ANA Apparels Shark Tank India Episode Review

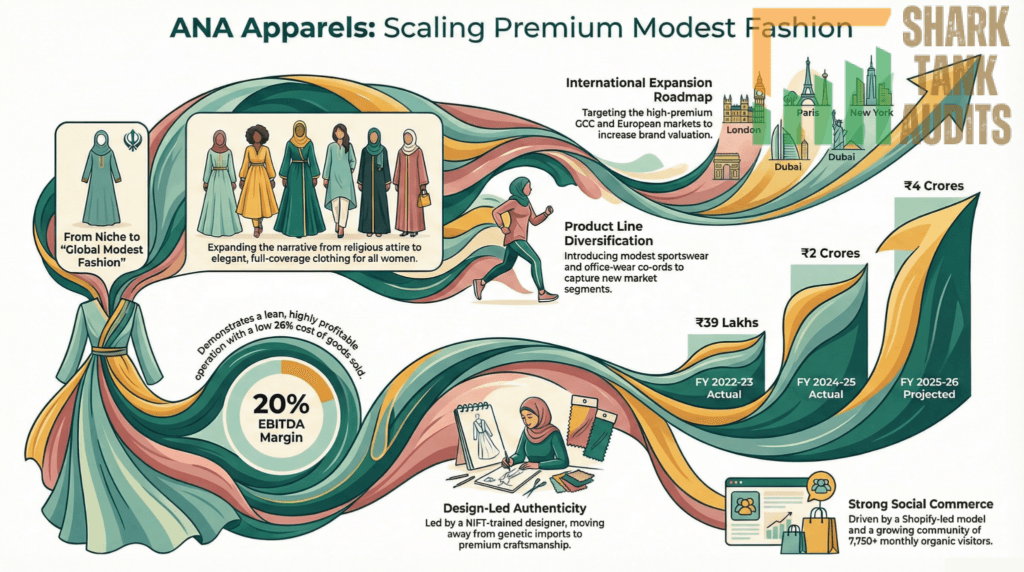

In Shark Tank India Season 5, Episode 33 (aired Wednesday, February 18, 2026), the modest fashion brand ANA Apparels presented a pitch that balanced cultural pride with strong business fundamentals. Founded by NIFT graduate Asma Nafis Ansari and her husband Zeeshan Kareem, the Mau-based startup specializes in premium, designer modest wear such as abayas, hijabs, and niqabs. Despite a lean operation with a notable 20% EBITDA and revenue scaling from ₹39 lakhs to ₹2 crores in just two years, the founders’ seek for ₹80 lakhs for 4% equity (at a ₹20 crore valuation) did not result in a deal. While the Sharks lauded Asma’s design excellence and the brand’s profitability, they ultimately cited concerns regarding the ease of replication in the fashion industry and the perceived difficulty in scaling a niche, community-driven business to a venture-level size.

The Shark panel, including Aman Gupta, Vineeta Singh, and Ritesh Agarwal, engaged in a deep discussion about the “defensibility” of the brand. Aman Gupta highlighted that without a proprietary fabric or a massive “brand pull,” designs in the modest wear space could be easily copied by local manufacturers, a sentiment echoed by others who viewed the business more as a successful lifestyle venture than a high-growth startup. Ritesh Agarwal specifically advised streamlining the product range to avoid operational bloat, while Namita Thapar suggested that the brand was still in an early stage where scaling further independently would be more beneficial than taking external capital. Consequently, ANA Apparels exited the tank without an investment but with significant praise for its “made in India” craftsmanship and its mission to empower women through identity-focused fashion.

Looking ahead, ANA Apparels aims to hit a revenue target of ₹4 crores for FY 25-26 by deepening its D2C presence and expanding its product line into modest sportswear and office wear. To mitigate the Sharks’ concerns about market size, the brand plans to pivot its narrative toward “Global Modest Fashion,” targeting the broader segment of women seeking elegant, full-coverage clothing regardless of religious affiliation. By leveraging its existing organic community on Instagram and a robust Shopify-led model, the brand intends to prove its scalability. Their long-term roadmap includes exploring international shipping to the GCC and European markets, where designer modest wear commands higher premiums, eventually aiming for a valuation inflection point through strategic partnerships with major fashion platforms.

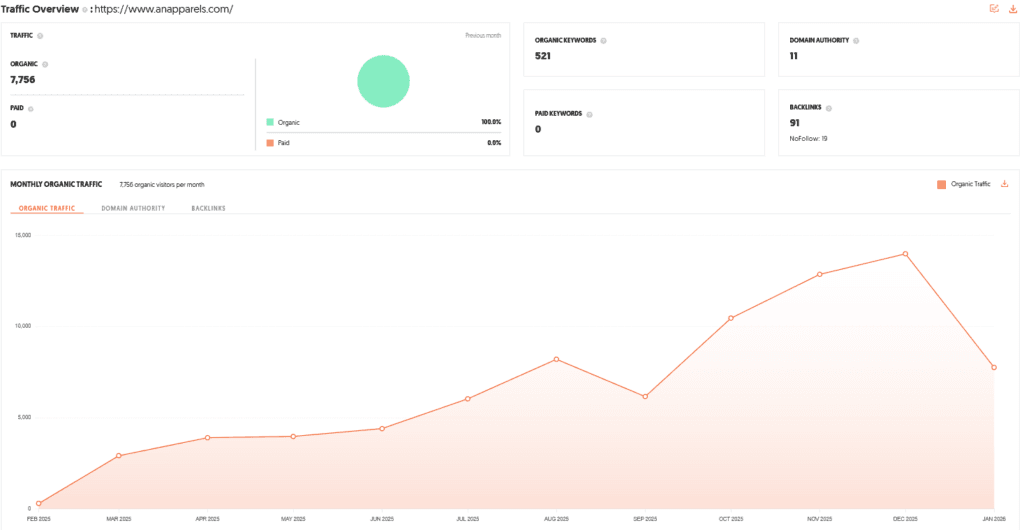

Website Information

- Website:- ANA Apparels

- Build on Shopify

- Good SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 7756 visitors per month.

The Founders of ANA Apparels

- The brand was co-founded by Asma Nafis Ansari, a graduate of the National Institute of Fashion Technology (NIFT), and her husband, Zeeshan Kareem.

- Asma serves as the primary visionary and lead designer, having started the business in a small warehouse owned by her father.

- Her entrepreneurial excellence has been recognized with awards such as the “Woman Entrepreneur of the Year 2023.”

- Zeeshan joined the venture to manage operations and growth, acting as a strategic pillar to the company’s vision.

Brand Overview: ANA Apparels

- Established in October 2021, ANA Apparels is a Direct-to-Consumer (D2C) modest fashion brand based in India.

- The name “ANA” is rooted in the values of dignity, self-respect, and confidence.

- The brand was born out of a perceived gap in the Indian market for high-quality, stylish, and culturally significant modest wear.

- By combining traditional roots with contemporary aesthetics, the brand aims to empower women through fashion that reflects their individual identities.

Shark Tank India Appearance & Ask: ANA Apparels

- ANA Apparels appeared on Season 5, Episode 33 of Shark Tank India.

- The founders presented a design-led business model with strong financial health, boasting a 20% EBITDA and consistent year-on-year growth.

- The Ask: Rs 80 Lakhs for 4% equity.

- Valuation: Rs 20 Crores.

- Equity Split: Asma holds 51%, while Zeeshan holds 49%.

Season and Episode Air Date

- Season: 05

- Episode: 33

- Episode Air Date: Wednesday, 18 February, 2026

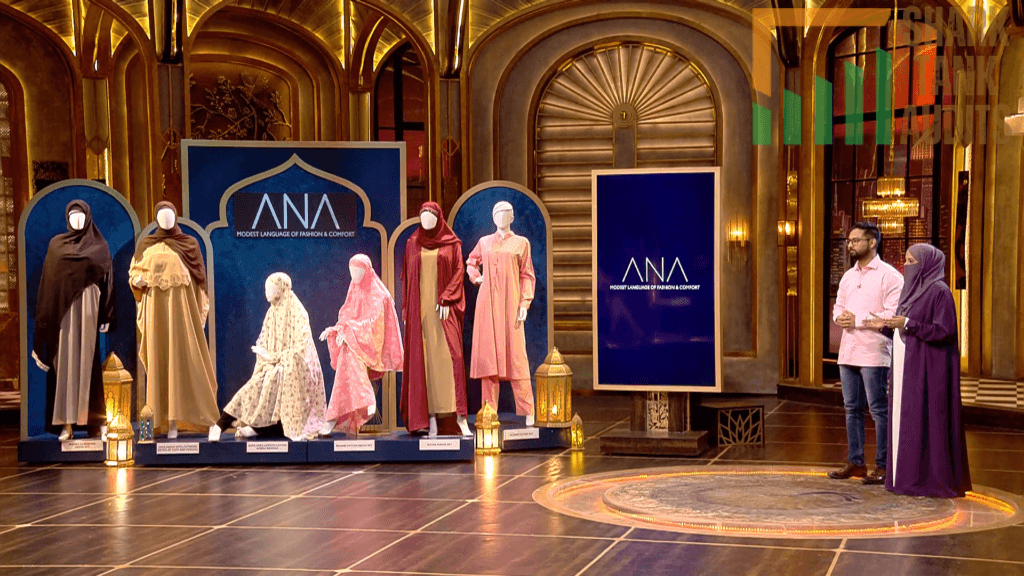

Product Overview: ANA Apparels

- The product line of ANA Apparels specializes in premium modest wear, including abayas, hijabs, niqabs, and dupattas.

- These wardrobe staples are crafted to balance comfort with style, catering to both daily wear and special occasions.

- A significant part of their service includes a focus on customization, allowing customers to tailor fabrics and fits to their specific preferences, which distinguishes them from generic, mass-produced imports.

Investor Reactions: ANA Apparels

The Sharks provided diverse feedback, ultimately leading to their decision to opt out:

- Aman Gupta: Backed out due to a lack of product differentiation, noting the designs could be easily replicated.

- Namita Thapar: Felt it was too early to invest and advised the founders to scale further before seeking external capital.

- Ritesh Agarwal: Expressed concern that the market segment was too small and advised streamlining the business.

- Vineeta Singh: Questioned the financial allocations and the use of funds in the initial stages.

- Kunal Bahl: Admired Asma’s effort in building a profitable business but did not offer a deal.

Customer Engagement Philosophy: ANA Apparels

- The brand treats fashion as a movement of sisterhood and empowerment rather than just a retail transaction.

- ANA Apparels relies heavily on “social commerce,” utilizing platforms like Instagram to build an organic community.

- Their philosophy centers on cultural pride and providing a personalized shopping experience that resonates emotionally with their target audience.

Product Highlights: ANA Apparels

- Design Authenticity: Moving away from generic imports toward culturally relevant, designer modest wear.

- High Profitability: Maintaining a 20% EBITDA with a COGS of 26%.

- Strong Scalability: Revenue grew from Rs 39 Lakhs in FY 22-23 to Rs 2 Crores in FY 24-25.

- Community Validation: Strong repeat purchases driven by social media engagement and customer testimonials.

Future Vision: ANA Apparels

- Moving forward, ANA Apparels aims to reach a projected revenue of Rs 4 Crores for FY 25-26.

- To address the Sharks’ critiques, the founders plan to focus on further differentiating their designs and streamlining their operations to improve scalability.

- The brand remains committed to its mission of revolutionizing the Indian modest fashion market by maintaining high quality and deepening its D2C presence.

Deal Finalized or Not: ANA Apparels

- No deal was finalized.

- Despite the brand’s profitability and the founders’ passion, ANA Apparels exited the tank without an investment.

- The Sharks expressed various concerns regarding the scalability and defensibility of the business model.

| Information | Details |

|---|---|

| Business Name | ANA Apparels |

| Built With | Shopify |

| SEO Performance | Good SEO performance, further SEO improvement needed |

| Organic Traffic | 7,756 visitors per month |

| Founders | Asma Nafis Ansari and Zeeshan Kareem |

| Founder Background | Asma is a NIFT graduate and lead designer; Zeeshan manages operations and growth |

| Awards | Woman Entrepreneur of the Year 2023 |

| Established | October 2021 |

| Business Model | Direct-to-Consumer (D2C) modest fashion brand |

| Brand Meaning | ANA represents dignity, self-respect, and confidence |

| Headquarters | India |

| Shark Tank Season | 05 |

| Shark Tank Episode | 33 |

| Episode Air Date | Wednesday, 18 February 2026 |

| The Ask | ₹80 Lakhs for 4% equity |

| Valuation Asked | ₹20 Crores |

| Equity Split | Asma 51%, Zeeshan 49% |

| Financial Health | 20% EBITDA margin |

| COGS | 26% |

| Revenue FY22-23 | ₹39 Lakhs |

| Revenue FY24-25 | ₹2 Crores |

| Projected Revenue FY25-26 | ₹4 Crores |

| Product Category | Premium modest wear |

| Key Products | Abayas, Hijabs, Niqabs, Dupattas |

| Customization | Personalized fabrics and fit options |

| Primary Target Audience | Muslim women aged 18–40 |

| Secondary Audience | Women seeking modest, elegant fashion |

| Geographic Focus | Tier 1 and Tier 2 cities including Mumbai, Hyderabad, Lucknow, Bangalore |

| Market Size India | Part of $105 Billion Indian apparel market |

| Modest Wear Growth | Outpacing general apparel growth (10–12% CAGR overall retail growth) |

| Global Market Opportunity | Global Islamic clothing market projected $90–100 Billion (2026) |

| TAM Base | ~200 Million Muslim population in India |

| Price Range | ₹1,500 – ₹5,000 per garment |

| Marketing Strategy | Lifestyle-led storytelling, Reels, 360-degree product videos |

| Influencer Strategy | Collaboration with modest fashion micro-influencers |

| Social Commerce | Instagram Shop and WhatsApp Business |

| SEO Strategy | Target keywords like Designer Abayas India, Customized Hijab Online |

| Distribution Model | Shopify-based D2C platform |

| Offline Strategy | Pop-up stores and experience centers |

| International Expansion | GCC and European markets |

| Key Advantage | 20% EBITDA and strong repeat purchases |

| Founder Strength | NIFT design expertise ensures authenticity |

| Key Challenge | Low barriers to entry and easy design replication |

| Scalability Concern | Market perceived as niche by Sharks |

| Operational Challenge | Inventory and logistics scaling for ₹4 Crore target |

| Mitigation Strategy (Competition) | IP/design registration and proprietary fabrics |

| Mitigation Strategy (Market Size) | Position as Global Modest Fashion brand |

| Phase 1 Goal (2026) | Achieve ₹4 Crore revenue and expand into modest sportswear |

| Phase 2 Goal (2027) | Raise bridge round at ₹30–40 Crore valuation |

| Phase 3 Goal (2028) | Partner with Nykaa Fashion Luxe or Ajio Gold |

| Long-Term Valuation Target | ₹100 Crore+ valuation |

| Deal Status | No deal finalized |

| Investor Feedback Summary | Sharks cited scalability, differentiation, and defensibility concerns |

ANA Apparels Shark Tank India Business Plan

1. Market Potential & Facts: ANA Apparels

- Indian Modest Fashion Market: As of 2026, the modest fashion sector in India is a significant sub-segment of the $105 Billion domestic apparel market.

- Economic Growth: India’s retail clothing market is growing at a 10-12% CAGR, while the modest wear segment—encompassing abayas, hijabs, and modest co-ords—is outpacing general apparel due to rising cultural pride and urbanization.

- The “Premiumization” Trend: There is a documented shift in India toward “Accessible Premium” fashion (growing at 25% CAGR). ANA Apparels sits perfectly in this niche, moving customers away from cheap, unbranded imports to designer-led, high-quality garments.

- Global Context: The global Islamic clothing market is projected to reach approximately $90-100 Billion in 2026, providing a massive export opportunity for Indian-made modest wear.

2. Total Addressable Market (TAM): ANA Apparels

- The Muslim Demographic: India houses the world’s third-largest Muslim population (approx. 200 Million). Over 50% of this demographic is under the age of 30, representing a massive, fashion-conscious consumer base.

- Broadening Appeal: While primarily serving Muslim women, “Modest Fashion” as a trend now appeals to a wider audience looking for comfort and grace. In India, over 65% of women’s apparel sales are now categorized under “modest” styles (long hemlines, higher necklines).

- Serviceable Market: ANA Apparels targets the urban middle-to-upper-class women in Tier 1 and Tier 2 cities (like Mumbai, Hyderabad, Lucknow, and Bangalore) who spend an average of ₹1,500 – ₹5,000 per occasion-wear garment.

3. Ideal Target Audience & Demographics: ANA Apparels

- Primary Segment: Muslim women aged 18–40 who are working professionals, students, or fashion enthusiasts seeking to balance religious values with modern style.

- Secondary Segment: Women of all faiths looking for high-quality, breathable, and non-clinging silhouettes for workwear or travel.

- Geographic Focus: High-density regions including Uttar Pradesh, Kerala, Maharashtra, and West Bengal, where there is a strong cultural affinity for the brand’s core products like abayas and niqabs.

4. Marketing & Digital Strategy: ANA Apparels

- Content Strategy: ANA Apparels should focus on “Lifestyle-led Storytelling.” Instead of just product photos, use Reels and 360-degree videos to show how a “Moonlit Abaya” or “Noir Grid Abaya” transitions from a business meeting to a social event.

- Influencer Marketing: Partner with “Modest Fashionistas” and micro-influencers who embody the brand’s “Sisterhood” philosophy. Authenticity is key—influencers must reflect the brand’s values of dignity and self-respect.

- SEO & Web Strategy: With an existing organic traffic of ~7,750 visitors/month, the brand must optimize for high-intent keywords like “Designer Abayas India” and “Customized Hijab Online” to convert search intent into sales.

- Social Commerce: Utilize Instagram’s “Shop” feature and WhatsApp Business for personalized styling consultations, maintaining the 20% EBITDA by reducing customer acquisition costs through organic community building.

5. Distribution Strategy: ANA Apparels

- D2C Excellence: Continue using the Shopify-based platform as the primary sales engine to maintain direct customer data and higher margins.

- Omnichannel Presence: Launch “Experience Centers” or pop-up stores in major malls in cities like Hyderabad and Delhi to address the Shark’s concerns about “touch and feel” (since 65% of modest wear sales still happen offline).

- Global Shipping: Leverage India’s manufacturing cost advantage to ship to the GCC (Gulf) and European markets, where the demand for designer modest wear is high but price points are significantly higher than in India.

6. Advantages & Challenges: ANA Apparels

Advantages

- High Profitability: A 20% EBITDA and 26% COGS indicate an extremely lean and efficient manufacturing process.

- Founder Expertise: Asma’s NIFT background ensures design authenticity that “mass-market” competitors cannot easily replicate.

- Niche Authority: Being an early mover in the “Designer Modest Wear” space in India creates strong brand recall.

Challenges

- Low Barriers to Entry: As Shark Aman Gupta noted, designs can be easily copied by local manufacturers.

- Scalability Perception: Sharks perceived the market as “small,” requiring the brand to prove its appeal to non-traditional segments.

- Operational Strain: Moving from a ₹2 Crore to a ₹4 Crore revenue model requires significant investment in inventory and logistics.

7. Success Reasons & Mitigation Strategies: ANA Apparels

- Why it will succeed: The brand isn’t just selling clothes; it’s selling identity and empowerment. In a world moving toward “Conscious Fashion,” the brand’s focus on quality over fast-fashion volume resonates with the 2026 consumer.

- Mitigation for Competition: ANA Apparels must secure IP/Design registrations for signature collections and focus on “proprietary fabrics” that are hard to source for local imitators.

- Mitigation for Market Size: Pivot the marketing narrative from “Religious Wear” to “Global Modest Fashion” to capture the broader market of women seeking elegant, full-coverage clothing.

8. Future Business & Roadmap to Valuation: ANA Apparels

- Phase 1 (2026): Achieve the ₹4 Crore revenue target by optimizing the Shopify store and expanding the product line to include “Modest Sportswear” and “Office-wear Co-ords.”

- Phase 2 (2027): Raise a Bridge Round at a ₹30-40 Crore valuation based on proven scalability and entry into 2-3 international markets.

- Phase 3 (2028): Partner with major platforms like Nykaa Fashion (Luxe segment) or Ajio Gold to cement the brand’s position as a “Premium Designer” label, aiming for a ₹100 Crore+ valuation.

ANA Apparels Shark Tank India Review