Gully Labs Shark Tank India Episode Review

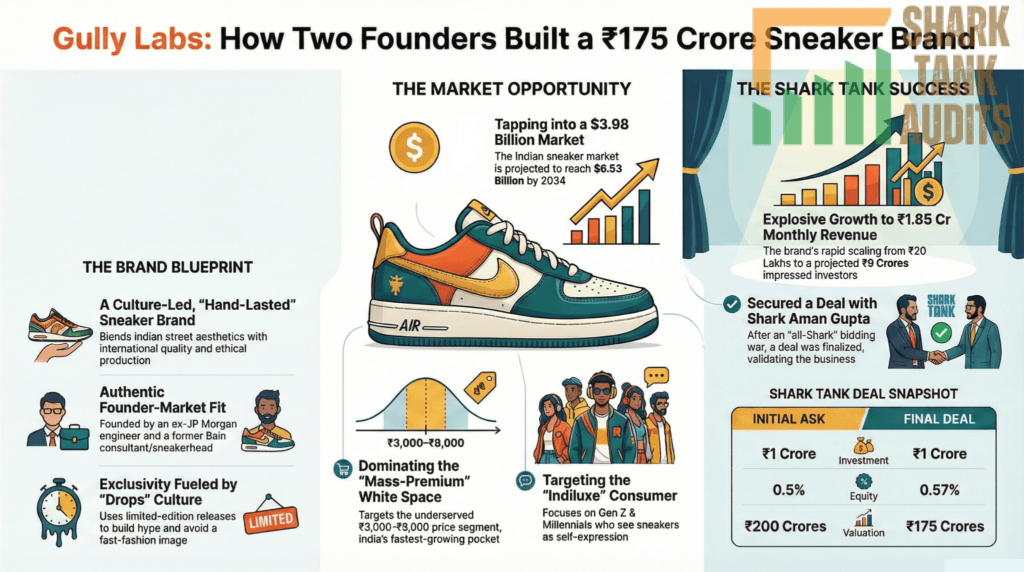

Gully Labs appeared on Shark Tank India Season 5, Episode 15, with co-founders Arjun Singh (ex-JP Morgan Sydney engineer who experimented with m8buy and Slow Dating via Antler venture program) and Animesh Mishra (ex-Bain US, dedicated sneakerhead) seeking ₹1 Crore for 0.5% equity (₹200 Crore valuation) and successfully closed a deal for ₹1 Crore for 0.57% equity (₹175 Crore valuation) with Shark Aman Gupta after all Sharks showed interest in rare “all-Shark” offer scenario.

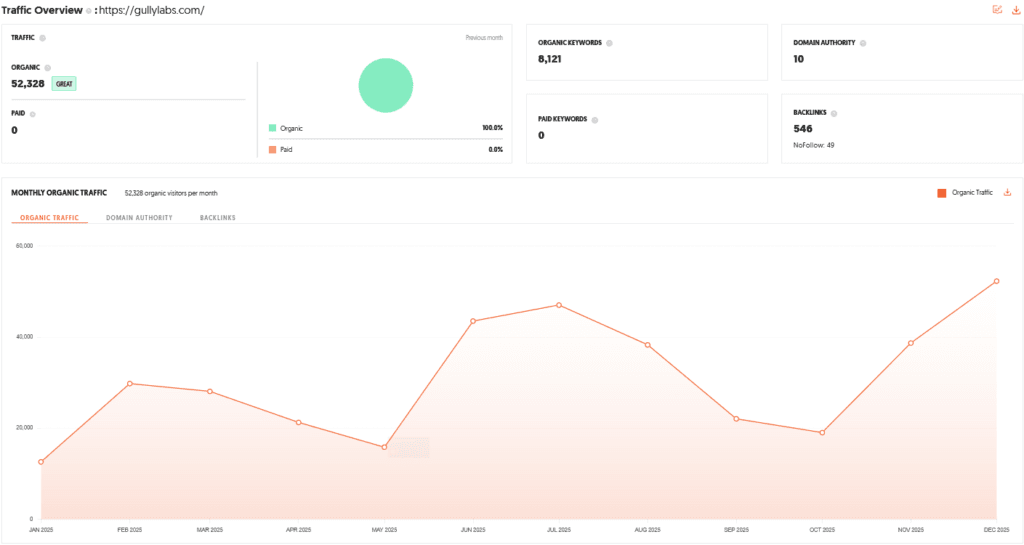

The Delhi NCR-based culture-led sneaker brand established August 2023 produces “hand-lasted” sneakers blending Indian street aesthetics with international quality in ₹3,000-₹8,000 mass-premium segment, growing explosively from ₹20 lakh (FY 23-24) to projected ₹9 Crore YTD with ₹1.85 Crore monthly revenue (November 2025) and 52,328 monthly organic visitors. With prior backing from Saama Capital and Atrium Ventures, they use limited “drops” culture (Onam, Phulkari themes), sustainable materials, and ethical production to maintain exclusivity versus fast-fashion while focusing on breathable fabrics, superior grip, and cushioning.

Operating in Indian sneaker market valued at $3.98 billion (2025) projected to reach $6.53 billion by 2034 (5.65% CAGR) within India’s $18.26 billion footwear market (2029), Gully Labs targets Gen Z/millennials (18-35) in Tier 1/2 cities viewing sneakers as self-expression, prioritizing “Authentic Indian Stories” and sustainability over mass-produced fashion in strategic whitespace between international giants (Nike/Adidas >₹10,000) and unbranded (<₹1,500).

Gully Labs Website Information

- Website:- Gully Labs

- Build on Shopify

- Great SEO Performance

- ORGANIC TRAFFIC: 52328 visitor per month.

Gully Labs Founders

The company was co-founded by Arjun Singh and Animesh Mishra.

- Arjun Singh: An engineer who formerly worked at JP Morgan in Sydney. After realizing corporate life lacked excitement, he joined the Antler venture program and experimented with two startups (m8buy and Slow Dating) before identifying a “white space” in the Indian sneaker market.

- Animesh Mishra: A college junior of Arjun’s who was working at Bain in the US. A dedicated sneakerhead, he left his job to return to India and co-found the brand after realizing his vision aligned perfectly with Arjun’s.

Gully Labs Brand Overview

- Gully Labs is a Delhi NCR-based, culture-led sneaker brand established in August 2023.

- The brand specializes in “hand-lasted” sneakers that blend Indian street aesthetics with international quality standards.

- Positioned in the premium-mass market, Gully Labs focuses on sustainability, ethical sourcing, and high-quality materials. Unlike fast-fashion labels, they prioritize curated collections and limited “drops” to maintain brand exclusivity and street credibility.

Gully Labs Shark Tank India Appearance & Ask

The founders appeared on Season 5 of Shark Tank India with a high-growth trajectory, reporting a jump from ₹20 Lakhs in FY 23-24 to a projected ₹9 Crores YTD.

- Original Ask: ₹1 Crore for 0.5% equity.

- Initial Valuation: ₹200 Crores.

Gully Labs Season and Episode Air Date

- Season: 05

- Episode: 15

- Episode Air Date: Friday, 23 January 2026

Gully Labs Product Overview

Gully Labs produces sneakers designed for versatility, making them suitable for college, the workplace, or social gatherings. The products feature:

- Design Philosophy: Simple silhouettes, neutral hues, and earthy tones with subtle branding.

- Functional Features: Emphasis on breathable fabrics, superior sole grip, and high-quality cushioning.

- Manufacturing: A focus on “hand-lasted” techniques and ethical production methods.

Gully Labs Investor Reactions

- The Sharks were impressed by the brand’s rapid scaling—specifically the jump to a monthly revenue of ₹1.85 Crores in November 2025.

- The brand’s ability to secure backing from notable VCs like Saama Capital and Atrium Ventures prior to the show added to its credibility.

- Every Shark on the panel showed interest, resulting in a rare “all-Shark” offer scenario, highlighting their confidence in the founders and the “desi” sneaker niche.

Gully Labs Customer Engagement Philosophy

Gully Labs utilizes a Direct-to-Consumer (D2C) model to foster a feedback loop and build brand loyalty. Their social media strategy focuses on:

- Lifestyle over Sales: Selling a sense of community and culture rather than just footwear.

- Community-Driven Content: Using platforms like Instagram and LinkedIn to share the “sustainability narrative” and behind-the-scenes stories.

- Emotional Connection: Targeting urban youth and the creative community by making them feel like a part of the brand’s evolving story.

Gully Labs Product Highlights

- Cultural Roots: Designs are inspired by Indian streets, local tales, and urban living.

- Exclusivity: Limited drops prevent the brand from being perceived as a mass-market fast-fashion entity.

- Sustainability: Sourcing environmentally friendly materials and maintaining transparency regarding ethical production.

Gully Labs Future Vision

- Gully Labs aims to be more than just a footwear company; it seeks to lead the Indian sneaker movement.

- The future roadmap includes expanding its digital footprint, launching new collections, and entering strategic partnerships to increase visibility.

- The brand intends to maintain its “gradual and sustainable growth” philosophy while bridging the gap between local Indian culture and global footwear trends.

Gully Labs Deal Finalized or Not

- Yes, a deal was finalized.

- After intense negotiations and multiple offers from Sharks Anupam Mittal, Kanika Tekriwal, Mohit Sadaani, and Kunal Bahl, the founders chose to partner with Aman Gupta.

- Final Deal: ₹1 Crore for 0.57% equity with Shark Aman Gupta.

- Final Valuation: ₹175 Crores.

| Category | Parameter | Details |

|---|---|---|

| Website & Tech | Website | Gully Labs |

| Tech Stack | Shopify | |

| SEO Performance | Excellent | |

| Monthly Organic Traffic | ~52,328 visitors | |

| Founders | Co-Founder | Arjun Singh |

| Background | Ex-JP Morgan (Sydney), Antler alumnus | |

| Startup Journey | Built m8buy & Slow Dating before spotting sneaker market gap | |

| Co-Founder | Animesh Mishra | |

| Background | Ex-Bain (USA), hardcore sneakerhead | |

| Brand Overview | Founded | August 2023 |

| Location | Delhi NCR | |

| Brand Type | Culture-led sneaker brand | |

| Market Position | Premium-Mass (₹3,000–₹8,000) | |

| Core Philosophy | “International Quality with Desi Soul” | |

| Product Overview | Category | Sneakers |

| Design Language | Minimal silhouettes, earthy tones | |

| Functional Features | Breathable fabrics, high grip soles, premium cushioning | |

| Manufacturing | Hand-lasted, ethical production | |

| Shark Tank India | Season | 05 |

| Episode | 15 | |

| Air Date | Friday, 23 January 2026 | |

| Original Ask | ₹1 Crore for 0.5% equity | |

| Valuation Asked | ₹200 Crores | |

| Business Performance | Revenue Growth | ₹20 Lakhs (FY23-24) → ₹9 Cr YTD |

| Monthly Revenue | ₹1.85 Crores (Nov 2025) | |

| VC Backing (Pre-Shark) | Saama Capital, Atrium Ventures | |

| Investor Reactions | Shark Sentiment | Extremely positive |

| Key Strengths | Scaling speed, founder-market fit | |

| Offer Scenario | Rare “All-Sharks Interested” moment | |

| Deal Outcome | Deal Status | ✅ Deal Closed |

| Final Investor | Aman Gupta | |

| Final Deal | ₹1 Crore for 0.57% equity | |

| Final Valuation | ₹175 Crores | |

| Customer Philosophy | Business Model | D2C |

| Engagement Style | Culture & lifestyle over hard selling | |

| Community Focus | Sustainability stories & BTS content | |

| Emotional Hook | Indian street culture pride | |

| Product Highlights | Cultural Inspiration | Indian streets, local stories |

| Drop Strategy | Limited editions | |

| Sustainability | Ethical sourcing & transparency | |

| Market Opportunity | Indian Sneaker Market | $3.98B (2025) |

| Projected Size | $6.53B by 2034 | |

| CAGR | ~5.65% | |

| Key White Space | Mass-Premium sneakers | |

| TAM Breakdown | TAM (Footwear – Premium) | $18.26B by 2029 |

| SAM (Sneakers) | ₹32,000 Cr | |

| SOM | ₹1,500–₹2,000 Cr | |

| Target Audience | Age Group | 18–35 years |

| Geography | Tier 1 & Tier 2 cities | |

| Core Users | Students, creatives, sneakerheads | |

| Psychographics | Sustainability-first, limited-drop lovers | |

| Marketing Strategy | Core Lever | Scarcity via drops |

| Storytelling | Vernacular & cultural narratives | |

| Brand Voice | Raw, street-inspired | |

| Digital Strategy | SEO | Strong Shopify SEO foundation |

| Social Commerce | Shoppable Reels & Shorts | |

| Founder Branding | LinkedIn thought leadership | |

| Distribution Strategy | Current Model | D2C |

| Expansion | Physical retail in 5+ cities | |

| Phygital Layer | AR try-ons & sneaker conventions | |

| Business Advantages | Founder-Market Fit | Deep sneaker + business insight |

| Design Control | 100% in-house | |

| Brand Moat | Cultural authenticity | |

| Challenges | High CAC | Offset via organic & community growth |

| Counterfeits | NFC / Blockchain authentication | |

| Supply Scaling | Invest in artisanal clusters | |

| Future Roadmap | Short Term | ₹60 Cr revenue, 10 stores |

| Mid Term | ₹100 Cr revenue + global markets | |

| Long Term | Full street-culture lifestyle brand | |

| Valuation Growth Plan | Brand-as-Movement | Higher brand multiple |

| Strategic Collabs | Artists & celebrities | |

| Exit Vision | ₹500 Cr+ valuation / IPO readiness |

Gully Labs Shark Tank India Business Plan

The Business Potential of Gully Labs in India

- Facts & Data: The Indian sneaker market is valued at $3.98 Billion in 2025 and is projected to reach $6.53 Billion by 2034, growing at a CAGR of 5.65%.

- White Space: While international giants (Nike, Adidas) dominate the >₹10,000 segment and unbranded players own the <₹1,500 segment, Gully Labs operates in the strategic ₹3,000–₹8,000 “Mass-Premium” whitespace, which is currently the fastest-growing pocket in Indian footwear.

- Market Opportunity: With India being the world’s second-largest footwear producer, Gully Labs leverages local manufacturing to provide “International Quality at Desi Soul” pricing.

Total Addressable Market (TAM) for Gully Labs

- TAM (Total Footwear): Projected to reach $18.26 Billion by 2029 (Premium Segment).

- SAM (Serviceable Addressable Market – Sneakers): Approximately ₹32,000 Crores ($3.9B) as of 2025.

- SOM (Serviceable Obtainable Market): Digital-first, urban sneakerheads seeking “Indiluxe” designs, estimated at ₹1,500–₹2,000 Crores.

Ideal Target Audience for Gully Labs

- Primary Segment: Gen Z and Millennials (Ages 18–35) who view sneakers as a form of self-expression rather than just utility.

- Demographics: Tier 1 and Tier 2 urban residents (NCR, Mumbai, Bengaluru), college students, creative professionals, and “sneakerheads.”

- Psychographics: Value “Authentic Indian Stories,” prioritize sustainability, and prefer “Limited Drops” over mass-produced fast fashion.

Gully Labs Marketing Strategy

- “Drops” Culture: Mimicking global giants, Gully Labs uses scarcity marketing with limited-edition releases (e.g., Onam or Phulkari themes) to drive immediate demand.

- Vernacular & Cultural Storytelling: Using Hindi and local dialects in communication to build a “Gully” (street) connection.

Gully Labs Content & Digital Strategy

- SEO Performance: Gully Labs already enjoys 52,328 monthly organic visitors through a high-performing Shopify-based SEO strategy.

- Video-First Commerce: Utilizing Shoppable Reels on Instagram and YouTube Shorts where influencers showcase the “unboxing experience” and “styling tips.”

- Community Engagement: Leveraging LinkedIn for “Founder-led branding” (Arjun and Animesh’s journey) to build trust among the investor and entrepreneur community.

Gully Labs Distribution Strategy

- Omnichannel Approach: Transitioning from a pure D2C website model to Physical Retail Presence in 5+ major cities to allow customers to experience “hand-lasted” quality.

- Phygital Experience: Using “Virtual Try-ons” (AR) on the website while expanding into premium lifestyle stores and “Sneaker Conventions.”

Gully Labs Advantages

- Authentic Founder-Market Fit: Founders Arjun (Corporate/Tech) and Animesh (Design/Strategy) bring a balanced “hustle and heart” approach.

- In-House Control: 100% in-house design ensures Gully Labs products cannot be easily replicated by mass-market competitors.

Gully Labs Challenges & Mitigation

| Challenge | Mitigation Strategy for Gully Labs |

| High CAC (Customer Acquisition Cost) | Focus on Organic SEO and community-led growth rather than heavy ad-spend. |

| Counterfeit Risk | Use NFC tags or Blockchain-based authenticity certificates in every shoe. |

| Supply Chain Scaling | Reinvest the ₹30 Crore Series A funds into scaling “hand-lasted” artisanal clusters. |

Gully Labs Future Business Roadmap

- Short Term (1 Year): Scale from the current ₹30 Cr annualized revenue to ₹60 Cr by expanding to 10 retail outlets.

- Mid Term (3 Years): Achieve ₹100 Cr revenue by FY 2026-27 through international expansion (US/UK) where “Indian Streetwear” is a growing niche.

- Long Term: Evolve into a complete Street-Culture Lifestyle Brand (Apparel, Accessories, and Community Spaces).

Roadmap to Increase Gully Labs Valuation

- Brand Equity Expansion: Transition from a “Product” to a “Movement,” increasing the valuation multiple from revenue-based to brand-equity based.

- Strategic Partnerships: Collaborating with Indian artists and global celebrities to create “Collectors’ Items.”

- IPO/Exit Readiness: Maintaining lean unit economics (high Contribution Margin per pair) to ensure profitability alongside growth, aiming for a ₹500 Cr+ valuation by the next funding round.

Gully Labs Shark Tank India Episode Review