Shark Tank India Season 5 Episode 21 Review

Episode Overview

Episode 21 of Shark Tank India Season 5 (aired Monday, February 2, 2026) presented a striking study in contrasts—featuring everything from chunky cookies to military-grade gyrocopters to AI-powered health rings. The episode explored fundamental questions about market viability, founder attitude, innovation authenticity, and the delicate balance between premium positioning and realistic valuation. From a successful three-Shark collaboration to complete rejections rooted in market skepticism and founder demeanor, this episode demonstrated how both product and personality determine investment outcomes.

Episode Summary

Success Rate: 1 out of 3 deals closed

Total Investment: ₹80 Lakhs deployed through strategic three-Shark partnership

Key Theme: The episode centered on the tension between premium positioning and market reality—when does “premium” justify high valuations, and when does it signal a niche too narrow to scale?

Pitch 1

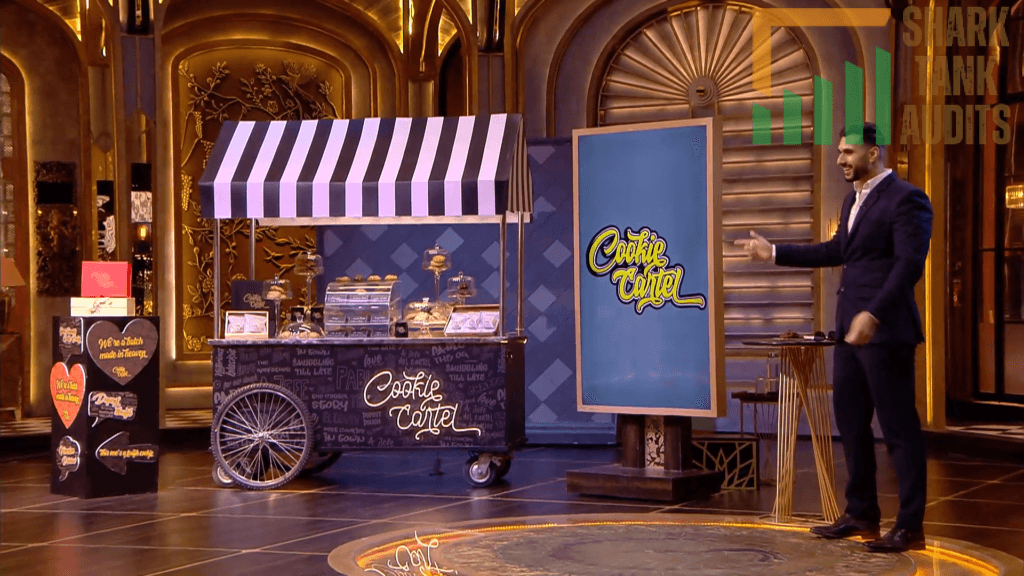

Cookie Cartel Shark Tank India Episode Review

In Shark Tank India Season 5, Episode 21 (aired Monday, February 2, 2026), the premium dessert brand Cookie Cartel—founded by Hisham Sunehra—presented its “New York–style” chunky and stuffed cookies. Sunehra initially sought an investment of ₹75 Lakhs for 5% equity at a ₹15 crore valuation. Despite being currently loss-making due to high marketing spends, the brand impressed the Sharks with its 65% gross margins and a high repeat purchase rate (up to 42% on food aggregators).

After a round of negotiations, a deal was finalized at ₹80 Lakhs for 12% equity (valuing the company at ₹6.67 crores), with Anupam Mittal, Kanika Tekriwal, and Vineeta Singh teaming up to back the venture. Cookie Cartel differentiates itself through its “smuggling” narrative and nitrogen-flushed packaging that ensures a 30-day shelf life for its thick, gooey cookies like “The Godfather” and “Notorious Blackie.”

Pitch 2

Avia Litewings Shark Tank India Episode Review

Avia Litewings appeared on Shark Tank India Season 5, Episode 20, with founders Air Marshal P.K. Desai (Retd, CMD, 40+ years experience), Wing Commander Jaydev Desai (Retd, CEO), Group Captain Kedar Kakade (Retd, COO), and Sergeant Vikram Trivedi (Head Engineer) seeking ₹1 Crore for 1% equity (₹100 Crore valuation) but left with no deal despite Sharks respecting military service and technical sophistication.

The Ahmedabad-based Government of India registered startup pioneers ultralight aviation offering gyrocopters (lightweight aircraft using non-powered rotor autorotation for lift, safer/easier than helicopters) and ultralight helicopters (<600kg max takeoff weight, 1-2 occupants) plus Pilot Training School, Engineering Instruction School, and Maintenance/Repair Organization (MRO) with 0 monthly organic visitors requiring SEO overhaul.

Operating via comprehensive aviation ecosystem with carbon fiber/titanium aircraft priced ₹40 lakh-₹1.2 Crore plus training (₹3-7 lakh/course) and MRO services (5-8% aircraft value AMC) in partnership with Italy’s Lamanna Ultralight Aviation, they target adventure enthusiasts (25-45), HNIs/CEOs (40-60, ₹10 Cr+ net worth), agri-entrepreneurs, and government agencies within Indian aviation market expected to reach $16.53 billion by 2026 (11.86% CAGR), global ultralight market projected at $9.45 billion by 2026, and Indian ultralight/aero-sports market estimated at ₹2,500 Crore by 2028, aiming for 5% capture (₹125 Crore revenue) amid government’s UDAN scheme push for 220+ operational airports by 2027 and 10% annual HNI population growth, though Sharks declined citing niche market, regulatory hurdles, and capital-intensive scalability concerns.

Pitch 3

Aabo Ring Shark Tank India Episode Review

Aabo Ring appeared on Shark Tank India Season 5, Episode 20, with founders Nirav Hemani and Atul Hemani seeking ₹1.5 Crore for 1% equity (₹150 Crore valuation) but left with no deal after all five Sharks opted out citing valuation concerns, lack of innovation, messy cap table, and founders’ dismissive attitude toward competitors.

The wearable tech brand positioned as “Indian version of Oura” offers AI-powered smart ECG rings tracking 30+ health parameters (ECG, heart rate, sleep quality, stress, activity) with water/scratch resistance and multi-day battery life, growing from ₹62 lakh (FY 23-24) to ₹3 Crore (FY 24-25) with ₹1.7 Crore YTD projecting ₹11 Crore (FY 25-26) and 186 monthly organic visitors. The pitch became controversial when founders repeatedly called boAt’s rings “third grade” fashion accessories versus serious health tools—Aman defended boAt’s pricing/logic demanding data respect, Vineeta slammed founders for taunting versus business focus calling valuation “outlandish,” Anupam criticized lack of “disruptive innovation” noting 33% equity already given for ₹5 Crore leaving no funding room, Namita questioned “AI” claims as basic analytics noting difficulty competing with Oura/UltraHuman, and Kanika criticized cheap packaging (paper peeling off velvet boxes) despite high price.

Operating in Indian smart wearable market valued at $3.62 billion (2026, 23.17% CAGR) with smart rings growing faster at 24.4% CAGR through 2031 and 15.1% annual growth in “Rich” households (>$36,000/year), Aabo holds 10.5% Indian smart ring volume share targeting 15-20% premium niche by 2027 among tech-savvy professionals (25-44, 55% male/45% female, ₹15 lakh+ household income) in Tier 1 cities seeking discreet jewelry-style health monitoring.

Episode Highlights

The Sweet Success Story

Cookie Cartel’s Strategic Close: Hisham Sunehra secured a rare three-Shark partnership (Anupam Mittal, Kanika Tekriwal, Vineeta Singh) despite being currently loss-making. The deal represented a 55% valuation reduction (₹15 Cr → ₹6.67 Cr) but gained the brand crucial expertise across D2C, aviation retail, and beauty/lifestyle sectors.

What Worked:

- Impressive Unit Economics: 65% gross margins demonstrated strong product-market fit

- Customer Loyalty: 42% repeat purchase rate on food aggregators proved customers come back

- Differentiation: “Smuggling” narrative + nitrogen-flushed packaging (30-day shelf life) for thick, gooey cookies

- Strategic Acceptance: Founder prioritized expertise over valuation, accepting 2.4x dilution (5% → 12%)

The Military Precision That Couldn’t Scale

Avia Litewings’ Respectful Rejection: A team of retired military officers (Air Marshal, Wing Commander, Group Captain, Sergeant) with 40+ years combined experience pitched India’s ultralight aviation ecosystem. Despite Sharks’ deep respect for their service and technical sophistication, all declined investment.

The Paradox:

- Impressive Credentials: Government of India registered, partnership with Italy’s Lamanna Ultralight Aviation

- Comprehensive Offering: Gyrocopters (₹40 lakh-₹1.2 Crore) + pilot training (₹3-7 lakh) + MRO services

- Large Market Claims: Global ultralight market at $9.45 billion by 2026, Indian aero-sports at ₹2,500 Crore by 2028

- Fatal Flaws: Niche customer base, regulatory complexity, capital-intensive operations, 0 organic visitors

The Sharks’ Dilemma: How do you invest in a venture that requires military-grade expertise, extensive regulatory navigation, and massive capital while targeting a tiny addressable market of HNIs and adventure enthusiasts?

The Attitude Adjustment That Never Came

Aabo Ring’s Self-Inflicted Wounds: What could have been a competitive smart ring pitch became a cautionary tale about founder arrogance. The Hemani brothers repeatedly dismissed boAt’s rings as “third grade fashion accessories” versus their “serious health tools”—directly antagonizing Shark Aman Gupta, boAt’s founder.

The Meltdown:

Aman’s Defense: Demanded data respect for boAt’s pricing and market logic

Vineeta’s Slam: Called out founders for “taunting versus business focus,” labeled ₹150 Cr valuation “outlandish”

Anupam’s Innovation Critique: Noted lack of “disruptive innovation,” pointed out 33% equity already given for ₹5 Crore leaves no funding room

Namita’s AI Skepticism: Questioned “AI” claims as just basic analytics, noted difficulty competing with Oura/UltraHuman

Kanika’s Quality Concern: Criticized cheap packaging (paper peeling off velvet boxes) despite high price point

The Lesson: When you walk into the tank calling a Shark’s product “third grade,” you better have extraordinary innovation and humility to back it up. Aabo Ring had neither.

Shark Dynamics

The Three-Shark Power Play (Cookie Cartel)

The collaboration between Anupam, Kanika, and Vineeta represented strategic portfolio diversification:

- Anupam: Consumer internet and D2C scaling expertise

- Kanika: Aviation and premium travel retail connections

- Vineeta: Beauty and lifestyle brand building experience

This multi-Shark approach gave Cookie Cartel access to complementary networks while distributing investment risk across three partners.

The Unanimous “No” to Premium Positioning

Both Avia Litewings and Aabo Ring faced complete Shark rejection, but for vastly different reasons:

Avia Litewings: Respectful decline due to market fundamentals (niche, capital-intensive, regulatory complexity)

Aabo Ring: Harsh rejection due to founder attitude, lack of innovation, and valuation disconnect

Aman’s Defended Honor

Rarely do Sharks take personal offense in the tank, but Aabo Ring’s repeated attacks on boAt’s products pushed Aman to demand respect for his company’s market logic and pricing strategy. This moment highlighted how founder attitude can instantly kill deals—even in competitive markets with growth potential.

Market Insights Revealed

The episode showcased three radically different premium markets:

- Premium Desserts (Cookie Cartel): Riding India’s expanding D2C food market and the “experience economy” where consumers pay premium for artisanal, Instagram-worthy treats

- Ultralight Aviation (Avia Litewings): Targeting the $16.53 billion Indian aviation market (11.86% CAGR) and ₹2,500 Crore aero-sports segment, constrained by regulatory barriers and limited customer base

- Smart Health Wearables (Aabo Ring): $3.62 billion Indian smart wearable market (23.17% CAGR) with smart rings growing at 24.4% CAGR, facing fierce competition from established players

Key Takeaways

1. Premium Doesn’t Always Mean Profitable (Yet)

Cookie Cartel’s Reality: Despite 65% gross margins, the brand remains loss-making due to high marketing spends. The Sharks bet on eventual profitability as brand awareness reduces customer acquisition costs—a common D2C trajectory.

The Calculation: High repeat purchase (42%) suggests strong product-market fit; losses are growth investment, not fundamental business model failure.

2. Technical Excellence ≠ Investable Business

Avia Litewings’ Paradox: You can have:

- Military-grade expertise (40+ years combined experience)

- Government partnerships and certifications

- Comprehensive ecosystem (aircraft + training + maintenance)

- Large market size projections ($9.45B global ultralight market)

…and still not be an attractive venture investment if:

- Customer base is too niche

- Regulatory hurdles are too complex

- Capital requirements are too intensive

- Scalability path is unclear

3. Founder Attitude Can Kill Better Businesses

The Aabo Ring Comparison:

- Better metrics than some funded companies: ₹3 Cr FY24-25, projecting ₹11 Cr FY25-26, 10.5% Indian smart ring market share

- Growing market: Smart rings expanding at 24.4% CAGR

- Fatal flaw: Founders’ dismissive attitude toward competitors and inability to justify “AI” claims or premium valuation

The Math: Good numbers + bad attitude = No deal

4. Multi-Shark Deals Signal Complementary Expertise Needs

Cookie Cartel’s Three-Shark Partnership: Required diverse skillsets:

- D2C/consumer internet (Anupam)

- Premium retail/distribution (Kanika’s aviation connections)

- Brand building/lifestyle positioning (Vineeta)

One Shark couldn’t provide all three; collaboration made strategic sense.

5. “AI-Powered” Without Real AI Is Dangerous Marketing

Aabo Ring’s Claims: Positioned as “AI-powered” but Namita called it out as basic analytics. In 2026’s sophisticated investor landscape, buzzword usage without substance backfires spectacularly.

The Standard: If you claim AI, be prepared to explain the actual machine learning models, training data, and differentiated algorithms—not just data analysis dashboards.

6. Zero Organic Traffic = Zero Digital Strategy

Avia Litewings’ Red Flag: 0 monthly organic visitors for a business targeting adventure enthusiasts and HNIs in 2026 suggests complete absence of SEO, content marketing, or digital presence—unacceptable for scaling any modern business.

7. Cap Table Cleanliness Matters

Aabo Ring’s Problem: Already gave away 33% equity for ₹5 Crore, leaving little room for future funding rounds. Anupam specifically cited this as a concern—messy cap tables signal poor financial planning and future funding challenges.

What Made This Episode Different

The Respect vs. Rejection Dynamic

Avia Litewings received one of the most respectful rejections in Shark Tank India history. Sharks acknowledged the founders’ military service, technical expertise, and comprehensive planning—but still declined due to market fundamentals. This highlighted that even with deep respect for founders, investors must follow market logic.

The Arrogance Tax

Aabo Ring demonstrated what happens when founders forget they’re seeking investment, not delivering a lecture on competitor inferiority. The “third grade” comments about boAt’s products created immediate hostility, turning what could have been a competitive negotiation into a defensive battlefield.

Premium Positioning on Trial

All three pitches involved premium positioning:

- Cookie Cartel: Premium desserts (funded despite losses)

- Avia Litewings: Premium aviation experiences (rejected for niche concerns)

- Aabo Ring: Premium health wearables (rejected for attitude + valuation)

The episode explored when “premium” is a viable strategy versus when it’s an excuse for limited market reach.

Behind the Numbers

Cookie Cartel’s Unit Economics

- Gross Margins: 65% (strong for food products)

- Repeat Rate: 42% on food aggregators (exceptional customer loyalty)

- Current Status: Loss-making (marketing investment phase)

- Valuation Journey: ₹15 Cr ask → ₹6.67 Cr final (55% reduction)

- Equity Dilution: 5% ask → 12% final (2.4x dilution)

- Strategic Trade: Accepted higher dilution for three-Shark expertise

Avia Litewings’ Market Reality

- Product Pricing: ₹40 lakh – ₹1.2 Crore per aircraft

- Training Revenue: ₹3-7 lakh per course

- MRO Services: 5-8% of aircraft value annually

- Market Projections: Indian ultralight market at ₹2,500 Cr by 2028

- Target Capture: 5% market share = ₹125 Cr revenue

- Digital Presence: 0 monthly organic visitors (complete SEO failure)

- Problem: Even capturing 5% of ₹2,500 Cr = ₹125 Cr requires selling 12-30+ aircraft annually to ultra-niche customer base

Aabo Ring’s Valuation Disconnect

- Revenue Trajectory: ₹62 lakh (FY23-24) → ₹3 Cr (FY24-25) → ₹11 Cr projected (FY25-26)

- Current Valuation Ask: ₹150 Crore

- Valuation Multiple: ~13.6x projected FY26 revenue (outlandish for competitive wearables market)

- Market Share: 10.5% Indian smart ring volume (respectable positioning)

- Cap Table Issue: 33% equity already distributed for ₹5 Crore

- Organic Traffic: 186 monthly visitors (weak digital presence for tech product)

The Episode’s Three Premium Paradoxes

Paradox 1: Cookie Cartel (Premium That Works)

Thesis: Artisanal desserts with NYC positioning at premium prices Reality: Currently loss-making but 65% margins + 42% repeat rate justify investment Outcome: Three-Shark deal at reduced valuation Lesson: Premium works when unit economics prove customer willingness to pay repeatedly

Paradox 2: Avia Litewings (Premium That’s Too Niche)

Thesis: Ultra-premium aviation experiences for HNIs and adventure seekers Reality: Market exists but too small, capital-intensive, and regulatory-complex for VC returns Outcome: Respectful unanimous rejection Lesson: Premium can be too premium—when your target market is measured in hundreds, not millions, scaling becomes impossible

Paradox 3: Aabo Ring (Premium Without Justification)

Thesis: Premium smart rings with AI-powered health tracking Reality: Competing with Oura/UltraHuman, questionable “AI” claims, dismissive of competitors Outcome: Harsh unanimous rejection Lesson: Premium pricing requires premium innovation AND premium professionalism—lacking any of the three kills the deal

Founder Personalities on Display

The Pragmatic D2C Builder (Cookie Cartel)

Hisham Sunehra demonstrated:

- Acceptance of valuation reality (₹15 Cr → ₹6.67 Cr)

- Focus on strategic value over equity protection

- Clear understanding of current losses as growth investment

- Willingness to dilute for right expertise (12% for three complementary Sharks)

The Honorable Veterans (Avia Litewings)

The military founders showcased:

- Exceptional technical competence and planning

- Government partnerships and certifications

- Comprehensive ecosystem thinking (products + training + services)

- Unfortunate market reality: excellence doesn’t guarantee investability

The Arrogant Innovators (Aabo Ring)

The Hemani brothers exemplified:

- Superiority complex toward competitors (“third grade” boAt products)

- Buzzword marketing without substance (“AI-powered” = basic analytics)

- Dismissive attitude when challenged

- Inability to read the room (kept attacking boAt despite Aman’s presence)

Episode Wisdom

For Founders:

1. Respect Your Competitors, Especially in the Room: When a Shark built a company you’re criticizing, show data-driven differentiation—not dismissive contempt. Aabo Ring’s “third grade” comments killed any chance with Aman and alienated other Sharks.

2. Premium Positioning Requires Premium Proof: Cookie Cartel justified premium with 65% margins and 42% repeat rates. Aabo Ring claimed premium but couldn’t justify ₹150 Cr valuation or AI capabilities.

3. Accept When Your Market Is Too Niche: Avia Litewings had impressive credentials but fundamentally couldn’t demonstrate a scalable path within venture timelines—sometimes the best businesses aren’t venture-backable.

4. Clean Your Cap Table Early: Giving away 33% equity (Aabo Ring) before major funding rounds signals poor financial planning and limits future flexibility.

5. Zero Digital Presence in 2026 Is Inexcusable: Whether you’re selling cookies or gyrocopters, having 0 or minimal organic traffic demonstrates failure to understand modern customer acquisition.

For Investors:

1. Multi-Shark Deals Reduce Risk, Add Value: Cookie Cartel’s three-Shark partnership distributed investment risk while providing complementary expertise—smart for uncertain but promising ventures.

2. Technical Excellence Needs Market Viability: Respect Avia Litewings’ expertise while recognizing that military-grade capabilities don’t overcome fundamental market size and scalability constraints.

3. Founder Attitude Predicts Post-Investment Relationship: Aabo Ring’s dismissiveness toward competitors signals how they’d handle feedback, pivots, or partner relationships—red flag for long-term collaboration.

4. Loss-Making Can Be Strategic: Cookie Cartel’s current losses from marketing spend differ fundamentally from businesses with broken unit economics—context matters in profitability analysis.

For Viewers:

1. Premium Is a Strategy, Not an Excuse: Cookie Cartel used premium positioning to build loyalty and margins. Avia Litewings used premium to justify limited market reach. Know the difference.

2. Buzzwords Without Backing Fail Fast: “AI-powered” means nothing if you can’t explain the actual AI—Sharks in 2026 demand technical substance behind marketing claims.

3. Sometimes the Market Just Isn’t There: No amount of expertise, planning, or credibility can overcome fundamental market size limitations (Avia Litewings’ lesson).

4. The Best Numbers Can’t Save Bad Attitude: Aabo Ring had respectable growth (₹3 Cr → ₹11 Cr projected) and 10.5% market share but destroyed their opportunity through arrogance.

The Valuation Realism Spectrum

Cookie Cartel: Negotiated Down Successfully

- Initial Ask: ₹15 Crore valuation

- Final Deal: ₹6.67 Crore valuation (55% reduction)

- Founder Response: Accepted pragmatically, prioritizing expertise

- Outcome: Three-Shark partnership, strategic success

Avia Litewings: Never Negotiable

- Ask: ₹100 Crore valuation

- Reality Check: Market too niche for any VC valuation

- Sharks’ Response: Respectful rejection, no counter-offers

- Outcome: No negotiation possible when fundamentals don’t support venture model

Aabo Ring: Dead on Arrival

- Ask: ₹150 Crore valuation

- Market Reality: ~13.6x projected revenue in competitive market

- Sharks’ Response: “Outlandish,” no serious negotiation attempted

- Outcome: Attitude + valuation + cap table issues = instant rejection

The Episode’s Defining Moments

1. Cookie Cartel’s Three-Shark Unity: Rare collaboration showing how complementary expertise creates more value than solo investment

2. Avia Litewings’ Respectful Goodbye: Sharks acknowledging founders’ excellence while declining investment—professionalism on both sides

3. Aabo Ring’s “Third Grade” Attack: The moment founders repeatedly dismissed boAt’s products in front of boAt’s founder—watching Aman’s reaction was television gold and a masterclass in what not to do

4. Namita’s AI Callout: Directly challenging “AI-powered” claims as basic analytics—raising the bar for technical credibility in 2026

5. Anupam’s Cap Table Concern: Highlighting how 33% equity given away limits future funding options—institutional investor thinking at work

Leave feedback about this

You must be logged in to post a comment.