Sepoy & Co Shark Tank India Episode Review

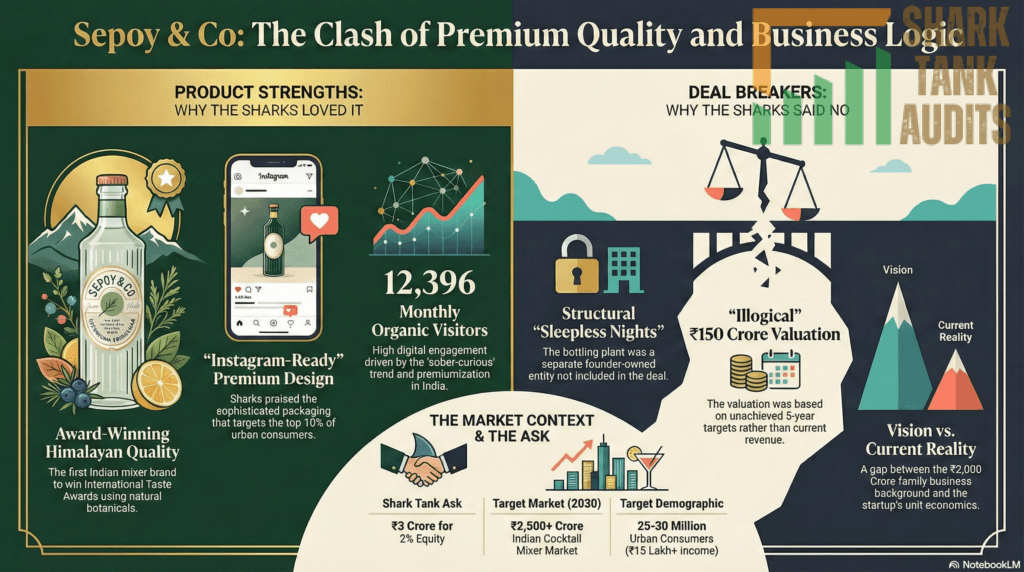

Sepoy & Co appeared on Shark Tank India Season 5, Episode 18, with founder Angad Soni (Delhi entrepreneur from family’s ₹2,000 Crore stock-listed tractor/construction machinery components business) seeking ₹3 Crore for 2% equity (₹150 Crore valuation) but left with no deal despite Sharks praising product quality.

The premium Indian mixer brand specializes in Sparkling Himalayan Mixers with natural botanicals, spring water, low sugar, and no artificial flavors, functioning as standalone mocktails or alcohol mixers (gin, vodka, rum), holding distinction as first Indian mixer company winning International Taste Awards with 12,396 monthly organic visitors. While all Sharks loved taste, premium packaging, and “Instagram-ready” bottle design, Anupam Mittal expressed “sleepless nights” concern over structural issue where bottling plant was separate founder-owned entity not included in deal, and both Anupam/Aman criticized ₹150 Crore valuation as “illogical thinking” when Angad projected ₹100-150 Crore revenue in 5 years, noting it’s illogical to value company today on unachieved future targets.

Operating in India cocktail mixers market projected to reach $304.5 million (₹2,500+ Crore) by 2030 (10.2% CAGR) within broader $11.7 billion carbonated soft drink market (2025) as Indian alcoholic beverage sector reaches ₹5,30,000 Crore by FY26, Sepoy targets top 5-10% urban population (25-30 million consumers, ages 24-45, ₹15 lakh+ household income) in Tier 1/2 cities seeking sophisticated non-alcoholic options amid “sober-curious” trend and premiumization shift from economy to premium spirits.

Sepoy & Co Website Information

- Website:- Sepoy & Co

- Build on Shopify

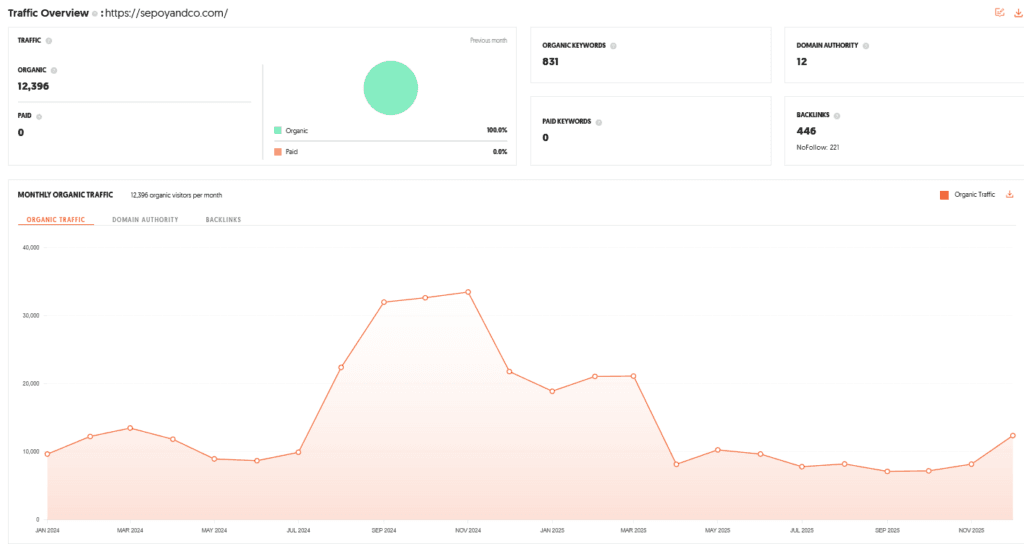

- Good SEO Performance

- ORGANIC TRAFFIC: 12396 visitor per month

Sepoy & Co Founder

- The company was founded by Angad Soni, a Delhi-based entrepreneur.

- Before venturing into the beverage industry, Angad worked in his family’s successful business, which manufactures components for tractors and construction machinery, a company currently valued at ₹2,000 crore on the stock exchange.

Sepoy & Co Brand Overview

- Sepoy & Co. is a premium Indian mixer brand that positions itself at the intersection of botanical ingredients and Himalayan purity.

- Unlike mass-market soft drinks, Sepoy focuses on sophisticated, low-sugar, and naturally flavored beverages.

- They hold the distinction of being the first Indian mixer company to win International Taste Awards, establishing a global benchmark for Indian-made mixers.

Sepoy & Co Shark Tank India Appearance & Ask

- Angad appeared on Shark Tank India Season 5 seeking an investment of ₹3 crore for 2% equity, which placed the company’s valuation at ₹150 crore.

Sepoy & Co Season and Episode Air Date

- Season: 05

- Episode: 18

- Episode Air Date: Wednesday, 28 January 2026

Sepoy & Co Product Overview

- Sepoy & Co. specializes in Sparkling Himalayan Mixers crafted with natural botanicals and spring water.

- The beverages are designed to be versatile; they can be consumed straight as refreshing sparkling drinks or used as mixers for spirits like gin, vodka, and rum.

- The brand avoids artificial flavors and excessive sweetness, focusing instead on balanced carbonation that is gentle on the throat.

Sepoy & Co Investor Reactions

The Sharks’ reactions were a mix of admiration for the product and frustration with the business terms:

- Product Praise: All Sharks, including Anupam Mittal and Aman Gupta, were highly impressed by the taste, premium packaging, and “Instagram-ready” bottle design.

- Structural Concerns: Anupam Mittal expressed significant concern (noting “sleepless nights”) because the bottling plant used by Sepoy was a separate entity owned by the founder, which was not part of the deal.

- Valuation Backlash: Anupam and Aman criticized the ₹150 crore valuation. When Angad stated he aimed to reach a ₹100–150 crore revenue in five years, Anupam pointed out it was illogical to value the company today based on a target it hadn’t yet achieved.

- Aman Gupta’s Critique: Aman labeled the business structure and the founder’s pitch as “illogical thinking,” despite liking the product itself.

Sepoy & Co Customer Engagement Philosophy

- The brand adopts a “mass-market premium” strategy, targeting the modern, health-conscious consumer.

- By creating visually appealing, “Instagram-ready” packaging, Sepoy & Co. engages younger audiences who view their choice of beverage as a lifestyle statement.

- Their philosophy centers on transparency, using clean labels with few ingredients to build credibility with discerning customers.

Sepoy & Co Product Highlights

- Natural Ingredients: Infused with organic botanicals and sourced with Himalayan water.

- Health-Conscious: Low sugar content and no artificial flavors.

- Award-Winning: Internationally recognized for superior taste.

- Versatility: Functions equally well as a standalone mocktail or a premium alcohol mixer.

- Aesthetic Packaging: Sleek, contemporary glass bottles suitable for high-end bars and home gatherings.

Sepoy & Co Future Vision

- Angad Soni envisions Sepoy & Co. becoming a ₹100–₹150 crore company within the next five years.

- The brand aims to dominate the Indian premium mixer market and expand its presence globally, sharing shelf space with the world’s finest mixers in international markets.

Sepoy & Co Deal Finalized or Not

- No deal was finalized.

- Despite the Sharks praising the quality of the product, the founder walked away empty-handed due to concerns regarding the business structure and what the Sharks deemed an “illogical” valuation.

| Parameter | Details |

|---|---|

| Website | Sepoy & Co |

| Website Platform | Shopify |

| SEO Performance | Good SEO performance |

| Organic Traffic | 12,396 visitors per month |

| Company Name | Sepoy & Co. |

| Brand Category | Premium Beverage / Cocktail Mixers |

| Headquarters | Delhi, India |

| Founder | Angad Soni |

| Founder Background | Formerly worked in family business manufacturing tractor & construction machinery components (₹2,000 Cr listed company) |

| Brand Positioning | Premium Indian botanical mixer brand |

| Core Philosophy | Natural, low-sugar, sophisticated mixers |

| Unique Identity | First Indian mixer brand to win International Taste Awards |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 18 |

| Episode Air Date | Wednesday, 28 January 2026 |

| Initial Ask | ₹3 Crore for 2% equity |

| Initial Valuation | ₹150 Crore |

| Product Category | Sparkling Himalayan Mixers |

| Water Source | Himalayan spring water |

| Key Ingredients | Natural botanicals, low sugar |

| Artificial Additives | No artificial flavors |

| Product Usage | Can be consumed standalone or as alcohol mixers |

| Target Spirits | Gin, Vodka, Rum |

| Taste Profile | Balanced carbonation, gentle on throat |

| Packaging Style | Premium, Instagram-ready glass bottles |

| Product USP | Combines aesthetics, health, and taste |

| Customer Strategy | Mass-market premium |

| Target Consumer | Health-conscious, urban lifestyle buyers |

| Lifestyle Angle | Beverage as a status & aesthetic statement |

| Shark Reaction (Overall) | Product praised, business model criticized |

| Anupam Mittal Reaction | Loved product, concerned about bottling structure |

| Key Concern Raised | Bottling plant owned separately by founder |

| Valuation Feedback | Sharks found valuation unjustified |

| Aman Gupta Reaction | Liked product, called valuation & logic “illogical” |

| Revenue Projection Statement | Founder projected ₹100–150 Cr revenue in 5 years |

| Shark Verdict | No deal |

| Deal Status | ❌ No deal finalized |

| Reason for No Deal | Business structure risk + high valuation |

| Indian Alcohol Market Size | ₹5,30,000 Crore by FY26 |

| Industry Trend | Rapid premiumization of mixers |

| Consumer Shift | From economy soda to premium mixers |

| Sober-Curious Trend | Growing demand for premium non-alcoholic drinks |

| Global Credibility | International Taste Awards recognition |

| TAM (Cocktail Mixers India) | USD 304.5 Million (~₹2,500+ Cr) by 2030 |

| Market CAGR | 10.2% |

| Carbonated Beverage Market | USD 11.7 Billion (2025) |

| Serviceable Market | Top 5–10% urban consumers (25–30M people) |

| Target Age Group | 24–45 years |

| Income Segment | ₹15 Lakhs+ annual household income |

| Core Persona | Home-mixologists & premium hosts |

| Secondary Persona | Health-conscious professionals |

| Competitive Benchmark | Fever-Tree (global equivalent) |

| Content Strategy | Aesthetic lifestyle & cocktail reels |

| Influencer Strategy | Mixologists, luxury creators, interior designers |

| SEO Opportunity | Gift sets & low-calorie mixer keywords |

| Transparency Marketing | Himalayan sourcing & clean labels |

| Distribution Model | Omnichannel |

| D2C Channel | Shopify website |

| Quick Commerce | Blinkit, Zepto |

| HORECA Focus | Premium bars, hotels & restaurants |

| Modern Trade | Nature’s Basket, Foodhall |

| Key Advantage | Pioneer in Indian botanical mixers |

| Taste Advantage | Award-winning international validation |

| Founder Advantage | Industrial scale & discipline |

| Key Challenge | High valuation gap |

| Logistics Challenge | Glass bottle breakage & shipping cost |

| Competitive Threat | Global & domestic premium mixer brands |

| Structural Risk Mitigation | SLA or merger of bottling entity |

| Valuation Justification Path | Focus on EBITDA & unit economics |

| Phase 1 Roadmap | ₹40–50 Cr revenue, quick-commerce dominance |

| Phase 2 Roadmap | Middle East & SE Asia expansion |

| Phase 3 Roadmap | ₹100–150 Cr revenue target |

| Long-Term Valuation Goal | ₹150–200 Crore with 15–20% EBITDA |

| Core Success Driver | Shift from quantity drinking to quality experiences |

Sepoy & Co Shark Tank India Business Plan

1. Sepoy & Co. Business Potential in India

- Rapid Premiumization: The Indian mixer market is no longer just about soda and tonic. With the Indian alcoholic beverage sector projected to reach ₹5,30,000 crore by FY26, there is a massive “value-creation” shift where consumers are upgrading from economy to premium spirits, necessitating premium mixers like Sepoy & Co.

- The “Sober-Curious” Trend: Sepoy & Co. is perfectly positioned to capture the rising demographic of urban Indians who seek sophisticated non-alcoholic options that look and taste like a cocktail without the alcohol.

- International Validation: Being the first Indian brand to win International Taste Awards gives Sepoy & Co. a “Global-First” credibility that appeals to the aspirational Indian middle class.

2. Sepoy & Co. Total Addressable Market (TAM)

- The Cocktail Mixer Market: The India cocktail mixers market is projected to reach USD 304.5 million (approx. ₹2,500+ crore) by 2030, growing at a CAGR of 10.2%.

- The Carbonated Segment: The broader Indian carbonated soft drink market is valued at USD 11.7 billion in 2025, with a significant chunk moving toward low-sugar and natural botanicals—the core of Sepoy & Co.’s portfolio.

- Target Market Reach: Sepoy & Co. is targeting the top 5-10% of the urban population across Tier 1 and Tier 2 cities, representing an immediate serviceable market of over 25-30 million consumers.

3. Sepoy & Co. Ideal Target Audience and Demographics

- Demographics: Aged 24–45, urban dwellers (Metros + Tier 1 cities), with an annual household income of ₹15 Lakhs+.

- The “Home-Mixologist”: Individuals who enjoy entertaining at home and take pride in serving high-quality, aesthetic drinks.

- Health-Conscious Professionals: Consumers who avoid high-fructose corn syrup and artificial flavors found in mass-market brands but still want a “treat” beverage.

- The Global Traveler: Customers who have experienced brands like Fever-Tree abroad and are looking for a homegrown, high-quality equivalent in Sepoy & Co.

4. Sepoy & Co. Marketing & Content Strategy

- The “Aesthetic Lifestyle” Content: Leverage the “Instagram-ready” bottle design of Sepoy & Co. to create high-production-value reels featuring home-bar setups and “3-step cocktail” tutorials.

- Influencer Collaborations: Partner with niche mixologists, luxury lifestyle influencers, and interior designers to position Sepoy & Co. as an essential “home decor” and “party” element.

- SEO & Digital Footprint: With a current organic traffic of 12,396 visitors/month, Sepoy & Co. should focus on “Gift Set” keywords and “Low-calorie mixers” to drive high-intent Shopify conversions.

- Transparency Marketing: Highlight the Himalayan water source and botanical sourcing to build trust with label-reading consumers.

5. Sepoy & Co. Distribution Strategy

- Omnichannel Presence: Maintaining the Shopify-built website for D2C (Direct-to-Consumer) high-margin sales while expanding on Quick-Commerce (Blinkit/Zepto) for instant gratification.

- Premium HORECA Focus: Aggressive placement in high-end Hotels, Restaurants, and Cafés. Sepoy & Co. needs to be the “default” premium mixer recommended by bartenders in top-tier bars.

- Modern Trade Expansion: Securing shelf space in premium retail chains like Nature’s Basket and Foodhall, where the target demographic shops for gourmet ingredients.

6. Sepoy & Co. Advantages & Challenges

- Advantages:

- Pioneer Status: First-mover advantage in the “Indian Botanical Mixer” space.

- Award-Winning Taste: Superior product quality confirmed by international judges.

- Founder Pedigree: Angad Soni’s background in a ₹2,000 crore family business brings industrial discipline and scale-up experience.

- Challenges:

- High Valuation Gap: The ₹150 crore valuation versus the current ₹20 crore revenue projection creates a “funding winter” risk.

- Logistics of Glass: High breakage and shipping costs for glass bottles in D2C.

- Competitive Pressure: Facing competition from global giants (Fever-Tree) and local emerging players.

7. Sepoy & Co. Success Reasons & Mitigation Strategies

- Reason for Success: The shift from “Quantity” to “Quality” drinking in India is permanent. Sepoy & Co. sells an experience, not just a liquid.

- Mitigation for Structural Issues: To address Shark Anupam Mittal’s “sleepless nights,” Sepoy & Co. should create a clear service-level agreement (SLA) or eventually merge the bottling entity into the brand to align investor interests.

- Mitigation for Valuation: Shift focus to Unit Economics and EBITDA positivity to justify the premium multiple in future funding rounds.

8. Sepoy & Co. Future Business Roadmap & Valuation Growth

- Phase 1 (Year 1-2): Scale revenue to ₹40-50 crore by dominating Quick-Commerce and expanding the SKU line to include functional sparkling waters (Vitamins/Electrolytes).

- Phase 2 (Year 3-4): International expansion into the Middle East and SE Asia, leveraging the “Himalayan” origin story to command a premium.

- Phase 3 (Year 5): Reaching the ₹100–150 crore revenue target mentioned on Shark Tank. By achieving this with a 15-20% EBITDA margin, a ₹150-200 crore valuation becomes a reality rather than a projection.

Sepoy & Co Shark Tank India Episode Review