bases (millions vs. Booon’s thousands)

- Capital reserves (billions vs. Booon’s funding rounds)

- Warehouse infrastructure (already built vs. Booon building from scratch)

- Brand recognition (decade+ vs. startup unknown)

Viraj’s Stage Assessment: Too early-stage with financials (₹4 lakh GMV monthly) not justifying ₹50 Crore valuation—need to prove unit economics and customer retention before premium valuation justified

Varun’s Team Risk: Lack of structured core team creates high execution risk—fashion quick-commerce requires:

- Supply chain excellence (sourcing, inventory management)

- Technology sophistication (2-hour delivery routing)

- Customer acquisition efficiency (competing against giants’ marketing budgets)

- Operational discipline (dark store management, gig worker coordination)

Kunal’s Portfolio Conflict: Appreciated concept but had portfolio company conflict (likely investment in competing fashion/commerce platform)

The Timing Paradox:

- Too Early: ₹4 lakh GMV insufficient to prove model works at scale

- Too Late: Giants already planning 2-hour fashion delivery (Myntra/Ajio parent companies have capital and infrastructure)

- The Trap: First-mover advantage disappears when well-funded incumbents can copy model overnight using existing assets

The Strategic Question: Should Booon have:

- Bootstrapped Longer: Prove ₹50+ lakh monthly GMV before seeking institutional capital

- Focused on Niche: Target specific category (occasion wear, ethnic fusion, accessories) where curation creates real moat

- Sold Early: Position for acquisition by Myntra/Ajio as their quick-commerce fashion division

- Never Launched: Accept that some innovations can’t overcome incumbent advantages

The Market Reality: Indian quick-commerce at $3.65B (2026) → $6.64B (2031) with fashion orders surging 340% YoY—massive opportunity but likely winner will be existing player (Myntra, Myntra’s parent Flipkart, or Reliance) with resources to execute, not underfunded startup.

The Culture-Tech Unicorn in the Making

MeMeraki’s Perfect Pitch:

The Founder: Yosha Gupta brought exceptional credibility:

- 15+ years at World Bank Group and Gates Foundation

- Financial inclusion and technology expertise

- Deep passion for Indian heritage preservation

- Established 2019, scaled to India’s largest culture-tech platform

The Business Model Excellence:

Zero-Inventory Made-on-Demand:

- 10,000+ handcrafted items cataloged

- 300+ art forms represented

- 500+ master artisan network

- Made only after order (no inventory carrying costs)

Impressive Metrics:

- 194,831 Monthly Organic Visitors: Highest in the episode by 100x+ versus other pitches

- 50% Gross Margin: Healthy economics for marketplace model

- ₹20,000 AOV: Premium average order value

- 25-30% Repeat Rate: Customer loyalty in artisan products (impressive for high AOV)

- 25% International Sales: Across 40+ countries

- 60% B2C / 40% B2B: Diversified revenue streams

- 50% to Artisans: Fair trade model ensuring sustainable livelihoods

The Content-Led Discovery Philosophy:

- Sell artist stories, not just products

- AR visualization for home décor placement

- Digital storytelling bringing craftsmanship alive

- Live and recorded artisan masterclasses

- Bespoke murals and cultural advisory for corporates

The Four-Shark Historic Deal:

Initial Ask: ₹50 lakh for 1.67% (₹30 Crore valuation)

What Happened: Two separate offers emerged, then founder Yosha proposed all four Sharks join together—unprecedented move demonstrating strategic sophistication.

Final Deal: ₹1 Crore for 4% equity (₹25 Crore valuation) with:

- Varun Alagh: Consumer brand scaling (Mamaearth’s founder), specifically lauded Yosha’s “passion and business acumen,” calling her ideal partner for global stage

- Namita Thapar: Healthcare/wellness (artisan wellness programs, corporate wellness partnerships)

- Kunal Bahl: E-commerce marketplace expertise (Snapdeal’s founder), technology infrastructure

- Viraj Bahl: Manufacturing and supply chain (Veeba’s founder), operational excellence

Why This Worked Despite Higher Dilution:

- Strategic Alignment: Each Shark brings distinct expertise (consumer branding, healthcare partnerships, marketplace tech, supply chain)

- 2x Capital: ₹1 Crore vs. ₹50 lakh ask—more runway for artisan onboarding and international expansion

- Credibility Multiplier: Four respected Sharks validates model to B2B clients (corporates, hotels, institutions)

- Network Effects: Access to four separate portfolio companies and partner ecosystems

Varun’s Emotional Endorsement: Specifically praised impact-led business maintaining high margins—rare combination of doing good (50% to artisans) while doing well (50% gross margin, ₹20K AOV).

The Vision Alignment:

- Technology: AR/digital tools for heritage design

- B2B Expansion: GMR Airports, Apollo Hospitals-style partnerships (Viraj/Namita connections)

- Artisan Preservation: Research-led documentation of dying art forms

- Culture-Tech Infrastructure: Brands using MeMeraki’s network for design needs (B2B SaaS/API for Heritage Design)

- Target: ₹100+ Crore valuation, 40% international revenue

The Market Opportunity:

- $71.3B Indian handicraft market by 2030 (6.9% CAGR)

- $1.1T global handicrafts market (2024) doubling by 2032

- $15B+ Indian luxury market crossing milestone 2026

- 64+ lakh registered artisans (massive supply side)

- 806+ million internet users (massive demand side)

- Government support: ₹837 Crore National Handicraft Development Programme

The Impact Story: MeMeraki proves social impact businesses can achieve venture-scale returns—50% margins, ₹20K AOV, 25% international sales, 194K organic visitors while ensuring artisans receive fair compensation and sustainable livelihoods.

The “Too Many Brands” Problem

3Sisters’ Strategic Scatter:

The Impressive Founder Story: Sanjay Prasad Bari’s “rags-to-riches” journey—moved from Benaras to Mumbai, drove autorickshaw, built massive manufacturing plant from single soda stall—deeply impressed Sharks.

The Business Reality:

- Incorporated: 2021 (3 years old)

- Revenue Trajectory: ₹2.35 Cr (FY23) → ₹11.89 Cr (current) → ₹27 Cr projected (FY26)

- EBITDA: ₹86 lakh positive (7.2% margin)

- Organic Traffic: 9,089 monthly visitors

The Strategic Confusion:

Brand Portfolio:

- Sanskari Non-Alcoholic Beer: 77% of sales, ₹80/bottle (flagship, “hero product”)

- Indie Soda: 8% of sales

- Aruba Mocktails: 10% of sales

- Jerk Energy Drink: 4% of sales

- Super Cola: 1% of sales

The Sharks’ Harsh Critique:

Varun & Viraj’s Focus Concern: “Cluttered vision”—launching too many sub-brands before scaling hero product (Sanskari NA beer at 77% sales).

The Math:

- If Sanskari = 77% of ₹11.89 Cr = ₹9.16 Cr revenue

- Remaining 4 brands = 23% = ₹2.73 Cr combined

- Super Cola at 1% = ₹11.89 lakh annual revenue (₹1 lakh monthly)—why does this brand exist?

Strategic Error: Instead of investing 100% resources into making Sanskari NA beer dominant (₹25-30 Cr revenue, 20-25% market share in non-alcoholic beer), founders diluted efforts across 5 brands achieving mediocrity in all.

Namita’s Quality Slam: Taste was “chemical” versus authentic—critical failure for beverage company where product quality is table stakes.

The Disconnect:

- Product Quality Issue: Chemical taste means reformulation needed BEFORE launching more brands

- Focus Issue: 5 brands with hero product only 77% of sales means 23% of revenue from distractions

- Team Distraction: Marketing, R&D, inventory, distribution split across 5 brands instead of laser-focused on one winner

Vineeta’s Manufacturing Insight: Consumer brand feels like “distraction” from actual competitive advantage—they own manufacturing plant providing better margins versus outsourcing competitors.

The Strategic Alternative They Should Have Pursued:

- Focus: 90%+ resources on Sanskari NA beer

- Quality: Reformulate to remove “chemical” taste—natural/Ayurvedic infusions (they mentioned Ashwagandha but hadn’t executed)

- Scale: Achieve ₹25+ Cr revenue in NA beer alone (vs. current ₹9.16 Cr)

- Leverage Manufacturing: White-label production for other beverage brands (B2B revenue using owned plant)

- Then Diversify: Only after dominating NA beer, consider line extensions

Kunal’s Balanced Assessment: Team is disciplined (demonstrated by ₹86 lakh EBITDA and manufacturing plant ownership) but lacks “laser focus” required for high-stakes investment—discipline without focus = wasted potential.

The Valuation Disconnect:

- Ask: ₹120 Crore valuation

- Current Revenue: ₹11.89 Crore

- Multiple: 10.1x revenue (aggressive for ₹86 lakh EBITDA = 7.2% margin)

- Comparable: Should be valued at ₹30-40 Cr (2.5-3.5x revenue) given margins and growth rate

The Market Opportunity Being Squandered:

- Indian non-alcoholic beverage: $34.71B (2025) growing 7.94% CAGR

- LNA (Low/No Alcohol): 10% annual growth

- NA beer/premium indie soda: $700M-$1.2B segment

- 43% seeking low-calorie beer (Mintel data)

- 49% Gen Z reducing alcohol as health goal

The Tragedy: 3Sisters had:

- Owned manufacturing (competitive advantage)

- Growing revenue (₹2.35 Cr → ₹11.89 Cr in 3 years = 5x growth)

- Positive EBITDA (₹86 lakh = profitability)

- Inspiring founder story (autorickshaw to manufacturing plant)

- Large addressable market (Gen Z “sober curious” movement)

But Lost Investment Because:

- Spread too thin across 5 brands

- Chemical taste quality issues

- ₹120 Cr valuation unjustified by ₹86 lakh EBITDA

- Strategic confusion (consumer brand vs. manufacturing focus)

Shark Dynamics

The Historic Four-Shark Unity (MeMeraki)

Unprecedented Collaboration: Founder Yosha’s proposal for all four Sharks to join together demonstrated sophisticated strategic thinking—recognized that complementary expertise creates more value than any single investor.

The Synergies:

- Varun (Mamaearth): Global consumer brand expansion, premium positioning

- Namita (Emcure): Healthcare partnerships, artisan wellness programs

- Kunal (Snapdeal): Marketplace technology, international e-commerce infrastructure

- Viraj (Veeba): Manufacturing excellence, supply chain optimization

Why Founders Proposed This:

- MeMeraki operates across multiple verticals (B2C marketplace, B2B corporate, artisan training, international exports)

- Each vertical needs different expertise

- Four Sharks provide comprehensive support across all verticals

- Validation from four successful entrepreneurs attracts B2B clients and international partners

The “Funding Battle” Fear

Vineeta’s Booon Concern: Loved the idea but predicted giants entering 2-hour fashion delivery within a year—when well-funded incumbents copy your model, they win through:

- Capital to subsidize customer acquisition

- Existing brand awareness requiring minimal marketing

- Infrastructure already built (warehouses, delivery networks)

- Technology teams that can replicate features in months

The Investor Calculation: Why invest ₹1 Cr in startup that will need ₹50-100 Cr to compete against Myntra’s ₹500+ Cr war chest?

The Focus Intervention

All Five Sharks’ Unified Message to 3Sisters: “Too many brands, too fast”

The Pattern Recognition:

- Varun/Viraj: Cluttered vision

- Vineeta: Consumer brand distracts from manufacturing strength

- Kunal: Disciplined team lacks laser focus

- Namita: Chemical taste = quality control failure across all brands

The Lesson: When all five Sharks independently identify the same problem (lack of focus), founders should listen—it’s not investment thesis mismatch, it’s fundamental strategic error.

Market Insights Revealed

The episode showcased three distinct markets with vastly different competitive dynamics:

- Fashion Quick-Commerce (Booon): $3.65B (2026) → $6.64B (2031) with 340% YoY fashion order growth, but dominated by well-funded incumbents who can enter instantly

- Culture-Tech/Artisan Marketplaces (MeMeraki): $71.3B Indian handicraft by 2030, $1.1T global market doubling by 2032, fragmented space with no dominant player—blue ocean opportunity

- Non-Alcoholic Beverages (3Sisters): $34.71B Indian market growing 7.94% CAGR with LNA at 10% growth, but requires focused execution and quality to win against established players

Key Takeaways

1. First-Mover Advantage Disappears When Giants Copy

Booon’s Dilemma:

- Innovative 2-hour fashion delivery

- ₹4 lakh monthly GMV proves concept

- But Myntra/Ajio can launch identical service using existing infrastructure

The Reality: In markets where incumbents have capital and infrastructure, being first means being beta tester for giants who will perfect and scale your innovation.

When First-Mover Works:

- High regulatory barriers (licenses, approvals)

- Network effects (value increases with users—marketplaces, social platforms)

- Switching costs (enterprise software with integrations)

- Brand loyalty (luxury, lifestyle brands where trust builds over time)

When First-Mover Fails:

- Operational innovation easily replicated (2-hour delivery)

- No defensible IP or technology

- Capital-intensive with low switching costs

- Incumbent can leverage existing customer base

2. Impact + Economics Alignment Creates Unicorn Potential

MeMeraki’s Model:

- 50% gross margin (healthy business)

- 50% to artisans (social impact)

- ₹20,000 AOV (premium positioning)

- 194,831 organic visitors (massive reach)

- 25% international sales (global validation)

The Proof: You don’t have to choose between profit and purpose—when structured correctly, fair trade models achieve both.

The Requirements:

- Premium positioning (₹20K AOV justifies artisan fair wages)

- Zero inventory (no working capital locked, made-on-demand only)

- Content-led discovery (storytelling justifies premium prices)

- Technology enablement (AR visualization, digital cataloging)

3. Too Many Brands = Strategic Confusion Signal

3Sisters’ Error:

- 5 brands across different beverage categories

- Hero product (Sanskari NA beer) only 77% of revenue

- 23% of sales from 4 other brands diluting focus

- Super Cola at 1% of sales (₹11.89 lakh annually) = pointless distraction

The Correct Approach:

- Achieve 90%+ revenue from hero product

- Only launch new brand after hero product reaches ₹25+ Cr revenue

- Each brand should have clear strategic rationale (different customer segment or occasion)

- Never launch new brand to “test market”—test through hero product line extensions

Red Flag for Investors: Multiple brands before scaling one signals:

- Inability to commit to winning strategy

- Fear of putting all eggs in one basket (ironically, diversification before domination increases failure risk)

- Founder ADHD—chasing shiny new ideas versus grinding on existing product

4. Founder Background Creates Credibility, Not Deals

Booon’s Founder (Arun Kumar):

- Myntra/Raymond experience (fashion industry deep knowledge)

- IIM Calcutta + NIFT pedigree (business + fashion education)

- Still couldn’t overcome fundamental market timing and competitive moat concerns

Comparison to CotoPay (Episode 27):

- CotoPay founders: Aadhaar/CoWIN architects, BharatPe founding member

- Closed four-Shark bidding war

- Difference: Infrastructure moat (e-RUPI integration) + immediate portfolio synergy

The Lesson: Credentials open doors and create initial interest, but deals close based on:

- Defensible competitive positioning

- Market timing and addressable opportunity

- Unit economics and traction validation

- Strategic fit with investor portfolio

5. Organic Traffic Validates Product-Market Fit

The Episode’s Traffic Comparison:

- MeMeraki: 194,831 monthly visitors (exceptional)

- 3Sisters: 9,089 monthly visitors (decent)

- Booon: 1,521 monthly visitors (concerning for platform business)

What High Organic Traffic Signals:

- Content strategy working (SEO, social, PR)

- Product-market fit (people searching for your solution)

- Reduced customer acquisition costs

- Brand awareness building organically

MeMeraki’s 194,831 Visitors: Proves that artisan crafts + digital storytelling resonates—people actively searching for authentic handcrafted products with cultural stories.

6. Manufacturing Ownership Misunderstood as Advantage

3Sisters’ Plant Ownership:

- Sharks noted better margins versus outsourcing

- But Vineeta saw consumer brand as “distraction” from manufacturing strength

The Strategic Alternative:

- Use owned plant for white-label B2B beverage production

- Let other brands handle consumer marketing/distribution

- Focus on being India’s best beverage co-manufacturer

- Higher margins, predictable B2B revenues, no brand building costs

The Lesson: Asset ownership (manufacturing plant) is advantage only if leveraged strategically—don’t assume owned assets automatically mean consumer brand success.

7. Four-Shark Deals Require Founder Sophistication

Why Yosha’s Proposal Worked:

- Recognized each Shark’s unique value (Varun=branding, Namita=healthcare, Kunal=marketplace, Viraj=manufacturing)

- Articulated how complementary expertise creates more value than any single investor

- Demonstrated strategic thinking beyond just raising capital

- Showed leadership capability to manage four investor relationships

When Multi-Shark Deals Make Sense:

- Business operates across multiple verticals requiring different expertise

- Complex product (culture-tech + artisan network + B2B + international) needing comprehensive support

- Founder has proven ability to manage stakeholder complexity

When Single Shark Better:

- Focused business needing deep domain expertise

- Early-stage requiring hands-on operational guidance

- Founder prefers simple decision-making structure

What Made This Episode Different

The Inevitable Giant Fear

Vineeta’s prediction that Myntra will enter 2-hour fashion delivery “within the next year” represented rare explicit timeline for competitive threat—most Sharks speak generally about competition, but Vineeta gave specific forecast demonstrating how imminent Booon’s obsolescence is.

The Four-Shark Founder Initiative

Yosha proposing all four Sharks join together (rather than Sharks suggesting it) demonstrated exceptional strategic sophistication—most founders passively accept whatever offer comes, but Yosha actively designed optimal investor structure.

The Manufacturing vs. Consumer Brand Debate

Vineeta’s observation that 3Sisters should focus on manufacturing (owned plant) rather than consumer brands sparked important discussion—not all businesses should pursue consumer-facing revenue when B2B might better leverage core assets.

The Rags-to-Riches Inspiration That Couldn’t Close

Sanjay’s autorickshaw-to-manufacturing-plant story impressed all Sharks, but ultimately couldn’t overcome strategic concerns—demonstrated that inspiring founder stories open hearts but analytical business concerns close deals (or prevent them).

Behind the Numbers

Booon’s First-Mover Risk

- GMV: ₹4 lakh (September 2025) = ₹48 lakh annual run rate

- Valuation Ask: ₹50 Crore

- Multiple: 104x annual GMV (astronomical)

- Organic Traffic: 1,521 monthly visitors (low for platform business)

- Market Size: $3.65B quick-commerce (2026) → $6.64B (2031)

- Competition Timeline: Myntra entering 2-hour delivery within 1 year (Vineeta’s prediction)

- Survival Requirement: Reach ₹5+ Cr monthly GMV before giants launch—nearly impossible given current ₹4 lakh

MeMeraki’s Exceptional Metrics

- Initial Ask: ₹50 lakh for 1.67% (₹30 Crore valuation)

- Final Deal: ₹1 Crore for 4% (₹25 Crore valuation)

- Capital Increase: 2x asked amount (₹1 Cr vs ₹50 lakh)

- Dilution: 2.4x equity given (4% vs 1.67%)

- Strategic Value: Four complementary Sharks vs. one

- Organic Traffic: 194,831 monthly visitors (128x higher than Booon, 21.4x higher than 3Sisters)

- Gross Margin: 50% (excellent for marketplace)

- AOV: ₹20,000 (premium positioning validated)

- Repeat Rate: 25-30% (strong for high-AOV artisan products)

- International: 25% of sales across 40+ countries

- Revenue Split: 60% B2C, 40% B2B (diversified)

- Artisan Network: 500+ master artisans

- Catalog: 10,000+ handcrafted items, 300+ art forms

- Market Opportunity: $71.3B Indian handicraft by 2030, $1.1T global market

3Sisters’ Focus Problem Mathematics

- Revenue: ₹11.89 Crore (current)

- EBITDA: ₹86 lakh (7.2% margin)

- Valuation Ask: ₹120 Crore (10.1x revenue, 139x EBITDA)

- Fair Valuation: ₹30-40 Crore (2.5-3.5x revenue given margins)

- Overvaluation: 3-4x too high

Brand Split Analysis:

- Sanskari NA Beer: 77% = ₹9.16 Cr revenue (FOCUS HERE)

- Aruba Mocktails: 10% = ₹1.19 Cr revenue

- Indie Soda: 8% = ₹95 lakh revenue

- Jerk Energy: 4% = ₹48 lakh revenue

- Super Cola: 1% = ₹12 lakh revenue (WHY DOES THIS EXIST?)

Strategic Error Quantified:

- If 100% focus on Sanskari → potential ₹15-20 Cr revenue (market share gains)

- Current approach: ₹9.16 Cr from Sanskari + ₹2.73 Cr from 4 other brands

- Lost opportunity: ₹5-11 Cr additional revenue if focused

Market Opportunity:

- $34.71B non-alcoholic beverage market (2025)

- 10% LNA (Low/No Alcohol) growth annually

- $700M-$1.2B NA beer/premium indie soda segment

- 43% consumers seeking low-calorie beer

- 49% Gen Z reducing alcohol for health

The Episode’s Three Strategic Archetypes

Archetype 1: The Doomed Innovator (Booon)

Characteristics:

- True innovation (2-hour fashion delivery)

- Proof of concept (₹4 lakh GMV)

- Strong founder credentials (Myntra/Raymond, IIM/NIFT)

- Fatal flaw: Giants can replicate instantly

Investor Perspective: Why fund startup requiring ₹50-100 Cr to compete when Myntra will launch identical service using existing infrastructure?

Outcome: No deal despite acknowledging innovation quality

Lesson: Some innovations should be built inside large companies, not as standalone startups

Archetype 2: The Impact Unicorn (MeMeraki)

Characteristics:

- Social impact mission (supporting 500+ artisans)

- Strong economics (50% margin, ₹20K AOV)

- Massive organic reach (194,831 visitors)

- Sophisticated founder (World Bank, Gates Foundation)

- Balanced growth (25% international, 40% B2B)

Investor Perspective: Rare combination of purpose + profit, scalable model (zero inventory), defensible moat (artisan network + content)

Outcome: Historic four-Shark partnership at 2x capital

Lesson: Impact businesses can achieve venture-scale returns when economics align with mission

Archetype 3: The Scattered Executor (3Sisters)

Characteristics:

- Inspiring founder story (autorickshaw to manufacturing plant)

- Real traction (₹11.89 Cr revenue, ₹86L EBITDA)

- Competitive advantage (owned manufacturing)

- Fatal flaw: 5 brands diluting focus, chemical taste quality issue

Investor Perspective: Disciplined team with potential but lacks strategic focus—unwilling to bet on scattered approach even with owned assets

Outcome: No deal despite respecting founder journey and acknowledging market opportunity

Lesson: Execution capability without strategic focus = wasted potential

Founder Personalities on Display

The Industry Veteran (Booon)

Arun Kumar demonstrated:

- Deep fashion industry knowledge (Myntra/Raymond)

- Educational pedigree (IIM Calcutta, NIFT)

- Genuine innovation (2-hour fashion delivery)

- Unfortunate market timing (giants entering space)

The Gap: Experience and innovation couldn’t overcome competitive moat concerns—sometimes being right isn’t enough if you can’t defend position.

The Impact Architect (MeMeraki)

Yosha Gupta showcased:

- Development sector credibility (World Bank, Gates Foundation, 15+ years)

- Business acumen praised by Varun (“passion + business acumen ideal for global stage”)

- Strategic sophistication (proposed four-Shark partnership herself)

- Mission clarity (preserving Indian artisan heritage while building sustainable business)

The Success Factor: Combined social sector experience with commercial discipline—rare founder who understands both impact measurement and unit economics.

The Scattered Dreamers (3Sisters)

The founding team exhibited:

- Inspiring resilience (Sanjay’s autorickshaw-to-plant journey)

- Operational discipline (owned manufacturing, positive EBITDA)

- Strategic confusion (5 brands across different categories)

- Quality control gaps (chemical taste criticism)

The Pattern: Strong operations without clear strategy—building capability without focused application.

Episode Wisdom

For Founders:

1. Know When Your Innovation Can’t Overcome Incumbents: Booon’s 2-hour fashion delivery is real innovation, but when Myntra can replicate using existing infrastructure, first-mover advantage evaporates—some battles shouldn’t be fought as standalone startups.

2. Four Investors Better Than One When Complexity Requires It: MeMeraki operates across B2C marketplace, B2B corporate, artisan training, international exports—each vertical benefits from different Shark expertise, making four-Shark partnership optimal.

3. Focus Beats Diversification Until You Dominate: 3Sisters should’ve achieved ₹25+ Cr revenue in Sanskari NA beer alone before launching Aruba, Jerk, Super Cola, Indie—77% revenue concentration isn’t focused enough.

4. Organic Traffic Validates Market Demand: MeMeraki’s 194,831 monthly visitors proved artisan craft demand exists at scale—organic reach reduces CAC and signals product-market fit.

5. Manufacturing Ownership Isn’t Automatic Advantage: 3Sisters owned plant but Sharks saw consumer brand as distraction—should’ve considered white-label B2B production leveraging manufacturing strength.

6. Quality Is Non-Negotiable: Namita’s “chemical taste” criticism of 3Sisters’ beverages is death sentence for food/beverage company—fix product quality before scaling or launching new brands.

7. Propose Optimal Investor Structure: Yosha’s initiative suggesting four Sharks join together demonstrated strategic sophistication—don’t passively accept offers, actively design optimal cap table.

For Investors:

1. Timing Beats Innovation: Booon’s 2-hour fashion delivery is innovative but poorly timed—giants entering within a year makes investment risky regardless of concept quality.

2. Impact + Economics Beats Pure Profit: MeMeraki’s 50% margin + 50% to artisans model proves purpose-driven businesses can achieve venture returns—don’t assume trade-off between impact and profit.

3. Focus Is Leading Indicator: 3Sisters’ 5-brand portfolio before scaling hero product signals strategic confusion—lack of focus predicts future execution failures.

4. Organic Traffic Reveals Truth: 194,831 visitors (MeMeraki) vs. 1,521 visitors (Booon) vs. 9,089 visitors (3Sisters) tells immediate story about market traction and product-market fit.

5. Founder Background Matters Less Than Market Position: Arun’s Myntra/Raymond/IIM/NIFT credentials couldn’t overcome competitive moat concerns—evaluate business positioning over resume.

For Viewers:

1. First-Mover Advantage Is Myth in Many Markets: Being first to 2-hour fashion delivery means nothing when Myntra can launch identical service tomorrow using existing infrastructure—first-mover works only with defensible barriers.

2. Social Impact Can Scale: MeMeraki proves artisan empowerment businesses can achieve 50% margins, ₹20K AOV, 194K organic visitors, 25% international sales—impact doesn’t require sacrificing returns.

3. Too Many Brands Signals Lack of Conviction: When founders launch 5 brands before scaling one to dominance, it reveals inability to commit to winning strategy—diversification before domination = strategic failure.

4. Giants Enter Markets When Proven: Vineeta’s prediction that Myntra will launch 2-hour fashion delivery within a year demonstrates how incumbents wait for startups to validate market, then copy and scale using superior resources.

5. Four Sharks Multiply Value: MeMeraki’s four-Shark partnership provides consumer brand expertise (Varun), healthcare partnerships (Namita), marketplace tech (Kunal), and manufacturing excellence (Viraj)—strategic value multiplies with complementary investors.

The Episode’s Central Paradox

Innovation That Invites Its Own Destruction:

Booon innovated 2-hour fashion delivery, proving market demand exists—but success validates opportunity for giants like Myntra who can execute better with existing infrastructure.

The Startup Dilemma:

- Innovate and prove market → Giants copy and win

- Don’t innovate → Never discover opportunity

- The Answer: Innovate only in spaces where giants can’t easily replicate (regulatory moats, network effects, brand loyalty, proprietary technology)

MeMeraki’s Counter-Example: Built artisan network moat (500+ craftspeople), content-led discovery (digital storytelling), zero-inventory model—not easily replicated even by large players because relationships and curation take years to develop.

Leave feedback about this

You must be logged in to post a comment.