PropFTX Shark Tank India Episode Review

PropFTX appeared on Shark Tank India Season 5, Episode 28, with founders Rajeev Kumar Chhabra (Founder & CEO, 40 years real estate experience) and Varun Singhi (Co-Founder, 20 years Tech/Web3 expertise) alongside co-founders Sathiyanarayanan Mahadevan and Vishal Singh Rajput seeking ₹1 Crore for 1.5% equity (₹66 Crore valuation) but left with no deal after all five Sharks declined citing critical “red flags.”

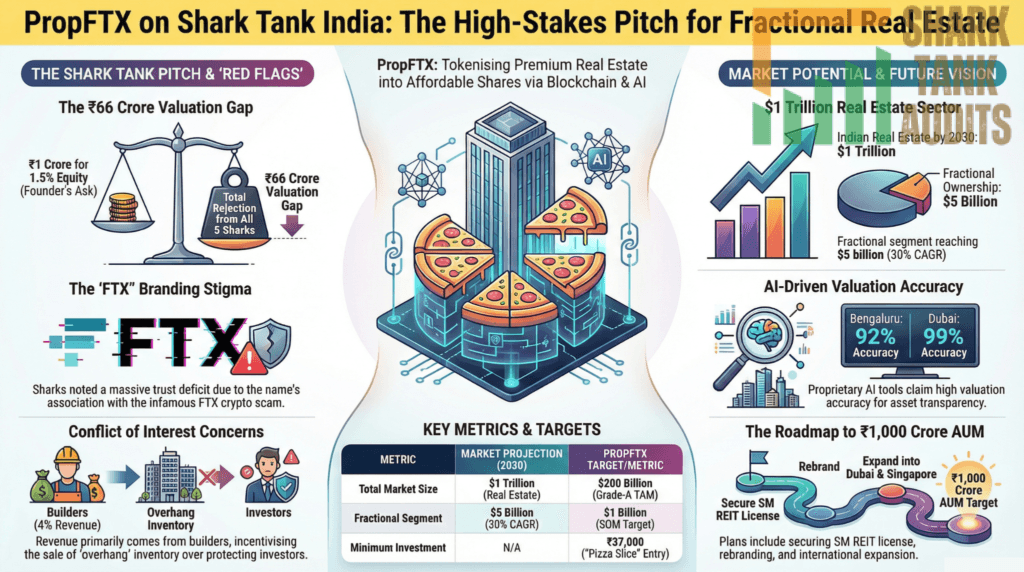

Established March 2024 as Propftx Ifsc International Private Limited, the digital marketplace for fractional real estate investment uses blockchain/AI to “tokenize” property allowing individuals to own legal shares (maximum 200 fractions per regulations) of high-value assets through SPV structure earning via builder onboarding/success fees (4%) and platform/interest fees from buyers (5.5%), with AI-powered tool claiming 92% valuation accuracy (Bangalore) and 99% (Dubai), having onboarded 5 builders listing ₹66 Crore properties across 5 cities with 0 organic visitors requiring SEO improvement. Sharks raised harsh concerns—Kunal heavily criticized “PropFTX” name association with infamous FTX crypto scam creating immediate trust deficit noting refusal to rebrand suggests lack of customer-orientation/safety focus, Anupam/Namita argued Indian investors not ready for complex alternative investments lacking liquidity/secondary market, Anupam pointed out conflict of interest where primary revenue from builders incentivizes selling “overhang” (rejected) inventory versus protecting investors, and Varun noted “playing around regulations” in space lacking clear legal frameworks.

Operating in Indian real estate sector projected at $1 trillion by 2030 (13% GDP contribution by 2025-2026) with fractional segment reaching $5 billion by 2030 (25-30% CAGR) amid SEBI’s SM REIT framework (2024-2025) formalizing pooled investments ₹50-500 crore and 10 million annual urban migrants driving demand, PropFTX targets millennial wealth builders (28-42, metro cities, ₹50,000+ monthly surplus), aspirational investors affording ₹50,000-₹5 lakh “pizza-slice” ownership versus ₹2 Crore flats, NRIs (US/UAE/UK seeking blockchain-verified Indian investment), and conservative diversifiers (50+ seeking 6-9% commercial rental yields beating FDs) within $200 billion Grade-A commercial/luxury residential TAM and $10 billion “overhang” inventory/mid-sized commercial assets ($5M-$50M), planning 1 million square feet onboarding, expansion into Dubai/Singapore, AR/VR property tours, ₹1,000 Crore AUM target, and SM REIT license aiming ₹500+ Crore valuation by 2028.

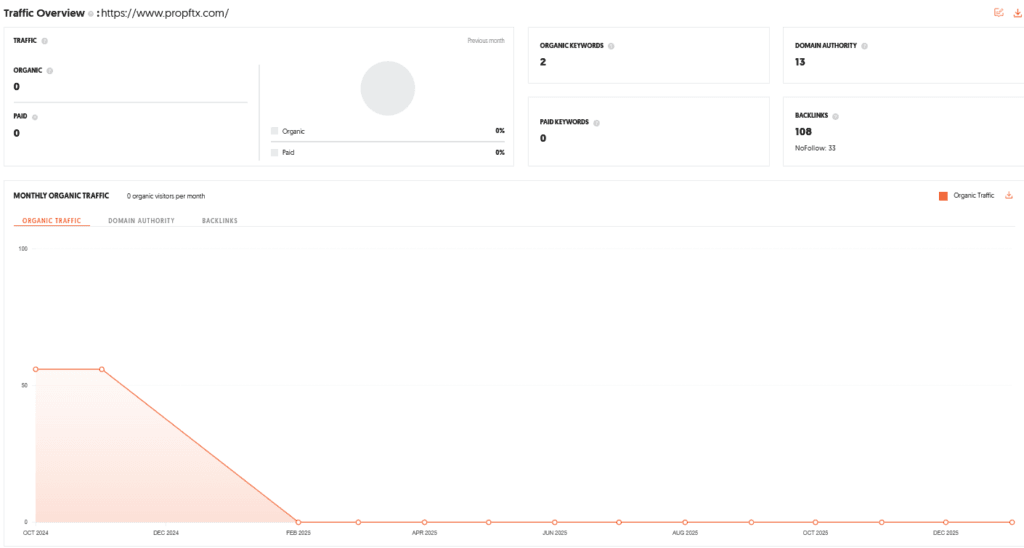

Website Information

- Website:- PropFTX

- Build on JavaScript frameworks Next.js 15.3.4, React

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 0 visitors per month.

The Founders of PropFTX

- PropFTX was founded by Rajeev Kumar Chhabra (Founder & CEO), a real estate veteran with 40 years of experience. He is supported by a specialized co-founding team:

- Varun Singhi: Co-Founder with 20 years of expertise in Tech and Web3.

- Sathiyanarayanan Mahadevan: Co-Founder.

- Vishal Singh Rajput: Co-Founder. The leadership bridges a 20-year age gap, combining traditional real estate wisdom with modern blockchain technology.

PropFTX Brand Overview

- Established in March 2024 as Propftx Ifsc International Private Limited, the company is a digital marketplace for fractional real estate investment.

- It utilizes blockchain and AI to “tokenize” property, allowing individuals to own a legal share of high-value assets that would otherwise be unaffordable.

- The brand positions itself as a way to democratize property ownership, using a “pizza slice” analogy to explain buying portions of a whole asset.

PropFTX Shark Tank India Appearance & Ask

Founders Rajeev Chhabra and Varun Singhi appeared on Season 5 of Shark Tank India.

- The Ask: ₹1 Crore for 1.5% equity.

- Valuation: ₹66 Crores.

- The Pitch: They presented a vision of turning premium real estate into “affordable slices” through an SPV (Special Purpose Vehicle) structure, aiming to make India’s favorite asset class accessible to the masses.

Season and Episode Air Date

- Season: 05

- Episode: 28

- Episode Air Date: Wednesday, 11 February, 2026

PropFTX Product Overview

The platform allows investors to buy fractional shares of premium properties (divided into a maximum of 200 fractions per regulations).

- Structure: Investors purchase tokens representing ownership, granting rights to rental income and capital appreciation.

- AI Integration: An AI-powered tool claims a valuation accuracy of 92% in Bangalore and 99% in Dubai.

- Security: Uses escrow accounts to hold funds until deals are fully verified.

- Revenue Model: The brand earns through onboarding and success fees from builders (4%) and platform/interest fees from buyers (approx. 5.5%).

PropFTX Investor Reactions

The Sharks raised several critical “red flags”:

- Trust & Branding: Kunal Bahl heavily criticized the name “PropFTX,” noting its association with the infamous FTX crypto scam, which creates an immediate trust deficit.

- Market Readiness: Anupam Mittal and Namita Thapar argued that Indian investors are not yet ready for such complex alternative investments, noting a lack of liquidity and a secondary market.

- Conflict of Interest: Anupam Mittal pointed out that the brand’s primary revenue comes from builders, suggesting they are incentivized to sell “overhang” (rejected) inventory rather than protect the investor.

- Regulatory Risks: Varun Alagh noted that the founders were “playing around regulations” in a space where clear legal frameworks have yet to evolve.

PropFTX Customer Engagement Philosophy

- The brand emphasizes a mission to simplify real estate, but the Sharks criticized their actual philosophy as builder-centric rather than customer-first.

- Kunal Bahl specifically noted that the refusal to change the name despite the negative “FTX” connotation suggested a lack of orientation toward the customer’s perspective and safety.

PropFTX Product Highlights

- Fractionalization: Lowering the entry barrier for luxury real estate.

- Tech-Driven: Use of Web3/Blockchain for transparency in ownership records.

- Market Reach: Already onboarded five builders and listed properties worth ₹66 Crores across five cities.

- High-Tech Valuation: Real-time market pricing through proprietary AI tools.

PropFTX Future Vision

Despite the rejection, Rajeev Chhabra remains optimistic, vowing to continue investing his personal funds “till eternity.” The brand’s roadmap includes:

- Onboarding one million square feet of diverse real estate projects.

- Scaling the platform to become the standard for co-ownership in India.

- Proving the skeptics wrong by establishing fractional ownership as a mainstream investment class within the next six months.

PropFTX Deal Finalized or Not

- No deal was finalized.

- All five Sharks—Anupam Mittal, Vineeta Singh, Namita Thapar, Varun Alagh, and Kunal Bahl—declined to invest, and the founders walked out empty-handed.

| Parameter | Details |

|---|---|

| Website | PropFTX |

| Website Technology | Next.js 15.3.4 & React |

| SEO Performance | Poor SEO Performance |

| Organic Traffic | 0 visitors per month |

| Founder & CEO | Rajeev Kumar Chhabra |

| Co-Founder | Varun Singhi |

| Co-Founder | Sathiyanarayanan Mahadevan |

| Co-Founder | Vishal Singh Rajput |

| Founder Experience | 40 years in real estate + 20 years Web3 expertise |

| Incorporated As | Propftx IFSC International Pvt Ltd (March 2024) |

| Brand Category | Fractional Real Estate / Web3 Marketplace |

| Core Concept | Tokenized fractional ownership of premium properties |

| Technology Stack | Blockchain + AI-powered valuation |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 28 |

| Episode Air Date | Wednesday, 11 February 2026 |

| Initial Ask | ₹1 Crore for 1.5% equity |

| Asked Valuation | ₹66 Crores |

| Pitch Theme | “Pizza-slice” model for democratizing real estate |

| Investment Structure | SPV-based ownership (max 200 fractions/property) |

| Revenue Model | 4% builder onboarding + 5.5% buyer platform fees |

| AI Claim | 92% accuracy (Bengaluru), 99% (Dubai) |

| Security | Escrow-based transaction model |

| Listed Assets | ₹66 Crores worth across 5 cities |

| Builder Partnerships | 5 builders onboarded |

| Shark Concern 1 | Brand trust issue (FTX association) |

| Shark Concern 2 | Market readiness & liquidity gaps |

| Shark Concern 3 | Builder-centric revenue conflict |

| Shark Concern 4 | Regulatory grey areas |

| Deal Status | No Deal |

| Sharks Declined | Anupam Mittal, Vineeta Singh, Namita Thapar, Varun Alagh, Kunal Bahl |

| Real Estate Market Projection | $1 Trillion by 2030 |

| Fractional Market Projection | $5 Billion by 2030 |

| SM REIT Framework | SEBI Small & Medium REIT (2024-25) |

| TAM | $200 Billion (Top 7 cities inventory) |

| SAM | $10 Billion (Tokenizable assets) |

| SOM | $1 Billion target capture |

| Minimum Investment | ₹37,000 |

| Target Audience 1 | Millennials (28–42) with ₹50K+ surplus |

| Target Audience 2 | NRIs (US, UAE, UK) |

| Target Audience 3 | Conservative yield-seeking investors |

| Expected Rental Yield | 6–9% (commercial properties) |

| Core Advantage 1 | Low entry barrier |

| Core Advantage 2 | AI-driven valuation engine |

| Core Advantage 3 | Escrow security |

| Major Challenge 1 | FTX branding stigma |

| Major Challenge 2 | Secondary market liquidity |

| Major Challenge 3 | Evolving SEBI regulations |

| Mitigation Strategy 1 | Immediate rebranding |

| Mitigation Strategy 2 | Founder co-investment in every asset |

| Mitigation Strategy 3 | In-app P2P resale marketplace |

| Phase 1 Goal | Secure SM REIT license + ₹5 Cr monthly volume |

| Phase 2 Goal | 50,000 investors + 10 cities |

| Phase 3 Goal | ₹1,000 Cr AUM |

| Valuation Target | ₹500+ Crores by 2028 |

| Strategic Vision | Transition from listing platform to regulated asset manager |

PropFTX Shark Tank India Business Plan

1. PropFTX Business Potential in India: Market Facts & Data

- Sector Growth: The Indian real estate sector is projected to reach a market size of $1 Trillion by 2030, contributing approximately 13% to the country’s GDP by 2025-2026.

- The Fractional Surge: Industry intelligence estimates that India’s fractional real estate segment will reach $5 Billion by 2030, growing at a CAGR of 25-30%.

- Regulatory Tailwind: The introduction of SEBI’s SM REIT (Small and Medium REIT) framework in 2024-2025 has formalized the sector, allowing for pooled investments between ₹50 crore to ₹500 crore, creating a massive legal playing field for PropFTX.

- Urbanization Fact: With 10 million people migrating to Indian cities annually, the demand for yield-generating commercial and premium residential assets is at an all-time high.

2. PropFTX Total Addressable Market (TAM): Detailed Breakdown

- Total Addressable Market (TAM): $200 Billion. This represents the total value of Grade-A commercial and luxury residential inventory in India’s top 7 cities (Mumbai, NCR, Bengaluru, etc.).

- Serviceable Available Market (SAM): $10 Billion. This focuses on the specific “overhang” inventory and mid-sized commercial assets ($5M – $50M range) suitable for tokenization.

- Serviceable Obtainable Market (SOM): $1 Billion. PropFTX aims to capture this through its goal of onboarding 1 million square feet of property and targeting the rising “Digital Native” investor class.

3. PropFTX Ideal Target Audience & Demographics

- The Millennial Wealth Builder: Age 28–42; Tech-savvy professionals in Metro cities with a monthly surplus of ₹50,000+.

- The “Aspirational” Investor: Middle-income individuals who cannot afford a ₹2 Crore flat but can invest ₹50,000–₹5 Lakh for “pizza-slice” ownership.

- Non-Resident Indians (NRIs): Demographics in the US, UAE, and UK seeking a simplified, blockchain-verified way to invest in Indian soil without physical management hassles.

- The Conservative Diversifier: Retirees or senior professionals (Age 50+) looking for rental yields (6-9% for commercial) that beat traditional FDs.

4. PropFTX Marketing & Digital Strategy

PropFTX Content Strategy

- Educational “Slice” Series: Short-form videos (Reels/YouTube Shorts) explaining SPVs, Tokenization, and Rental Yields using the “Pizza Analogy.”

- Transparency Logs: Behind-the-scenes “Property Inspection” videos using the PropFTX AI tool to show how 92-99% valuation accuracy is achieved.

- The “Pure Heart” Campaign: Leveraging Founder Rajeev Chhabra’s 40 years of experience to build a narrative of “Old World Trust meets New World Tech.”

PropFTX Digital Marketing Strategy

- SEO Overhaul: Pivot from 0 organic traffic by targeting high-intent keywords: “Fractional ownership India,” “Best REIT alternatives,” and “Invest in Bengaluru Real Estate with 1 Lakh.”

- LinkedIn Thought Leadership: Position the PropFTX founders as experts in Web3 and Real Estate through whitepapers on “Blockchain in Indian Land Titles.”

- Performance Marketing: Lead generation via Google Search Ads specifically targeting NRI-heavy regions and Indian fintech hubs.

5. PropFTX Distribution & Operational Strategy

- Direct-to-Consumer (D2C) Platform: A seamless JavaScript-based mobile/web app for instant token purchase and dashboard tracking.

- Channel Partner Program: Partnering with Wealth Management firms and Independent Financial Advisors (IFAs) to offer PropFTX as a diversification product to their clients.

- Institutional Tie-ups: Collaborating with Grade-A builders to offload their inventory as “exclusive fractional drops” on the PropFTX platform.

6. PropFTX Advantages & Challenges

PropFTX Advantages

- Experience Synergy: The unique 20-year age gap between founders combines institutional real estate knowledge with Web3 execution.

- Low Entry Barrier: Minimum investment as low as ₹37,000 makes PropFTX one of the most accessible platforms in India.

- Proprietary AI: High-precision valuation tools reduce the risk of overpaying for assets.

PropFTX Challenges

- Branding Crisis: The “FTX” name association remains a significant psychological barrier for investors.

- Liquidity Concerns: Secondary market trading for real estate tokens is still in its infancy in India.

- Regulatory Evolution: Constant shifts in SEBI’s SM REIT guidelines require high legal agility.

7. PropFTX Success Factors & Mitigation Strategies

- Success Factor – Trust:PropFTX must achieve “Skin in the Game.”

- Mitigation: Commit to the 0.01% – 1% “Founder’s Stake” in every listed property to align interests with investors.

- Success Factor – Branding: Overcoming the “FTX” fraud stigma.

- Mitigation: Immediate Rebranding. Transition to a name like “PropElite” or “BharatProp” to disconnect from the US crypto scam.

- Success Factor – Liquidity: Providing exit routes.

- Mitigation: Implement a “Buy-back Window” or a peer-to-peer (P2P) secondary marketplace within the PropFTX app.

8. PropFTX Future Business & Valuation Roadmap

- Phase 1 (0-6 Months): Secure SM REIT license from SEBI; complete rebranding; achieve ₹5 Crore in monthly transaction volume.

- Phase 2 (6-18 Months): Scale to 10 cities; integrate AR/VR property tours; reach 50,000 active investors.

- Phase 3 (18-36 Months): Expansion into Dubai and Singapore markets; Target AUM (Assets Under Management) of ₹1,000 Crore.

- Valuation Strategy: By moving from a “Listing Platform” to a “Regulated Asset Manager (SM REIT),” PropFTX can command a 10x-15x multiple on annual revenue, aiming for a ₹500 Crore+ valuation by 2028.

PropFTX Shark Tank India Episode Review