Shark Tank India Season 5 Episode 32 Review

Aired on Tuesday, February 17, 2026, Episode 32 of Shark Tank India Season 5 centered on the theme of “Pure, Precious, and Powerful.” The Tank transformed into a space where traditional Indian roots—from grandmother’s snack recipes to ancient oil-pressing techniques—met the high-stakes world of modern D2C (Direct-to-Consumer) scaling.

This episode was a masterclass in brand storytelling and financial scrutiny. We saw Aman Gupta attempt to build the “Pandora of India” with a premium jewelry brand, while other Sharks like Vineeta Singh and Kunal Bahl dug deep into the “vicious cycles” of marketing spend versus profitability. It was an evening that proved passion for heritage is a great starting point, but in the Tank, your unit economics must be as refined as your product.

Summary: The Episode Verdicts

Episode 32 was a bittersweet night for the entrepreneurs. While two brands walked away with life-changing deals from Aman Gupta, the episode also highlighted the “valuation gap” that can sink even the most promising health-focused startups.

Pitch 1

BabyWorks by Swapnil Shark Tank India Episode Review

In Shark Tank India Season 5, Episode 32, the Mumbai-based premium jewelry brand BabyWorks by Swapnil delivered a memorable pitch that highlighted a significant gap in the organized children’s jewelry market. Founded by the sibling duo Swapnil Anuj Gupta and Shrey Khandelwal, the brand was born from Swapnil’s personal search as a mother for high-quality, safe jewelry for infants and kids. Swapnil, a Chartered Accountant and Company Secretary, brought financial rigor to the table, while Shrey, an architecture graduate, spearheaded the brand’s digital and architectural design. Their primary value proposition centers on handcrafted, hallmarked gold and 925 sterling silver pieces, such as nazariyas, bangles, and themed brooches, specifically designed with smooth, hypoallergenic finishes to protect delicate baby skin.

The founders entered the Tank with an initial ask of ₹60 lakhs for 4% equity, valuing the company at ₹15 crores. During the demonstration, the Sharks were particularly impressed by the “tech moat” provided by their proprietary 3D customization tool on their Shopify-powered website, which allows parents to personalize designs in real-time. The brand’s financials were a major highlight, as Swapnil revealed a net profit margin of 35%, a remarkable figure for the jewelry industry where gold price volatility often squeezes earnings. This combination of emotional storytelling, technological edge, and financial health earned them high praise from the panel.

Despite the brand’s strong unit economics, the Sharks noted a significant challenge in its digital visibility, with only 122 monthly organic visitors. This indicated a heavy reliance on performance marketing rather than organic search growth. Aman Gupta, co-founder of boAt, saw an opportunity to scale the business as a D2C lifestyle gifting brand. After a round of negotiations regarding the valuation and the scale of the customization model, the founders accepted Aman’s counter-offer of ₹60 lakhs for 6% equity, valuing the company at ₹10 crores. The strategic partnership was aimed at leveraging Aman’s expertise in brand building and aggressive digital scaling to transform BabyWorks from a niche boutique into a household name for children’s keepsakes.

Post-investment, the roadmap for BabyWorks by Swapnil focuses on a radical digital overhaul, including SEO optimization to capture high-intent search traffic for personalized baby gifts. The brand plans to expand its distribution strategy beyond its direct website to high-end marketplaces like FirstCry and premium maternity hospitals through shop-in-shop models. By integrating augmented reality (AR) for virtual try-ons and scaling its influencer marketing efforts, the brand aims to capture a larger share of the growing Indian baby care market, which is expanding at over 24% CAGR. The ultimate goal is to become the global go-to destination for safe, luxury children’s jewelry, securing the “first gift” sentiment for a lifetime of customer loyalty.

Pitch 2

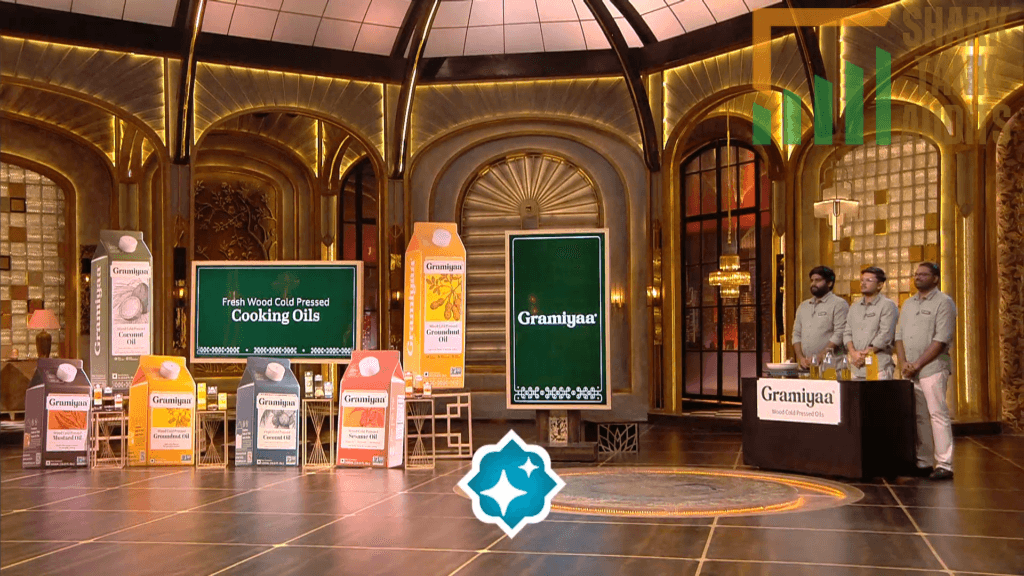

Gramiyaa Shark Tank India Episode Review

Gramiyaa appeared on Shark Tank India Season 5, Episode 32, with Bengaluru-based co-founders Sibi Manivannan (robotics engineer inspired by grandfather’s 1960s traditional oil setup witnessing chemical-heavy modern refineries), Mohamed Yaseen, and Naveen Rajamaran seeking ₹1.4 Crore for 1% equity (₹140 Crore valuation) but left with no deal after all five Sharks opted out citing strategic/financial concerns.

The premium cooking oil brand provides chemical-free nutrient-rich edible oils through vertically integrated traditional wood/stone mill cold-pressing (no high heat/solvents) offering groundnut/sesame/coconut/extra virgin olive oil and specialty blends from US FDA/ISO-certified Tamil Nadu facility using non-GMO seeds with zero trans fats/preservatives, growing from ₹1.5 Crore (FY 22-23) to projected ₹32 Crore (FY 25-26) with 35% sales from quick commerce and international exports to US/UAE with 5,044 monthly organic visitors requiring SEO improvement. Sharks reacted harshly—Vineeta noted gap between revenue and break-even labeling it “risky investment,” Kunal expressed concern over “vicious cycle” burning cash to increase marketing/gross margins, Ritesh applauded quality but felt pricing/costs in “tricky place” for current stage, Namita cited heavy competition questioning execution sharpness, and Aman unimpressed by founders’ “stubbornness” regarding B2B sales famously stating “Tumhare sapne bade hain, kaam nahi hai” (Your dreams are big, but the work isn’t showing).

Operating in Indian edible oil market valued at $25+ billion with cold-pressed segment growing ~15% CAGR through 2030 within premium/health-conscious urban segment ($1.5 billion) and ₹500-1,000 Crore wood-pressed oil niche amid rising lifestyle diseases driving shift from refined oils to cold-pressed variants and “clean label” trend (consumers paying 2x-3x premium for chemical-free products), Gramiyaa targets health-conscious parents (28-50, Tier 1/2 cities, ₹15 lakh+ household income prioritizing family wellness), educated professionals understanding refined versus cold-pressed fats shopping on Zepto/Blinkit/BigBasket, and fitness enthusiasts/clean eaters seeking high-smoke-point natural fats for specialized diets (Keto) within 700+ million internet users, planning quick commerce deepening (Blinkit/Zepto partnerships for 10-minute delivery in urban clusters), subscription models increasing customer lifetime value, specialty blends launch (infused oils) increasing gross margins, EBITDA-positive transition justifying ₹150+ Crore Series A valuation, and global “Ethical Fat” brand expansion into European/Southeast Asian markets beyond existing US/UAE presence employing local oil producers who lost livelihoods to industrialization integrating traditional craftsmanship into modern supply chain.

Pitch 3

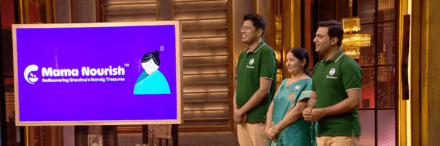

Mama Nourish Shark Tank India Episode Review

Mama Nourish appeared on Shark Tank India Season 5, Episode 32, with Mumbai-based co-founders Kunal Goel, Usha Shrotriya (mother who inspired brand 2021), and Yash Parashar (Usha’s son who officially launched with friend Kunal in 2023, bringing first product to market 2024) seeking ₹60 lakh for 1.5% equity (₹40 Crore valuation) but successfully closed a deal for ₹2 Crore for 20% equity (₹10 Crore valuation) with Shark Aman Gupta after Sharks immediately skeptical of steep valuation given early stage and significant financial losses.

The “clean-label” D2C healthy snacking brand modernizes traditional Indian nutritional wisdom through 100% natural gluten-free preservative-free flagship LadduBar (portable nutrient-dense snack bar inspired by traditional laddoo recipes using millets/dry fruits, kamarkas/cassava seeds, fenugreek/dates) sourcing recipes from grandmothers across India through contests ensuring culinary heritage authenticity, operating across website (20%), quick commerce (34%), vending machines (19%), and e-commerce (19%) with 3,088 monthly organic visitors and high ₹2.2 Crore EBITDA loss requiring SEO improvement. Sharks reacted critically—Vineeta opted out citing “flimsy” packaging and lack of variety in base recipes, Namita withdrew feeling product overpriced lacking “execution rigor,” Ritesh expressed concern over low cash runway and unproven product-market fit, Kunal believed while founders loved business unit economics suggested customers not yet “in love” with product, while Aman remained critical of finances and contract manufacturing model but saw story potential offering “rescue” investment noting he was their “only chance” to avoid running out of capital within three months.

Operating in Indian healthy snacks market projected at $4.4 billion by 2026 (8.1% CAGR through 2033) within broader $248 billion snack market (2025) and $3.13 billion clean-label/healthy segment amid 3-of-5 urban consumers seeking “superfood” alternatives (makhana/millets/seeds) due to increasing lifestyle diseases (diabetes/obesity) and government Pradhan Mantri Kisan Sampada Yojana offering 35-50% food processing grants, Mama Nourish targets mindful parents (30-45, metros seeking preservative-free children’s snacks with traditional “Grandma” trust), busy professionals (22-35, Tier 1 cities prioritizing modern convenience/functional nutrition for high-stress lifestyles), and health seekers (diabetes/gluten-sensitive) within Tier 1/2 metropolitan professionals aiming 2-3% premium snack bar segment share, planning packaging quality fixes, SKU consolidation focusing top 3 bestsellers reducing inventory burn improving unit economics, regional flavor expansion (South/East India), subscription boxes increasing customer lifetime value, hybrid manufacturing transition increasing production cost control, and EBITDA neutrality achieving ₹50+ Crore Series A valuation target based on proven repeat-purchase metrics and offline retail footprint.

| Pitch | Brand | Ask | Deal Status | Shark(s) Involved |

| Pitch 1 | BabyWorks by Swapnil | ₹60 Lakh for 4% | ₹60 Lakh for 6% | Aman Gupta |

| Pitch 2 | Gramiyaa | ₹1.4 Cr for 1% | No Deal | Sharks cited high valuation and a “risky” path to break-even. |

| Pitch 3 | Mama Nourish | ₹60 Lakh for 1.5% | ₹2 Crore for 20% | Aman Gupta |

Key Takeaways from the Tank

- The “Solo Shark” Dominance: Aman Gupta was the man of the hour, closing both successful deals. He prioritized “founder hunger” over perfect spreadsheets, specifically rescuing Mama Nourish from a limited cash runway.

- The Valuation Wall: Gramiyaa presented a high-quality, much-needed product for Indian kitchens, but their ₹140 Crore valuation proved too steep for the Sharks to digest, especially given the heavy competition in the edible oil space.

- Tech meets Tradition: BabyWorks successfully used a “tech moat” (their 3D customization tool) to justify a premium position, proving that even a traditional category like jewelry can be disrupted with the right digital edge.

Leave feedback about this

You must be logged in to post a comment.