Ayuvya & Imfresh Shark Tank India Episode Review

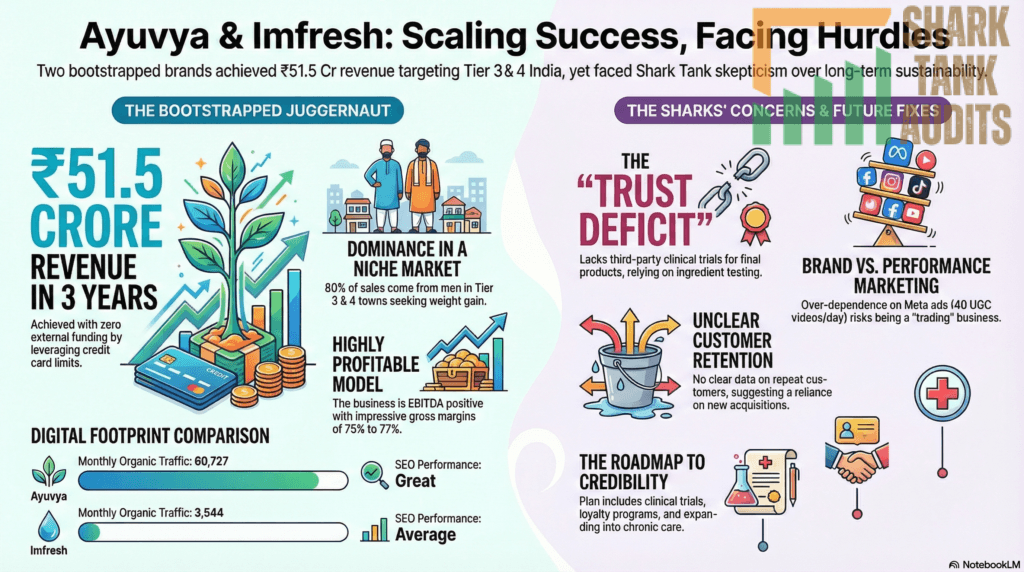

Ayuvya & Imfresh appeared on Shark Tank India Season 5, Episode 11, with founders Astha Jain (PEC engineer from Bhind, MP), Pawanjot Kaur (PEC graduate from Jalandhar, Punjab, inspired after Ayurveda cured her eczema), and Tanishk Pandey (UP, creative copywriter, married to Astha) seeking ₹1 Crore for 0.5% equity (₹200 Crore valuation) but left with no deal despite impressive ₹51.5 Crore revenue bootstrapped from credit cards in 3 years.

Operating dual brands—Ayuvya (modernized Ayurveda health supplements specializing in weight gain with iGain Plus/Legs Gain using Ashwagandha, Safed Musli, generating 75% revenue) and Imfresh (India’s first full-body deodorant cream)—they achieved 75-77% gross margins with AYUSH certification and 80% sales from Tier 3/4 towns via 40 UGC video ads daily on Meta. While Sharks praised financial discipline and ₹70 Crore revenue projection, Aman/Vineeta deemed it “performance marketing/trading play” versus sustainable brand, Kunal/Ritesh raised concerns over lack of third-party clinical trials for formulations (only individual ingredients tested), Vineeta questioned unclear annual repeat rates suggesting over-reliance on new customers versus retention, and Namita exited due to Ayurvedic space conflict. Operating in India’s Ayurveda market growing 21.5% CAGR to $35 billion by 2030 and $31.2 billion beauty/personal care market, targeting rural men (18-35, 80% male) seeking weight gain for confidence/military fitness with 3.38x ROAS on Meta.

Website Information

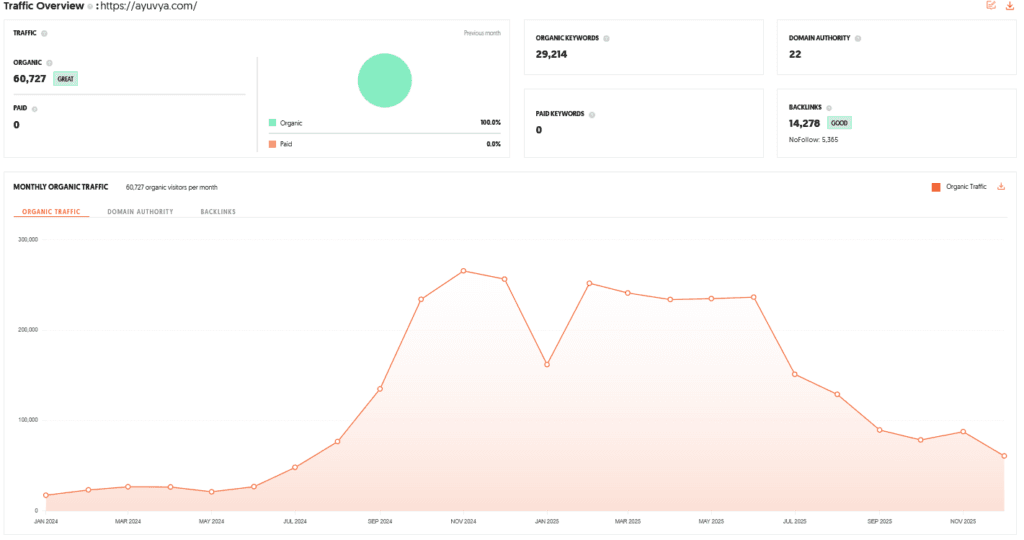

Website Information Ayuvya

- Website:- Ayuvya

- Build on JavaScript frameworks Next.js 13.4.12 React

- Great SEO Performance

- ORGANIC TRAFFIC: 60727 visitor per month.

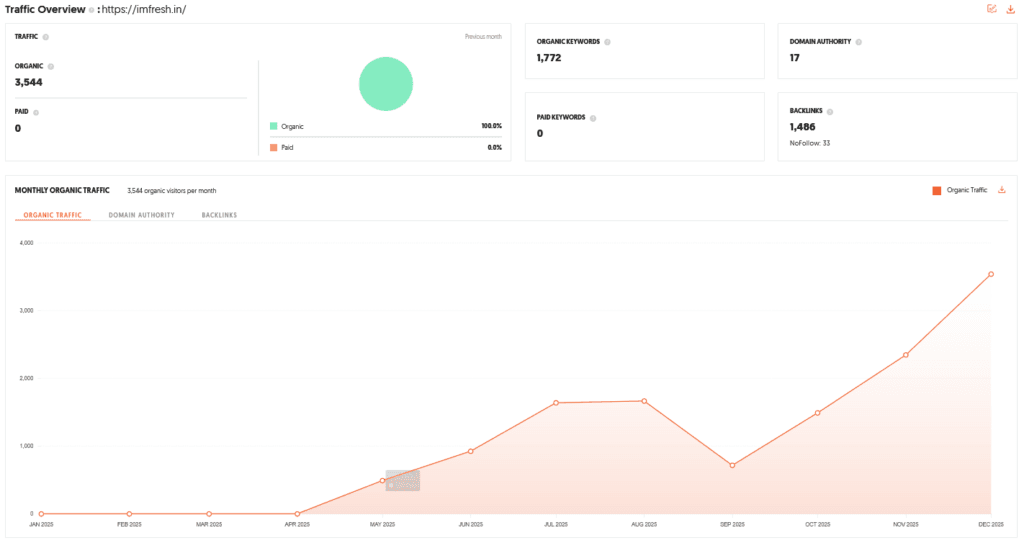

Website Information Imfresh

- Website:- Imfresh

- Build on JavaScript frameworks Next.js 13.4.12 React

- Average SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 3544 visitor per month.

Founders

The company was built by a trio of ambitious entrepreneurs from diverse backgrounds:

- Astha Jain: An engineer from Punjab Engineering College (PEC) originally from Bhind, MP. She manages the operational and strategic side.

- Pawanjot Kaur: A PEC graduate from Jalandhar, Punjab, who was inspired to start the brand after Ayurveda cured her chronic eczema.

- Tanishk Pandey: Hailing from Divyapur, UP, he has a background in creative copywriting and scriptwriting. Tanishk and Astha are also a married couple.

Brand Overview

- Ayuvya and Imfresh represent a dual-brand approach to wellness and personal care. Ayuvya focuses on modernizing traditional Ayurveda, specializing in health supplements that address specific concerns like weight gain and digestion using “Brimhan” (body-building) herbs.

- Imfresh is a separate venture that introduced India’s first full-body deodorant cream, born out of a desire to provide fragrance solutions in a unique, non-spray format. The business is heavily driven by performance marketing, with a significant 80% of sales coming from Tier 3 and Tier 4 towns.

Shark Tank India Appearance & Ask

- The founders appeared on the show seeking ₹1 crore for 0.5% equity, valuing the company at a staggering ₹200 crore.

- Their pitch highlighted their rapid scale, having bootstrapped the business from credit card limits to a ₹51.5 crore revenue in just three years.

Season and Episode Air Date

- Season: 05

- Episode: 11

- Episode Air Date: Monday, 19 January 2026

Product Overview

The brand’s portfolio is divided into two distinct lines:

- Ayuvya (Health): The hero products are iGain Plus and Legs Gain. These supplements use ingredients like Ashwagandha, Safed Musli, and Senna to improve appetite, digestion, and nutrient absorption to facilitate healthy weight gain.

- Imfresh (Personal Care): A cream-based deodorant designed for the whole body, offering an alternative to traditional alcohol-based sprays.

Product Highlights

- Weight Gain Specialist: 75% of the revenue is generated from weight gain products, a niche the founders identified through customer feedback.

- Scientific Ayurveda: Formulations are inspired by classical texts like Bhav Prakash and Keshari Ratnavali.

- AYUSH Certified: All products carry AYUSH certification, and the R&D team is led by an MD in Ayurveda.

- High Margins: The products boast impressive gross margins of 75% to 77%.

Customer Engagement Philosophy

- The founders follow a “Dynamic Content” philosophy. They produce nearly 40 UGC (User Generated Content) video ads per day to stay relevant on Meta platforms.

- They use AYUSH-certified doctors in their advertisements to explain the science behind the products, aiming to educate the rural and semi-urban Indian consumer (Tier 3 and 4) who primarily shops via Facebook and Instagram.

Investor Reactions

The Sharks were deeply impressed by the financial discipline and scale of the business but remained skeptical about the brand’s long-term sustainability:

- Performance vs. Brand: Aman Gupta and Vineeta Singh felt the business was more of a “trading” or “performance marketing” play than a sustainable brand.

- Clinical Validation: Kunal Bahl and Ritesh Agarwal raised serious concerns regarding the lack of third-party clinical trials for the specific formulations, arguing that “individual ingredient testing” is not the same as “product testing.”

- Retention Issues: Vineeta Singh pointed out the lack of clarity on annual repeat customer rates, suggesting the business relies too heavily on finding new customers rather than retaining old ones.

- Conflict of Interest: Namita Thapar exited due to her existing involvement in the Ayurvedic space.

Future Vision

- The founders aim to transition Ayuvya from a weight-gain specialist into a chronic care provider.

- Their roadmap includes developing Ayurvedic solutions for long-term health issues such as diabetes, cholesterol, and piles, while continuing to scale the Imfresh brand in the personal care category.

Deal Finalized or Not

- No Deal.

- Despite the impressive ₹70 crore revenue projection and profitability, the Sharks declined to invest due to concerns over product validation, low customer retention data, and the risk of being overly dependent on Meta advertising.

| Parameter | Details |

|---|---|

| Episode Review | Ayuvya & Imfresh Shark Tank India Episode Review |

| Ayuvya Website | Ayuvya |

| Ayuvya Technology | Built on JavaScript frameworks using Next.js 13.4.12 and React |

| Ayuvya SEO Performance | Great SEO performance |

| Ayuvya Organic Traffic | 60,727 visitors per month |

| Imfresh Website | Imfresh |

| Imfresh Technology | Built on JavaScript frameworks using Next.js 13.4.12 and React |

| Imfresh SEO Performance | Average SEO performance, improvement needed |

| Imfresh Organic Traffic | 3,544 visitors per month |

| Founder – Astha Jain | Engineer from PEC, originally from Bhind MP, manages operations and strategy |

| Founder – Pawanjot Kaur | PEC graduate from Jalandhar Punjab, inspired by Ayurveda curing eczema |

| Founder – Tanishk Pandey | From Divyapur UP, creative copywriter and scriptwriter, married to Astha Jain |

| Brand Model | Dual-brand approach with Ayuvya and Imfresh |

| Ayuvya Brand Focus | Modern Ayurvedic health supplements for weight gain and digestion |

| Imfresh Brand Focus | India’s first full-body cream-based deodorant |

| Core Market | Tier 3 and Tier 4 towns |

| Sales Contribution | 80% sales from Tier 3 and Tier 4 regions |

| Shark Tank Ask | ₹1 crore for 0.5% equity |

| Valuation Asked | ₹200 crore |

| Revenue Achievement | ₹51.5 crore in 3 years, bootstrapped |

| Season | Shark Tank India Season 05 |

| Episode Number | Episode 11 |

| Air Date | Monday, 19 January 2026 |

| Ayuvya Hero Products | iGain Plus and Legs Gain |

| Key Ingredients | Ashwagandha, Safed Musli, Senna |

| Imfresh Product | Cream-based full-body deodorant |

| Revenue Concentration | 75% revenue from weight gain products |

| Certification | AYUSH certified |

| R&D Leadership | Led by an MD in Ayurveda |

| Gross Margins | 75% to 77% |

| Content Strategy | Dynamic content with around 40 UGC videos per day |

| Advertising Platforms | Facebook and Instagram |

| Shark Concern – Branding | Seen as performance marketing driven business |

| Shark Concern – Validation | Lack of third-party clinical trials |

| Shark Concern – Retention | Low clarity on repeat customer data |

| Deal Outcome | No deal |

| Reason for No Deal | Validation gaps, retention concerns, Meta ad dependency |

| Future Vision | Expansion into chronic care and scaling Imfresh |

| Target Chronic Categories | Diabetes, cholesterol, piles |

| Ayurveda Market Growth | 21.5% CAGR, projected $35 billion by 2030 |

| Deodorant Market Size | Over $1 billion (2024) |

| Core Ayuvya Audience | Men aged 18–35 from Tier 3 and 4 towns |

| Core Imfresh Audience | Chem-conscious unisex young adults |

| Distribution Split | 60% D2C, 40% marketplaces |

| Key Advantage | High margins and profitability |

| Key Challenge | Trust deficit due to lack of clinical trials |

| Long-Term Goal | ₹100 crore ARR with improved retention and validation |

Ayuvya & Imfresh Shark Tank India Business Plan

1. Business Potential in India: Ayuvya & Imfresh

- Ayurveda Market Growth: The Indian Ayurveda market is projected to grow at a CAGR of 21.5% through 2026–2030, reaching approximately $35 billion by 2030.

- Nutraceuticals Shift: Preventive healthcare and “personalization” are major trends. Ayuvya is perfectly positioned as 77% of Indian households now use Ayurveda-based products for daily wellness.

- Deodorant Innovation: The Indian deodorant market is valued at over $1 billion (2024) and is growing at 5.21% CAGR. Imfresh’s cream-based format addresses the “natural/organic” shift where 47% of consumers are moving away from chemical sprays.

2. Total Addressable Market (TAM): Ayuvya & Imfresh

- Ayuvya TAM (Wellness): Includes the 400 million+ policyholders now covered under AYUSH health insurance and the growing demographic of “weight-conscious” individuals in rural India.

- Imfresh TAM (Personal Care): Targets the $31.2 billion Beauty and Personal Care market in India, specifically the 27% segment dedicated to natural skincare and grooming.

- Tier 3 & 4 Dominance: With 62% of new health-related sales originating from non-metro locations, the “Bharat” market remains the primary revenue driver for these brands.

3. Ideal Target Audience & Demographics: Ayuvya & Imfresh

- The Ayuvya “Gainer”: Primary segment is Men (80%) aged 18–35 in Tier 3 & 4 towns (e.g., UP, MP, Rajasthan) seeking physical transformation for confidence or job requirements (e.g., military/police fitness).

- The Imfresh “Modernist”: Young adults (Unisex) who are “chem-conscious” and prefer long-lasting, skin-friendly fragrance over alcohol-heavy aerosols.

- Psychographics: Value-conscious consumers who trust traditional “Dadi-Nani” (Grandmother) wisdom but want the convenience of a modern capsule or cream.

4. Marketing & Content Strategy: Ayuvya & Imfresh

- Dynamic UGC Engine: Continue the 40 video ads/day cycle to combat “ad fatigue” on Meta platforms.

- The “Expert-Trust” Loop: Use AYUSH doctors in short-form content to explain the Prakriti (body type) benefits of ingredients like Ashwagandha and Vidarikand.

- Vernacular Content: Focus on Hindi and regional dialects to maintain the 80% Tier 3/4 conversion rate.

- SEO & Web Performance: Leverage Ayuvya’s high organic traffic (60k/mo) to cross-sell Imfresh (3.5k/mo) through bundled “Wellness & Grooming” kits.

5. Digital Marketing Strategy: Ayuvya & Imfresh

- Meta Arbitrage: Maintain the 3.38x ROAS by scaling “Lookalike Audiences” based on the successful weight-gain customer profile.

- Educational Funnels: Shift from “Direct Buy” to “Consultation First” ads, where users get a free diet chart or doctor chat before purchasing.

- Retention Remarketing: Use WhatsApp Business API to offer refill discounts 25 days after the first purchase to solve the “low repeat rate” concern raised by Sharks.

6. Distribution Strategy: Ayuvya & Imfresh

- D2C First (60%): Optimize the Next.js/React websites for mobile-first checkout, as most Tier 4 traffic comes from low-end smartphones.

- Marketplace Power (40%): Deepen penetration on Flipkart and Meesho, which are the go-to apps for rural Indian e-commerce.

- Phygital Future: Pilot small-scale “Ayuvya Experience Centers” in districts like Bhind or Divyapur to build physical trust and credibility.

7. Advantages & Challenges: Ayuvya & Imfresh

Advantages

- Profitability: Already EBITDA positive with high 75%+ gross margins.

- Execution Speed: Bootstrapped to ₹51.5 crore in 3 years with zero external funding.

- Niche Leadership: Dominance in the “Ayurvedic Weight Gain” category where competition is fragmented.

Challenges

- The “Trust Deficit”: Lack of third-party clinical trials for the final formulation (not just ingredients).

- Platform Dependency: High risk of “Ad Account Bans” on Meta, as seen with their previous sexual wellness category.

- Brand vs. Trade: Currently viewed as a performance-marketing engine rather than a “household brand.”

8. Success Reasons & Mitigation: Ayuvya & Imfresh

- Why it can Succeed: It solves a specific, high-intent problem (weight gain) for a neglected demographic (Rural Men) using a trusted system (Ayurveda).

- Mitigation for Clinical Concerns: Invest in Double-Blind Placebo-Controlled Trials for iGain Plus to provide the scientific proof Sharks demanded.

- Mitigation for Repeat Rates: Launch a Loyalty Program and “Subscription Model” (15% off for recurring orders) to increase Customer Lifetime Value (LTV).

9. Future Business & Roadmap: Ayuvya & Imfresh

- Year 1 (Scientific Credibility): Obtain third-party validation and ISO/GMP certifications for all flagship formulations.

- Year 2 (Category Expansion): Enter Chronic Care (Diabetes/Piles) utilizing the same Tier 3 distribution network.

- Year 3 (Omnichannel): Expand into modern trade pharmacies (Apollo, Wellness Forever) to diversify away from Meta-only sales.

10. Roadmap to Increase Valuation: Ayuvya & Imfresh

- Data Attribution: Implement advanced analytics to track “Yearly Cohort Retention.” A brand with 40% repeat rate commands a 3x higher valuation than a pure acquisition business.

- Brand Building: Move from UGC-only ads to Brand Storytelling featuring the founders’ journey to build emotional equity.

- Revenue Diversification: Aim for a 50/50 split between website and marketplaces to reduce platform risk, aiming for a ₹100 crore ARR to justify a ₹200-300 crore valuation.

Leave a Comment