Japam Shark Tank India Episode Review

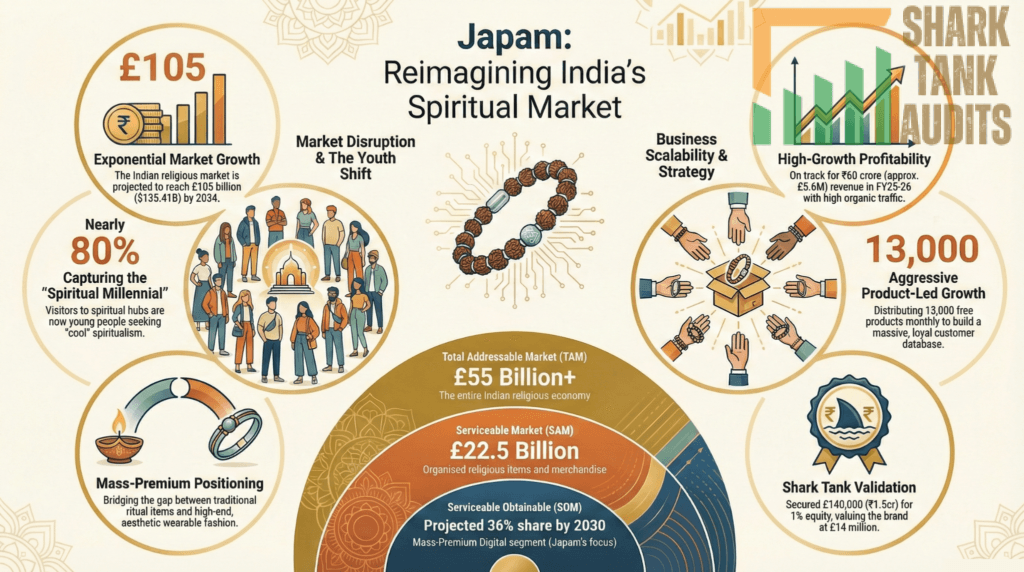

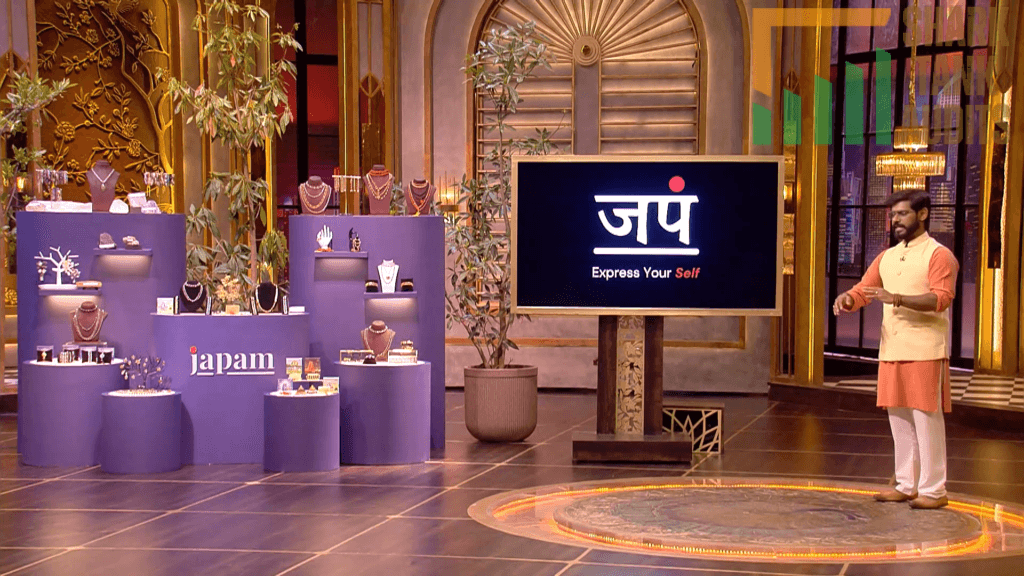

Japam appeared on Shark Tank India Season 5, Episode 9, with founder Ritoban Chakrabarti from Mohali seeking ₹1.5 Crore for 1% equity (₹150 Crore valuation) and successfully closed a deal for ₹1.5 Crore for 1% equity with 1x royalty with Sharks Namita Thapar and Varun Alagh. The spiritual wearables brand offers certified Rudraksh beads, gemstones, and zodiac bands with 102,795 monthly organic visitors and projected ₹60 Crore revenue for the year. Operating in India’s $70.14 billion religious market (growing to $135.41 billion by 2034), Japam brings authenticity to the unorganized faith-based products sector through lab certificates and mass-premium positioning targeting younger demographics.

The pitch sparked ethical debate—Viraj Bahl exited saying it violated his belief system against commercializing spirituality, while Vineeta and Kunal noted the already-profitable company didn’t need funding. A tense moment occurred when Kunal (who was “out”) supported Ritoban’s skepticism of Namita’s royalty offer, prompting Namita to tell him to stay out. Despite controversy, Ritoban’s aggressive customer acquisition strategy (12,000-13,000 free products monthly) and focus on making spirituality “cool” for Gen Z secured the deal in the fast-growing “Faith-Tech” sector (10% CAGR).

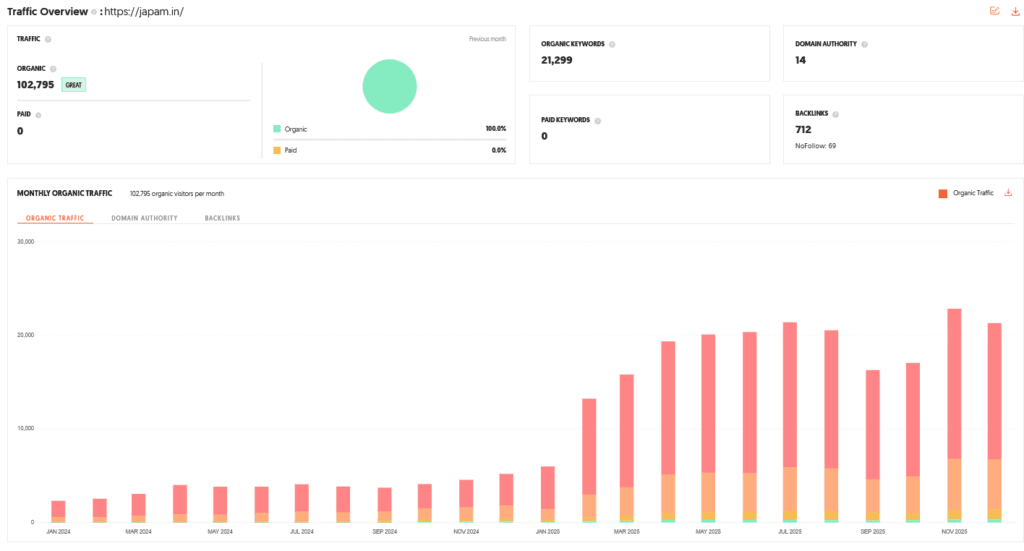

Japam Website Information

- Website:- Japam

- Build on Shopify

- Great SEO Performance.

- ORGANIC TRAFFIC: 102795 visitor per month.

Japam Founder

- The brand was founded by Ritoban Chakrabarti.

- During his pitch, he shared a lighthearted anecdote about how an astrologer once predicted he would engage in “do numbri ka kaam” (shady business), which he later reinterpreted as his destiny to be an entrepreneur.

- He describes his business as a combination of ethics and commerce.

Japam Brand Overview

- Japam is a “spiritual wearables brand” based in Mohali that operates in the highly unorganized market of faith-based products.

- The brand aims to bring “authenticity” to the spiritual sector by offering certified products to a mass-premium audience.

- The company is currently highly profitable, on track to close the financial year with a revenue of approximately Rs 60 crore.

Japam Shark Tank India Appearance & Ask

- Ritoban appeared on the show seeking an investment of Rs 1.5 crore for 1% equity, valuing his company at Rs 150 crore.

- The panel of Sharks included Namita Thapar, Varun Alagh, Viraj Bahl, Kunal Bahl, and Vineeta Singh.

Japam Season and Episode Air Date

- Season: 05

- Episode: 09

- Episode Air Date: Thursday, 15 January 2026

Japam Product Overview

Japam specializes in spiritual merchandise and “wearables,” including:

- Rudraksh: Traditional spiritual beads.

- Gemstones: Various stones believed to have spiritual properties.

- Zodiac Sign Bands: Modernized, aesthetically pleasing bands designed to attract a younger demographic.

- Certificates of Authenticity: The brand issues its own certificates based on labs and centers selected by the company itself.

Japam Product Highlights

- Authenticity Focus: The founder claims to promote “asliyat” (reality) in a market filled with fakes.

- Mass-Premium Positioning: The products are designed to look high-end while remaining accessible to a broad audience.

- Younger Appeal: A strategic focus on design-led products (like zodiac bands) to bring the youth into the spiritual ecosystem.

Japam Customer Engagement Philosophy

- Ritoban employs an aggressive customer acquisition strategy. He revealed that the company sends out 12,000 to 13,000 free products every month.

- The philosophy is to allow potential customers to experience the “faith-based” product first, with the goal of converting them into loyal, paying customers later.

Japam Investor Reactions

The pitch sparked a significant ethical and personal debate among the Sharks:

- Viraj Bahl: He was the first to exit, stating the business went against his “belief system.” He argued that spiritual items should not be commercialized for profit.

- Vineeta Singh & Kunal Bahl: Both opted out because the business was already highly profitable and flush with cash, suggesting the founder didn’t actually need their money.

- Namita Thapar: Despite claiming to be “anti-superstition,” she saw an opportunity for a “real player” to organize the market.

- Conflict: A heated moment occurred when Kunal Bahl (who was “out”) supported the pitcher’s skepticism regarding Namita’s royalty offer, prompting Namita to tell Kunal to stay out of the deal.

Japam Future Vision

- Ritoban Chakrabarti has ambitious goals for Japam.

- He aims to build a billion-dollar enterprise by expanding his ecosystem of spiritual products.

- His roadmap involves capturing the younger generation through modern designs and eventually upselling them from basic zodiac items to more premium spiritual products.

Japam Deal Finalized or Not

- Yes, a deal was finalized. After a tense negotiation where the founder questioned what the Sharks were actually bringing to the table given the “royalty” structure, a deal was struck.

- Namita Thapar and Varun Alagh invested Rs 1.5 crore for 1% equity with a 1x royalty (meaning the Sharks will receive their investment back through a percentage of sales).

| Item | Details |

|---|---|

| Website | Japam |

| Platform | Built on Shopify |

| SEO Performance | Great SEO performance |

| Organic Traffic | 102,795 visitors per month |

| Founder | Ritoban Chakrabarti |

| Founder Background | Entrepreneur who blends ethics with commerce |

| Pitch Anecdote | Astrologer predicted “do numbri ka kaam,” later interpreted as entrepreneurship |

| Brand Category | Spiritual wearables brand |

| Brand Location | Mohali, India |

| Market Type | Highly unorganized faith-based products market |

| Brand Objective | Bring authenticity and certification to spiritual products |

| Current Revenue | Approx. ₹60 crore (FY closing projection) |

| Shark Tank Ask | ₹1.5 crore for 1% equity |

| Company Valuation | ₹150 crore |

| Sharks Present | Namita Thapar, Varun Alagh, Viraj Bahl, Kunal Bahl, Vineeta Singh |

| Season | Season 05 |

| Episode Number | Episode 09 |

| Episode Air Date | Thursday, 15 January 2026 |

| Product Category | Spiritual merchandise and wearables |

| Product – Rudraksh | Traditional spiritual beads |

| Product – Gemstones | Spiritually significant stones |

| Product – Zodiac Bands | Modern, youth-oriented spiritual bands |

| Certification | In-house certificates based on selected labs |

| Core Product Focus | Authenticity in a fake-dominated market |

| Market Positioning | Mass-premium spiritual products |

| Youth Strategy | Design-led wearables to attract younger customers |

| Customer Acquisition Strategy | Large-scale free product distribution |

| Monthly Free Samples | 12,000–13,000 products |

| Engagement Philosophy | Experience-first to build faith and long-term loyalty |

| Viraj Bahl’s View | Opted out due to belief that faith should not be commercialized |

| Vineeta Singh’s View | Opted out initially due to strong cash position |

| Kunal Bahl’s View | Opted out citing no real need for funding |

| Namita Thapar’s View | Saw opportunity to organize a chaotic market |

| Panel Conflict | Heated exchange over royalty model and deal interference |

| Founder’s Negotiation Style | Questioned Shark value beyond capital |

| Deal Status | Deal finalized |

| Investors | Namita Thapar and Varun Alagh |

| Deal Structure | ₹1.5 crore for 1% equity |

| Royalty Clause | 1x royalty until investment amount is recovered |

| Future Vision | Build a billion-dollar spiritual commerce ecosystem |

| Growth Strategy | Capture youth with modern products and upsell premium items |

| Indian Market Size | $70.14 billion in 2025 |

| Market Growth Projection | $135.41 billion by 2034 |

| Faith-Tech Growth Rate | 10% CAGR |

| Youth Market Shift | 80% youth visitors in major spiritual hubs |

| Revenue Validation | ₹60 crore expected in FY25–26 |

| Total Addressable Market | $70+ billion Indian religious economy |

| Serviceable Market | $29 billion organized merchandise segment |

| Target SOM | Mass-premium digital spiritual segment |

| Primary Audience | Spiritual millennials aged 25–35 |

| Secondary Audience | NRIs seeking certified spiritual products |

| Consumer Psychology | Belief-driven but authenticity-conscious buyers |

| Regional Focus | North India and South India temple hubs |

| SEO Strength | High-intent keywords like Original Rudraksh |

| Content Approach | Educational storytelling over superstition |

| Influencer Strategy | Wellness and lifestyle creators |

| Growth Funnel | Product-led growth through free sampling |

| D2C Channel | High-conversion Shopify website |

| Quick Commerce | Potential partnerships with Blinkit and Zepto |

| Marketplace Presence | Amazon and Flipkart |

| Competitive Advantage | Organized, certified brand in unorganized market |

| Retention Strength | High repeat purchase potential |

| Ethical Challenge | Commercialization of faith |

| Certification Risk | Long-term credibility of in-house certificates |

| Core Success Factor | Positioning spirituality as lifestyle |

| Trust Mitigation | Move to government-accredited labs |

| Ethics Mitigation | Temple restoration and cultural giveback |

| Phase 1 Roadmap | Gold-plated and premium spiritual jewelry |

| Phase 2 Roadmap | Global expansion to US and UK |

| Phase 3 Roadmap | E-pujas and astrology services |

| Long-Term Valuation Goal | ₹1,000+ crore within 3–5 years |

Japam Shark Tank India Business Plan

1. Japam Business Potential in India: Facts & Data

- Massive Market Valuation: The Indian religious and spiritual market is valued at approximately $70.14 billion in 2025 and is projected to reach $135.41 billion by 2034.

- Fast-Growing “Faith-Tech” Sector: Spiritual tech and e-commerce are growing at a 10% CAGR, driven by the digitization of ancient traditions.

- Youth Engagement Surge: In major spiritual hubs like Varanasi, nearly 80% of visitors are now youth, indicating a massive shift in consumer behavior toward “cool” spiritualism.

- High Profitability Potential: Japam is already leading this shift with an expected Rs 60 crore revenue in FY25-26, proving that organized retail can command premium margins in a traditionally unorganized sector.

2. Japam Total Addressable Market (TAM): Facts & Data

- Total Addressable Market (TAM): The entire religious economy in India is over $70 billion (approx. ₹5.8 Lakh Crore).

- Serviceable Addressable Market (SAM): The organized “Religious Items and Merchandise” segment, where Japam operates, accounts for roughly 42% of the distribution channel, valued at approx. $29 billion.

- Serviceable Obtainable Market (SOM): Japam aims to capture the Mass-Premium Digital segment, which is the fastest-growing sub-sector, expected to double its market share from 18% to 36% by 2030.

3. Japam Ideal Target Audience & Demographics

- Primary Demographic (The “Spiritual Millennial”): Individuals aged 25–35 years who contribute to 70% of spiritual tech revenue.

- The Global Diaspora (NRIs): Non-resident Indians seeking “authentic” and “lab-certified” spiritual connections to their roots.

- Psychographics: Value-driven consumers who believe in spirituality but are skeptical of “fake” products; they seek aesthetic appeal and proof of authenticity.

- Regional Focus: North India (Varanasi, Haridwar hubs) and South India (Temple-driven tourism) are the primary geographic strongholds.

4. Japam Marketing, Content & Digital Strategy

- Search Engine Dominance: With 102,795 organic visitors per month, Japam utilizes high-intent SEO keywords like “Original Rudraksh” and “Zodiac Bracelets” to capture traffic.

- Content Strategy: Use of “educational storytelling” regarding the benefits of specific stones and beads to bridge the gap between fear-based superstition and logic-based spirituality.

- Influencer Integration: Partnering with wellness and lifestyle influencers to position Japam wearables as “spiritual fashion” rather than just ritualistic items.

- Digital Funnel: Aggressive “Product-Led Growth” (PLG) by shipping 12k–13k free products monthly to build a massive retargeting database for high-ticket upsells.

5. Japam Distribution Strategy

- D2C Excellence: A robust Shopify-built platform optimized for high conversion and mobile-first shopping.

- Quick-Commerce Partnerships: Integrating with platforms like Blinkit or Zepto for instant delivery of spiritual essentials during festivals.

- Marketplace Presence: Strategic listings on Amazon and Flipkart to tap into the broad horizontal search volume for spiritual goods.

6. Japam Business Advantages & Challenges

Advantages

- Organized Player Status: In a market dominated by local street vendors, Japam‘s “Lab Certification” creates a significant trust moat.

- High Retention: Spiritual products often lead to repeat purchases (malas, stones for different phases), providing high Customer Lifetime Value (CLV).

Challenges

- Ethical Scrutiny: As seen in the Shark Tank episode, commercializing faith can lead to “backlash” regarding profit motives.

- Certification Validity: Since Japam issues its own certificates, long-term credibility depends on maintaining absolute transparency.

7. Japam Success Reasons & Mitigation Strategies

- Reason for Success: Japam treats spirituality as a “lifestyle upgrade” rather than just a ritual, making it “cool” for Gen Z.

- Mitigation Strategy (Trust): Transition from “In-house Certification” to Third-Party Government-Accredited Labs to silence critics and increase brand equity.

- Mitigation Strategy (Ethics): Implement “Social Giveback” programs where a percentage of profits go to temple restoration or Sanskrit schools to balance commerce with “Karma.”

8. Japam Future Business & Roadmap to Increase Valuation

- Phase 1 (Product Expansion): Launching gold-plated and high-jewelry spiritual lines to increase Average Order Value (AOV).

- Phase 2 (Global Export): Tapping into the $5.5 billion global spiritual market by targeting the US and UK yoga/wellness communities.

- Phase 3 (Service Integration): Moving from “Wearables” to “Services” by offering e-pujas and astrology consultations through the Japam ecosystem.

- Valuation Goal: By reaching a revenue of Rs 200–300 crore with high EBIDTA, Japam can target a valuation of Rs 1,000+ crore (Unicorn status) within the next 3–5 years.

Japam Shark Tank India Episode Review