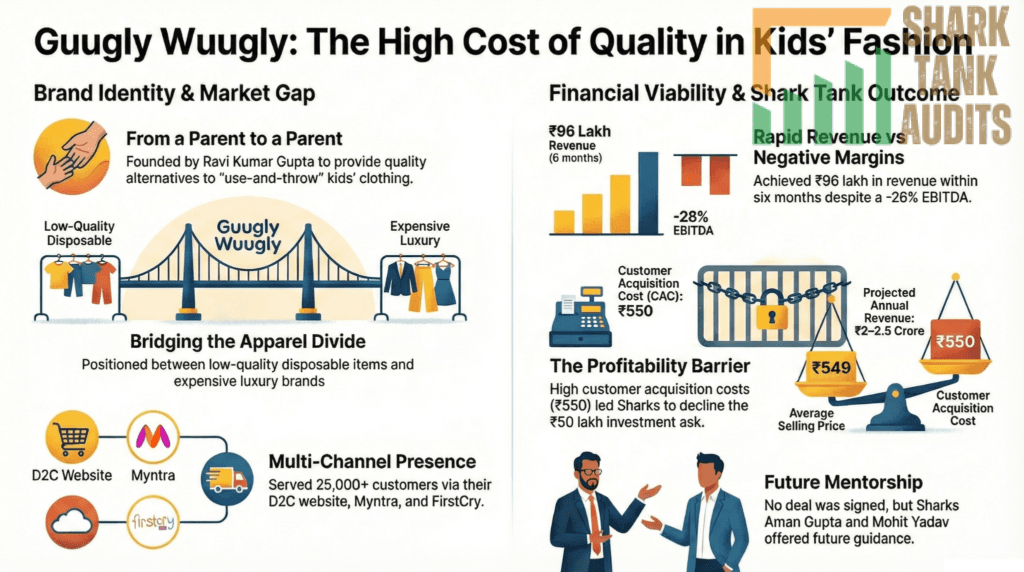

Guugly Wuugly Shark Tank India Episode Review

Guugly Wuugly appeared on Shark Tank India Season 5, Episode 1, with founder Ravi Kumar Gupta from Lucknow seeking ₹50 lakh for 5% equity, valuing the company at ₹10 crore. Despite an emotional pitch where he was accompanied by his 5-year-old daughter and shared his personal sacrifices of investing ₹80-90 lakh, selling family gold, and taking a loan against his home, the pitch ended with no deal finalized as all Sharks opted out due to concerns about profitability and sustainability.

Guugly Wuugly is a kids’ apparel brand launched in November 2022 that focuses on providing durable, affordable clothing for children aged 1-12 years. Positioned in the gap between low-quality “use-and-throw” items and expensive luxury brands, the company offers products at an average selling price of ₹549 and has served over 25,000 customers through its D2C website and presence on Myntra and FirstCry. Operating under the philosophy “From a parent to a parent,” founder Ravi Kumar Gupta—himself a father—built the brand to solve the common parental dilemma of choosing between quality and affordability. However, despite achieving ₹96 lakh in revenue in the first six months and projecting ₹2-2.5 crore for the year, the business faces challenges with a -28% EBITDA and a high customer acquisition cost of ₹550. While the Sharks were moved by Ravi’s dedication and humility, they cited lack of a unique selling proposition and financial viability as reasons for not investing, though Aman Gupta and Mohit Yadav offered mentorship and left the door open for future investment if the business shows a turnaround.

Guugly Wuugly Website Information

- Website:- Guugly Wuugly

- Build on Shopify

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 62 visitor per month.

Guugly Wuugly Founder

- Ravi Kumar Gupta, an entrepreneur hailing from Lucknow, is the driving force behind the brand.

- During his pitch, he was accompanied by his 5-year-old daughter.

- He impressed the panel of Sharks not only with his business effort but with his humility and the personal sacrifices he made to build the company, including investing Rs 80–90 lakh of his own money, selling family gold, and taking a loan against his home.

Guugly Wuugly Brand Overview

- Guugly Wuugly is a dedicated kids’ apparel brand launched in November 2022. The brand focuses on providing clothing solutions for children between the ages of 1 and 12.

- Since its inception, the company has served over 25,000 customers, primarily operating through its own D2C (direct-to-consumer) website, with additional presence on platforms like Myntra and FirstCry.

Guugly Wuugly Shark Tank India Appearance & Ask

Ravi appeared on the show seeking an investment of Rs 50 lakh for 5% equity, which placed the company’s valuation at Rs 10 crore. The panel of Sharks for this session included:

- Namita Thapar

- Anupam Mittal

- Aman Gupta

- Kunal Bahl

- Mohit Yadav

Guugly Wuugly Season and Episode Air Date

- Season: 05

- Episode: 01

- Episode Air Date: Monday, 05 January 2026

Guugly Wuugly Product Overview

The brand focuses on the gap in the children’s clothing market between low-quality “use-and-throw” items and overly expensive luxury brands.

- Average Selling Price (ASP): Rs 549.

- Average Order Value (AOV): Rs 1,100.

- The products are designed to be durable enough to withstand multiple washes while remaining affordable for parents whose children quickly outgrow their clothes.

Guugly Wuugly Investor Reactions

The Sharks had mixed but mostly cautious reactions:

- Namita Thapar: She expressed concern over the lack of a USP and foresaw increasing losses, leading her to exit the deal.

- Kunal Bahl: He advised the founder to cut costs immediately to extend the “runway” of the business and also opted out.

- Aman Gupta: While he found Ravi “sweet” and empathetic, he suggested that Ravi might be better off quitting the business to avoid further financial ruin.

- Mohit Yadav: He shared a personal story of a failed kids’ apparel brand he started before founding Minimalist. He warned Ravi about the emotional trap of fearing failure and suggested exploring other business avenues.

- Anupam Mittal: He praised Ravi’s passion but did not see the venture as a viable investment at its current stage.

Guugly Wuugly Customer Engagement Philosophy

- The brand operates under the tagline “From a parent to a parent.” This philosophy stems from Ravi’s personal experience as a father struggling to find high-quality, reasonably priced clothing for his daughter.

- The brand aims to build trust by solving the common parental dilemma of choosing between quality and price.

Guugly Wuugly Product Highlights

- Target Demographic: Children aged 1 to 12 years.

- Accessibility: Focused on middle-market pricing to ensure high-quality fabric is accessible to the average consumer.

- Sales Performance: Rapid growth in reach, serving 25,000+ customers in a relatively short timeframe since November 2022.

Guugly Wuugly Future Vision

Despite the current financial hurdles—including a -28% EBITDA and a high Customer Acquisition Cost (CAC) of Rs 550—the brand has seen significant revenue growth.

- Revenue Projection: Ravi estimated a revenue of Rs 2–2.5 crore for the current financial year, having already achieved Rs 96 lakh in the first six months.

- Mentorship: Although no formal deal was made, Aman Gupta and Mohit Yadav offered to guide Ravi in branding outside the show. They left the door open for potential future investment if the business shows signs of a turnaround.

Guugly Wuugly Deal Finalized or Not

- No deal was finalized. While the Sharks were moved by Ravi’s story and his dedication, they ultimately decided not to invest due to concerns regarding the business’s profitability, high customer acquisition costs, and lack of a unique selling proposition (USP).

| Parameter | Details |

|---|---|

| Website | Guugly Wuugly |

| Website Platform | Shopify |

| SEO Performance | Poor SEO performance; SEO improvement needed |

| Organic Traffic | 62 visitors per month |

| Founder | Ravi Kumar Gupta |

| Founder Origin | Lucknow, India |

| Pitch Companion | Appeared with his 5-year-old daughter |

| Founder Investment | Invested ₹80–90 lakh of personal funds |

| Personal Sacrifices | Sold family gold and took loan against home |

| Founder Impression | Known for humility, emotional resilience, and perseverance |

| Brand Launch Date | November 2022 |

| Brand Category | Kids’ apparel |

| Target Age Group | Children aged 1–12 years |

| Customer Base | 25,000+ customers |

| Primary Sales Channel | D2C website |

| Marketplace Presence | Myntra and FirstCry |

| Brand Positioning | Durable, affordable kidswear between low-cost and luxury segments |

| Shark Tank Ask Amount | ₹50 lakh |

| Equity Asked | 5% |

| Valuation Sought | ₹10 crore |

| Shark Panel | Namita Thapar, Anupam Mittal, Aman Gupta, Kunal Bahl, Mohit Yadav |

| Season | Season 05 |

| Episode | Episode 01 |

| Episode Air Date | Monday, 05 January 2026 |

| Market Gap Addressed | Between disposable low-quality and expensive luxury kidswear |

| Average Selling Price (ASP) | ₹549 |

| Average Order Value (AOV) | ₹1,100 |

| Product Durability | Designed to withstand multiple washes |

| Parent Value Proposition | Affordable clothing for fast-growing children |

| Namita Thapar Reaction | Concerned about lack of USP and future losses |

| Namita Thapar Decision | Opted out |

| Kunal Bahl Reaction | Advised immediate cost-cutting |

| Kunal Bahl Decision | Opted out |

| Aman Gupta Reaction | Empathetic but warned about financial risk |

| Aman Gupta Advice | Suggested quitting to avoid further losses |

| Mohit Yadav Reaction | Shared past failure in kidswear business |

| Mohit Yadav Advice | Encouraged emotional detachment and exploring alternatives |

| Anupam Mittal Reaction | Praised passion but found business unviable |

| Brand Philosophy | “From a parent to a parent” |

| Trust-Building Approach | Solving quality vs price dilemma for parents |

| Sales Growth | Rapid reach since 2022 |

| EBITDA Status | -28% |

| Customer Acquisition Cost (CAC) | ₹550 |

| Revenue Projection | ₹2–2.5 crore for current financial year |

| Revenue Achieved (6 months) | ₹96 lakh |

| Mentorship Offered | Aman Gupta and Mohit Yadav |

| Future Investment Possibility | Conditional on business turnaround |

| Deal Outcome | No deal finalized |

| Shark Decision Reason | Profitability concerns, high CAC, lack of USP |

| Kidswear Market Size (2024) | $24.56 billion |

| Market Projection (2030) | $29.35 billion |

| D2C Fashion Growth | 22% CAGR |

| Industry Shift | Unorganized to branded kidswear |

| TAM – Child Population | 350+ million children under 15 |

| TAM – Apparel Spend | ₹1.6 trillion |

| SAM – Urban Children | ~100 million |

| SAM Market Value | ₹40,000–₹50,000 crore |

| SOM Target Share | 0.5% |

| SOM Revenue Potential | ₹200–₹250 crore annually |

| Primary Buyer Persona | Parents aged 25–40 |

| Target Cities | Tier 1 & Tier 2 cities |

| Buyer Mindset | Value-conscious millennial parents |

| Buying Behavior | Research on Instagram, purchase on Shopify |

| Usage Need | Wash-and-wear durability |

| Social Media Influence | Camera-ready kidswear |

| SEO Strategy | Target long-tail kidswear keywords |

| Shopify Optimization | Improve metadata and product descriptions |

| Content Strategy | Founder-led storytelling |

| Video Series Idea | “Parent-to-Parent” stories |

| UGC Strategy | Incentivized reels from existing customers |

| Social Commerce Focus | Instagram Shop and WhatsApp marketing |

| Marketplace Expansion | Exclusive Brand Store on Myntra & FirstCry |

| Quick Commerce Strategy | Blinkit, Zepto, Swiggy Instamart |

| Quick Commerce Products | Essentials like tees and shorts |

| Offline Expansion | Mall kiosks in Lucknow and Delhi |

| Offline Store Size | 200–300 sq. ft. |

| Product Strength | High durability fabric |

| Product Weakness | Lack of strong visual design USP |

| Pricing Advantage | Mid-market sweet spot |

| Financial Challenge | CAC higher than per-unit profit |

| Founder Strength | High emotional intelligence |

| Founder Risk | Heavy personal debt exposure |

| Brand Trust Strength | Authentic parent-led story |

| Brand Recall Challenge | Low vs established brands |

| Core Success Factor | Founder resilience |

| Market Opportunity | Largest volume pricing segment |

| Financial Mitigation | Stop high-spend Meta ads |

| CAC Reduction Target | ₹150–₹200 |

| Operational Mitigation | Reduce SKU count |

| Inventory Focus | Top 20% best-selling designs |

| Debt Strategy | Angel funding and debt restructuring |

| Year 1 Focus | Profitability and lean operations |

| Year 1 Organic Target | 10,000+ visits/month |

| Year 1 Revenue Target | ₹2.5 crore |

| Year 2 Focus | Omnichannel expansion |

| Year 2 Product Expansion | Mommy & Me matching sets |

| Year 2 Revenue Target | ₹6 crore |

| Year 3 Focus | Brand moat creation |

| Physical Stores Goal | 5 experience centers |

| Product USP Goal | Proprietary fabric technology |

| Year 3 Revenue Target | ₹15+ crore |

| Year 3 EBITDA Target | 15% |

| Final Valuation Goal | ₹40–₹50 crore |

| Valuation Multiple | 3x–4x revenue |

Guugly Wuugly Shark Tank India Business Plan

Business Potential in the Indian Market

The Indian market presents a massive opportunity for a mid-premium brand like Guugly Wuugly.

- Sector Growth: The Indian kids’ apparel market was valued at $24.56 billion in 2024 and is projected to grow to $29.35 billion by 2030.

- D2C Explosion: While the overall apparel market grows at roughly 3–6%, the Direct-to-Consumer (D2C) fashion segment in India is growing at a CAGR of 22%, creating a high-velocity lane for Guugly Wuugly.

- Shift to Branded Wear: There is a rapid migration from the unorganized sector to organized brands, as parents increasingly prioritize fabric safety and durability over the lowest price point—a gap Guugly Wuugly is perfectly positioned to fill.

Total Addressable Market (TAM)

The scale of the opportunity for Guugly Wuugly is defined by India’s unique demographic dividend.

- Total Addressable Market (TAM): India has over 350 million children under the age of 15. The total apparel spend for this group exceeds ₹1.6 trillion.

- Serviceable Addressable Market (SAM): Guugly Wuugly targets the urban middle and upper-middle class. With ~100 million children in urban centers, this represents a ₹40,000–₹50,000 crore market.

- Serviceable Obtainable Market (SOM): By focusing on the 1–12 age group with a digital-first approach, Guugly Wuugly can realistically aim for a 0.5% market share, translating to a ₹200–₹250 crore annual revenue potential.

Ideal Target Audience & Demographics

The success of Guugly Wuugly depends on hyper-targeting the “Value-Conscious Millennial Parent.”

- Primary Demographic: Parents aged 25–40 residing in Tier 1 and Tier 2 cities (Delhi-NCR, Mumbai, Bangalore, Lucknow, etc.).

- Psychographics: Parents who find luxury brands (like Mothercare) too expensive and local unbranded clothes too poor in quality. They are “smart shoppers” who research on Instagram but buy on Shopify.

- User Persona: A working mother or father who needs “wash-and-wear” durability for their 5-year-old child’s daily play but wants the child to look “camera-ready” for social media.

Marketing & Digital Strategy

To fix the high ₹550 CAC and poor 62 monthly organic visits, Guugly Wuugly must pivot from paid-only to content-led growth.

- SEO Overhaul for Guugly Wuugly: * Target long-tail keywords like “Durable kids cotton wear India” or “Affordable luxury clothes for 5-year-olds.”

- Optimize Shopify metadata and product descriptions to rank for high-intent search terms.

- Content Strategy for Guugly Wuugly: * “Parent-to-Parent” Video Series: Founder Ravi can leverage his “humble entrepreneur” persona to share behind-the-scenes stories of sourcing skin-friendly fabrics.

- User-Generated Content (UGC): Incentivize the 25,000+ existing customers to post “Guugly Wuugly Kids” reels in exchange for loyalty points.

- Social Commerce: Shift focus to Instagram Shop and WhatsApp Marketing to nurture the existing database and reduce reliance on expensive Meta ads.

Distribution Strategy

Expanding the footprint of Guugly Wuugly beyond the website is essential for survival.

- Online Marketplace Dominance: While currently on Myntra and FirstCry, Guugly Wuugly needs an “Exclusive Brand Store” (EBS) presence on these platforms to improve visibility.

- Quick Commerce Integration: Partner with Blinkit, Zepto, and Swiggy Instamart for “Essentials” (basic tees and shorts) to cater to the 15-minute delivery demand of urban parents.

- Offline “Experience Centers”: Launch small-format (200-300 sq. ft.) kiosks in high-traffic malls in Lucknow and Delhi to build trust through “touch and feel” before the customer moves to online repeat buying.

Brand Advantages & Challenges

| Feature | Guugly Wuugly Advantages | Guugly Wuugly Challenges |

| Product | High durability; fabric retains shape after multiple washes. | Lack of a strong, visual “Design USP” or “Hook.” |

| Pricing | Mid-market sweet spot (ASP ₹549). | High CAC (₹550) is currently higher than the profit per unit. |

| Founder | High emotional intelligence and dedication. | Heavy financial debt and personal risk (mortgaged home). |

| Trust | “From a parent to a parent” brand story. | Low brand recall compared to giants like Hopscotch or Gini & Jony. |

Success Factors & Mitigation Strategies

Why Guugly Wuugly Can Succeed:

- Founder’s Resilience: Ravi Gupta’s “all-in” commitment ensures the brand won’t quit easily.

- Market Vacuum: The gap between ₹200 (local) and ₹1500 (premium) is the largest volume segment in India.

Mitigation Strategies for Guugly Wuugly:

- Financial Mitigation: Immediately stop high-spend Facebook ads. Shift to influencer “barter deals” to bring CAC down to ₹150–₹200.

- Operational Mitigation: Reduce SKU (Stock Keeping Unit) count. Focus on the top 20% of best-selling designs to free up working capital.

- Debt Management: Use the mentorship of Aman Gupta and Mohit Yadav to restructure business debt and find “Angel” funding rather than high-interest loans.

Future Roadmap & Valuation Growth

To reach the ₹10 crore valuation Ravi sought on Shark Tank, Guugly Wuugly must follow this 3-year plan:

- Year 1: Profitability Focus (The “Lean” Phase)

- Improve SEO to reach 10,000+ organic visits/month.

- Achieve EBITDA neutrality by reducing CAC.

- Target Revenue: ₹2.5 crore.

- Year 2: Scalability Focus (The “Omnichannel” Phase)

- Launch on Quick Commerce platforms.

- Expand product line to include “Mommy & Me” matching sets (higher margins).

- Target Revenue: ₹6 crore.

- Year 3: Brand Moat Focus (The “Valuation” Phase)

- Establish 5 physical experience centers.

- Build a proprietary fabric technology (e.g., “EverSoft Cotton”) to create a USP.

- Target Revenue: ₹15+ crore with 15% EBITDA.

- Result: A sustainable business valued at ₹40–₹50 crore based on a 3x-4x revenue multiple.

Guugly Wuugly Shark Tank India Episode Review