Shark Tank India Season 5 Episode 19 Review

Episode Overview

Episode 19 of Shark Tank India Season 5 delivered a masterclass in contrasts—showcasing the thin line between visionary confidence and tone-deaf defensiveness, between bootstrap success and venture-scale viability, and between knowing your numbers and knowing your audience. From a lightning-fast “dream deal” to a founder’s costly stubbornness to a pitch that unraveled in real-time, this episode explored what happens when founders either deeply understand or fundamentally misread the room.

Episode Summary

Success Rate: 1 out of 3 deals closed

Total Investment: ₹1.5 Crore deployed in one decisive pitch

Key Theme: The episode centered on founder readiness—not just in business metrics, but in self-awareness, receptiveness to feedback, and the crucial ability to distinguish between conviction and ego.

Pitch 1

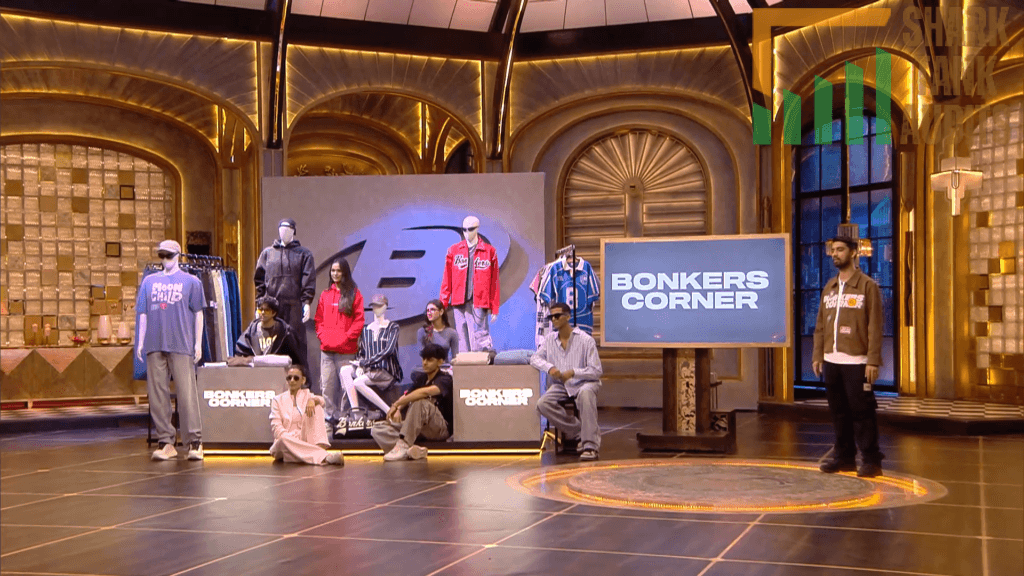

Bonkers Corner Shark Tank India Episode Review

Bonkers Corner appeared on Shark Tank India Season 5, Episode 19, with founder Shubham Gupta (Mumbai entrepreneur who rebuilt after family’s 2011 textile business bankruptcy losing home/livelihood, joined father’s garment industry 2012 learning manufacturing nuances) seeking ₹1.5 Crore for 0.5% equity (₹300 Crore valuation) and successfully closed exact ask for ₹1.5 Crore for 0.5% equity with Shark Namita Thapar who provided “no-royalty dream deal” concluded swiftly before Aman/Kunal could counter-negotiate.

The homegrown Indian unisex luxury streetwear brand specializes in oversized fits (T-shirts, hoodies, joggers, cargos, coordinated sets) with global franchise licenses (Marvel, Disney, Star Wars, Pokémon), operating 19 profitable offline stores plus robust online presence with exceptional 731,622 monthly organic visitors, projecting ₹170-180 Crore net sales (FY 25-26) with ₹30-35 Crore expected profits entirely bootstrapped without external funding.

While Namita was highly impressed by numbers and founder clarity, Aman/Anupam initially criticized design strategy, Mohit offered ₹2 Crore for 1% equity (₹200 Crore valuation, significantly lower), and Kunal expressed surprise at quick deal closure. Operating in Indian apparel market valued at $60 billion with streetwear/casual segment at $15-18 billion growing 12% CAGR (3x faster than traditional apparel), Bonkers fills “aspirational gap” between mass-market (Bewakoof) and international giants (Zara/H&M) at 30-40% lower prices targeting Gen Z/young millennials (16-28) in Tier 1/2 cities following pop culture, anime, gaming trends with gender-neutral inclusive designs proudly “Made in India.”

Pitch 2

Bubble Me Shark Tank India Episode Review

Bubble Me appeared on Shark Tank India Season 5, Episode 19, with founder Akshina Jindal (ex-Goldman Sachs, Amazon, launched 2024) seeking ₹50 lakh for 1.67% equity (₹30 Crore valuation) but left with no deal after rejecting Aman Gupta’s offer.

Positioned as India’s first magnesium-driven wellness brand addressing stress, sleep, and muscle recovery through magnesium-rich topicals (bath salts, Epsom salt soaks), daily supplements (tablets), and aromatherapy blends (peppermint, jasmine, eucalyptus, lavender), the brand served 100,000+ customers growing from ₹33 lakh net sales (FY 24-25) to ₹2.45 Crore YTD with ₹40 lakh monthly (Oct 25) projecting ₹6 Crore (FY 25-26) with 952 monthly organic visitors.

Aman offered ₹1.5 Crore for 15% equity (₹10 Crore valuation) but founder countered with ₹2 Crore for 10% equity (₹20 Crore valuation) which Aman rejected, unwilling to negotiate further while founder refused lower valuation prioritizing long-term vision. Operating in Indian wellness market projected at $30.95 billion by 2026 (7.18% CAGR) with global magnesium supplement market expected to hit $5.93 billion by 2032 (7.97% Asia-Pacific growth) within India’s ₹47,000 Crore health/wellness/bath market, Bubble Me targets overworked professionals (25-40), fitness enthusiasts, and skincare-conscious Gen Z (65% female, 35% male, ₹75,000+ monthly household income) in Tier 1 cities seeking “bedtime rituals” and active recovery amid fastest-growing stress management segment.

Pitch 3

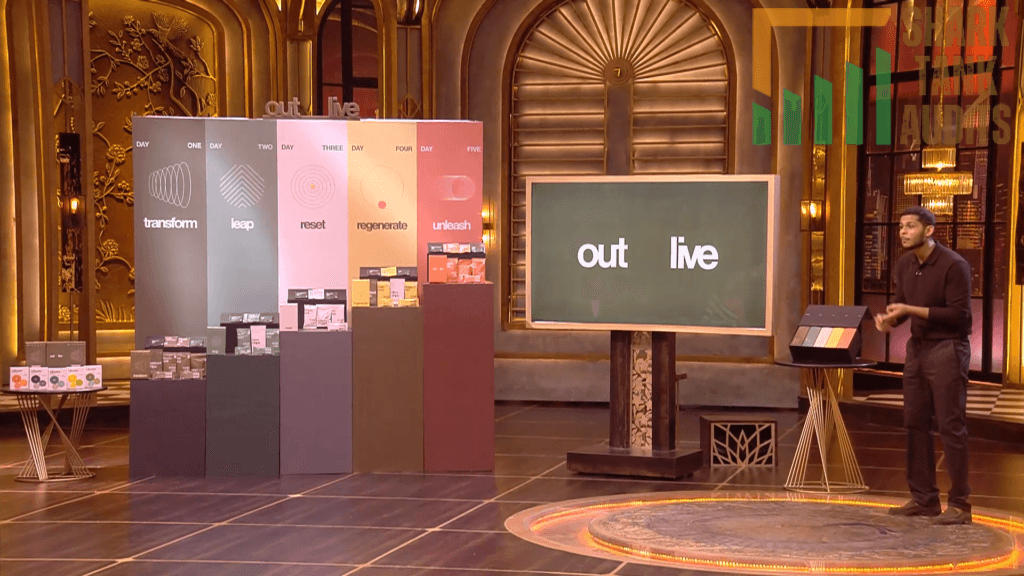

Outlive Shark Tank India Episode Review

Outlive appeared on Shark Tank India Season 5, Episode 19, with founder Varun Khanna (food science/longevity expert) seeking ₹1 Crore for 4% equity (₹25 Crore valuation) but left with no deal after all five Sharks opted out citing harsh criticisms.

The Bengaluru-based brand positioned as India’s first structured fasting program offers 5-day guided fasting kits (₹7,000) containing nutrient-dense meal replacements, electrolytes, and low-calorie high-satiety foods claiming 2-4 kg weight loss through “fasting-mimicking technology” for longevity and metabolic health with 505 monthly organic visitors. Sharks reacted overwhelmingly negatively—Anupam called it “misguided and lost” stating “₹7,000 box doesn’t have ₹500 worth of contents” claiming weight loss is merely water from calorie restriction, Namita exited early over founder’s defensiveness refusing feedback, Kunal noted US-based model only reached $15-20 million in 25 years suggesting lack of scale advising “speak less, listen more,” Aman stated Indian market not ready for niche expensive product, and Mohit found founder too philosophical failing to provide direct business answers while Sharks perceived him as “health educator/influencer” versus business-oriented founder.

Operating in Indian wellness market valued at $156 billion (2024) projected to reach $256.9 billion by 2033 (5.3% CAGR) with nutraceuticals growing 11.14% CAGR within ₹2.1 lakh crore health/wellness food market, Outlive targets high-performing professionals (30-50) in metros, longevity seekers using wearables, and post-clinical demographic (pre-diabetic, high BMI) seeking non-pharmacological interventions among 40 million urban high-income households and 500,000 active biohackers in Tier 1 cities.

Episode Highlights

The Lightning-Fast “Dream Deal”

Bonkers Corner’s Perfect Storm: Shubham Gupta executed what may be the fastest successful pitch of the season. Namita Thapar moved decisively, offering the exact ask (₹1.5 Crore for 0.5% at ₹300 Crore valuation) before Aman or Kunal could counter-negotiate. This “no-royalty dream deal” concluded so swiftly that Kunal expressed surprise at the quick closure.

Why It Worked:

- Undeniable Numbers: ₹170-180 Crore projected revenue with ₹30-35 Crore expected profits

- Organic Dominance: 731,622 monthly organic visitors (highest in episode by far)

- Bootstrap Credibility: Entirely self-funded success story

- Resilience Narrative: Founder rebuilt after family’s 2011 textile bankruptcy that cost them home and livelihood

- Offline + Online Mastery: 19 profitable physical stores plus robust digital presence

The Valuation Standoff

Bubble Me’s Costly Rigidity: In a fascinating contrast to Bonkers Corner’s negotiation success, Akshina Jindal walked away from Aman Gupta’s ₹1.5 Crore offer over valuation disagreement.

The Numbers:

- Founder’s Ask: ₹50 lakh for 1.67% (₹30 Crore valuation)

- Aman’s Offer: ₹1.5 Crore for 15% (₹10 Crore valuation) – 3x the capital at 1/3 the valuation

- Founder’s Counter: ₹2 Crore for 10% (₹20 Crore valuation)

- Result: Deal collapsed as neither would budge

The Irony: Founder rejected ₹1.5 Crore (3x her ask amount) to protect valuation, choosing ₹0 over ₹1.5 Crore plus Shark expertise.

The Philosophical Founder’s Downfall

Outlive’s Complete Rejection: Varun Khanna’s pitch became a cautionary tale about the difference between being an educator and being an entrepreneur. All five Sharks declined, with unusually harsh criticism:

Anupam’s Brutal Assessment: “Misguided and lost” — claimed the ₹7,000 fasting box “doesn’t have ₹500 worth of contents”

Namita’s Early Exit: Left the deal early over founder’s defensiveness and refusal to accept feedback

Kunal’s Reality Check: Noted the US-based model only reached $15-20 million in 25 years, suggesting fundamental scalability issues, adding “speak less, listen more”

The Core Issue: Sharks perceived Varun as a “health educator/influencer” rather than a business-oriented founder—too philosophical, not direct enough in business answers.

Shark Dynamics

Namita Thapar: The Decisive Closer

Namita dominated the episode with her fastest deal closure yet. Her ability to recognize exceptional fundamentals (Bonkers Corner) and move with conviction before competitors could counter-bid showcased strategic speed as a competitive advantage.

Aman Gupta: The Frustrated Negotiator

Aman’s experience with Bubble Me highlighted the challenge investors face when founders prioritize valuation over capital and expertise. His willingness to offer 3x the requested amount (₹1.5 Cr vs ₹50 lakh ask) at a fair valuation demonstrated genuine interest, making the founder’s rejection particularly notable.

The Collective “No” to Outlive

Rarely do all five Sharks decline with such harsh consensus. The unanimous rejection, combined with specific criticisms about defensiveness and lack of business focus, sent a clear message about founder coachability being as important as the business idea itself.

Market Insights Revealed

The episode showcased three distinct wellness and lifestyle markets:

- Indian Streetwear (Bonkers Corner): $15-18 billion segment growing at 12% CAGR (3x faster than traditional apparel), filling the “aspirational gap” between mass-market and international luxury

- Magnesium Wellness (Bubble Me): ₹47,000 Crore health/wellness/bath market within $30.95 billion Indian wellness sector, capitalizing on stress management and “bedtime ritual” trends

- Structured Fasting (Outlive): $156 billion Indian wellness market with nutraceuticals growing at 11.14% CAGR, targeting 500,000 active biohackers and longevity-focused professionals

Key Takeaways

1. Speed Kills (In a Good Way)

Bonkers Corner Lesson: When your numbers speak for themselves, the best deal might be the one that closes fastest. Shubham’s preparation allowed Namita to make an instant decision, preventing competitive bidding that might have introduced complexity or worse terms.

2. More Money ≠ Better Deal If Valuation Is Wrong

The Bubble Me Paradox: Akshina rejected ₹1.5 Crore (3x her ask) because it came at 1/3 her desired valuation. This raises the critical question: Is 0.5% of a bootstrapped success worth more than 15% with a Shark’s guidance?

Counterargument: Perhaps she was right to protect dilution if confident in organic growth trajectory (100,000+ customers, ₹6 Crore projected FY26)

Reality Check: She left with ₹0, not ₹1.5 Crore

3. Founder Personality Can Trump Business Potential

Outlive’s Fatal Flaw: Even in a massive market ($156B wellness sector) with a differentiated product (India’s first structured fasting program), a founder who:

- Can’t take feedback without defensiveness

- Speaks philosophically instead of answering business questions directly

- Is perceived as educator/influencer rather than business-builder

…will struggle to close deals regardless of market opportunity.

4. Bootstrap Success Signals Better Than VC Validation

Bonkers Corner’s Credibility: Being completely self-funded with 19 profitable stores and ₹30-35 Crore projected profits proved more convincing than any previous funding round would have. Bootstrap success demonstrates:

- Real customer demand (not subsidized growth)

- Unit economics that work

- Founders who can execute without hand-holding

5. Product Value Perception Is Everything

Outlive’s Pricing Problem: Anupam’s claim that a ₹7,000 box “doesn’t have ₹500 worth of contents” highlighted a fundamental issue—when Sharks question your value proposition this starkly, the business model has deeper problems than just pricing.

6. Know When You’re Being Offered a Gift

Bubble Me’s Missed Opportunity: When a Shark offers you:

- 3x your requested capital

- Their expertise and network

- Validation in your market

…and you counter-negotiate for more equity at higher valuation, you risk losing the deal entirely. Understanding the difference between negotiating and overplaying your hand is crucial.

What Made This Episode Different

The Perfect Pitch Execution

Bonkers Corner demonstrated what happens when every element aligns:

- Compelling Founder Story: Family bankruptcy to ₹300 Crore valuation

- Undeniable Metrics: 731,622 organic visitors, 19 profitable stores

- Market Timing: Riding India’s streetwear boom (12% CAGR)

- Strategic Differentiation: Global licenses (Marvel, Disney) + “Made in India” positioning

- Shark Recognition: Namita saw the value instantly and moved decisively

The Tale of Two Rejections

The episode featured two “no deals” with completely different narratives:

Bubble Me (Founder’s Choice): Had a viable offer but walked away over valuation principles—a gamble that she chose to take based on conviction in her growth trajectory

Outlive (Sharks’ Choice): All five Sharks actively opted out with harsh criticism—a clear signal that fundamental issues existed beyond just the numbers

The Feedback Receptiveness Test

Outlive’s pitch became an unintentional demonstration of how Sharks evaluate founder coachability:

- Early Warning Signs: Namita exited early over defensiveness

- Communication Style: Kunal’s “speak less, listen more” advice

- Business vs. Philosophy: Mohit’s observation about lack of direct business answers

These weren’t criticisms of the fasting concept itself, but of the founder’s inability to engage productively with investor feedback.

Behind the Numbers

Bonkers Corner’s Dominance

- Organic Traffic: 731,622 monthly visitors (768x higher than Bubble Me’s 952, 1,449x higher than Outlive’s 505)

- Revenue Projection: ₹170-180 Crore (28x higher than Bubble Me’s ₹6 Crore)

- Profit Projection: ₹30-35 Crore (demonstrating not just revenue but profitability at scale)

- Valuation Multiple: ~1.7x projected revenue (reasonable for profitable, growing consumer brand)

Bubble Me’s Negotiation Math

- Aman’s Offer Value: ₹1.5 Cr for 15% = ₹10 Cr valuation

- Founder’s Counter Value: ₹2 Cr for 10% = ₹20 Cr valuation

- Gap: 2x valuation difference (₹10 Cr vs ₹20 Cr)

- Question: Was protecting 5% extra equity (15% vs 10%) worth losing ₹1.5 Cr and Aman’s expertise?

Outlive’s Value Perception Crisis

- Product Price: ₹7,000 per 5-day fasting kit

- Anupam’s Claimed Value: ₹500 worth of contents

- Perceived Margin: 93% markup if Anupam’s assessment accurate

- Problem: Even if margins are healthy, perception of poor value kills deals

Founder Archetypes on Display

The Prepared Executioner (Bonkers Corner)

Shubham Gupta exemplified:

- Clear, concise communication

- Let numbers speak for themselves

- Knew his market position

- Ready to close immediately when the right offer came

- Humility (rebuilt from family bankruptcy) combined with confidence (₹300 Cr valuation)

The Conviction-Driven Rejecter (Bubble Me)

Akshina Jindal represented:

- Strong belief in long-term vision

- Willingness to walk away from capital to protect equity

- Prioritizing valuation over immediate funding

- Bet on organic growth trajectory over Shark acceleration

Time Will Tell: Whether this was wise conviction or costly stubbornness depends on Bubble Me’s growth over the next 2-3 years.

The Educator-Entrepreneur Mismatch (Outlive)

Varun Khanna demonstrated:

- Deep subject matter expertise (food science, longevity)

- Philosophical approach to health

- Defensiveness when challenged

- Difficulty pivoting from educator mode to business mode

The Lesson: Being right about the science doesn’t mean you’re ready for venture investment—investors want business operators, not health educators.

Episode Wisdom

For Founders:

1. Prepare for the Fast Close: If your numbers are exceptional, be ready to accept a great offer immediately. Don’t let perfection become the enemy of excellent.

2. Do the Valuation Math Before the Tank: Understand the difference between:

- Getting your asked amount at desired valuation (ideal but rare)

- Getting more money at lower valuation (often the better deal)

- Getting nothing because you wouldn’t compromise

3. Feedback Receptiveness Is Being Evaluated: Every interaction in the tank is a test of coachability. Defensiveness is a red flag; thoughtful engagement with criticism is a green flag.

4. Bootstrap Success Speaks Louder: If you can achieve profitability and scale without external funding, you enter negotiations from a position of strength.

5. Know Your Founder Type: Are you an educator, influencer, or business operator? Sharks invest in operators who can also educate, not educators trying to become operators.

For Investors:

1. Speed Can Be Strategy: Namita’s instant offer prevented competitive bidding and secured the deal before complexity entered negotiations.

2. 3x Capital at 1/3 Valuation Can Still Fail: Even generous offers fail when founders prioritize equity over growth capital—understanding founder psychology matters.

3. Some Founders Aren’t Ready: No amount of market opportunity compensates for a founder who can’t receive feedback or pivot from their communication style.

For Viewers:

1. The Best Deal Might Be the Fastest: Drawn-out negotiations introduce complexity and potential for collapse—sometimes clarity and speed create better outcomes.

2. Walking Away Can Be Right or Wrong: Context matters. Bubble Me might prove genius or foolish depending on what happens next; Outlive never had a deal to walk from.

3. Organic Traffic Tells a Story: Bonkers Corner’s 731,622 monthly visitors validated everything the founder said—when your digital presence backs up your claims, investors listen.

4. Value Perception Kills Deals: If investors question whether your ₹7,000 product has ₹500 worth of value, you have a fundamental business problem, not just a pricing question.

The Valuation Psychology Spectrum

This episode perfectly illustrated three valuation approaches:

Validated High (Bonkers Corner – ₹300 Cr):

- Backed by exceptional metrics

- Profitable operations

- Strong organic growth

- Result: Got exact ask instantly

Contested Middle (Bubble Me – ₹30 Cr ask, ₹10 Cr offered, ₹20 Cr countered):

- Some traction (100K+ customers)

- Growing revenue (₹6 Cr projected)

- Investor interest but valuation gap

- Result: No deal due to inability to bridge gap

Questioned Low (Outlive – ₹25 Cr):

- Market opportunity exists

- Value proposition questioned

- Founder readiness concerns

- Result: Complete rejection by all Sharks

The Episode’s Defining Question

What matters more: Getting the valuation you want or getting the capital and expertise you need?

- Bonkers Corner: Got both (perfect scenario)

- Bubble Me: Chose valuation over capital (TBD if wise)

- Outlive: Got neither (never had the choice)

Leave feedback about this

You must be logged in to post a comment.