SaveSage Shark Tank India Episode Review

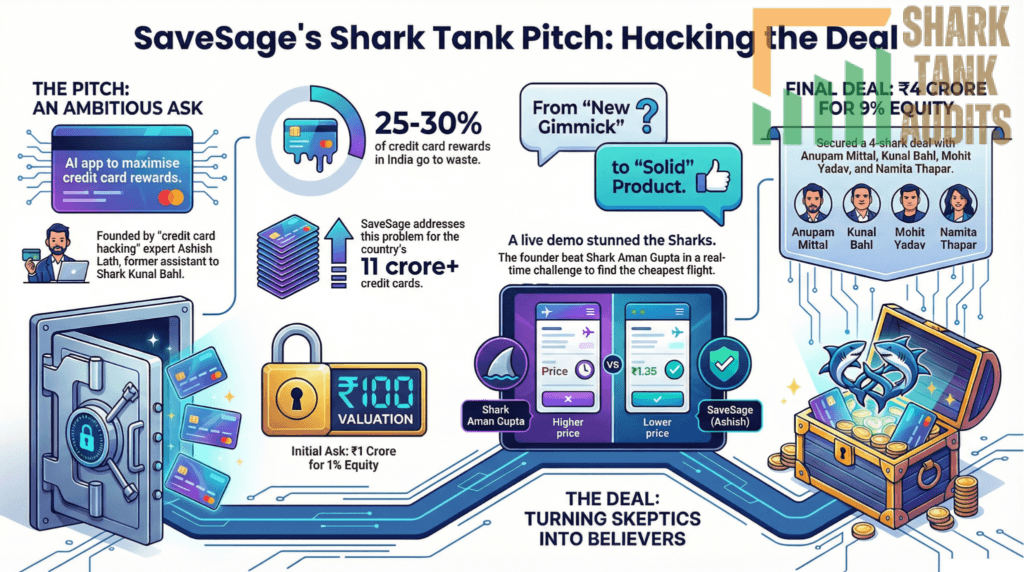

SaveSage appeared on Shark Tank India Season 5, Episode 3, with founder Ashish Lath seeking ₹1 Crore for 1% equity (₹100 Crore valuation). After intense negotiations and a dramatic pitch where he beat Aman Gupta in a live flight-price challenge, Ashish successfully closed a deal for ₹4 Crore for 9% equity (~₹44.4 Crore valuation) with Sharks Anupam Mittal, Kunal Bahl, Mohit Yadav, and Namita Thapar.

SaveSage is an AI-powered fintech app founded by Gurugram-based entrepreneur Ashish Lath (former Executive Assistant to Kunal Bahl) that optimizes credit card rewards for consumers. The platform provides personalized credit card recommendations, real-time reward point tracking, and optimization strategies to maximize value from every rupee spent—addressing the fact that 25-30% of reward points in India go unredeemed. Ashish demonstrated impressive personal results: a 23% return on all his credit card spends over two years, not paying for a flight in 10 years (350 domestic and 80 international flights), plus 100 hotel nights and ₹15 lakh in jewelry—all through reward optimization. Despite initial skepticism from the Sharks (Anupam called it a “Naya Totka”), the turning point came when Ashish outperformed Aman in finding the cheapest Dubai flight, proving the app’s value. Operating on a subscription model with three revenue streams and having raised ₹6.8 crore previously, SaveSage targets India’s 11 crore credit card users who hold an average of 1.5 cards each.

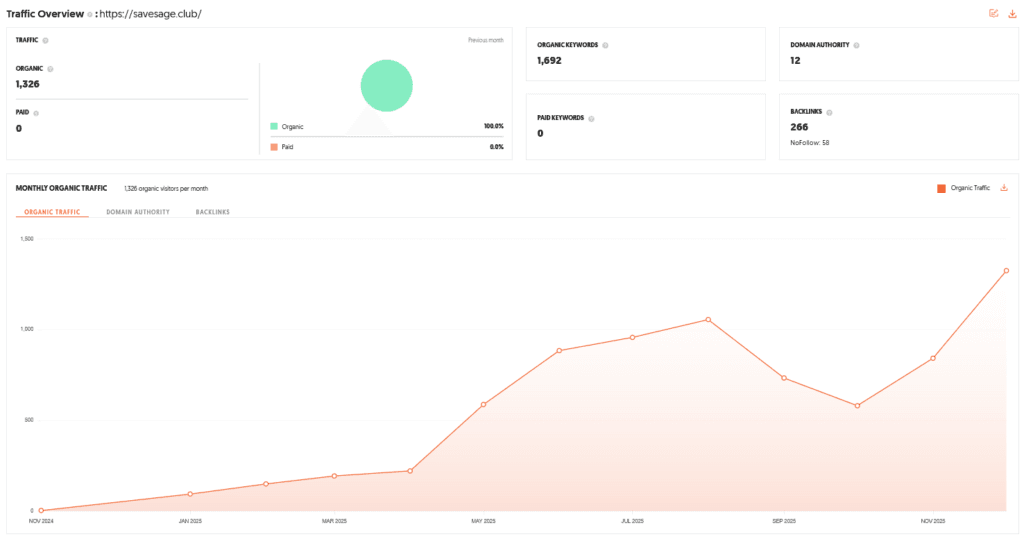

SaveSage Website Information

- Website:- SaveSage

- Build on JavaScript frameworks Next.js 14.2.3 React

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 1326 visitor per month.

SaveSage Founder

- The company was founded by Ashish Lath, an entrepreneur based in Gurugram.

- Interestingly, Ashish has a professional history with one of the Sharks, having previously served as the Executive Assistant to Kunal Bahl.

- His expertise in the field is backed by his personal success in credit card “hacking,” which he used as the foundation for his business.

SaveSage Brand Overview

- SaveSage is an AI-powered, app-based platform designed to help consumers navigate the complex world of credit card rewards.

- The brand serves as a financial optimization tool that identifies the most suitable credit cards based on an individual’s specific spending patterns.

- By tracking reward points in real-time, the platform suggests the best possible deals, ensuring users extract the maximum value from every rupee spent.

SaveSage Shark Tank India Appearance & Ask

Ashish appeared on Shark Tank India Season 4/5, pitching to a panel consisting of Kunal Bahl, Anupam Mittal, Namita Thapar, Mohit Yadav, and Aman Gupta.

- Initial Ask: Rs 1 Crore for 1% equity.

- Initial Valuation: Rs 100 Crore.

SaveSage Season and Episode Air Date

- Season: 05

- Episode: 03

- Episode Air Date: Wednesday, 07 January 2026

SaveSage Product Overview

SaveSage operates as a comprehensive credit card management ecosystem. Its primary functions include:

- Personalized Recommendations: Finding the best credit card tailored to a user’s lifestyle.

- Reward Tracking: Monitoring points across multiple cards to prevent expiration and ensure usage.

- Optimization Engine: Providing specific suggestions on how to redeem points for the highest possible return on investment (ROI).

SaveSage Investor Reactions

The pitch saw a dramatic shift in investor sentiment:

- Initial Skepticism: Anupam Mittal initially dismissed the idea as a “Naya Totka” (new gimmick).

- Turning Point: The Sharks were stunned when Ashish demonstrated how he outperformed Aman Gupta in a real-time challenge to find the cheapest flight to Dubai.

- Validation: Aman Gupta eventually called the product “solid,” and Namita Thapar praised the model as “great.”

- Dissenting Voice: Aman Gupta ultimately opted out, believing the information could be found for free via social media influencers (Instagram Reels).

SaveSage Customer Engagement Philosophy

- SaveSage is built on the philosophy of financial empowerment through data.

- The founder believes that since there are over 11 crore credit cards in India with an average of 1.5 cards per user, there is a massive gap in consumer knowledge.

- The brand aims to move users away from “blind spending” and toward a strategy where every transaction contributes to a lifestyle upgrade.

SaveSage Product Highlights

- Proven Results: The founder demonstrated a 23% return value on all his credit card spends over the last two years.

- Real-World Utility: Ashish shared that he has not paid for a flight in 10 years, totaling 350 domestic and 80 international flights, plus 100 hotel nights and Rs 15 lakh in jewelry.

- Strong Revenue Streams: The business features a subscription-based model with three distinct revenue channels.

- Market Traction: Prior to the show, the company had already raised Rs 6.8 crore across two funding rounds.

SaveSage Future Vision

- The future vision for SaveSage is to scale into a dominant fintech player that simplifies credit for the Indian masses.

- With a current burn rate of approximately Rs 30 lakh per month and significant capital in the bank, the founder intends to use the Shark’s investment to refine the AI algorithms and expand the user base.

- Despite a mixed post-episode reaction from some App Store reviewers, the brand aims to solidify its position as the go-to authority for credit card rewards in India.

SaveSage Deal Finalized or Not

- Yes, a deal was finalized. Although the Sharks initially questioned the high valuation, four of them saw the immense potential in the platform.

- After negotiations regarding the company’s previous valuation rounds, a deal was struck.

- Final Deal: Rs 4 Crore for 9% equity.

- Investment Partners: Anupam Mittal, Kunal Bahl, Mohit Yadav, and Namita Thapar.

| Parameter | Details |

|---|---|

| Website | SaveSage |

| Website Technology | Next.js 14.2.3, React |

| SEO Performance | Poor SEO performance, improvement needed |

| Organic Traffic | 1,326 visitors per month |

| Founder | Ashish Lath |

| Founder Location | Gurugram, India |

| Founder Background | Former Executive Assistant to Kunal Bahl |

| Domain Expertise | Credit card reward optimization |

| Founder Edge | Personal success in credit card “hacking” |

| Shark Tank Appearance | Season 4 / Season 5 |

| Shark Panel | Kunal Bahl, Anupam Mittal, Namita Thapar, Mohit Yadav, Aman Gupta |

| Initial Ask | ₹1 Crore for 1% equity |

| Initial Valuation | ₹100 Crore |

| Season | Season 05 |

| Episode | Episode 03 |

| Episode Air Date | Wednesday, 07 January 2026 |

| Product Category | Fintech / Credit Card Optimization |

| Platform Type | AI-powered mobile app |

| Core Product | Credit card management ecosystem |

| Primary Function | Maximize credit card reward value |

| Personalization | Lifestyle-based card recommendations |

| Reward Tracking | Real-time points tracking across cards |

| Optimization Engine | Suggests best redemption for highest ROI |

| Consumer Problem Solved | Unused or poorly redeemed reward points |

| Market Insight | 25–30% reward points go wasted in India |

| Founder Proof | 23% return on spends over 2 years |

| Founder Usage Stats | 350 domestic flights, 80 international flights |

| Additional Benefits | 100 hotel nights, ₹15 Lakh jewelry via rewards |

| Monetization Model | Subscription-based |

| Revenue Streams | 3 distinct revenue channels |

| Pre-Show Funding | ₹6.8 Crore raised (2 rounds) |

| Burn Rate | ~₹30 Lakh per month |

| Initial Shark Reaction | Skepticism (“Naya Totka”) |

| Turning Point | Real-time Dubai flight cost comparison |

| Competitive Demo | Beat Aman Gupta in live challenge |

| Aman Gupta Reaction | Called product “solid” but opted out |

| Namita Thapar Reaction | Praised business model |

| Anupam Mittal Reaction | Shifted from skeptical to bullish |

| Reason for Aman Exit | Info available via influencers |

| Customer Philosophy | Financial empowerment via data |

| Credit Card Stats India | 11 crore cards, 1.5 cards per user |

| Core Belief | Every spend should upgrade lifestyle |

| Deal Finalized | Yes |

| Final Deal Amount | ₹4 Crore |

| Final Equity Given | 9% |

| Final Valuation | ~₹44.4 Crore |

| Investing Sharks | Anupam Mittal, Kunal Bahl, Mohit Yadav, Namita Thapar |

| Industry Growth | Credit card market growing at 15%+ CAGR |

| Digital Payments Tailwind | UPI + BNPL accelerating card usage |

| Total Addressable Market (TAM) | ~11 crore credit card users |

| Serviceable Market (SAM) | 35–40 million urban multi-card users |

| Serviceable Obtainable Market (SOM) | 5 million reward-focused users |

| Target Cities | Bangalore, Mumbai, Delhi-NCR, Gurugram |

| Target Age Group | 25–45 years |

| Income Segment | ₹8 Lakh+ annually |

| User Psychographics | Travel-focused, reward hackers |

| SEO Opportunity | Credit card comparison & redemption content |

| SEO Growth Goal | 100k+ organic visits per month |

| Content Strategy | “23% Return Challenge” stories |

| Paid Acquisition | High-intent Google Search Ads |

| Influencer Strategy | Finance & travel creators |

| Primary Distribution | iOS & Android apps |

| B2B Strategy | Corporate HR benefits |

| Affiliate Expansion | Travel booking integrations |

| Competitive Advantage | Real-time AI optimization |

| Founder Credibility | Personal 10-year reward history |

| Network Advantage | Backed by Titan Capital ecosystem |

| Key Challenge | Trust & data security |

| Security Mitigation | Bank-grade encryption, ISO 27001 |

| App Review Issue | 1-star post-show reviews |

| UX Mitigation | Beta-fix + free premium month |

| Bank Devaluation Risk | Frequent reward policy changes |

| Tech Mitigation | Daily AI backend updates |

| Core Value Proposition | Turns spending into assets |

| Emotional Hook | Free luxury travel |

| Scalability Factor | High LTV subscription model |

| Year 1 Goal | 1M downloads + SEO fixes |

| Year 2 Expansion | Co-branded SaveSage credit card |

| Year 3 Expansion | UAE & Southeast Asia |

| Paid Subscriber Target | 500k |

| Subscription Price | ₹999/year |

| Long-Term Valuation Goal | ₹500 Crore+ |

SaveSage Shark Tank India Business Plan

1. SaveSage: Business Potential in India (Facts & Data)

- SaveSage Market Growth: The Indian credit card market is growing at a CAGR of over 15%. With 110 million (11 crore) active credit cards, the complexity of managing rewards is at an all-time high.

- SaveSage Opportunity: Research suggests that roughly 25-30% of reward points in India go unredeemed or are used for low-value items. SaveSage addresses this multi-crore wastage.

- SaveSage Digital Adoption: With India’s digital payment revolution (UPI), the shift toward credit cards for “Buy Now Pay Later” and “Reward Hacking” is peaking among Gen Z and Millennials.

2. SaveSage: Total Addressable Market (TAM) Analysis

- SaveSage TAM: Total credit card users in India (~11 Crore cards).

- SaveSage SAM (Serviceable Addressable Market): Urban “Credit-Healthy” individuals (CIBIL > 750) who hold 2 or more cards, estimated at 35-40 million users.

- SaveSage SOM (Serviceable Obtainable Market): Early adopters and “Reward Seekers” currently using apps like CRED or following “Finfluencers,” targeting 5 million users in the next 3 years.

3. SaveSage: Ideal Target Audience & Demographics

- SaveSage Primary Audience: Working professionals (Age 25–45) in Tier 1 cities (Bangalore, Mumbai, Delhi-NCR, Gurugram).

- SaveSage Demographic Profile: Annual income of Rs 8 Lakh+, high travel frequency, and active users of e-commerce platforms like Amazon/Flipkart.

- SaveSage User Intent: Users looking to “hack” the system to get free luxury travel, hotel stays, and high-value cashback.

4. SaveSage: Marketing, Content, & Digital Strategy

- SaveSage SEO Overhaul: Transition from the current 1,326 monthly visitors to 100k+ by optimizing Next.js metadata and creating a “Credit Card Comparison” blog engine.

- SaveSage Content Strategy: Launch “The 23% Return Challenge,” a series of video testimonials showing users how they saved lakhs, mirroring the founder’s 10-year travel history.

- SaveSage Digital Performance: High-intent Google Ads targeting keywords like “Best Credit Card for Travel” or “How to redeem HDFC/ICICI points.”

- SaveSage Influencer Tie-ups: Partner with travel and finance creators to showcase real-time “SaveSage App” flight bookings using points.

5. SaveSage: Distribution & Channel Strategy

- SaveSage Direct-to-Consumer (D2C): Primary distribution via the iOS and Android App Stores.

- SaveSage B2B Partnerships: Partnering with corporate HR portals to offer SaveSage Premium as an employee benefit for financial wellness.

- SaveSage Affiliate Integration: Collaborative API integrations with travel booking sites where SaveSage appears as a “Pay with Points” optimization plugin.

6. SaveSage: Competitive Advantages

- SaveSage AI Proprietary Engine: Unlike static blogs, SaveSage uses AI to calculate real-time ROI on spends based on evolving bank terms.

- SaveSage Founder Pedigree: Ashish Lath’s personal track record (430+ flights) provides the “Proof of Concept” that competitors lack.

- SaveSage Network Effect: Backed by Kunal Bahl (Titan Capital) and Anupam Mittal, providing unmatched access to the Indian startup ecosystem.

7. SaveSage: Challenges & Mitigation Strategies

- SaveSage Challenge – Trust & Security: Users are hesitant to link credit card data.

- Mitigation: SaveSage must implement bank-grade encryption and ISO 27001 certification.

- SaveSage Challenge – App Store Friction: Recent 1-star reviews.

- Mitigation: SaveSage must launch a “Beta-Fix” campaign, offering 1 month of free premium to users who provide constructive feedback for UI/UX improvements.

- SaveSage Challenge – Bank Policy Changes: Banks frequently devalue points.

- Mitigation: SaveSage AI must update its backend daily to ensure point-valuation accuracy.

8. SaveSage: Why It Can Be Successful

- SaveSage Value Proposition: It turns a “liability” (spending) into an “asset” (rewards), promising a 23% return which is higher than most mutual funds.

- SaveSage Emotional Hook: The dream of “Free Luxury Travel” is a powerful motivator for the Indian middle and upper-middle class.

- SaveSage Scalability: The subscription model ensures high LTV (Lifetime Value) with low marginal cost once the AI engine is built.

9. SaveSage: Future Business & Roadmap to Valuation Increase

- Phase 1 (Year 1): Focus on SaveSage Community growth; hit 1 million downloads; fix technical SEO and app glitches.

- Phase 2 (Year 2): Launch SaveSage Credit Card (Co-branded) that automatically optimizes rewards across the SaveSage ecosystem.

- Phase 3 (Year 3): Expand SaveSage into the UAE and Southeast Asia markets where credit card penetration and reward complexity are high.

- Valuation Target: By reaching 500k paid subscribers at an average of Rs 999/year, SaveSage can eye a valuation of Rs 500 Crore+ ($60M+) by the next Series A round.

SaveSage Shark Tank India Episode Review