Sovrenn Shark Tank India Episode Review

Sovrenn appeared on Shark Tank India Season 5, Episode 13, with co-founders Aditya Joshi (IIT Delhi Silver Medalist, IIM Calcutta, ex-VP Lenskart, ex-Senior VP Stanza Living), Akriti Swaroop (IIT Kharagpur, IIM Calcutta, CFA, ex-Credit Suisse/Deutsche Bank), and Apoorva Joshi (IIT Delhi, IIM Calcutta) seeking ₹1 Crore for 1% equity (₹100 Crore valuation) but left with no deal despite impressive profitability.

The Delhi-based fintech platform simplifies stock market research by transforming 1 crore pages of company filings into actionable insights through Sovrenn Discovery (logic-based stock finding), Pulse (AI-powered portfolio alerts), Education (₹10k-20k courses), and Prime (premium research). With 193,679 monthly organic visitors, 30,000+ daily active users, ₹1.2 Crore net profit on ₹4.5 Crore ARR, 40% IRR, and zero marketing spend, they achieved exceptional metrics. However, Sharks Anupam Mittal and Kunal Bahl questioned scalability of the manual “Founder-Led Content Play” versus AI competitors like Multibagg AI automating 90% of work, viewing it as lacking tech platform scalability without constant founder input. Operating in India’s exploding investor market (3 crore to 12 crore investors since 2019, 21.28 crore Demat accounts with 1 lakh daily openings, retail holding at 22-year high of 18.75% worth ₹83.6 trillion), Sovrenn targets Gen Z/millennials and experienced investors (50/50 split) in Tier 2/3 cities within $51.3 billion Indian fintech market projected for 2026.

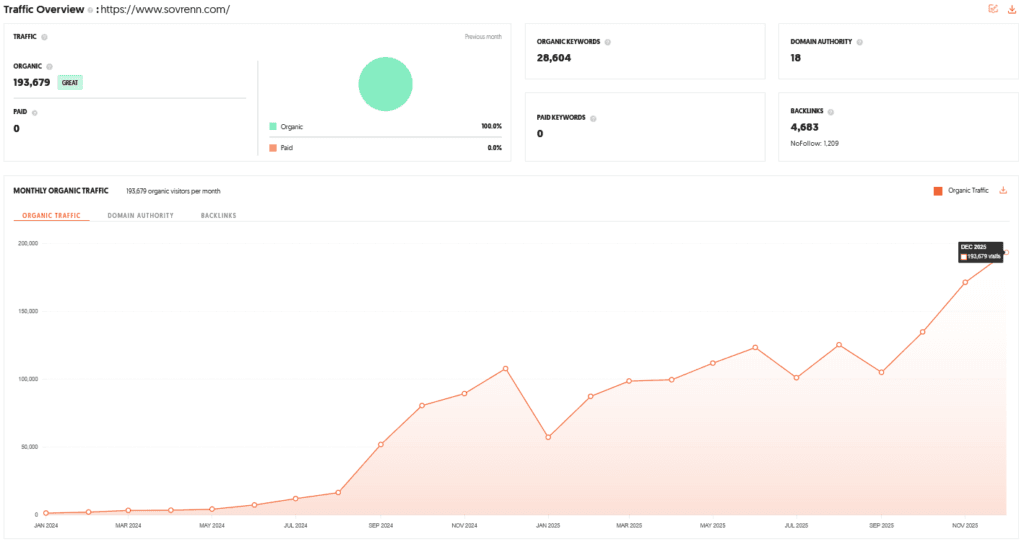

Website Information

- Website:- Sovrenn

- Build on JavaScript frameworks Next.js 14.2.28 Emotion React

- Great SEO Performance.

- ORGANIC TRAFFIC: 193679 visitor per month.

Founder

Sovrenn was founded by a high-pedigree leadership team:

- Aditya Joshi: Co-founder & CEO. An IIT Delhi (Silver Medalist) and IIM Calcutta alumnus, formerly a VP at Lenskart and Senior VP at Stanza Living.

- Akriti Swaroop: Co-founder & COO. An IIT Kharagpur and IIM Calcutta alumna and CFA Charterholder with research experience at Credit Suisse and Deutsche Bank.

- Apoorva Joshi: Co-founder. Aditya’s sister, an IIT Delhi and IIM Calcutta alumna.

Brand Overview

- Sovrenn (Sovrenn Financial Technologies Private Limited) is a Delhi-based fintech platform dedicated to simplifying stock market research for retail investors.

- The brand operates with the philosophy that while market data is vast, it is often “unreadable” for the average person.

- Sovrenn bridges this gap by transforming nearly one crore pages of annual company filings into structured, actionable insights.

Shark Tank India Appearance & Ask

The founders appeared in Season 5, Episode 13, presenting a pitch focused on “Information vs. Intelligence.”

- The Ask: ₹1 Crore for 1% equity.

- Valuation: ₹100 Crores. The pitch emphasized their bootstrapped nature and daily active user base of 30,000+ investors.

Season and Episode Air Date

- Season: 05

- Episode: 13

- Episode Air Date: Wednesday, 21 January 2026

Product Overview

Sovrenn offers an integrated ecosystem for stock discovery and financial education:

- Sovrenn Discovery: A flagship tool that uses logic-based buckets (e.g., revenue guidance, capacity expansion) to help users find high-growth companies.

- Sovrenn Pulse: A tracking tool where users upload portfolios to receive AI-powered filing summaries and real-time alerts.

- Sovrenn Education: Structured, self-paced video courses priced at approximately ₹10,000 to ₹20,000 to improve financial literacy.

- Sovrenn Prime: A premium subscription service providing deep-dive research summaries.

Investor Reactions

The Sharks’ reactions were a mix of respect for the business’s current state and skepticism about its future:

- The “AI vs. Human” Debate: Anupam Mittal and Kunal Bahl were concerned that Sovrenn’s model relies heavily on manual human curation (Aditya reading filings). They argued that AI-driven competitors (like Multibagg AI, which appeared in the same episode) might soon automate 90% of this work.

- Scalability Concerns: Sharks felt the business was currently a “Founder-Led Content Play” rather than a tech platform that could scale globally without the founders’ constant manual input.

- Appreciation: All Sharks praised the founders’ IRR of 40% and their “zero marketing spend” organic growth.

Customer Engagement Philosophy

Sovrenn follows a “Learning-First” approach. They focus on empowering “Sovereign” investors—those who make decisions based on conviction rather than unverified social media tips. Their strategy relies on:

- Organic Reach: Using educational threads and free daily newsletters to acquire users at near-zero cost.

- Anonymity & Insight: Providing a database to track promoter “red flags” (like circular transactions) that aren’t easily found elsewhere.

Product Highlights

- High Profitability: Achieved a ₹1.2 Crore net profit on an ARR of ₹4.5 Crores.

- Zero CAC: Customer Acquisition Cost is virtually zero due to strong social media presence.

- Simplified Data: Converts complex, thousand-page regulatory filings into concise summaries.

- Dual User Base: Evenly split between beginners (under 1 year) and experienced investors.

Future Vision

The brand aims to transition its manual analysis into an AI-powered ecosystem while maintaining the depth of traditional equity research. Their roadmap includes:

- Projected Growth: Aiming for ₹3.5 Crores in revenue for FY 25-26.

- Financial Independence: Their mission is to provide every Indian with the tools to be truly financially “Sovereign.”

- Corporate Partnerships: Expanding into B2B data partnerships to diversify revenue beyond retail subscriptions.

Deal Finalized or Not

- No deal was finalized. Although the Sharks were deeply impressed by the founders’ academic credentials and the company’s high profitability (₹1.2 Crores PAT), they ultimately declined to invest.

- The founders walked away without a deal as the panel remained divided on the scalability of their human-led model.

| Category | Parameter | Details |

|---|---|---|

| Website & Tech | Website | Sovrenn |

| Tech Stack | Next.js 14.2.28, Emotion React | |

| Framework | JavaScript | |

| SEO Performance | Excellent | |

| Monthly Organic Traffic | 193,679 visitors | |

| Founders | Aditya Joshi | Co-founder & CEO – IIT Delhi (Silver Medalist), IIM Calcutta, Ex-VP Lenskart, Ex-SVP Stanza Living |

| Akriti Swaroop | Co-founder & COO – IIT Kharagpur, IIM Calcutta, CFA, Ex-Credit Suisse, Deutsche Bank | |

| Apoorva Joshi | Co-founder – IIT Delhi, IIM Calcutta | |

| Company Overview | Legal Name | Sovrenn Financial Technologies Pvt. Ltd. |

| Location | Delhi, India | |

| Industry | Fintech / Stock Market Research | |

| Core Philosophy | Information vs Intelligence | |

| Core Value | Converts ~1 crore pages of filings into actionable insights | |

| Shark Tank India | Season | 05 |

| Episode | 13 | |

| Air Date | Wednesday, 21 January 2026 | |

| Ask | ₹1 Crore for 1% equity | |

| Valuation | ₹100 Crores | |

| Daily Active Users | 30,000+ | |

| Business Status | Bootstrapped | |

| Products | Sovrenn Discovery | Logic-based high-growth stock discovery |

| Sovrenn Pulse | AI-powered portfolio tracking & alerts | |

| Sovrenn Education | Financial courses priced ₹10k–₹20k | |

| Sovrenn Prime | Premium deep-dive research subscription | |

| Financials | ARR | ₹4.5 Crores |

| Net Profit (PAT) | ₹1.2 Crores | |

| Gross Margin | ~85% | |

| CAC | Zero | |

| Marketing Spend | Zero | |

| Investor Reactions | AI vs Human Debate | Concerns over heavy manual curation |

| Scalability | Viewed as founder-led content model | |

| Appreciation | 40% IRR, organic growth, profitability | |

| Competition Risk | AI platforms like Multibagg AI | |

| Customer Strategy | Philosophy | Learning-first |

| Investor Identity | “Sovereign Investors” | |

| Acquisition Method | Educational threads & free newsletters | |

| Unique Feature | Promoter red-flag databases | |

| Target Audience | Aspirational Alpha | Gen Z & Millennials (18–44) |

| Serious Researchers | Experienced investors | |

| Geography | Tier 2 & Tier 3 cities | |

| Income Bracket | ₹5L+ annually | |

| User Split | 50% beginners / 50% experienced | |

| Market Opportunity | Individual Investors | 12+ crore (2025) |

| Demat Accounts | 21.28 crore | |

| Daily Account Additions | ~1 lakh | |

| Retail Equity Holding | 18.75% (~₹83.6 trillion) | |

| Market Gap | Low financial literacy | |

| TAM / SAM / SOM | TAM | 210M Demat holders + $51.3B fintech market |

| SAM | 4.5 crore traders & 13.6 crore investors | |

| SOM | 1–2% (5–10 lakh paid users) | |

| Revenue Target | ₹150 Cr+ ARR | |

| Marketing Strategy | Primary Channel | SEO-first |

| Social Engine | Aditya Joshi on X & LinkedIn | |

| Content Engine | Sovrenn Times | |

| Community | Prime-only investor groups | |

| Distribution | D2C | Web & Mobile App |

| Pricing | Prime ₹3,000/year | |

| Funnel | Newsletter → Prime → Education | |

| B2B | Brokerages & wealth firms | |

| Advantages | Key Strengths | IIT/IIM credibility, profitability, proprietary data |

| Challenges | Key Risks | Human scalability, AI competition, founder dependency |

| Risk Mitigation | Strategy | AI-augmented human verification |

| Future Roadmap | FY 25–26 | ₹3.5 Cr revenue |

| Year 2 | B2B Data API – ₹10 Cr ARR | |

| Year 3 | AI Agent for filing analysis | |

| Valuation Goal | 15–20x PAT | |

| Final Outcome | Deal Status | ❌ No Deal |

| Reason | Scalability concerns | |

| Shark Sentiment | Highly impressed but divided | |

| Founder Exit | Walked away without funding |

Sovrenn Shark Tank India Business Plan

1. Sovrenn: Executive Business Summary

- The brand specializes in high-fidelity stock market research, converting millions of pages of unstructured company filings into actionable insights.

- Operating with a “Privacy-First” and “Learning-First” approach, Sovrenn has achieved significant profitability with zero marketing spend, proving the power of organic content-led growth.

2. Sovrenn: Business Potential in India (Facts & Data)

The Indian market is experiencing a structural shift from “savers” to “investors,” creating a massive opportunity for Sovrenn:

- Investor Explosion: India’s individual investor base has surged from 3 crore in 2019 to over 12 crore by 2025.

- Demat Growth: Total Demat accounts in India hit a record 21.28 crore in late 2025, with roughly 1 lakh new accounts being opened daily.

- Shift to Direct Equity: Retail holding in NSE-listed companies reached a 22-year high of 18.75% in Q2 FY26, valued at approximately ₹83.6 trillion.

- Financial Literacy Gap: While 40% of new investors are under 30, a significant portion lacks the technical expertise to read balance sheets, creating a direct demand for Sovrenn’s simplified insights.

3. Sovrenn: Total Addressable Market (TAM)

- TAM (Total Addressable Market): All 210 million Demat account holders and the broader $51.3 billion Indian fintech market (projected for 2026).

- SAM (Serviceable Addressable Market): The 4.5 crore active monthly traders and 13.6 crore individual investors who seek beyond “tips” for conviction-led investing.

- SOM (Serviceable Obtainable Market): Capturing 1-2% of India’s active investor base (~5-10 lakh paid subscribers) within 5 years, targeting an ARR of ₹150 Crore+.

4. Sovrenn: Ideal Target Audience & Demographics

- The “Aspirational Alpha”: Gen Z (Ages 18-27) and Millennials (Ages 28-44) from Tier 2 and Tier 3 cities who are mobile-first and seek financial independence.

- The “Serious Researcher”: Experienced investors (50% of Sovrenn’s current base) who need deep-dive data to identify small-cap and micro-cap “multibaggers.”

- Demographics: Professionals, business owners, and students with an annual income of ₹5L+ who value Sovrenn’s high-pedigree insights (IIT/IIM founded).

5. Sovrenn: Marketing & Digital Content Strategy

Sovrenn currently maintains a “Great SEO Performance” with 193,679 monthly organic visitors.

- “Sovrenn Times” Social Engine: Continue using Aditya Joshi’s educational threads on X (Twitter) and LinkedIn to drive top-of-funnel traffic at zero cost.

- SEO-First Approach: Capitalize on the Next.js framework to rank for high-intent keywords like “quarterly result summaries,” “promoter red flags,” and “small-cap analysis.”

- Community-Led Growth: Building private communities for Sovrenn Prime members to discuss human-curated “logic buckets” (e.g., companies with 100%+ revenue guidance).

6. Sovrenn: Distribution & Sales Strategy

- Direct-to-Consumer (D2C): The primary channel is the Sovrenn web platform and mobile app (built on Next.js and Emotion React for high speed).

- B2B Partnerships: Partner with wealth management firms and smaller brokerages to provide Sovrenn Discovery as a value-added research tool for their clients.

- Freemium Funnel: Use the free daily newsletter to convert users into Sovrenn Prime (₹3,000/yr) and Sovrenn Education (₹10k-₹20k) tiers.

7. Sovrenn: Advantages & Challenges

| Sovrenn Advantages | Sovrenn Challenges |

| High Pedigree: IIT/IIM/CFA founders provide instant trust in a “noisy” market. | Scalability Risk: The “Human-Led” model is difficult to scale globally without massive hiring. |

| Financial Health: Highly profitable (₹1.2 Cr PAT) with an 85% gross margin. | AI Competition: Automated AI tools like Multibagg AI could disrupt manual curation speeds. |

| Proprietary Data: Databases on promoter investigations are a unique moat. | Founder Dependency: The brand is currently synonymous with the founders’ personal brands. |

8. Sovrenn: Success Factors & Mitigation Strategies

- Why Sovrenn can succeed: In a world of AI-generated noise, human-verified intelligence acts as a premium “filter” that serious investors are willing to pay for.

- Mitigation for Scalability: Gradually transition from “Manual Only” to AI-Augmented Curation, where AI scrapes data and human analysts verify the “Red Flags.”

- Mitigation for AI Competition: Focus on “Investigative Fintech”—conducting channel checks and promoter background scores that AI cannot yet replicate on-ground.

9. Sovrenn: Future Business & Valuation Roadmap

To reach and exceed the ₹100 Crore Valuation presented on Shark Tank:

- Roadmap Year 1 (FY 25-26): Reach ₹3.5 Crore Revenue by expanding the “Prime” subscriber base through aggressive SEO and organic social virality.

- Roadmap Year 2: Launch Sovrenn B2B Data API for corporate research and institutional investors; target ₹10 Crore ARR.

- Roadmap Year 3: Full integration of Sovrenn AI-Agent, allowing users to query 10 years of filings instantly with human-verified overlays.

- Valuation Increase: Shift from a content/education play to a SaaS-based Fintech Terminal, commanding a 15-20x multiple on PAT as the brand becomes the “Bloomberg for Retail India.”

Leave a Comment