Multibagg AI Shark Tank India Episode Review

Multibagg AI appeared on Shark Tank India Season 5, Episode 13, with founder Aditya Anand from Munger, Bihar (Super 30 graduate under Anand Kumar, IIT Kanpur, American Express AI hackathon winner, ex-Goldman Sachs) seeking ₹50 lakh for 2% equity (₹25 Crore valuation) and successfully closed a deal for ₹50 lakh for 1% equity (₹50 Crore valuation, doubling his ask) with Shark Aman Gupta after a massive bidding war.

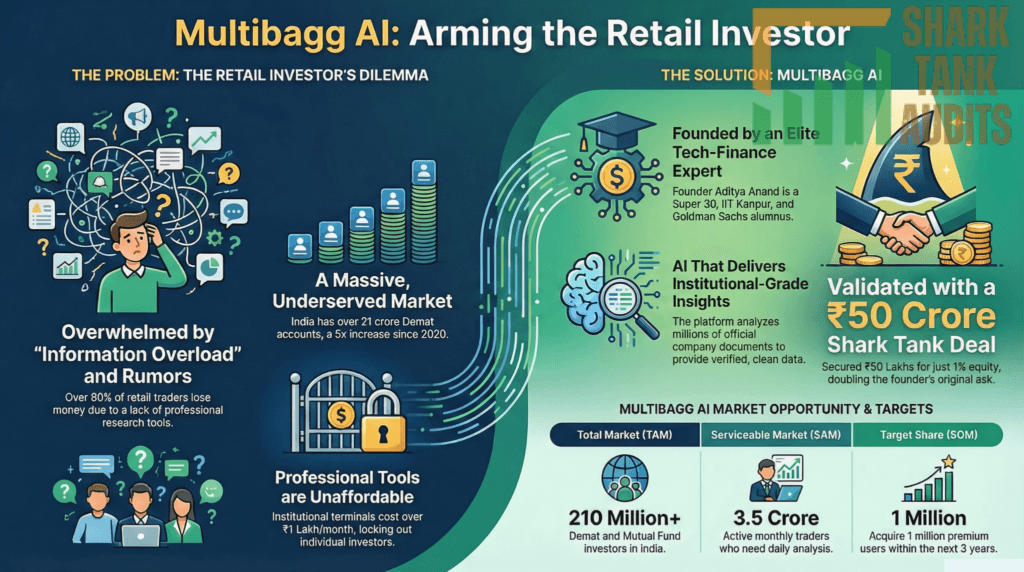

The Bengaluru-based AI-native stock market research platform launched in early 2024 uses machine learning to analyze millions of NSE/BSE documents, providing institutional-grade insights to retail investors through automated research and smart AI chatbot for verified company filing analysis, operated by just 3-person lean team with 318 premium paid users and 1,974 monthly organic visitors. Founder’s inspiring journey from family hardship (free education at mother’s school post-plague tragedy) to IIT Kanpur (topped district Class 12) to Goldman Sachs (resigned 2023) and prior funding rounds reaching ₹16.67 Crore valuation impressed Sharks who “clashed” over the opportunity. Operating in India’s booming investor market (21.28 crore Demat accounts up from 4 crore in 2020, retail holding 22-year high 18.75% of ₹84 lakh crore NSE market cap, Indian AI market at $22.85 billion with 38%+ CAGR to 2033), Multibagg targets 3.5 crore active monthly traders where 80% lose money from lack of research tools, aiming for 1 million premium users within 3 years toward ₹1,000 Crore valuation.

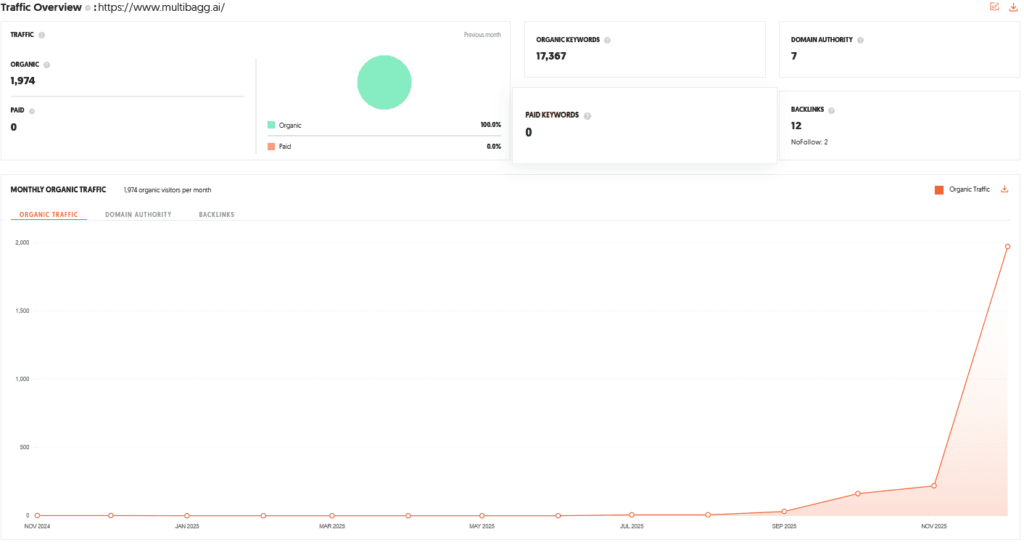

Multibagg AI Website Information

- Website:- Multibagg AI

- Build on JavaScript frameworks Next.js 14.2.35 React

- Average SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 1974 visitor per month.

Multibagg AI Founder

Aditya Anand, a native of Munger, Bihar, is the visionary behind Multibagg AI. His journey is one of academic excellence and resilience:

- Early Life: Following a family tragedy involving the plague around the time of Independence, his family faced severe financial hardship. He was educated for free at the school where his mother taught.

- Academic Success: He qualified for the prestigious Super 30 program under Anand Kumar, topped his district in Class 12, and secured admission to IIT Kanpur on his first attempt.

- Professional Background: A winner of a pan-India AI hackathon by American Express, he later worked at American Express and Goldman Sachs. He resigned from Goldman Sachs in 2023 to build his own startup.

Multibagg AI Brand Overview

- Multibagg AI is a Bengaluru-based, AI-native stock market research platform designed to bridge the gap between institutional and retail investors.

- Launched in early 2024, the platform utilizes advanced machine learning to analyze millions of documents from thousands of companies listed on the NSE and BSE.

- It simplifies complex financial data into clean, actionable insights, helping users cut through market “noise” and avoid making losses based on unverified rumors or tips.

Multibagg AI Shark Tank India Appearance & Ask

Aditya appeared on Shark Tank India 5 with a clear and confident pitch. He highlighted that his platform provides retail investors with the same caliber of research tools usually reserved for big institutions.

- Original Ask: ₹50 Lakhs for 2% equity.

- Original Valuation Seeked: ₹25 Crore.

Multibagg AI Season and Episode Air Date

- Season: 05

- Episode: 13

- Episode Air Date: Wednesday, 21 January 2026

Multibagg AI Product Overview

- Multibagg AI acts as an institutional-grade solution for the everyday investor. The platform automates the analysis of massive datasets, providing a “clean and crisp” view of company performance.

- A core feature is its smart AI chatbot, which allows users to ask specific analytical questions and receive answers grounded in verified company filings.

- The entire platform is managed by a lean team of just three people, as the backend is highly automated.

Multibagg AI Investor Reactions

- The Sharks were exceptionally impressed by Aditya’s technical pedigree, his humble beginnings, and the robustness of his business plan.

- The “Super 30” and IIT Kanpur background, combined with his experience at Goldman Sachs, gave the investors high confidence in his capability.

- The interest was so high that the judges “clashed” with one another, leading to a rapid decrease in the equity they were willing to take, eventually settling at half the equity the founder originally offered.

Multibagg AI Customer Engagement Philosophy

The brand focuses on empowering retail investors who suffer from “information overload” or a lack of time. Multibagg AI’s philosophy is built on four pillars of solving investor problems:

- Discovering new investment ideas.

- Conducting in-depth research on specific companies.

- Gaining a better understanding of one’s current portfolio.

- Tracking company developments efficiently.

Multibagg AI Product Highlights

- AI-Driven Research: Processes millions of NSE/BSE documents instantly.

- Chatbot Integration: Provides conversational analytics based on verified data.

- Efficiency: Claims to enable users to do “10 times better research” than traditional methods.

- Verified Data: Focuses on grounded company filings to eliminate market rumors.

- Subscription Model: Already boasts approximately 318 premium paid users.

Multibagg AI Future Vision

- Aditya aims to continue scaling Multibagg AI as the go-to platform for retail investors seeking professional-level insights.

- Having already raised institutional rounds at growing valuations (reaching ₹16.67 Crore in 2025 prior to the Shark Tank deal), the founder’s vision is to democratize high-end financial technology.

- He plans to use the Shark Tank investment to further enhance the AI’s capabilities and expand the user base, ensuring that “the little guy” in the stock market has the tools to succeed against institutional giants.

Multibagg AI Deal Finalized or Not

- Yes, the deal was finalized.

- The pitch sparked a massive bidding war among the Sharks.

- While several judges offered different combinations of equity and capital, Aditya eventually closed a deal with Aman Gupta for ₹50 Lakhs in exchange for 1% equity.

- This effectively doubled his requested valuation to ₹50 Crore.

| Category | Parameter | Details |

|---|---|---|

| Website & Tech | Website | Multibagg AI |

| Tech Stack | Next.js 14.2.35, React | |

| Framework | JavaScript | |

| SEO Performance | Average (Improvement Needed) | |

| Monthly Organic Traffic | 1,974 visitors | |

| Founder | Name | Aditya Anand |

| Origin | Munger, Bihar | |

| Early Life | Educated free at mother’s school due to family hardship | |

| Academic Background | Super 30 (Anand Kumar), IIT Kanpur | |

| Achievements | District Topper (Class 12), AMEX AI Hackathon Winner | |

| Professional Experience | American Express, Goldman Sachs | |

| Founder Decision | Quit Goldman Sachs in 2023 to build Multibagg AI | |

| Company Overview | Location | Bengaluru, India |

| Industry | Fintech / AI Stock Market Research | |

| Launch Year | 2024 | |

| Core Mission | Democratize institutional-grade research for retail investors | |

| Problem Solved | Information overload & rumor-based investing | |

| Shark Tank India | Season | 05 |

| Episode | 13 | |

| Air Date | Wednesday, 21 January 2026 | |

| Original Ask | ₹50 Lakhs for 2% equity | |

| Original Valuation | ₹25 Crore | |

| Final Deal | ₹50 Lakhs for 1% equity | |

| Final Valuation | ₹50 Crore | |

| Shark Partner | Aman Gupta | |

| Product Overview | Core Product | AI-native stock research platform |

| Key Feature | AI chatbot for filing-based analysis | |

| Data Source | NSE & BSE company filings | |

| Team Size | 3 members | |

| Automation Level | Highly automated backend | |

| Product Highlights | AI Research | Processes millions of documents instantly |

| Conversational AI | Ask analytical questions via chatbot | |

| Research Efficiency | Claims 10× faster research | |

| Data Reliability | Filing-backed, rumor-free insights | |

| Paid Subscribers | ~318 premium users | |

| Customer Philosophy | Target Problem | Time shortage & data overload |

| Core Use Cases | Discovery, research, portfolio analysis, tracking | |

| Ideal User | Retail investor seeking institutional tools | |

| Financial & Growth | Previous Funding | Institutional rounds at ₹16.67 Cr valuation (2025) |

| Revenue Model | Subscription-based | |

| Pricing Strategy | Affordable vs Bloomberg terminals | |

| Operating Model | Lean, AI-first | |

| Investor Reactions | Founder Pedigree | Highly appreciated (Super 30 + IIT Kanpur) |

| Emotional Connect | Humble background impressed Sharks | |

| Competition Among Sharks | High – bidding war | |

| Equity Reduction | Sharks settled for half original equity | |

| Market Opportunity | Demat Accounts | 21.28 crore (2026) |

| Retail Holding | 18.75% NSE market cap (~₹84 Lakh Cr) | |

| AI Market Size | $22.85B (2025), 38%+ CAGR | |

| Investor Loss Problem | 80% retail traders lose money | |

| TAM / SAM / SOM | TAM | 210M+ Demat holders + MF investors |

| SAM | 3.5 Cr active monthly traders | |

| SOM Target | 1M premium users | |

| Valuation Goal | ₹1,000 Crore | |

| Target Audience | New-Gen Investors | Age 22–35, finfluencer-driven |

| HNI Retail Investors | Portfolio >₹10 Lakhs | |

| Geography | Tier 1 & Tier 2 cities | |

| Aspirational Segment | Tier 3 talent (e.g., Munger) | |

| Marketing Strategy | Content Theme | “Truth Behind the Noise” |

| Founder Branding | Super 30 → Goldman Sachs story | |

| SEO Plan | AI stock research, NSE analyzer keywords | |

| Paid Marketing | YouTube & Instagram ads (market hours) | |

| Distribution Strategy | Growth Model | Freemium → Premium |

| Broker Integrations | Zerodha, Groww, Angel One (API vision) | |

| Operational Efficiency | AI builds AI | |

| Advantages | Key Strengths | Speed, cost efficiency, automation |

| Challenges | Key Risks | AI hallucination, SEBI regulations |

| Risk Mitigation | Accuracy Control | Source-linked answers to filings |

| Compliance | SEBI Research Analyst registration | |

| Future Roadmap | Phase 1 (2026) | SEO scale: 2k → 100k monthly traffic |

| Phase 2 (2027) | Portfolio Health AI launch | |

| Monetization Goal | 50k users × ₹499/month | |

| ARR Potential | ~₹30 Crore | |

| Valuation Potential | ₹300 Crore+ | |

| Final Outcome | Deal Status | ✅ Deal Closed |

| Shark Confidence | Very High | |

| Brand Positioning | “Institutional tools for the little guy” |

Multibagg AI Shark Tank India Business Plan

1. Multibagg AI: Executive Business Summary

- Brand Mission: To democratize “Institutional-Grade” financial research for 120 million+ retail investors using AI-native automation.

- Core Problem Solved: Eliminates “Information Overload” and “Rumor-based Investing” by providing verified, document-backed data insights.

- Key Fact: Multibagg AI was founded by Aditya Anand (IIT Kanpur/Goldman Sachs) and achieved a ₹50 Crore valuation on Shark Tank India.

2. Multibagg AI: Business Potential in India (Stats & Facts)

- Equity Cult Expansion: As of early 2026, India has over 21.28 Crore Demat accounts, a massive jump from just 4 Crore in 2020.

- Retail Market Share: Retail investors now hold a 22-year high of 18.75% of the NSE market capitalization, valued at approximately ₹84 Lakh Crore.

- AI Sector Growth: The Indian AI market is clocking $22.85 Billion in revenue (2025) with a projected CAGR of 38%+ until 2033.

- Financial Literacy Gap: While millions are entering the market, over 80% of retail traders lose money due to a lack of research tools—the primary opportunity for Multibagg AI.

3. Multibagg AI: Total Addressable Market (TAM)

- TAM (Total Market): All 210 million+ Demat account holders and the broader ₹80 Lakh Crore Mutual Fund investor base in India.

- SAM (Serviceable Market): The 3.5 Crore active monthly traders (as per NSE 2025 data) who require daily data analysis.

- SOM (Target Share): Capturing 1 million premium users within 3 years, aiming for a ₹1,000 Crore valuation.

4. Multibagg AI: Ideal Target Audience & Demographics

- The “New-Gen” Investor: Age 22–35, tech-savvy, likely influenced by “Finfluencers” but seeking professional tools to validate tips.

- The High-Net-Worth Retailer: Individuals with portfolios >₹10 Lakhs who currently lack access to expensive Bloomberg/Reuters terminals.

- Geography: Primarily Tier 1 and Tier 2 cities (Bengaluru, Mumbai, Pune, Ahmedabad), with a growing segment of “Super 30” style aspirants from Tier 3 towns like Munger.

5. Multibagg AI: Marketing & Digital Strategy

- Content Strategy:

- “Truth Behind the Noise”: Daily short-form videos debunking trending market rumors using Multibagg AI data.

- Founder-Led Branding: Leveraging Aditya Anand’s “Super 30 to Goldman Sachs” journey to build trust and authority.

- Digital Marketing Strategy:

- SEO Overhaul: Optimize the Multibagg AI website for high-intent keywords like “AI stock research,” “NSE document analyzer,” and “multibagger stock screeners.”

- Performance Marketing: Targeted YouTube and Instagram ads during market hours (9:15 AM – 3:30 PM).

6. Multibagg AI: Distribution & Operations Strategy

- Product-Led Growth: A “Freemium” model where basic stock data is free, but deep AI-filing analysis requires a premium subscription.

- B2B Partnerships: Integrating Multibagg AI APIs with popular discount brokers (Zerodha, Groww, Angel One) as an “add-on” research tool.

- Lean Operations: Maintaining the 3-person core team (as mentioned in the pitch) by using “AI to build AI,” keeping burn rates ultra-low.

7. Multibagg AI: Advantages & Challenges

- Advantages:

- Low Cost: Institutional tools cost ₹1 Lakh+/month; Multibagg AI offers similar insights for a fraction of the cost.

- Speed: Processes millions of filings in seconds—faster than any human analyst.

- Challenges:

- Data Accuracy: Generative AI “hallucinations” could lead to wrong financial advice.

- Regulation: SEBI’s strict guidelines on investment advice and “fin-tech” platforms.

8. Multibagg AI: Success Reasons & Mitigation

- Why it will Succeed: The massive influx of retail money into the Indian stock market is a permanent structural shift. Multibagg AI is the “pick and shovel” for this gold mine.

- Mitigation Strategies: * Implement “Source-Link” Transparency: Every AI answer must link directly to the specific page of an NSE/BSE filing to ensure 100% accuracy.

- Obtain SEBI RA (Research Analyst) registration to remain compliant with Indian laws.

9. Multibagg AI: Future Roadmap & Valuation Growth

- Phase 1 (2026): Scaled SEO and Organic Growth (Current Traffic: ~2,000/mo → Target: 100,000/mo).

- Phase 2 (2027): Launching “Portfolio Health AI” which proactively warns users about risks in their connected portfolios.

- Valuation Increase Plan: By hitting 50,000 premium users at a ₹499/month price point, Multibagg AI can achieve an Annual Recurring Revenue (ARR) of ~₹30 Crore, potentially pushing its valuation to ₹300 Crore+ (10x Revenue Multiple).

Multibagg AI Shark Tank India Episode Review