CotoPay Shark Tank India Episode Review

CotoPay appeared on Shark Tank India Season 5, Episode 27, with co-founders Aviral Gupta (CEO, London Business School, founding member BharatPe, National Health Authority working on CoWIN/e-RUPI framework), Vidit Sidana (CBO, IIM Ahmedabad, ex-ITC Brand Manager managing ₹7,000 Crore Sunfeast portfolio), and Uzair Syed Ahmed (CTO, 20 years experience, original Aadhaar team member, designed CoWIN architecture) seeking ₹50 lakh for 1% equity (₹50 Crore valuation) and successfully closed a deal for ₹75 lakh for 2% equity + 1% advisory (3% total) with Sharks Anupam Mittal and Kunal Bahl after intense negotiations with four Sharks making matching offers.

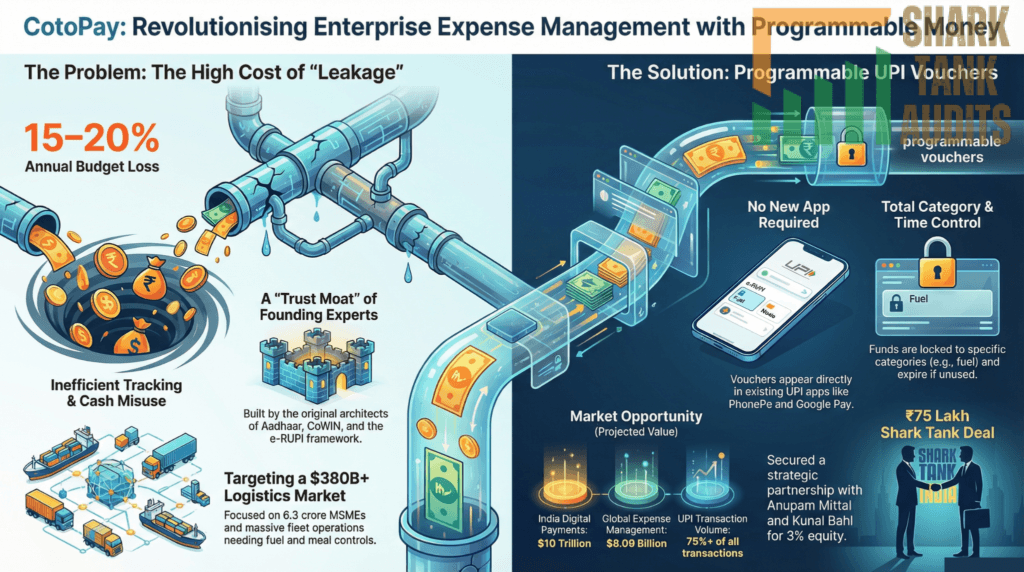

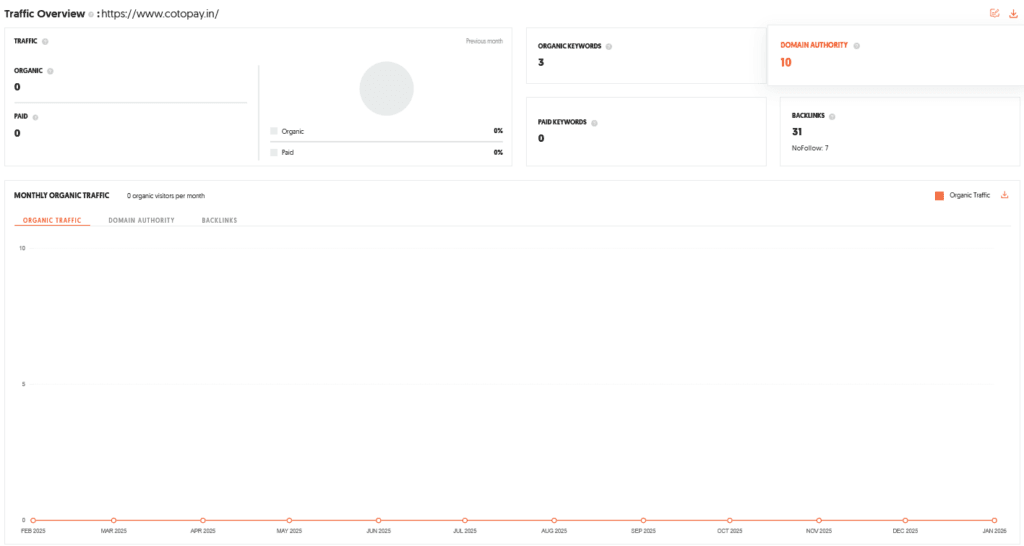

The fintech platform revolutionizes enterprise expense management using NPCI’s e-RUPI infrastructure to issue programmable digital UPI vouchers (appearing in existing Google Pay/PhonePe apps without new downloads) allowing business owners to control spending with category locking (fuel/meals/travel restrictions), time-bound expiration keeping unused funds in company account, real-time audit tracking with merchant details/digital receipts, and seamless integration with five major banks, solving “leakage” and visibility problems with 0 organic visitors requiring SEO improvement. Sharks praised founders’ “underachiever” credentials (sarcastic compliment regarding Aadhaar/CoWIN work) calling apps “well-made” and “solid assets”—Aman opted out fearing “long and painful” HR/Admin sales cycles, while Anupam/Kunal recognized massive fleet management/logistics potential seeing synergies with portfolio companies (Rapido, Zingbus).

Operating in India’s digital payments market projected at $10 trillion by 2026 (UPI 75%+ transaction volumes) within global corporate expense management valued at $9.09 billion (2026, India fastest-growing region) and India’s $380+ billion logistics market, CotoPay targets 6.3 crore registered MSMEs (top 10% digitally active) specifically fleet owners/logistics companies (50+ drivers), event management firms, and corporate finance/HR heads (30-55, Tier 1/2 hubs) addressing estimated 15-20% annual travel/field budget losses from inefficient tracking, lost receipts, and cash misuse, planning expansion into ERP integration (SAP/Oracle) for MNCs and “CotoPay Credit” offering working capital loans targeting “Soonicorn” (₹1,000+ Crore) valuation by 2028.

Website Information

- Website:- CotoPay

- Build on JavaScript libraries jQuery 3.7.1 OWL Carousel Slick Tiny Slider

- Poor SEO Performance, SEO Improvement needed.

- ORGANIC TRAFFIC: 0 visitors per month.

CotoPay Founders

The venture was founded by a powerhouse trio with deep roots in India’s digital infrastructure:

- Aviral Gupta (CEO): An alumnus of London Business School and a founding member of BharatPe. He played a pivotal role at the National Health Authority, working on CoWIN and the initial e-RUPI framework.

- Vidit Sidana (CBO): An IIM Ahmedabad graduate and former Brand Manager at ITC, where he managed a ₹7,000 crore portfolio for Sunfeast.

- Uzair Syed Ahmed (CTO): A tech veteran with 20 years of experience who was part of the original Aadhaar team and designed the architecture for the CoWIN platform.

CotoPay Brand Overview

- CotoPay is a fintech platform designed to revolutionize expense management for Indian enterprises.

- Unlike traditional credit cards or cash-based systems, it utilizes the NPCI’s e-RUPI infrastructure to issue programmable, digital UPI vouchers.

- The brand focuses on solving the “leakage” and “visibility” problems in corporate spending by ensuring money is spent exactly where it is intended.

CotoPay Shark Tank India Appearance & Ask

- The founders appeared in Season 5, delivering a pitch that highlighted the frustrations of manual bookkeeping and lost receipts.

- Initial Ask: ₹50 lakh for 1% equity.

- Initial Valuation: ₹50 crore. The sharks were immediately impressed by the founders’ “underachiever” credentials (a sarcastic compliment regarding their work on Aadhaar and CoWIN).

Season and Episode Air Date

- Season: 05

- Episode: 27

- Episode Air Date: Tuesday, 10 February, 2026

CotoPay Product Overview

- The CotoPay solution allows business owners to issue digital vouchers directly to an employee’s phone.

- Seamless Integration: Employees do not need to download a new app; the vouchers appear in existing UPI apps like Google Pay or PhonePe.

- Control: The money stays in the company’s bank account until the moment the voucher is scanned and redeemed at a merchant.

- Usage: Employees simply scan a merchant QR code, select the voucher, and pay via UPI PIN.

CotoPay Investor Reactions

The reactions were polarized but generally respectful of the tech:

- Aman Gupta: Opted out, fearing the “long and painful” sales cycle involved in dealing with HR and Admin departments.

- Anupam Mittal & Kunal Bahl: Recognized the massive potential in “fleet management” and “logistics,” seeing immediate synergies with their existing portfolio companies like Rapido and Zingbus.

- General Sentiment: The sharks lauded the technical architecture, calling the apps “well-made” and “solid assets.”

CotoPay Customer Engagement Philosophy

- CotoPay adopts a volume-based growth strategy rather than a traditional SaaS “per-user” fee.

- Their philosophy is to remove the “tax on growth”—by not charging per head, they encourage companies to onboard their entire workforce without worrying about rising monthly subscriptions.

- They prioritize category locking (fuel, meals, travel) to build trust between employers and employees.

CotoPay Product Highlights

- Programmability: Vouchers can be restricted by category (e.g., a fuel voucher cannot be used for alcohol).

- Time-Bound: Vouchers can be set to expire after a specific duration (e.g., 3 days), with unused funds remaining in the company account.

- Real-Time Audit: Every transaction is tracked instantly on a dashboard with merchant details and digital receipts.

- Deep Integration: The platform is already integrated with five major banks to ensure funds are handled securely.

CotoPay Future Vision

- The CotoPay team aims to bridge the gap between personal UPI ease and corporate spending discipline.

- Expansion: They plan to move beyond their initial pilot clients to target massive fleet owners and event management firms.

- Market Penetration: By temporarily lowering commission barriers (as suggested by Kunal Bahl), they aim to replace legacy systems like Sodexo.

- Ecosystem Integration: Future updates include deeper integration with HRMS and ERP systems to automate accounting and compliance reporting entirely.

CotoPay Deal Finalized or Not

- Yes, a deal was finalized.

- After intense negotiations and multiple matching offers from four different sharks, the founders opted for a strategic partnership.

- Final Deal: ₹75 lakhs for 2% equity + 1% advisory equity (3% total).

- Investors: Anupam Mittal and Kunal Bahl.

| Parameter | Details |

|---|---|

| Website | CotoPay |

| Tech Stack | jQuery 3.7.1, OWL Carousel, Slick, Tiny Slider |

| SEO Status | Poor SEO Performance |

| Organic Traffic | 0 visitors per month |

| Founders | Aviral Gupta, Vidit Sidana, Uzair Syed Ahmed |

| CEO | Aviral Gupta |

| CBO | Vidit Sidana |

| CTO | Uzair Syed Ahmed |

| Founder Credentials | BharatPe founding team, Aadhaar & CoWIN architecture |

| Brand Category | Fintech / Expense Management |

| Core Concept | Programmable UPI vouchers via e-RUPI |

| Infrastructure Base | NPCI e-RUPI Framework |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 27 |

| Episode Air Date | Tuesday, 10 February 2026 |

| Initial Ask | ₹50 Lakhs for 1% Equity |

| Initial Valuation | ₹50 Crores |

| Core Problem Solved | Expense leakage & lack of visibility in corporate spending |

| Product Type | Digital UPI Voucher Platform |

| App Requirement | No new app needed (Works in existing UPI apps) |

| Payment Flow | Voucher appears in Google Pay/PhonePe |

| Fund Control | Money stays in company bank until redemption |

| Usage Method | Scan merchant QR → Select voucher → Enter UPI PIN |

| Key Feature 1 | Category-based programmable vouchers |

| Key Feature 2 | Time-bound expiry controls |

| Key Feature 3 | Real-time audit dashboard |

| Key Feature 4 | Digital receipt capture |

| Bank Integration | Integrated with 5 major banks |

| Investor Reaction (Aman) | Concerned about long B2B sales cycles |

| Investor Reaction (Anupam) | Saw strong fleet/logistics synergy |

| Investor Reaction (Kunal) | Suggested lowering commission for market capture |

| Overall Shark Sentiment | Strong tech appreciation |

| Deal Status | Deal Finalized |

| Final Deal | ₹75 Lakhs for 2% Equity + 1% Advisory |

| Total Equity Given | 3% |

| Investors | Anupam Mittal & Kunal Bahl |

| Digital Payments Market | $10 Trillion by 2026 (India) |

| UPI Share | 75%+ of transaction volume |

| Leakage Problem | 15–20% expense inefficiency in Indian firms |

| TAM | 6.3 Crore registered MSMEs |

| Global Expense Mgmt Market | $9.09 Billion (2026) |

| Logistics Market | $380+ Billion (India) |

| Primary Target | Fleet & logistics companies |

| Secondary Target | Event management firms |

| Corporate Target | HR & Finance heads |

| Decision Maker Age | 30–55 years |

| Geography | Tier 1 & Tier 2 cities |

| Marketing Strategy | B2B partnerships + leakage audit tool |

| SEO Focus | e-RUPI for business, digital fuel vouchers |

| Content Strategy | LinkedIn thought leadership on programmable money |

| Distribution Channel 1 | Direct enterprise sales |

| Distribution Channel 2 | Bank white-label partnerships |

| Distribution Channel 3 | HRMS & ERP API integrations |

| Core Advantage 1 | Works within existing UPI ecosystem |

| Core Advantage 2 | Zero float risk |

| Core Advantage 3 | Purpose locking of funds |

| Key Challenge 1 | 3–6 month sales cycles |

| Key Challenge 2 | Competition from Razorpay/Sodexo |

| Key Challenge 3 | Merchant tech literacy barriers |

| Mitigation Strategy 1 | Deep exclusive banking APIs |

| Mitigation Strategy 2 | 3-month commission-free onboarding |

| Year 1 Focus | Fleet management penetration (17.8% CAGR sector) |

| Year 2 Focus | ERP integration (SAP/Oracle) |

| Year 3 Focus | Launch CotoPay Credit |

| Revenue Model | Volume-based commission (not per-user SaaS) |

| Liquidity Benefit | Funds remain in company account until use |

| Expansion Strategy | Replace legacy systems like Sodexo |

| Long-Term Vision | Bridge personal UPI ease with corporate discipline |

| Spend Automation Goal | ₹5,000 Crore annual processing |

| Take Rate Target | 1% |

| Valuation Target | ₹1,000+ Crore (Soonicorn by 2028) |

CotoPay Shark Tank India Business Plan

1. CotoPay Business Potential in India

- Digital Dominance: India’s digital payments market is projected to reach $10 trillion by 2026, with UPI accounting for over 75% of transaction volumes. CotoPay sits at the intersection of this explosion.

- The “Leakage” Gap: Indian businesses lose an estimated 15–20% of their travel and field budgets due to inefficient tracking, lost receipts, and cash misuse. CotoPay solves this at the root.

- Government Backing: With the government pushing e-RUPI for direct benefit transfers, CotoPay is the first mover in repurposing this sovereign tech for the private B2B sector.

2. CotoPay Total Addressable Market (TAM)

- The MSME Sector: India has over 6.3 crore registered MSMEs as of 2026. CotoPay can realistically target the top 10% that are digitally active.

- Corporate Expense Management: The global market is valued at $9.09 billion in 2026, with India being the fastest-growing region.

- Fleet & Logistics: India’s logistics market is a $380+ billion opportunity. CotoPay targets the specific “fuel and driver allowance” segment within this, worth billions in annual processing volume.

3. CotoPay Ideal Target Audience and Demographics

- Fleet Owners & Logistics Companies: Managing 50+ drivers who need fuel and food allowances without cash risks.

- Event Management Firms: Companies handling large temporary staff/contractors for weddings and corporate events.

- Corporate Finance/HR Heads: Professionals in IT, Manufacturing, and BFSI sectors looking to automate “per-diem” and meal allowance disbursements.

- Demographics: Decision-makers aged 30–55, residing in Tier-1 and Tier-2 hubs like Delhi-NCR, Bengaluru, and Mumbai.

4. CotoPay Marketing Strategy

- B2B Partnership Program: Collaborate with corporate travel agencies and fuel companies (HPCL, BPCL) to offer CotoPay as a value-added service.

- Lead Magnets: Offer a “Leakage Audit Tool” on the CotoPay website where CFOs can calculate how much they lose to manual expense tracking.

- Shark Tank Leverage: Use the “As Seen on Shark Tank India” badge across all marketing collateral to build instant trust with traditional business owners.

5. CotoPay Content & Digital Marketing Strategy

- SEO Overhaul: Pivot from “0 visitors” by targeting high-intent keywords like “e-RUPI for business,” “digital fuel vouchers,” and “tax-free meal allowances India.”

- LinkedIn Thought Leadership: Founders (Aviral, Vidit, Uzair) should publish weekly insights on the “Programmable Money” revolution to position CotoPay as a tech pioneer.

- Video Case Studies: Create short, 60-second reels showing a driver paying for fuel via CotoPay versus the old “torn bill” struggle to humanize the brand.

6. CotoPay Distribution Strategy

- Direct Sales Force: High-touch sales teams targeting large enterprises for custom integrations.

- Bank Partnerships: White-label or co-branded CotoPay solutions sold through the existing relationship managers of the 5 integrated partner banks.

- API-First Approach: Allow HRMS platforms (like Darwinbox or GreytHR) to plug into CotoPay directly, making it a “one-click” activation for their clients.

7. CotoPay Advantages

- No New App Needed: Unlike competitors, CotoPay works inside the UPI apps employees already love (PhonePe/Google Pay).

- Zero Float Risk: Money stays in the company’s bank account until the very second of redemption—a massive liquidity advantage for CotoPay clients.

- Purpose Locking: Total control over spending categories, preventing the “fuel money spent on movies” syndrome.

8. CotoPay Challenges

- Long Sales Cycles: Selling to HR/Admin departments can take 3–6 months.

- Competition: Tech giants like Razorpay or Sodexo could potentially pivot into the e-RUPI space.

- Tech Literacy: Small-scale merchants in rural areas may need education on accepting e-RUPI vouchers via CotoPay.

9. CotoPay Success Factors & Mitigation Strategies

- Credential Power: The founders’ Aadhaar/CoWIN background acts as a “trust moat” that competitors cannot easily replicate.

- Mitigation for Competition: Build deep, exclusive banking API integrations that create high switching costs for CotoPay users.

- Mitigation for Adoption: Offer the first 3 months “Commission Free” to allow companies to see the 15% savings before they start paying.

10. CotoPay Future Business & Roadmap to Valuation

- Phase 1 (Year 1): Focus on the 17.8% CAGR fleet management market to stabilize cash flow.

- Phase 2 (Year 2): Integrate with global ERPs (SAP/Oracle) to target MNCs, significantly increasing CotoPay’s enterprise valuation.

- Phase 3 (Year 3): Launch “CotoPay Credit”—using transaction data to offer working capital loans to the SMEs using the platform.

- Valuation Target: By automating ₹5,000 crore in annual spends at a 1% take rate, CotoPay can aim for a “Soonicorn” (₹1,000+ crore) valuation by 2028.

CotoPay Shark Tank India Episode Review