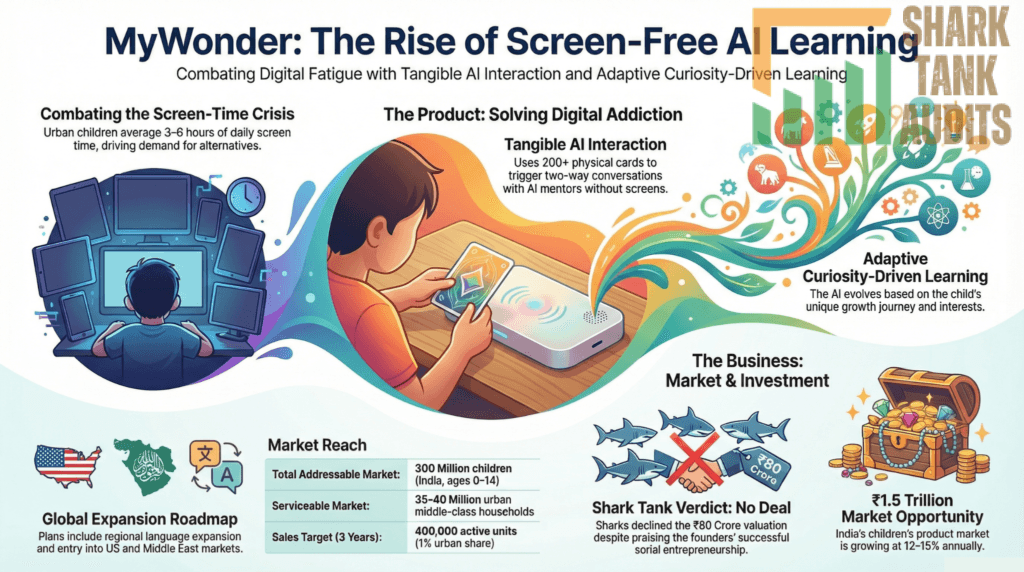

MyWonder Shark Tank India Episode Review

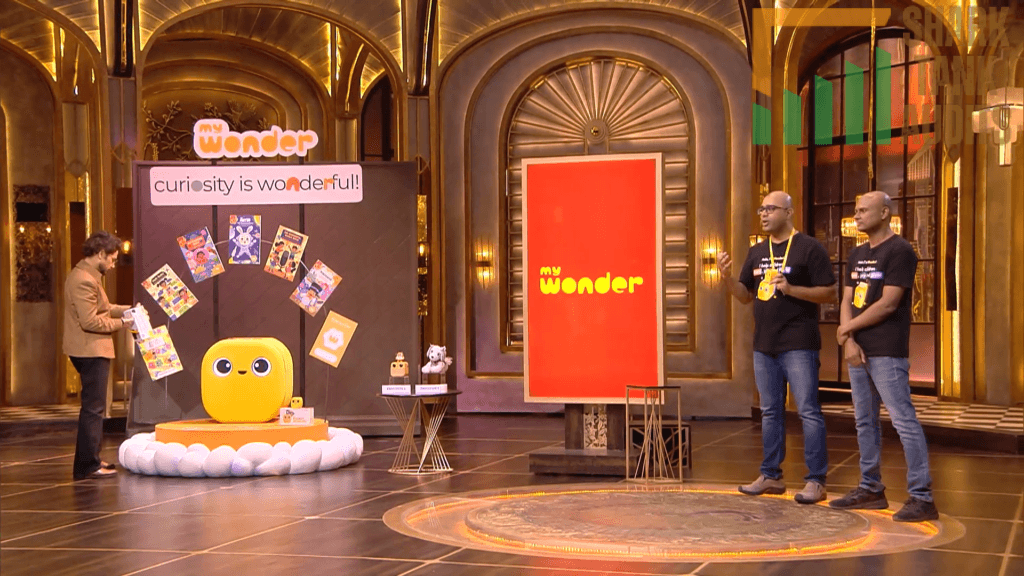

MyWonder appeared on Shark Tank India Season 5, Episode 27, with co-founders Chandramouli Kasinathan (engineer overseeing core technology/AI integration) and Venkata Srinivasa Murali Potluri (IIM Bangalore alumnus, serial entrepreneur who co-founded Sellerworx successfully acquired by Capillary Technologies in 2017) seeking ₹80 lakh for 1% equity (₹80 Crore valuation) but left with no deal despite Sharks appreciating vision and founder pedigree citing high valuation and competitive toy/ed-tech landscape.

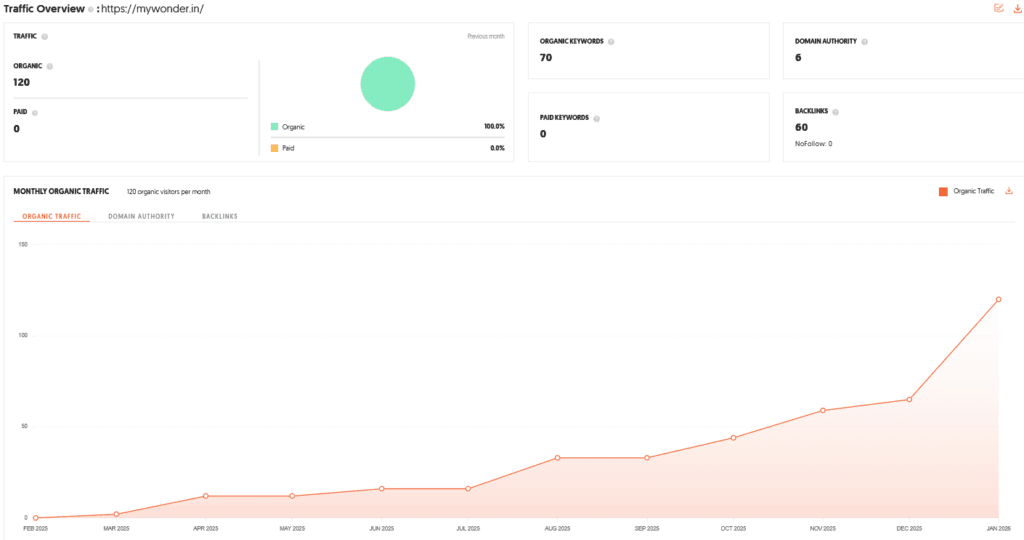

The screen-free conversational AI learning companion for children (ages 3-10) offers physical AI-powered device operating via Wi-Fi with 200+ interactive cards categorized by age (Companion Talk Cards for two-way conversations with AI mentors, Content Narration Cards for one-way storytelling/mythology/science) featuring sophisticated voice recognition, adaptive learning evolving with child’s curiosity, parental insights app, and curated global publisher content with 120 monthly organic visitors requiring SEO improvement. Sharks raised concerns over defensibility against giants (Amazon Alexa/Google Home), scalability of hardware-heavy model versus pure software, and whether children would use independently without parental intervention, while founders defended positioning as “Companion” for emotional/educational growth versus “Assistant” for task execution.

Operating in India’s ₹1.5 trillion children’s product market (12-15% annual growth) with toy market projected at $4.74 billion by 2034 amid digital addiction crisis (urban Indian children averaging 3-6 hours daily screen time per Economic Survey 2026), MyWonder targets 120 million urban children within 300 million Indian children (ages 0-14, highest globally) specifically focusing on 35-40 million middle/upper-middle-class urban households (3-10 years) among millennial/Gen X parents (28-45, ₹12 lakh+ annual household income) who are tech-savvy yet “screen-wary” seeking holistic development and Montessori-style cognitive growth over passive content consumption.

Website Information

- Website:- MyWonder

- Build on Shopify

- Poor SEO Performance, SEO Improvement needed.

- ORGANIC TRAFFIC: 120 visitors per month.

MyWonder Founders

The brand was co-founded by two highly experienced professionals, Chandramouli Kasinathan and Venkata Srinivasa Murali Potluri.

- Chandramouli Kasinathan: An engineer with a deep technical foundation, he oversees the core technology and AI integration of the product.

- Venkata Srinivasa Murali Potluri: An alumnus of the College of Engineering, Guindy, and IIM Bangalore. He is a serial entrepreneur who previously co-founded Sellerworx, which was successfully acquired by Capillary Technologies in 2017.

- Together, they bring a mix of technical expertise and business acumen to the venture.

MyWonder Brand Overview

- MyWonder is an innovative educational technology brand that specializes in creating screen-free, conversational AI learning companions for children.

- In an era where “digital fatigue” and “screen addiction” are major concerns for parents, MyWonder offers a refreshing alternative.

- The brand focuses on the “learn while you play” concept, transforming a child’s natural curiosity into a structured yet fun learning journey.

- By utilizing advanced voice recognition and artificial intelligence, MyWonder bridges the gap between passive content consumption and active, curiosity-driven exploration.

Shark Tank India Appearance & Ask – MyWonder

- MyWonder appeared in Season 5, Episode 27 of Shark Tank India, which aired on February 10, 2026.

- The founders delivered a compelling pitch, highlighting the “exhaustion” parents face when trying to answer a child’s endless “Why?” questions.

- The Ask: The founders requested ₹80 Lakhs for 1% Equity in the company.

- Valuation: This put the brand’s valuation at ₹80 Crores.

Season and Episode Air Date

- Season: 05

- Episode: 27

- Episode Air Date: Tuesday, 10 February, 2026

MyWonder Product Overview

- The core product of MyWonder is a physical, AI-powered device designed to act as a “24/7 intelligent friend” for kids.

- Unlike standard smart speakers, it is built specifically for pedagogy.

- Hardware: A child-friendly, durable device that operates via Wi-Fi.

- Interactive Cards: The device uses physical cards to trigger different modes:

- Companion (Talk) Cards: These enable two-way conversations where the AI acts as a mentor (e.g., a Science Mentor or English Teacher).

- Content (Narration) Cards: These offer one-way storytelling, mythology, and science facts.

- Customization: It features over 200+ cards categorized by age groups (3–5, 5–7, and 8–10 years).

MyWonder Investor Reactions

- The Sharks had mixed but constructive reactions.

- They were impressed by the Founders’ Background, noting that this was their second successful venture. However, they raised critical questions regarding:

- Defensibility: How the product stays relevant against giants like Amazon (Alexa) or Google Home.

- Scalability: Whether the hardware-heavy model could scale as quickly as pure software.

- Utility: Whether children would use it independently for long periods or if it required constant parental intervention. The founders defended the brand by stating that MyWonder is a “Companion,” not an “Assistant” like Alexa, focusing on emotional and educational growth rather than just executing tasks.

MyWonder Customer Engagement Philosophy

- MyWonder operates on a philosophy of Holistic Development. The brand believes that every child is unique and learns best when they receive personalized coaching.

- Confidence Building: By encouraging children to ask questions without judgment, it builds their speaking and listening skills.

- Safe Environment: It provides a “walled garden” of content, ensuring that children are not exposed to the inappropriate materials often found on open platforms like YouTube.

- Habit Formation: The device includes routines like “brushing timers” to help children develop healthy life skills naturally.

MyWonder Product Highlights

- Screen-Free Learning: Protects children’s eyesight and reduces dopamine-driven screen addiction.

- Conversational AI: Uses sophisticated voice recognition to understand and respond to a child’s unique way of speaking.

- Adaptive Learning: The AI evolves based on the child’s curiosity level and growing knowledge base.

- Parental Insights: A dedicated mobile app allows parents to track what their child is learning and identify areas of interest.

- High-Quality Content: Content is curated from global publishers to ensure top-tier storytelling and educational accuracy.

MyWonder Future Vision

- The long-term vision for MyWonder is to become a global leader in personalized AI education.

- The founders aim to democratize high-end “adaptive learning” (which is usually expensive or tech-heavy) into a simple, handheld device for every household.

- They envision a world where technology nurtures a child’s natural curiosity rather than replacing it, making the process of “being curious” a joyful and safe experience for children worldwide.

Deal Finalized or Not – MyWonder

- Despite the impressive technology and the clear problem-solving nature of the product, no deal was finalized on the show.

- While the Sharks appreciated the vision and the founders’ pedigree, the high valuation and the competitive landscape of the toy and ed-tech market led to a “No Deal” outcome.

| Parameter | Details |

|---|---|

| Website | MyWonder |

| Platform | Shopify |

| SEO Status | Poor SEO Performance, Improvement Needed |

| Organic Traffic | 120 visitors per month |

| Founders | Chandramouli Kasinathan & Venkata Srinivasa Murali Potluri |

| Founder 1 Expertise | AI integration & core technology |

| Founder 2 Background | CE Guindy Alumnus, IIM Bangalore |

| Founder Exit History | Co-founded Sellerworx (acquired by Capillary Technologies, 2017) |

| Brand Category | EdTech / AI Learning Companion |

| Core Concept | Screen-free conversational AI device for children |

| Brand Positioning | 24/7 Intelligent Learning Companion |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 27 |

| Episode Air Date | Tuesday, 10 February 2026 |

| Initial Ask | ₹80 Lakhs for 1% Equity |

| Initial Valuation | ₹80 Crores |

| Core Problem Solved | Screen addiction & parental fatigue answering “Why?” questions |

| Product Type | Physical AI-powered educational device |

| Hardware | Child-friendly Wi-Fi enabled device |

| Trigger Mechanism | Interactive Physical Cards |

| Card Types | Companion (Two-way) & Content (One-way narration) |

| Total Cards | 200+ categorized by age groups |

| Age Groups Targeted | 3–5, 5–7, 8–10 years |

| Key Differentiator | Companion (mentor) vs Assistant (like Alexa) |

| Learning Model | Curiosity-driven adaptive learning |

| Parental Control | Dedicated app with learning insights |

| Additional Features | Brushing timers & habit routines |

| Content Source | Curated from global publishers |

| Investor Concern 1 | Defensibility vs Alexa/Google |

| Investor Concern 2 | Hardware scalability challenges |

| Investor Concern 3 | Independent child engagement sustainability |

| Founder Defense | Emotional & educational growth focus |

| Deal Status | No Deal |

| Reason for No Deal | High valuation & competitive market |

| Market Opportunity | ₹1.5 Trillion Indian kids market |

| Market Growth Rate | 12–15% annually |

| Indian Toy Market Projection | $4.74 Billion by 2034 |

| Screen Time Concern | 3–6 hours daily average for urban children |

| TAM | 300 Million children (0–14 years) in India |

| SAM | 35–40 Million urban children (3–10 years) |

| SOM Target | 400,000 units (1% urban share in 3 years) |

| Target Parents | Urban Millennial & Gen X (28–45 years) |

| Income Profile | ₹12L+ annual household income |

| Psychographics | Screen-wary, Montessori-focused, holistic development |

| Marketing Priority | SEO for screen-free toy keywords |

| Content Strategy | “The Curious Parent” blog + YouTube Shorts |

| Influencer Strategy | Mom-fluencers & child psychologists |

| Paid Ads Strategy | Meta & Google ads targeting FirstCry/Lego audience |

| Distribution Channel 1 | D2C Shopify optimization |

| Distribution Channel 2 | Amazon & FirstCry |

| Distribution Channel 3 | Blinkit & Zepto (Quick commerce gifting) |

| Distribution Channel 4 | Preschools & Pediatric clinic partnerships |

| Advantage 1 | Founder pedigree & proven exit |

| Advantage 2 | Screen-free positioning |

| Advantage 3 | Recurring revenue via content cards |

| Advantage 4 | Adaptive conversational AI |

| Key Challenge 1 | High customer acquisition cost |

| Key Challenge 2 | Hardware manufacturing complexity |

| Key Challenge 3 | Big-tech competition risk |

| Defensibility Strategy | Build proprietary “Curiosity Graph” per child |

| Cost Mitigation Strategy | Hardware-as-a-Service model |

| Year 1 Goal | 10,000 units + 500+ content cards |

| Year 2 Goal | Regional language expansion |

| Year 3 Goal | US & Middle East expansion |

| Tier 2 Opportunity | 398M rural/semi-urban internet users |

| Recurring Revenue Focus | Subscription-based content cards |

| Valuation Target | ₹200 Crore+ via Series A |

| Growth Target | 3x YoY recurring revenue growth |

| Long-Term Vision | Global leader in personalized AI education |

MyWonder Shark Tank India Business Plan

1. Business Potential in India – MyWonder

- The “Kidconomy” Growth: India’s children’s product market is estimated at over ₹1.5 Trillion, growing at 12-15% annually.

- Digital Addiction Crisis: As per the Economic Survey 2026, digital addiction is a major public health concern. Urban Indian children spend an average of 3-6 hours daily on screens, creating a massive demand for screen-free solutions like MyWonder.

- The Rise of STEM & AI Toys: The Indian toy market is projected to reach $4.74 Billion by 2034. Parents are shifting from passive toys to AI-powered educational tools that foster cognitive development.

2. Total Addressable Market (TAM) – MyWonder

- TAM (Total Addressable Market): India has over 300 million children aged 0-14, the highest globally.

- SAM (Serviceable Addressable Market): Approximately 120 million children live in urban areas. The target segment for MyWonder (ages 3-10) in middle to upper-middle-class urban households is estimated at 35-40 million children.

- SOM (Serviceable Obtainable Market): Targeting a 1% market share of urban early elementary children (ages 3-10) within 3 years, aiming for 400,000 active units.

3. Ideal Target Audience & Demographics – MyWonder

- Primary Audience: Urban “Millennial” and “Gen X” parents (Aged 28-45) in Tier 1 and Tier 2 cities.

- Socio-Economic Profile: Annual household income of ₹12 Lakhs+ (Upper Middle Class).

- Psychographics: Tech-savvy yet “Screen-Wary” parents; focus on holistic development, Montessori-style learning, and cognitive growth.

- Child Demographic: Children aged 3 to 10 years who are transitioning from home to formal schooling.

4. Marketing & Digital Strategy – MyWonder

- SEO & Organic Growth (Immediate Need): Since MyWonder has only 120 organic visitors, the strategy involves targeting “long-tail” keywords like “Best screen-free toys for 5-year-olds” and “How to reduce child screen time.”

- Content Marketing: Create “The Curious Parent” blog series and YouTube shorts featuring MyWonder answering “Why” questions to showcase its conversational depth.

- Influencer Collaborations: Partner with “Mom-fluencers” and child psychologists to provide social proof and demonstrate MyWonder as a “safe companion.”

- Performance Marketing: High-intent Meta and Google Ads targeting parents interested in brands like FirstCry, Lego, and Montessori education.

5. Distribution Strategy – MyWonder

- D2C Excellence: Enhance the MyWonder Shopify store with faster loading times and “Subscription Boxes” for new Content Cards.

- E-commerce Marketplaces: Aggressive presence on Amazon and FirstCry (the leader in India’s ₹1.5T kid-market).

- Quick-Commerce Integration: Partner with Blinkit and Zepto for “instant gifting” and “emergency learning” needs.

- B2B2C Partnerships: Tie-ups with premium urban preschools and pediatric clinics to place MyWonder demo zones.

6. Advantages & Challenges – MyWonder

- Advantages: * Founder Pedigree: Proven exit (Sellerworx) and deep AI expertise.

- First-Mover Edge: Being a “Companion” (mentor) rather than an “Assistant” (utility) sets MyWonder apart from Alexa.

- High LTV: The Interactive Card model ensures recurring revenue beyond the initial hardware sale.

- Challenges:

- High CAC: Reaching urban parents in a crowded digital space is expensive.

- Hardware Scaling: Manufacturing and supply chain logistics are more complex than pure software.

- Competition: Tech giants could potentially introduce a “Kids Mode” for existing smart speakers.

7. Success Factors & Mitigation Strategies – MyWonder

- Why it can be Successful: MyWonder hits the “sweet spot” of parental guilt regarding screen time and the aspiration for AI-driven excellence.

- Mitigation Strategy (Defensibility): Build a proprietary “Curiosity Graph” for each child. If the AI knows the child’s specific growth journey, the parent is less likely to switch to a generic device.

- Mitigation Strategy (Cost): Shift to a “Hardware-as-a-Service” or low-cost entry model with high-margin monthly content card subscriptions to lower the initial barrier to entry.

8. Future Business Roadmap – MyWonder

- Year 1 (Stability): Fix SEO, reach 10,000 units in sales, and expand to 500+ Content Cards.

- Year 2 (Language Expansion): Introduce MyWonder in regional languages (Hindi, Tamil, Telugu) to capture the Tier 2 market (398 million rural/semi-urban internet users).

- Year 3 (Global Expansion): Export MyWonder to the US and Middle East markets, leveraging India’s low-cost manufacturing and high-quality AI talent.

- Valuation Strategy: Aim for a Series A funding round by demonstrating a 3x Year-on-Year growth in recurring card revenue, moving the brand toward a ₹200 Crore+ valuation.

MyWonder Shark Tank India Episode Review