Emori Shark Tank India Episode Review

Emori appeared on Shark Tank India Season 5, Episode 5, with founder Arushi Jain seeking ₹75 lakh for 1% equity (₹75 Crore valuation). She successfully closed a deal for ₹3 Crore for 6% equity (₹50 Crore valuation) with Sharks Anupam Mittal, Namita Thapar, Vineeta Singh, and Ritesh Agarwal.

Emori is a Gurgaon-based premium lab-grown diamond jewellery brand with 117,121 monthly organic visitors and an exceptional 10x inventory turnover that impressed the Sharks. Founder Arushi Jain’s calm confidence and statement “I’m here for myself, not validation” resonated strongly. Offering sustainable, conflict-free diamonds at ₹20,000-₹80,000 per carat (versus ₹70,000-₹5 lakh for natural diamonds), the brand targets Gen-Z, Millennials, and value-conscious couples. While Sharks praised the business fundamentals, Aman Gupta criticized the website storytelling and offered a solo deal, which Arushi declined for strategic multi-shark alignment. With India’s lab-grown diamond market growing from $450M to $1.2B by 2030-31, Emori positions itself as superior to competitors like True Diamond.

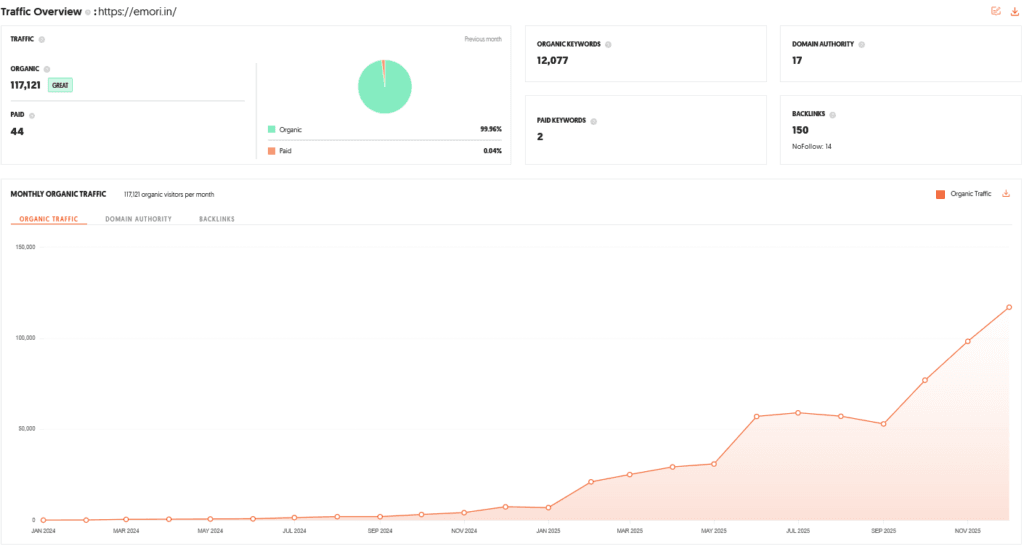

Emori Website Information

- Website:- Emori

- Build on Shopify

- Great SEO Performance.

- ORGANIC TRAFFIC: 117121 visitor per month.

Emori Founder

- The brand was represented by Arushi Jain, a Gurgaon-based entrepreneur.

- Throughout the pitch, she was highly commended for her calm, composed demeanor and professional confidence.

- A standout moment occurred when she expressed that her presence on the show was “for herself” rather than for external validation, a statement that resonated deeply with the Sharks.

Emori Brand Overview

- Emori is a premium jewellery brand specializing in lab-grown diamonds.

- Based in Gurgaon, the company distinguishes itself through high business efficiency and a modern approach to luxury.

- During the episode, it was positioned as a superior alternative to competitors like True Diamond due to its polished presentation and robust business fundamentals.

Emori Shark Tank India Appearance & Ask

- Arushi Jain entered the tank with an initial ask of ₹75 lakh for 1% equity, which placed the company’s pre-money valuation at ₹75 crore.

- The pitch was noted for its clarity and the founder’s ability to handle intense questioning from the panel.

Emori Season and Episode Air Date

- Season: 05

- Episode: 05

- Episode Air Date: Friday, 09 January 2026

Emori Product Overview

- The brand focuses on lab-grown diamond jewellery, offering a sustainable and ethically sourced alternative to mined diamonds.

- The products were showcased as high-quality pieces that balance luxury with accessible price points.

- While the physical products were well-received, the digital presentation of the brand became a central point of debate during the episode.

Emori Investor Reactions

The Sharks were notably impressed by the company’s 10x inventory turnover, a metric considered exceptional for the jewellery industry.

- Amit Jain, Anupam Mittal, Namita Thapar, and Ritesh Agarwal showed strong interest, ultimately joining forces for the deal.

- Aman Gupta was more critical, specifically targeting the brand’s website design and vertical display, suggesting that the storytelling lacked the “spark” needed for a top-tier brand.

Emori Customer Engagement Philosophy

- Emori’s philosophy centers on transparency and empowering the modern consumer.

- However, the “storytelling” aspect of their customer engagement was a point of contention.

- While critics felt the business metrics proved the brand’s strength, some Sharks suggested that the brand needs to refine its narrative to better connect with customers emotionally through its digital platforms.

Emori Product Highlights

- Efficiency: The brand boasts a “mind-boggling” inventory turnover rate, ensuring fresh designs and low capital stagnation.

- Quality vs. Competition: In a direct face-off with competitor True Diamond, Emori was perceived to have a more refined product-market fit and business articulation.

- Sustainability: By utilizing lab-grown diamonds, the brand highlights a commitment to modern, eco-conscious luxury.

Emori Future Vision

- With the backing of four prominent Sharks—Amit Jain, Anupam Mittal, Namita Thapar, and Ritesh Agarwal—Emori aims to scale its operations across multiple domains.

- The founder’s vision involves leveraging the combined expertise of these investors to move beyond pure business metrics and build a household brand name in the evolving lab-grown diamond sector.

Emori Deal Finalized or Not

- Yes, a deal was finalized. While Aman Gupta offered a solo deal, the founder strategically chose a multi-shark alignment.

- ₹ 1.5 Crores for 3% for Anupam Mittal and 1.5 Crores for 3% for Namita Thapar, Vineeta Singh & Ritesh Agarwal.

- The final agreement was ₹3 crore for 6% equity, resulting in a revised valuation of ₹50 crore.

| Parameter | Details |

|---|---|

| Website | Emori |

| Platform Built On | Shopify |

| SEO Performance | Excellent |

| Organic Traffic | ~117,121 visitors per month |

| Brand Name | Emori |

| Brand Category | Premium Jewellery / Lab-Grown Diamonds |

| Brand Location | Gurgaon, India |

| Founder | Arushi Jain |

| Founder Background | Gurgaon-based entrepreneur |

| Founder Impression | Calm, composed, confident |

| Pitch Highlight Statement | “I am here for myself, not validation” |

| Brand Positioning | Modern, efficient luxury jewellery brand |

| Core Product | Lab-grown diamond jewellery |

| Sustainability Angle | Ethical, conflict-free diamonds |

| Competitive Benchmark | Positioned stronger than True Diamond |

| Season | Season 05 |

| Episode | 05 |

| Shark Tank India Air Date | 09 January 2026 |

| Initial Ask | ₹75 Lakh |

| Equity Offered | 1% |

| Valuation Asked | ₹75 Crore |

| Pitch Quality | Clear, confident, well-articulated |

| Product Quality Perception | High-quality, accessible luxury |

| Inventory Turnover | 10× (exceptional for jewellery) |

| Key Metric Appreciated | Inventory efficiency |

| Investor Interest | Very high |

| Shark Feedback – Aman Gupta | Criticized website UX and lack of storytelling |

| Shark Feedback – Other Sharks | Strongly positive on fundamentals |

| Sharks Showing Interest | Amit Jain, Anupam Mittal, Namita Thapar, Ritesh Agarwal |

| Founder’s Strength | Handling pressure with clarity |

| Customer Philosophy | Transparency + empowerment |

| Storytelling Debate | Metrics strong, emotional narrative needs work |

| Product Differentiation | Balance of luxury and affordability |

| Sustainability Advantage | Eco-conscious alternative to mined diamonds |

| Deal Finalized | ✅ Yes |

| Final Deal Structure | ₹3 Crore for 6% equity |

| Sharks in Final Deal | Anupam Mittal, Namita Thapar, Vineeta Singh, Ritesh Agarwal |

| Final Valuation | ₹50 Crore |

| Aman Gupta Offer | Solo offer (declined) |

| Strategic Decision | Multi-shark alignment |

| Indian LGD Market Size (2024) | ~$450 Million |

| LGD Market Projection (2030–31) | ~$1.2 Billion |

| Natural Diamond Pricing | ₹70,000 – ₹5 Lakh per carat |

| Emori LGD Pricing | ₹20,000 – ₹80,000 per carat |

| India LGD Production Share | ~15% global |

| Supply Chain Advantage | Localized & vertically integrated |

| Total Addressable Market (TAM) | $75+ Billion Indian jewellery market |

| Serviceable Addressable Market (SAM) | $300–400 Million LGD segment |

| Serviceable Obtainable Market (SOM) | 5–7% of organized LGD retail |

| Primary Target Audience | Gen Z & Millennials (18–35) |

| Secondary Audience | Working professional women |

| Wedding Buyer Segment | Value-conscious couples |

| Core Buyer Motivation | Ethical luxury + affordability |

| Digital Strategy | SEO-first, high-intent keywords |

| Key SEO Focus | Sustainable rings, LGD solitaires |

| Content Direction | Emotional storytelling over specs |

| Influencer Strategy | Virtual try-ons, styling reels |

| Platform Focus | Instagram, Reels, short video |

| Distribution Model | Omnichannel |

| D2C Channel | Shopify website |

| Offline Expansion | Experience Centres |

| Target Cities | Gurgaon, Mumbai, Bangalore |

| Marketplace Strategy | Tata CLiQ Luxury, Ajio Luxe |

| Inventory Model | Just-in-time assembly |

| Key Advantage | High liquidity via fast inventory churn |

| Competitive Advantage | Shark backing + efficiency |

| Key Challenge | Perception of resale value |

| Market Risk | Rising CAC due to Titan, large brands |

| Mitigation Strategy | Buy-back & exchange guarantees |

| Design Strategy | Focus on niche cuts |

| Phase 1 Goal | ₹100 Cr revenue run rate |

| Phase 2 Goal | Bespoke wedding line |

| Phase 3 Goal | International expansion |

| Target EBITDA | 20%+ |

| Future Valuation Goal | ₹250 Cr+ |

| Funding Vision | Series A by 2028 |

| Overall Assessment | Strong fundamentals, scalable luxury brand |

Emori Shark Tank India Business Plan

Emori Business Potential in India: Facts & Data

- Rapid Market Expansion: The Indian lab-grown diamond market is projected to grow from $450 million in 2024 to $1.2 billion by 2030-31, representing a massive shift in consumer luxury preferences.

- Price Advantage: Emori capitalizes on a significant pricing gap; while natural diamonds cost between ₹70,000 to ₹5 lakh per carat, Emori’s lab-grown alternatives retail between ₹20,000 to ₹80,000, making luxury accessible to the middle class.

- Supply Chain Dominance: India produces roughly 15% of the world’s lab-grown diamonds, providing Emori with a localized, cost-effective, and vertically integrated supply chain.

Emori Total Addressable Market (TAM): Facts & Data

- TAM (Total Addressable Market): The overall Indian gems and jewellery market is valued at over $75 billion, with diamond-studded jewellery growing at a CAGR of 9%.

- SAM (Serviceable Addressable Market): The specific LGD jewellery segment in India, estimated at $300-$400 million (approx. ₹2,500 – ₹3,300 Cr) as of 2025-26.

- SOM (Serviceable Obtainable Market): Emori aims to capture 5-7% of the organized LGD retail market within the next 3 years, leveraging its 10x inventory turnover efficiency.

Emori Ideal Target Audience & Demographics

- The Conscious Gen Z & Millennials: Individuals aged 18–35 who prioritize ethical sourcing and sustainability over traditional “rarity.”

- The Modern Professional Woman: Working women in Tier 1 and Tier 2 cities looking for “daily wear” luxury that doesn’t require a locker.

- Value-Conscious Wedding Buyers: Couples who want the “solitaire look” (2+ carats) but have a budget that would typically only afford a small natural diamond.

Emori Marketing, Content & Digital Strategy

- Digital-First Presence: With 117,121 monthly organic visitors, Emori will focus on high-intent SEO keywords like “sustainable engagement rings” and “lab-grown solitaires India.”

- Educational Storytelling: Shifting from “technical specs” to “emotional narratives,” addressing the Shark Tank critique by showcasing the “Science of Love” and “Conflict-Free Luxury.”

- Influencer & Social Proof: Utilizing Instagram and TikTok/Reels for “Virtual Try-ons” and styling videos to appeal to the visual nature of the target demographic.

Emori Distribution Strategy

- Omnichannel Integration: Maintaining the Shopify-powered D2C store while expanding into Experience Centres in major hubs like Gurgaon, Mumbai, and Bangalore.

- Marketplace Presence: Strategic listings on premium platforms like Tata CLiQ Luxury and Ajio Luxe to build brand halo.

- Lean Inventory Model: Continuing the 10x inventory turnover strategy by using a “Just-in-Time” assembly model for high-value solitaires.

Emori Advantages & Challenges

| Advantages | Challenges |

| 10x Inventory Turnover: High liquidity and low capital stagnation. | Resale Perception: Consumers still perceive natural diamonds as better long-term investments. |

| Sustainability: 100% conflict-free and environmentally superior. | Market Crowding: Entry of giants like Titan (beYon) increases CAC (Customer Acquisition Cost). |

| Shark Backing: Access to the networks of Amit Jain, Anupam Mittal, and Namita Thapar. | Digital Storytelling: The need to improve the “luxury feel” of the website as noted by Aman Gupta. |

Emori Success Factors & Mitigation Strategies

- Success Reason (Efficiency): Emori’s ability to churn stock faster than traditional jewelers ensures they always carry the latest trends without debt.

- Success Reason (Founder’s Brand): Arushi Jain’s “calm confidence” provides a relatable face for the brand, building trust in a high-ticket category.

- Mitigation (Trust): Emori will offer Buy-back/Exchange guarantees to mitigate consumer fears regarding the falling prices of LGD stones.

- Mitigation (Competition): Focusing on Design-led differentiation (niche cuts like Pear and Emerald) rather than a price war with larger conglomerates.

Emori Future Business Roadmap & Valuation Growth

- Phase 1 (Year 1): Improve website UI/UX and storytelling; hit ₹100 Cr revenue run rate leveraging the “Shark Tank” tailwind.

- Phase 2 (Year 2): Launch a “Bespoke” line for high-end wedding jewellery; expand to 5 physical flagship Experience Centres.

- Phase 3 (Year 3): Explore international shipping to the US and Middle East (the largest LGD markets).

- Valuation Strategy: By maintaining a 20%+ EBITDA margin and high turnover, Emori aims to increase its valuation from the current ₹50 Cr to ₹250 Cr+ through a Series A round by 2028.

Emori Shark Tank India Episode Review