Mister Veg Shark Tank India Episode Review

Mister Veg appeared on Shark Tank India Season 5, Episode 34, with Faridabad-based founders Simarjeet Singh and Rupinder Singh (incorporated 2020, started business journey 2018) seeking ₹2 Crore for 2.5% equity (₹80 Crore valuation) but left with no deal after performing bhangra exit despite all Sharks declining.

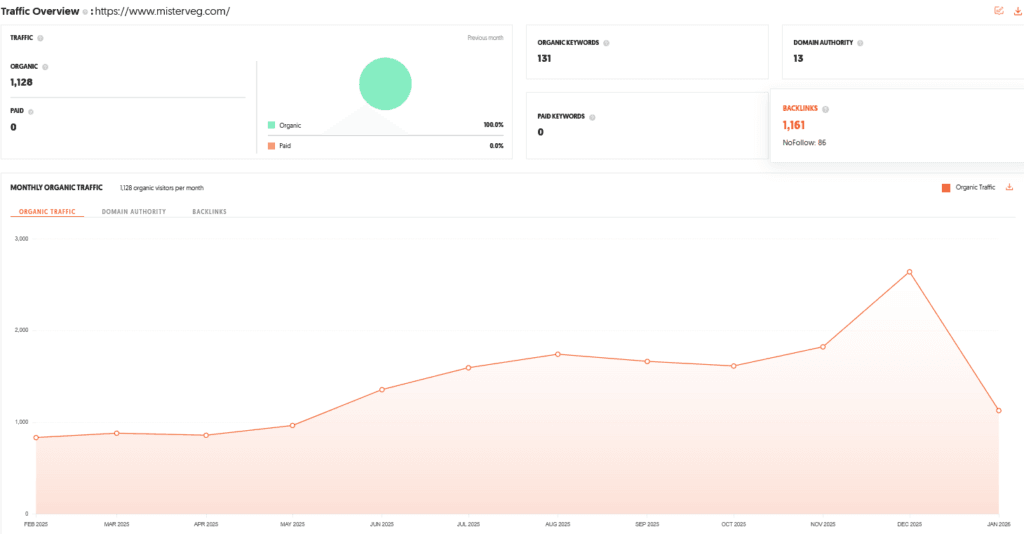

The DPIIT-recognized startup specializes in cruelty-free plant-based meat alternatives operating from 3,500+ MT annual capacity Haryana manufacturing facility offering 30+ ready-to-cook products (soya-based shammi kebabs, crunchy nuggets, fish-shaped plant-based fillets) including India’s first Pure Soya Chaap containing 0% maida/wheat/gluten requiring 2-5 minutes preparation (pan/air fryer/oven), backed by Jubilant Bhartia Group (₹4.25 Crore for 38% stake in 2021) with restaurant partners (King of Kulcha, Son of Swaad) and 1,128 monthly organic visitors requiring SEO improvement. Sharks reacted critically—Aman enjoyed Shammi Kebab but Anupam/Ritesh found taste unconvincing, Namita “put off” by fish-shaped visual on vegetarian product, founders frustrated Sharks with vague answers (when asked if simply selling Soya Chaap, Simarjeet’s cryptic reply “Gangadhar hi Shaktimaan hai” irked Aman/Anupam), most felt plant-based meat industry in downturn, and Anupam jokingly stated he’d only work if they paid him to “tolerate” them (“Aapko jhelne ke liye”) citing difficult communication style.

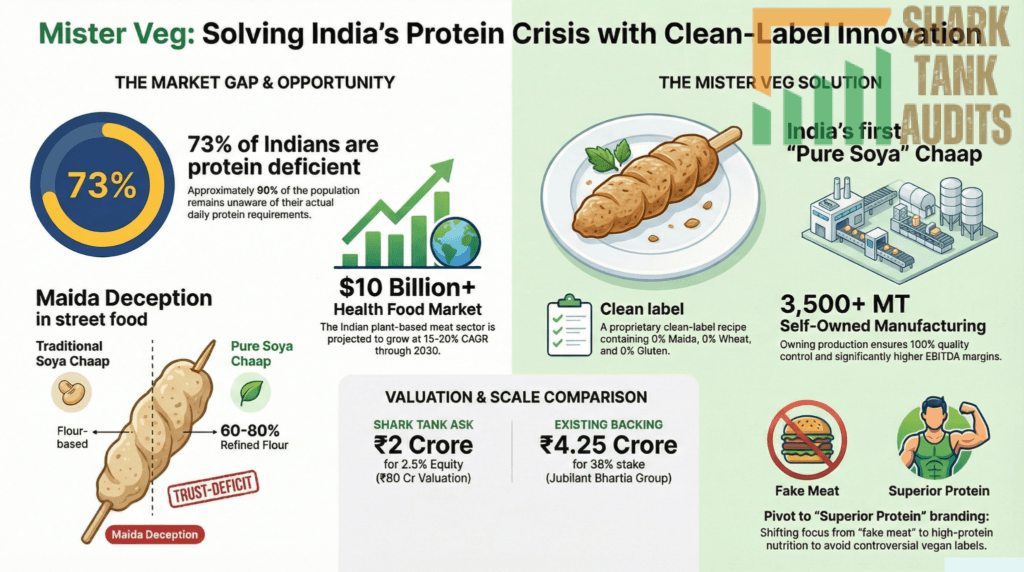

Operating in Indian plant-based meat market projected at 15-20% CAGR by 2030 within $10+ billion health food/protein supplement market and ~400 million “flexitarians” SAM reducing meat consumption seeking vegetarian protein sources amid 73% Indians protein deficient (90% unaware of daily requirement) and traditional soya chaap often 60-80% refined flour (maida) creating trust-deficit, Mister Veg targets health-conscious professionals (25-45, Delhi-NCR/Mumbai/Bangalore seeking quick high-protein meals), parents seeking maida-free children’s snacks, gym-goers/athletes requiring plant-based protein, and flexitarian non-vegetarians observing meatless days (Tuesdays/Saturdays) craving meat texture/taste within 50-70 million urban Tier 1/2 population prioritizing clean-label ready-to-cook convenience, planning “Anti-Maida” campaign educating high-carb street chaap versus high-protein version, SEO modernization targeting keywords (“Gluten-free Soya Chaap,” “Vegan Meat India”), fitness influencer/clean-eating chef partnerships showcasing 2-5 minute preparation, quick-commerce expansion (Blinkit/Zepto/Instamart), HoReCa segment scaling utilizing 80% facility capacity improving EBITDA margins, global exports to high NRI regions (UK/Canada/UAE), and cap table cleanup with consistent 20% MoM D2C growth justifying/exceeding ₹80 Crore valuation through taste calibration R&D addressing “neither here nor there” feedback and pivoting marketing from “fake meat” to “Superior Protein” avoiding controversial vegan-meat branding.

Website Information

- Website:- Mister Veg

- Build on JavaScript libraries jQuery 1.10.2 FancyBox 3.3.5

- Average SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 1128 visitors per month.

The Founders of Mister Veg

- Mister Veg was represented by entrepreneurs Simarjeet Singh and Rupinder Singh.

- Based out of Faridabad, the duo incorporated the company in 2020 (starting the business journey in 2018) with a mission to address the protein deficiency crisis in India.

- Their presentation reflected a deep-rooted passion for providing high-protein, plant-based alternatives to traditional meat products.

Mister Veg Brand Overview

- Mister Veg is a DPIIT-recognized startup that specializes in cruelty-free, plant-based meat alternatives.

- Operating from a 3,500+ MT annual capacity manufacturing facility in Haryana, the brand offers over 30 ready-to-cook products.

- Unlike many competitors, Mister Veg focuses on “clean-label” nutrition, positioning itself as a healthy, vegetarian solution for “flexitarians”—those who consume meat but are looking for plant-based substitutes.

Mister Veg Shark Tank India Appearance & Ask

- During their appearance in Season 5 of Shark Tank India, the founders of Mister Veg sought an investment of Rs 2 crore in exchange for 2.5% equity, which placed the company at an ambitious valuation of Rs 80 crore.

- They highlighted their unique manufacturing process and their existing B2B (Business-to-Business) presence to justify the scale of their “plant-power” mission.

Season and Episode Air Date

- Season: 05

- Episode: 34

- Episode Air Date: Thursday, 19 February, 2026

Mister Veg Product Overview

- The Mister Veg product line consists of soya-based versions of popular non-vegetarian delicacies, such as Shammi Kebabs, crunchy nuggets, and “fish-shaped” plant-based fillets.

- The brand prides itself on being the first in India to introduce Pure Soya Chaap that contains 0% Maida, 0% Wheat, and 0% Gluten.

- Their items are designed to be “ready-to-cook,” requiring only 2–5 minutes of preparation in a pan, air fryer, or oven.

Investor Reactions to Mister Veg

The Sharks had mixed and eventually critical reactions toward Mister Veg:

- Taste & Visuals: Aman Gupta enjoyed the Shammi Kebab, but Anupam Mittal and Ritesh Agarwal found the taste unconvincing. Namita Thapar was specifically “put off” by the fish-shaped visual of a vegetarian product.

- Communication Issues: The founders frustrated the Sharks with vague answers. When asked if they were simply selling “Soya Chaap,” Simarjeet’s cryptic reply, “Gangadhar hi Shaktimaan hai,” irked Aman and Anupam.

- Business Viability: Most Sharks felt the plant-based meat industry was currently in a downturn.

- Anupam’s Critique: Anupam Mittal jokingly stated he would only work with them if they paid him to “tolerate” them (“Aapko jhelne ke liye”), citing their difficult communication style.

Mister Veg Customer Engagement Philosophy

- The Mister Veg philosophy centers on bridging the “Protein Gap” in India, where 73% of the population is protein deficient.

- The brand aims to educate consumers that traditional “Soya Chaap” is often actually “Maida Chaap” (flour-based).

- Mister Veg engages customers by offering “Restaurant-Style” snacks that are budget-friendly, highly nutritious, and authentic, targeting the growing demographic of health-conscious and ethical eaters.

Mister Veg Product Highlights

- Clean Ingredients: 100% Soya with 0% Maida, Wheat, or Gluten.

- High Nutrition: High protein and low carb content with no fillers.

- Variety: Over 30+ SKUs ranging from raw chaap to tandoori kebabs.

- Convenience: Pre-cooked meals that are ready in under 5 minutes.

- Quality Control: Manufactured in a fully automated, hygienic, and self-owned facility.

Mister Veg Future Vision

- The future vision for Mister Veg involves scaling their 3,500+ MT production capacity to further dominate the HoReCa (Hotel, Restaurant, and Cafe) sector and expand their consumer packs.

- Backed by the Jubilant Bhartia Group (who invested Rs 4.25 crore for a 38% stake in 2021), the brand aims to drive global awareness of sustainable food habits and continue its growth through restaurant partners like King of Kulcha and Son of Swaad.

Mister Veg: Deal Finalized or Not?

- No deal was finalized.

- Despite the founders’ energetic exit—leaving the tank while performing bhangra—none of the Sharks chose to invest.

- The primary reasons for the rejection included concerns over a declining industry trend, the company’s existing heavy cap table (with Jubilant FoodWorks owning a significant share), and the founders’ perceived inability to provide direct answers during the Q&A session.

| Information | Details |

|---|---|

| Business Name | Mister Veg |

| Built With | JavaScript libraries (jQuery 1.10.2, FancyBox 3.3.5) |

| SEO Performance | Average SEO performance, SEO improvement needed |

| Organic Traffic | 1,128 visitors per month |

| Founders | Simarjeet Singh and Rupinder Singh |

| Headquarters | Faridabad, Haryana |

| Incorporated | 2020 (business journey started in 2018) |

| Business Model | B2B (HoReCa) + D2C plant-based meat brand |

| DPIIT Recognition | Yes (DPIIT-recognized startup) |

| Manufacturing Capacity | 3,500+ MT annually (self-owned facility) |

| Product Category | Plant-based meat alternatives |

| Product Range | Shammi Kebabs, Nuggets, Fish-style fillets, Pure Soya Chaap, 30+ SKUs |

| Key USP | 0% Maida, 0% Wheat, 0% Gluten |

| Preparation Time | Ready-to-cook in 2–5 minutes |

| Shark Tank Season | 05 |

| Shark Tank Ask | ₹2 Crore for 2.5% equity |

| Valuation Asked | ₹80 Crores |

| Deal Status | No deal finalized |

| Investor Backing (2021) | ₹4.25 Crore for 38% stake by Jubilant Bhartia Group |

| Primary Target Audience | Urban health-conscious professionals (25–45 years) |

| Secondary Audience | Parents, gym-goers, flexitarians |

| Core Consumer Segment | 400M+ Indian flexitarians |

| Market Opportunity | 73% Indians protein deficient |

| Indian Plant-Based CAGR | ~15–20% projected growth till 2030 |

| TAM | $10B+ Indian health food & protein market |

| SAM | ~400M flexitarians in India |

| SOM | 50–70M Tier 1 & 2 urban consumers |

| Sales Channel Focus | HoReCa + D2C + Quick-Commerce |

| Restaurant Partners | King of Kulcha, Son of Swaad |

| Marketing Strategy | Anti-Maida education campaign |

| SEO Strategy | Target “Gluten-free Soya Chaap” & “Vegan Meat India” keywords |

| Content Strategy | Protein awareness, factory transparency, recipe content |

| Distribution Strategy | HoReCa expansion + Blinkit/Zepto/Instamart listings |

| Competitive Advantage | Own manufacturing, clean-label positioning |

| Key Challenge | Taste perception and plant-meat downturn concerns |

| Shark Criticism | Communication issues and unclear differentiation |

| Operational Risk | High CAC in plant-based segment |

| Mitigation Strategy (Taste) | R&D-driven flavor calibration |

| Mitigation Strategy (Branding) | Shift from “fake meat” to “Superior Protein” positioning |

| Phase 1 Goal | Double organic traffic and expand quick-commerce |

| Phase 2 Goal | Utilize 80% of 3,500 MT capacity |

| Phase 3 Goal | Export to UK, Canada, UAE (NRI markets) |

| Long-Term Valuation Goal | Exceed ₹80 Crores with sustained D2C growth |

Mister Veg Shark Tank India Episode Review

1. Mister Veg: Business Potential in India (Facts & Data)

- Protein Deficiency Crisis: With 73% of Indians being protein deficient and 90% unaware of their daily requirement, Mister Veg sits at the center of a massive health-tech opportunity.

- The “Maida” Deception: Traditional soya chaap in India is often 60-80% refined flour (maida). Mister Veg provides a 100% soya alternative, tapping into the trust-deficit in the current street food market.

- Economic Growth: The Indian plant-based meat market is projected to reach a CAGR of ~15-20% by 2030, driven by rising disposable income and health consciousness, providing a fertile ground for Mister Veg.

2. Mister Veg: Total Addressable Market (TAM) Analysis

- Total Addressable Market (TAM): The broader Indian health food and protein supplement market, valued at approximately $10 Billion+.

- Serviceable Addressable Market (SAM): The Mister Veg SAM includes the ~400 million “flexitarians” in India who are looking to reduce meat consumption or find better vegetarian protein sources.

- Serviceable Obtainable Market (SOM): Targeting the urban Tier-1 and Tier-2 population (approx. 50-70 million people) who prioritize “clean-label” and “ready-to-cook” convenience.

3. Mister Veg: Ideal Target Audience & Demographics

- Primary Audience: Health-conscious professionals (25–45 years) in urban hubs like Delhi-NCR, Mumbai, and Bangalore seeking quick, high-protein meals.

- Secondary Audience: Parents looking for healthy, maida-free snacks for children, and gym-goers/athletes requiring plant-based protein.

- The “Flexitarian” Segment: Non-vegetarians who observe meatless days (e.g., Tuesdays/Saturdays) but crave the texture and taste of meat, which Mister Veg replicates.

4. Mister Veg: Marketing, Content, & Digital Strategy

- The “Anti-Maida” Campaign: Mister Veg should launch a “Know Your Chaap” campaign to educate users on the high-carb content of street chaap versus their high-protein version.

- SEO & Website Optimization: Currently at 1,128 monthly visitors, Mister Veg must modernize its JavaScript libraries and optimize for keywords like “Gluten-free Soya Chaap” and “Vegan Meat India” to boost organic reach.

- Influencer Collaboration: Partnering with fitness influencers and “clean-eating” chefs to showcase the 2–5 minute preparation time of Mister Veg products.

- Content Pillars: Educational Reels on protein facts, “behind-the-scenes” of their automated Faridabad facility to build trust, and recipe-driven content for their 30+ SKUs.

5. Mister Veg: Distribution Strategy

- B2B Dominance (HoReCa): Strengthening the existing Mister Veg footprint in hotels and restaurants, providing bulk plant-based meat to high-end catering.

- D2C & E-Commerce: Expanding the Mister Veg website sales and listing on Quick-Commerce platforms (Blinkit, Zepto, Instamart) where the 2-5 minute “Ready-to-Cook” USP thrives.

- Strategic Partnerships: Leveraging the Jubilant FoodWorks connection to integrate Mister Veg products into major food chains and their partner brands like King of Kulcha.

6. Mister Veg: Advantages & Challenges

- Advantages: Mister Veg owns its manufacturing (3,500+ MT capacity), ensuring 0% maida/gluten and higher margins compared to brands that outsource production.

- Challenges: High customer acquisition cost (CAC), the “unconvincing taste” feedback from Sharks like Anupam Mittal, and the “declining trend” perception of the global plant-meat industry.

7. Mister Veg: Success Factors & Mitigation Strategies

- Success Factor – Taste Calibration: To succeed, Mister Veg must refine its flavor profiles (addressing the “neither here nor there” feedback) through R&D.

- Mitigation for Communication: Founders must shift from cryptic analogies to data-driven communication to win over future institutional investors.

- Mitigation for Market Downturn: Instead of being “fake meat,” Mister Veg should pivot marketing toward being “Superior Protein,” moving away from the controversial vegan-meat branding.

8. Mister Veg: Future Business Roadmap & Valuation Growth

- Phase 1 (0-12 Months): Optimize Mister Veg SEO and Quick-Commerce presence; achieve a 2x growth in monthly organic traffic.

- Phase 2 (1-2 Years): Scale the HoReCa segment to utilize 80% of the 3,500 MT facility capacity, improving EBITDA margins.

- Phase 3 (3+ Years): Global exports to regions with high NRI populations (UK, Canada, UAE) seeking authentic Indian vegetarian protein.

- Valuation Strategy: By cleaning up the cap table and showing consistent 20% MoM growth in the D2C segment, Mister Veg can justify and exceed the Rs 80 crore valuation sought on Shark Tank.

Mister Veg Shark Tank India Episode Review