Saras Shark Tank India Episode Review

Saras appeared on Shark Tank India Season 5, Episode 34, with Surat-based co-founders Chanchal Chakrachhatri (CEO, IIM Kashipur alumnus, former Petroleum Engineer), Sarthak Joshi (COO, deep brokerage experience from London/Angel One), and Swapnil Tripathi (CTO, IIT Bombay graduate, ex-Apple) seeking ₹70 lakh for 2% equity (₹35 Crore valuation) but left with no deal despite compelling presentation and functional product with significant traction.

Operating under Finosauras Tech Private Limited (originally “Finosauras,” transitioned to “Saras” from Gujarati word for “good”), the stock research app serves as “trust layer” for Indian market aggregating 400+ daily trade ideas from public sources (Telegram/WhatsApp/research reports) using AI to track recommendations in real-time providing transparent metrics (ROI, win rates, risk-reward ratios) acting as accountability engine showing which advisors are consistently accurate versus contributing noise, achieving 124,978+ Android downloads (2,300 last 30 days, ~15-78 MB app size, 4.5-4.6 star iOS rating, 100,000+ Google Play downloads) with 50,000+ active traders community but 0 organic website visitors requiring SEO overhaul, founded after experiencing personal financial losses from unverified market “tips.” Sharks validated core problem noting retail investors desperately need transparency but raised concerns over contradiction—while aiming to eliminate unverified tips, Saras still displayed unregistered individual opinions under “Opinions” tab—and some viewed it as “feature” (advisor rating system) versus standalone scalable company comparing potential utility to Uber/Amazon ratings, citing long-term business model concerns, regulatory hurdles in brokerage space, and competitive landscape.

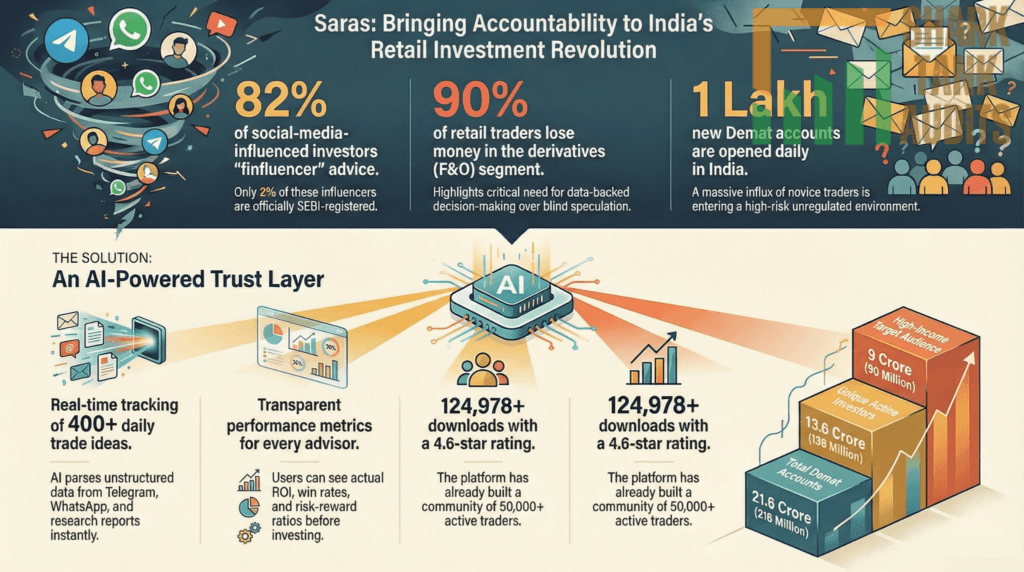

Operating in Indian market’s “retail revolution” where retail investors hold 19% total NSE market cap (~₹83.6 lakh crore) within 21.6 crore (216 million) demat accounts (13.6 crore unique active investors) and 90 million top income layer with investable surplus shifting from gold/FDs to equities amid 1 lakh new daily demat accounts, Saras targets “Digital Novice” (22-35, tech-savvy on Telegram/Instagram seeking quick safe trading entry) and “Busy Professional” (30-45, Tier 1/2 cities with capital lacking deep research time, 75% male with rapidly growing female base) concentrated in Maharashtra/Gujarat (Surat/Ahmedabad)/Karnataka amid 82% social-media-influenced investors acting on “finfluencer” advice (only 2% SEBI-registered) and 90% retail traders losing money in derivatives (F&O), planning SEO overhaul building “Stock Advisor Directory” ranking for high-intent keywords (“Best SEBI registered Telegram channels,” “Accuracy of [Advisor Name]”), brokerage integration partnerships (Zerodha/Groww/Angel One offering analytics as add-on tool), SEBI-registered influencer “Win-Rate Badge” accountability program, in-app trade execution prototype capturing brokerage transaction fees, AI personalization recommending advisors based on user risk profiles (intraday versus long-term), and expansion into crypto/global markets (US equities) targeting 1 million downloads with freemium model for deep advisor analytics aiming to evolve from tracking/analytics platform into full-scale digital brokerage democratizing institutional-grade data ensuring every internet stock recommendation held accountable to actual performance.

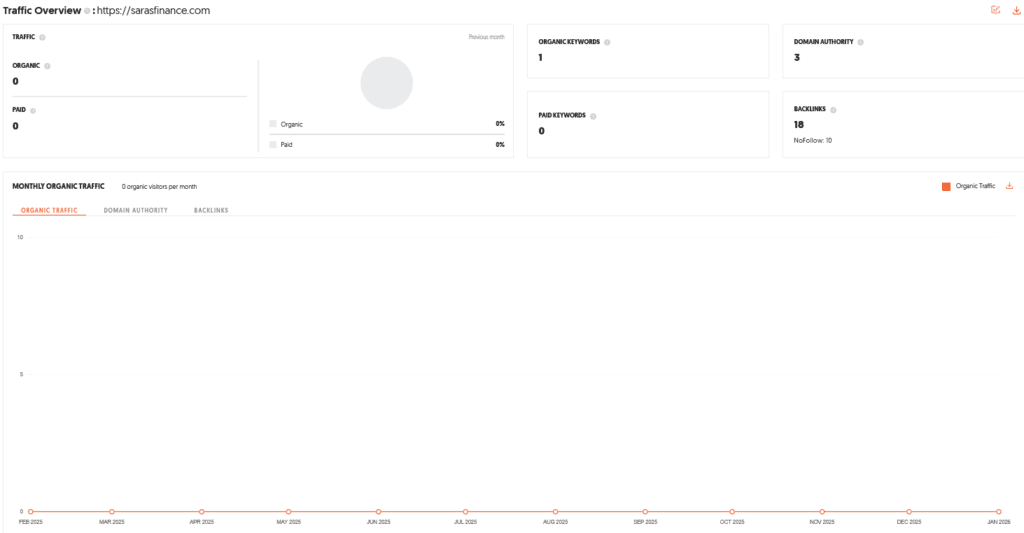

Website & App Information

- Website:- Saras

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 0 visitors per month.

- The app has been downloaded approximately 124,978+ times on Android devices (Google Play & APK analytics combined).

- Recent estimates suggest there have been about 2.3 thousand downloads in the last 30 days.

- The app size is around ~15–78 MB depending on the version and platform.

- On the Apple App Store, the iOS version shows a 4.5–4.6 star rating

The Founders of Saras

- The venture was co-founded by a versatile trio bringing together expertise in finance, technology, and management.

- Chanchal Chakrachhatri (CEO), an IIM Kashipur alumnus and former Petroleum Engineer, leads the vision alongside Sarthak Joshi (COO), who brings deep brokerage experience from London and Angel One.

- Completing the team is Swapnil Tripathi (CTO), an IIT Bombay graduate who previously worked with Apple.

- Based in Surat, the founders were inspired to build Saras after experiencing personal financial losses due to unverified market “tips.”

Brand Overview: Saras

- Saras Stock Research (operated under Finosauras Tech Private Limited) serves as a “trust layer” for the Indian stock market.

- The name “Saras” is derived from the Gujarati word for “good,” reflecting the brand’s mission to simplify and improve the investing experience.

- Originally known as “Finosauras,” the platform transitioned to the Saras brand to focus on providing a data-driven analytics app that filters out market “noise” and provides structured, verified information for retail investors.

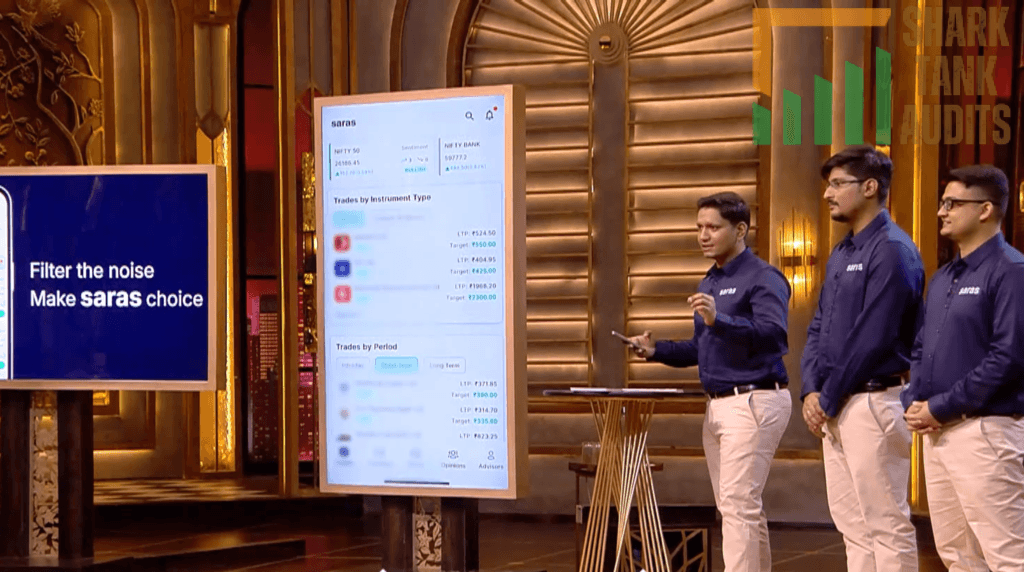

Shark Tank India Appearance and Ask for Saras

- The founders appeared on Shark Tank India Season 5 (Episode 34), which aired on February 20, 2026.

- They entered the tank with a clear and confident pitch, highlighting the chaos of unregulated stock advice on social media.

- To scale their operations and further develop their AI infrastructure, the Saras team made an initial ask of ₹70 Lakhs for 2% equity, valuing the company at ₹35 Crores.

Season and Episode Air Date

- Season: 05

- Episode: 34

- Episode Air Date: Thursday, 19 February, 2026

Product Overview: Saras

- The Saras app is a modern financial tool that aggregates over 400+ daily trade ideas from public sources like Telegram, WhatsApp, and research reports.

- It utilizes AI to track these recommendations in real-time, providing users with transparent metrics such as Return on Investment (ROI), win rates, and risk-reward ratios.

- The app acts as an accountability engine, allowing users to see which advisors are consistently accurate and which are merely contributing to market noise.

Investor Reactions to Saras

- The Sharks had mixed reactions to the Saras pitch.

- They validated the core problem, noting that retail investors desperately need transparency.

- However, a significant point of contention arose when the Sharks noticed a contradiction: while Saras aimed to eliminate unverified tips, it still displayed opinions from unregistered individuals under a specific “Opinions” tab.

- Some Sharks viewed Saras more as a “feature” (an advisor rating system) rather than a standalone scalable company, comparing its potential utility to rating systems on platforms like Uber or Amazon.

Customer Engagement Philosophy of Saras

- Saras follows a philosophy of transparency and education rather than direct solicitation.

- The brand is highly active on social media, particularly Instagram, where they share educational content, market updates, and tips to help users navigate the stock market safely.

- By positioning themselves as an informational and educational tool, rather than an investment advisor, Saras builds a community based on data-backed trust.

Product Highlights of Saras

- Performance Tracking: Real-time monitoring of entry prices, targets, and stop-losses for shared trade ideas.

- Advisor Comparison: A dedicated feature to compare the historical consistency and accuracy of different financial advisors.

- Clean UI/UX: A fresh interface featuring performance cards, watchlists, and sentiment indicators.

- Smart Filtering: Users can filter insights based on trading styles (Intraday vs. Swing) or specific instruments (Stocks vs. F&O).

- Massive Traction: Over 100,000+ downloads on Google Play with a strong community of 50,000+ active traders.

Future Vision for Saras

- The ultimate goal for Saras is to evolve from a tracking and analytics platform into a full-scale digital brokerage.

- The founders plan to integrate trade execution directly within the app, allowing users to act on verified insights instantly.

- By leveraging AI and advanced analytics, Saras aims to democratize access to institutional-grade data, ensuring that every stock market recommendation on the internet is held accountable to its actual performance.

Deal Finalized or Not: Saras

- Despite a compelling presentation and a functional product with significant traction, no deal was finalized on the show.

- While the Sharks appreciated the problem-solving nature of the app, concerns regarding the long-term business model, regulatory hurdles in the brokerage space, and the competitive landscape prevented them from making an investment.

| Information | Details |

|---|---|

| Business Name | Saras (Saras Stock Research) |

| Operating Entity | Finosauras Tech Private Limited |

| SEO Performance | Poor SEO performance, SEO improvement needed |

| Organic Traffic | 0 visitors per month |

| Android Downloads | 124,978+ downloads (Google Play & APK combined) |

| Recent Monthly Downloads | ~2.3K downloads in last 30 days |

| App Size | ~15–78 MB (varies by version/platform) |

| iOS Rating | 4.5–4.6 stars (Apple App Store) |

| Founders | Chanchal Chakrachhatri (CEO), Sarthak Joshi (COO), Swapnil Tripathi (CTO) |

| Founder Background | IIM Kashipur (CEO), Brokerage experience in London & Angel One (COO), IIT Bombay & ex-Apple (CTO) |

| Headquarters | Surat, Gujarat |

| Founded | Rebranded from Finosauras to Saras |

| Brand Meaning | “Saras” = “Good” (Gujarati origin) |

| Business Model | AI-powered stock research & advisor analytics platform |

| Core Problem Solved | Unverified stock tips & finfluencer misinformation |

| Shark Tank Season | 05 |

| Shark Tank Episode | 34 |

| Episode Air Date | 19–20 February 2026 |

| Initial Ask | ₹70 Lakhs for 2% equity |

| Valuation Asked | ₹35 Crores |

| Deal Status | No deal finalized |

| Product Type | Stock market analytics & advisor tracking app |

| Data Sources | Telegram, WhatsApp, public research reports |

| Daily Trade Ideas Tracked | 400+ ideas per day |

| Key Features | ROI tracking, win rate tracking, risk-reward analysis |

| Advisor Comparison | Yes (historical performance comparison tool) |

| Filters | Intraday vs Swing, Stocks vs F&O |

| Active Community | 50,000+ active traders |

| Vision | Become full-scale digital brokerage with in-app execution |

| Industry Context | Retail investors hold ~19% NSE market cap (~₹83.6 Lakh Crore) |

| Market Risk Insight | 90%+ retail traders lose money in F&O |

| TAM | 21.6 Crore Demat accounts in India |

| SAM | 13.6 Crore active market participants |

| SOM | ~90 Million high-income retail investors |

| Growth Factor | ~1 Lakh new Demat accounts opened daily |

| Primary Audience | Digital novice traders (Age 22–35) |

| Secondary Audience | Busy professionals (Age 30–45) |

| Geographic Focus | Maharashtra, Gujarat, Karnataka |

| Marketing Strategy | Performance-based content & advisor leaderboards |

| SEO Strategy | Advisor directory & keyword targeting (e.g., SEBI registered Telegram channels) |

| Distribution Strategy | Brokerage integrations (Zerodha, Groww, Angel One) |

| Competitive Edge | “Amazon rating system” for stock advisors |

| Key Challenge | SEBI regulatory compliance & advisory boundary |

| Technical Challenge | Parsing unstructured Telegram/social data via AI |

| Revenue Risk | Converting free-tip users to paid analytics users |

| Mitigation Strategy (Regulatory) | Strict analytics positioning + heavy disclaimers |

| Mitigation Strategy (Revenue) | Brokerage-as-a-Service monetization |

| Phase 1 Goal | 1 Million downloads via Freemium model |

| Phase 2 Goal | In-app trade execution prototype |

| Phase 3 Goal | AI-based personalized advisor recommendations |

| Phase 4 Goal | Expand to Crypto & Global Markets |

| Long-Term Valuation Goal | Exceed ₹35 Crores via scalable brokerage integration |

Saras Shark Tank India Business Plan

1. Business Potential of Saras in India

The Indian stock market is witnessing a “retail revolution.” As of February 2026, the potential for Saras is immense:

- Retail Dominance: Retail investors now hold nearly 19% of the total NSE market cap (approx. ₹83.6 Lakh Crore).

- The “Tips” Epidemic: Research shows that 82% of social-media-influenced investors act on advice from “finfluencers,” yet only 2% of these influencers are SEBI-registered.

- Speculation Reality: Over 90% of retail traders lose money in the derivatives (F&O) segment. Saras fills the critical gap between blind speculation and data-backed decision-making.

2. Total Addressable Market (TAM) for Saras

- TAM (Total Market): There are over 21.6 Crore (216 million) Demat accounts in India as of early 2026.

- SAM (Serviceable Market): Approximately 13.6 Crore unique investors actively participate in the market.

- SOM (Targetable Market): The 90 Million people in India’s top income layer who possess an investable surplus and are increasingly shifting from gold/FDs to equities.

- Growth Factor: With 1 Lakh new Demat accounts being opened daily, Saras has a non-stop influx of potential new users.

3. Ideal Target Audience and Demographics for Saras

- Primary Segment: “The Digital Novice” (Age 22–35). Tech-savvy, active on Telegram/Instagram, and looking for quick but “safe” entry into trading.

- Secondary Segment: “The Busy Professional” (Age 30–45). Tier-1 & Tier-2 city residents who have capital but lack the time for deep technical research.

- Demographics: * Gender: Primarily male (approx. 75%), but with a rapidly growing female investor base.

- Location: High concentration in Maharashtra, Gujarat (Surat/Ahmedabad), and Karnataka.

4. Digital Marketing and Content Strategy for Saras

To improve the current 0 organic traffic on the website, Saras must implement:

- SEO Overhaul: Build a “Stock Advisor Directory” on the website. Ranking for keywords like “Best SEBI registered Telegram channels” or “Accuracy of [Advisor Name]” will capture high-intent organic traffic.

- Performance-Led Content: Use Instagram Reels to show “Reality Checks”—comparing a viral stock tip’s claim vs. its actual Saras performance data.

- Educational Authority: Repurpose AI-tracked data into weekly “Advisor Leaderboards” to create a sense of competition and transparency.

5. Distribution and Partnership Strategy for Saras

- Brokerage Integration: Partner with discount brokers (Zerodha, Groww, Angel One) to offer Saras analytics as an “add-on” tool within their platforms.

- Influencer Accountability Program: Partner with SEBI-registered influencers. They can use their Saras “Win-Rate Badge” as a certificate of authenticity to attract more followers.

- Community Distribution: Direct presence in large Telegram trading communities as the “Official Audit Partner.”

6. Advantages and Challenges for Saras

| Saras Advantages | Saras Challenges |

| First-Mover Moat: Creating the “Amazon Ratings” for stock advisors. | Regulatory Tightrope: Constant need to stay compliant with evolving SEBI finfluencer norms. |

| High Trust Factor: Does not sell “tips”; it sells “accountability.” | Data Integrity: Parsing messy Telegram/social media data accurately using AI is technically difficult. |

| Scalable AI: Can track thousands of advisors simultaneously. | Adoption: Moving users from “free tips” to a paid analytics mindset. |

7. Success Factors and Mitigation Strategies for Saras

- Why it can be Successful: Saras solves the single biggest pain point of the modern Indian trader—Trust. By providing a “win rate” for every advisor, they become the Google of market credibility.

- Mitigation (Regulatory Risk): Ensure the app strictly remains an Analytics Tool and never crosses into Investment Advisory. The “Opinions” section should have heavy disclaimers to avoid being flagged as promoting unregistered tips.

- Mitigation (Revenue Risk): Diversify from a subscription model to a Brokerage-as-a-Service model to capture transaction fees.

8. Future Business and Roadmap to Increase Valuation for Saras

To justify and exceed the ₹35 Crore valuation, Saras must follow this roadmap:

- Phase 1 (User Growth): Reach 1 Million downloads by optimizing SEO and launching a “Freemium” model for deep advisor analytics.

- Phase 2 (Brokerage Integration): Launch the prototype for in-app trade execution. This allows Saras to monetize via brokerage sharing or becoming a sub-broker.

- Phase 3 (AI Personalization): Implement a “Smart Portfolio Filter” where the AI recommends specific advisors based on the user’s risk profile (Intraday vs. Long-term).

- Phase 4 (Expansion): Expand tracking to Crypto and Global Markets (US Equities), significantly increasing the TAM and attracting global VC interest.

Saras Shark Tank India Episode Review