Shark Tank India Season 5 Episode 22 Review

Episode 22 of Shark Tank India Season 5 delivered a rare episode featuring direct competitor face-off in the intimate apparel category, creating the season’s most fascinating comparison of two businesses targeting identical markets with divergent execution philosophies and dramatically different outcomes. From premium “second skin” engineering to fashion-first empowerment positioning, both pitches addressed India’s rapidly evolving innerwear market where consumer spending on intimate apparel increasingly surpasses food budgets amid social media influence and urban lifestyle shifts.

The episode became memorable for Sharks’ sharply contrasting reactions—one brand securing investment at premium valuation despite minor equity dilution, while its competitor faced harsh criticism about product finishing, celebrity ambassador relatability, and Amazon ratings despite similar revenue scale. With ₹3.2 crore total investment deployed across size-inclusive shapewear and fashion-forward foundational garments, Episode 22 demonstrated how execution quality, founder credibility, and product differentiation determine success even when addressing identical consumer needs in the explosive ₹91,000 crore Indian innerwear market growing toward ₹1.66 lakh crore by 2034.

Episode Summary

Total Pitches: 2 (Unique format: Direct innerwear/shapewear competitor face-off)

Successful Deals: 2 (Both competitors secured funding)

Total Investment Made: ₹3.2 Crore equity

Featured Sharks: Namita Thapar, Aman Gupta, Vineeta Singh, Anupam Mittal, Kanika Tekriwal

Pitch 1

Krvvy Shark Tank India Episode Review

Krvvy appeared on Shark Tank India Season 5, Episode 22, with founders Yash Goyal (ex-investment banking, worked for Vineeta Singh’s venture) and Anant Bhardwaj (content creation expert) from Patiala seeking ₹1.2 Crore for 2% equity (₹60 Crore valuation) and successfully closed a deal for ₹1.2 Crore for 3% equity (₹40 Crore valuation) with Shark Namita Thapar.

Founded May 2024, the size-inclusive innerwear/shapewear brand designed for Indian body types offers bras, panties, and functional shapewear engineered as “second skin” with seamless supportive designs using sophisticated sewing preventing chafing, growing from ₹2-3 lakh to ₹6 Crore YTD with 2,779 monthly organic visitors and 4.4-star Amazon rating. During pitch, Anupam jokingly regretted rejecting founders at lower revenue while Aman teased his “poor” investment choice, though Namita and Vineeta lauded premium quality, with founders securing recent ₹6.1 Crore pre-seed funding from Titan Capital and All In Capital projecting ₹15 Crore (FY 25-26).

Operating in Indian innerwear market valued at $10.9 billion (₹91,000 Crore, 6.49% CAGR) projected to reach $19.8 billion by 2034 with shapewear segment growing 9% CAGR driven by shift from “basic necessity” to “fashion/confidence” garments amid 1.1 billion smartphones by 2026 enabling online intimate wear shopping, Krvvy targets urban women (22-40) in Tier 1/2 cities—”Confident Professionals” and “Modern Brides” prioritizing all-day comfort and seamless silhouettes—within ₹8,500 Crore mid-to-premium segment, aiming 2-3% premium online shapewear niche share challenging established giants (Zivame, Clovia) through body-positive ergonomic design versus restrictive traditional innerwear.

Pitch 2

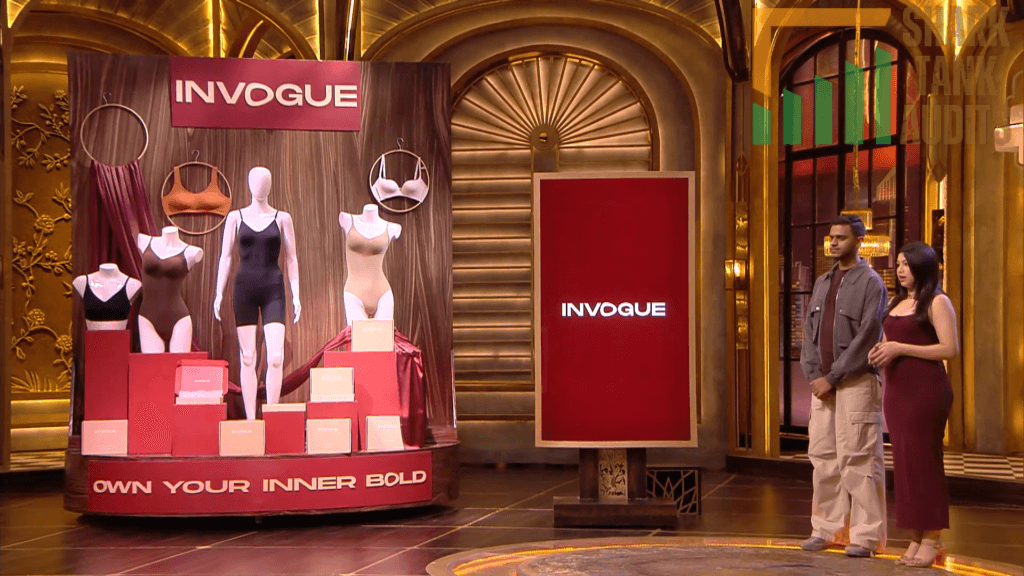

Invogue Shark Tank India Episode Review

Invogue appeared on Shark Tank India Season 5, Episode 22, with 25-year-old founders Maadhav Saxena (entrepreneur since age 12) and Ragini Saxena (dating since school) from Delhi seeking ₹50 lakh for 2% equity (₹40 Crore valuation) and successfully closed a deal for ₹2 Crore for 15% equity (₹13.33 Crore valuation) with Shark Aman Gupta after most Sharks opted out.

The New Delhi-based D2C innerwear/shapewear brand launched 2023 offers “fashion-first” empowering foundational garments with Invogue Intense (high compression) and Invogue Essentials (daily wear) lines featuring breathable skin-friendly fabrics, tummy control, seamless fit, durability maintaining shape/color after washes, and health-conscious design preventing blood circulation issues, growing to ₹5 Crore+ revenue with 1,427 monthly organic visitors and Bollywood actress Malaika Arora as brand ambassador. Sharks reacted critically—Namita criticized product finishing/finances, Kanika/Vineeta found Malaika “unrelatable” ambassador for shapewear, Anupam expressed concern over low Amazon ratings (3.6-3.8) and slow growth, though Aman appreciated founders’ young hustle despite operational mistakes.

Operating in Indian lingerie market valued at $5.06 billion (2024) projected to reach $9.57 billion by 2030 (11.2% CAGR) with shapewear as fastest-growing sub-segment (24.3% CAGR D2C e-commerce) within $190 billion apparel market by FY30 and $53.13 billion women’s segment, Invogue targets contemporary women (22-45) in Tier 1/2 cities—working professionals, brides-to-be, fitness enthusiasts viewing shapewear as “empowerment tool”—within $591 million online lingerie market amid consumer “rotational shift” spending more on fashion/functional innerwear than food driven by social media and urban lifestyles.

Episode Highlights:

- Perfect closure rate: 100% deal success (third time this season)

- Direct competitor face-off: Both innerwear brands funded despite identical category

- 3x valuation gap: Krvvy ₹40 Cr vs. Invogue ₹13.33 Cr (same market, different execution)

- Institutional validation: Krvvy’s ₹6.1 Cr from Titan Capital/All In derisking Shark investment

- Celebrity misalignment: Malaika Arora deemed “unrelatable” for shapewear positioning

- Rating gap crucial: 4.4 stars (Krvvy) vs. 3.6-3.8 stars (Invogue) influencing decisions

- Age advantage questioned: 25-year-old entrepreneurs praised for hustle but criticized for execution

- Playful Shark banter: Anupam regretting early rejection, Aman teasing investment choices

Key Lessons:

- Institutional funding (₹6.1 Cr pre-seed) provides credibility reducing Shark risk perception

- Amazon ratings matter enormously—0.6-0.8 star difference can determine valuation

- Celebrity endorsements must match customer reality (perfect-bodied actress ≠ shapewear target)

- Founder pedigree (ex-Vineeta employee) creates trust versus pure youth entrepreneurship

- Product finishing quality visible in physical demonstrations affects investment decisions

- “Fashion-first” positioning weaker than “engineering-first” in functional intimate apparel

- Explosive growth (₹3L → ₹6 Cr in months) commands premium over steady growth (₹5 Cr in year)

- Size-inclusive body-positive messaging resonates more than celebrity glamour in innerwear

Deal Structure Analysis:

Krvvy:

- Asked: ₹1.2 Cr for 2% (₹60 Cr valuation)

- Got: ₹1.2 Cr for 3% (₹40 Cr valuation)

- Equity increase: 50% (2% → 3%)

- Valuation: 33% reduction (₹60 Cr → ₹40 Cr)

- Rationale: Premium quality + institutional backing + explosive growth = maintained premium

- Investor: Namita (personal care/wellness expertise)

Invogue:

- Asked: ₹50L for 2% (₹25 Cr valuation, later unclear if ₹40 Cr based on document)

- Got: ₹2 Cr for 15% (₹13.33 Cr valuation)

- Investment increase: 4x (₹50L → ₹2 Cr)

- Equity increase: 7.5x (2% → 15%)

- Valuation: 47-67% reduction depending on actual ask

- Rationale: Product/finishing concerns + low ratings + unrelatable celebrity requiring capital infusion and large equity for turnaround

- Investor: Aman (youth hustle + coachability potential)

Strategic Patterns:

- Quality Perception Premium: Visible product excellence (Krvvy) commanding 3x valuation over criticized finishing (Invogue)

- Institutional Validation: VC funding derisking Shark investment significantly

- Rating Differential: Amazon stars directly correlating with investor confidence

- Celebrity Strategy: Aspirational endorsements backfiring when misaligned with customer insecurities

- Founder Background: Industry experience (ex-Vineeta employee) valued over pure youth enthusiasm

Market Context:

- Innerwear Market: $10.9B (₹91,000 Cr) → $19.8B by 2034 at 6.49% CAGR

- Shapewear Segment: 9% CAGR (faster than overall innerwear)

- D2C Shapewear: 24.3% CAGR (explosive e-commerce growth)

- Lingerie Market: $5.06B (2024) → $9.57B (2030) at 11.2% CAGR

- Women’s Apparel: $53.13B within $190B total apparel by FY30

- Online Lingerie: $591M market with smartphone enabling comfortable shopping

- Smartphone Penetration: 1.1B by 2026 removing in-store embarrassment

- Consumer Behavior Shift: Spending more on innerwear than food (urban India)

- Mid-Premium Segment: ₹8,500 Cr (Krvvy’s target)

The Quality Perception Gap:

Episode 22’s stark contrast revealed how product quality perception determines valuation:

Krvvy’s Perceived Excellence:

- “Second skin” engineering terminology

- Sophisticated sewing preventing chafing

- 4.4-star Amazon rating

- Namita/Vineeta praising premium quality

- Indian body-type specific design

- Seamless supportive construction

Invogue’s Perceived Weaknesses:

- Namita criticizing product finishing

- 3.6-3.8 star Amazon ratings

- Quality concerns from multiple Sharks

- “Fashion-first” suggesting style over substance

- No specific engineering differentiation highlighted

Result: Same category, same revenue scale (₹5-6 Cr), but 3x valuation gap (₹40 Cr vs. ₹13.33 Cr) purely based on quality perception.

The Celebrity Endorsement Paradox:

Invogue’s Malaika Arora choice backfiring spectacularly:

Founder Logic:

- Bollywood celebrity adds glamour

- Premium positioning through association

- Social media reach and credibility

- Aspirational brand building

Shark Reality (Kanika/Vineeta):

- Malaika has perfect body naturally

- Women buy shapewear feeling insecure about bodies

- Perfect-bodied celebrity unrelatable to target customer

- Creates disconnect: “Easy for you to look good”

Better Celebrity Choice:

- Real women with body insecurities who use shapewear

- Fitness influencers showing transformation

- Working mothers juggling body changes

- Everyday professionals who need confidence

Lesson: In body-conscious categories, relatable authenticity beats aspirational glamour.

Institutional Validation Power:

Krvvy’s ₹6.1 Cr from Titan Capital/All In Capital providing massive advantage:

What It Signaled to Sharks:

- Kunal Bahl/Rohit Bansal (Snapdeal founders) vetted business

- Professional VCs did due diligence already

- Business model validated by experienced investors

- Reduced Shark risk significantly

- Founders already learned from institutional board

Impact on Negotiation:

- Sharks comfortable with premium valuation

- Less concern about financial projections

- Trust in founder capability amplified

- Minimal equity dilution (2% → 3%) required

Outcome: Prior institutional funding = 3x better valuation vs. bootstrap competitor.

The Amazon Rating Significance:

0.6-0.8 star difference (4.4 vs. 3.6-3.8) proving decisive:

Why Ratings Matter:

- Customer satisfaction proxy

- Product quality indicator

- Operational excellence signal

- Repeat purchase likelihood

- Brand reputation in competitive market

Anupam’s Concern:

- Low ratings + slow growth = red flag

- Suggests product issues or unmet expectations

- Indicates customer retention problems

- Points to operational execution gaps

Krvvy’s Advantage:

- 4.4 stars = happy customers

- Validates premium quality claims

- Supports higher pricing strategy

- Reduces churn concerns

Result: Half a star difference = millions in valuation premium.

The Founder Pedigree Premium:

Yash Goyal’s ex-Vineeta employee status providing credibility:

Direct Benefits:

- Vineeta’s implicit endorsement through hiring history

- Learned D2C/personal care playbook firsthand

- Network access to Vineeta’s ecosystem

- Operational discipline from established company

Sharks’ Perception:

- Not first-time naive entrepreneur

- Understands industry dynamics

- Execution risk reduced

- Coachable with right fundamentals

Contrast with Invogue:

- Maadhav entrepreneur since age 12 = impressive hustle

- But: No industry-specific training

- Operational mistakes expected

- Requires more hands-on Shark involvement

Episode Thematic Coherence:

Both pitches addressed intimate apparel transformation:

- Krvvy: Engineering excellence for Indian bodies (functional sophistication)

- Invogue: Fashion-forward empowerment positioning (aesthetic confidence)

Success pattern: Engineering > Fashion when product performance determines customer satisfaction in functional categories.

The Spending Shift Phenomenon:

Both brands capitalizing on documented consumer behavior change:

Traditional Hierarchy:

- Food > Clothing > Luxury goods

- Basic necessities prioritized

- Fashion secondary to survival

New Urban Reality:

- Innerwear spending > Food spending

- Social media showcasing importance of foundation garments

- Professional image requiring quality basics

- Confidence economics: Better underwear = better outfit = better opportunities

Market Implications:

- ₹91,000 Cr innerwear market not discretionary anymore

- Premium segment (₹8,500 Cr) growing fastest

- Consumers willing to pay 3-5x for quality

- Category shifting from commodity to premium

Comparative Face-Off Outcomes This Season:

| Episode | Category | Winner(s) | Pattern |

|---|---|---|---|

| 5 | Lab-grown diamonds | Emori only | Winner-take-all |

| 6 | Pet care | Both funded | Complementary niches |

| 13 | Fintech research | Multibagg AI only | AI beat content |

| 22 | Innerwear/shapewear | Both funded | Quality premium 3x |

Episode 22 showed that in mature consumer categories, both competitors can secure funding but execution quality determines valuation multiples—unlike emerging categories (fintech AI) where paradigm shift creates winner-take-all dynamics.

Age vs. Experience Debate:

Episode 22 tested youth entrepreneurship thesis:

Invogue’s Case (25-year-olds):

- Pros: Hustle, energy, adaptability, understanding Gen Z

- Cons: Product finishing issues, operational mistakes, unclear finances

- Aman’s Bet: Youth + capital + mentoring = turnaround potential

Krvvy’s Case (Ex-corporate):

- Pros: Industry knowledge, operational discipline, quality execution

- Cons: Less relatable “founder story,” potentially less nimble

- Namita’s Bet: Experience + institutional backing = safer premium play

Conclusion: Age advantage exists but doesn’t overcome execution gaps. Experience commands premium until youth proves comparable quality.

Future Implications:

- Quality Documentation Required: Physical product demonstrations influencing decisions more than metrics

- Celebrity Alignment Critical: Endorsements must match customer psychographics not brand aspirations

- Institutional Pre-Funding: Securing VC before Shark Tank provides valuation leverage

- Amazon Ratings Scrutinized: Online reviews becoming primary due diligence signal

- Indian Body-Type Design: Localization advantage versus Western-designed alternatives

Episode Significance:

Episode 22 will be remembered as the clearest demonstration of how execution quality and founder credibility create valuation premiums even in identical markets with similar revenue scales. Krvvy’s ₹40 crore valuation versus Invogue’s ₹13.33 crore—despite both operating in shapewear with ₹5-6 crore revenue—proved that institutional validation, product quality perception, customer ratings, and founder pedigree matter infinitely more than revenue alone. The episode demolished the myth that “all revenue is equal”—showing that ₹6 crore with 4.4-star ratings and VC backing commands 3x valuation versus ₹5 crore with 3.6-star ratings and celebrity misalignment. Most importantly, the contrasting Shark reactions (Namita/Vineeta praising Krvvy quality versus criticizing Invogue finishing) demonstrated that in consumer products, tangible quality differences observable during pitch sessions directly determine investment terms regardless of similar financials.

Closing Reflection:

Episode 22 taught that in mature consumer categories like innerwear, differentiation comes from execution excellence not market positioning alone. Both Krvvy and Invogue understood the market opportunity (India’s ₹91,000 crore innerwear transformation from necessity to fashion), targeted identical customers (urban women 22-45 seeking confidence), and achieved comparable revenue (₹5-6 crore). Yet the 3x valuation gap revealed harsh truth: quality perception, institutional credibility, and founder experience create exponential value premiums over enthusiasm and celebrity endorsements. Krvvy’s “second skin” engineering and 4.4-star ratings beat Invogue’s Malaika Arora glamour and fashion-first positioning because shapewear customers prioritize function over fantasy, comfort over celebrity, and proven quality over aspirational marketing. The lesson: In categories where product performance directly impacts customer satisfaction, execution excellence isn’t just important—it’s the only thing that determines whether you command premium or discount valuations. Build something that works exceptionally well (Krvvy’s sophisticated sewing), not just something that looks good on Instagram (Invogue’s Bollywood ambassador), and let quality speak louder than celebrity endorsements ever could.

Leave feedback about this

You must be logged in to post a comment.