Shark Tank India Season 5 Episode 26 Review

Welcome to our deep-dive review of Shark Tank India Season 5, Episode 26. This episode served as a fascinating crossroads where India’s rich cultural heritage clashed—and sometimes merged—with the cutting edge of modern technology. From the bustling startup hubs of Delhi and Bengaluru to the digital frontier of Generative AI, the pitchers this week brought a diverse array of visions to the carpet.

The evening featured a masterclass in negotiation, a reality check on artisan scalability, and a debate on the future of automated sales. Whether it was redefining childhood education through “screen-free” spirituality or attempting to turn the traditional bindi into a luxury fashion statement, the entrepreneurs pushed the Sharks to weigh passion against profit margins.

In this episode, we witness:

- A high-stakes battle for a ₹1.2 Crore joint deal.

- The tension between “niche artisan projects” and venture-scale businesses.

- The daunting reality of competing in the global AI arms race.

Pitch 1

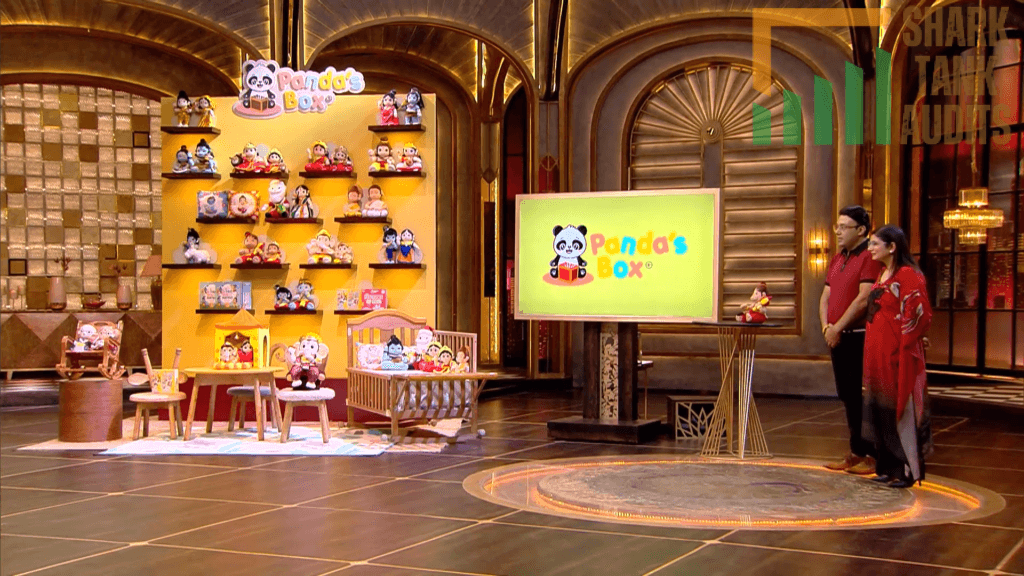

Panda’s Box Shark Tank India Episode Review

In Shark Tank India Season 5, Episode 26 (aired Monday, February 9, 2026), the Delhi-based early learning startup Panda’s Box delivered a compelling pitch centered on “Screen-Free” cultural education. Founders Sukriti and Rajat Mendiratta presented their mission to revive Indian traditions through toys like mantra-chanting plushies and interactive spiritual books.

Despite initial skepticism from Sharks like Anupam Mittal regarding the brand’s low repeat rates, the founders’ strong operational background and impressive growth (projected at ₹14 Crores for FY 25-26) led to a high-stakes negotiation. Ultimately, they secured a significant ₹1.2 Crore joint deal with Aman Gupta and Namita Thapar, albeit with a unique condition from Aman to re-evaluate the brand’s name to better align with its Indian heritage.

Pitch 2

The Bindi Project Shark Tank India Episode Review

The Bindi Project appeared on Shark Tank India Season 5, Episode 25, with founder Meghna Khanna (daughter of Indian Air Force fighter pilot, Symbiosis management background, ran Levitate boutique accessory store in Bengaluru for 18 years before pandemic closure) seeking ₹50 lakh for 10% equity (₹5 Crore valuation) but left with no deal after all Sharks opted out citing scalability concerns and niche market despite impressive 43% EBITDA margin.

The Bengaluru-based premium brand redefines traditional bindi as “jewellery for the forehead” through handcrafted reusable artisan-driven designs using upcycled materials (vintage sarees, leather scraps) priced ₹1,300-₹2,500 per pack (~₹250/bindi) with separate glue tube targeting “divine feminine energy,” growing from ₹7 lakh to ₹13 lakh monthly revenue with 20 organic visitors requiring SEO overhaul. Sharks reacted critically—Aman bluntly called it a “project” versus scalable business (physically escorted her out as she wouldn’t stop talking), Anupam noted bindis felt flimsy and glue packaging unpremium for high price, Namita questioned targeting ages 30-50 ignoring younger trend-drivers, Kunal appreciated “free spirit” but felt external investment might dilute authentic creative vision, though all acknowledged founder’s passion and healthy profit margins.

Operating in Indian fashion accessories market projected at $24.3 billion by 2030 (9% CAGR) with 40% surge in artisanal product demand from Gen Z/millennials embracing “Ethnic Fusion/Cottage-core” aesthetics within $19 billion ethnic wear/accessories market and $1.5 billion premium women’s accessories segment, The Bindi Project targets “Modern Traditionals” (25-45, Tier 1 cities, ₹20 lakh+ household income wearing bindis as fashion statement versus religious obligation) within 5-7 million affluent Indian women (top 5%) valuing sustainability and social impact, engaging through pop-up events and social media cold DMs to stylists like Rhea Kapoor while employing marginalized community women for handcrafted production.

Pitch 3

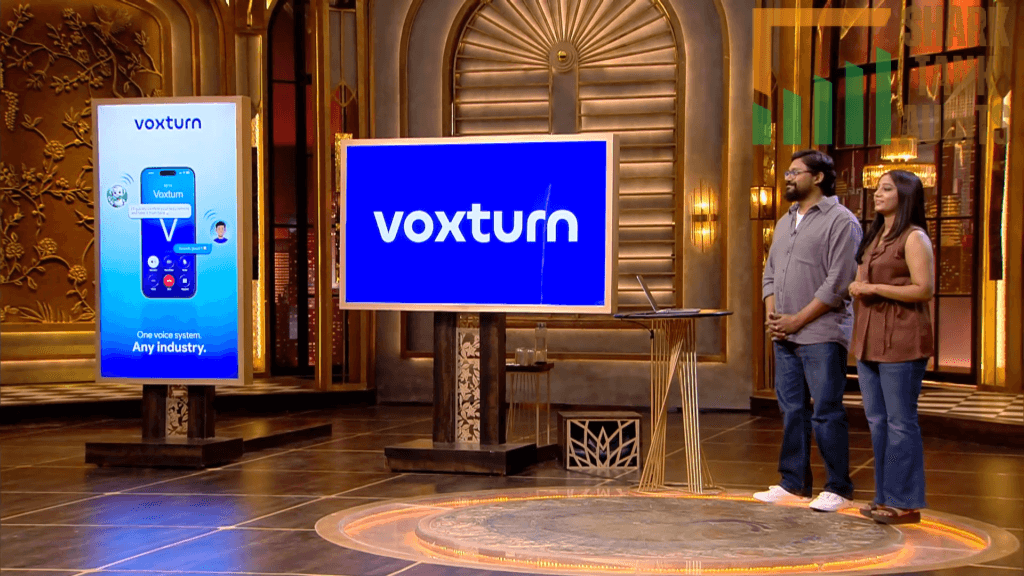

Voxturn AI Shark Tank India Episode Review

Voxturn AI appeared on Shark Tank India Season 5, Episode 26, with co-founders Gaurav Krishna Vishwakarma and CEO Anuja Murlidhar Futane seeking ₹1 Crore for 10% equity (₹10 Crore valuation) but left with no deal after all Sharks opted out citing high competition, lack of USP, and concerns over long-term sustainability in crowded market.

Launched August 2024, the generative AI platform automates sales interactions and lead nurturing through sophisticated “AI Sales Agent” mimicking human-like conversation via text/speech interfaces with “per connected minute” pricing (₹6/minute), automatic 7-second disconnect feature saving costs, and CRM integration, achieving ₹30.5 lakh YTD sales with impressive 27% EBITDA and 20% PAT (FY 24-25) using partner-led GTM strategy. Sharks reacted skeptically—Namita cited high market competition and scaling difficulties, Anupam critiqued pricing model suggesting productive human sales executive might offer better value, Shaily struggled identifying USP viewing product as too common, Kunal worried specific sectors like real estate require “full-stack” solutions currently lacking, and Aman questioned long-term future in crowded market.

Operating in Indian conversational AI market projected at $1.85 billion by 2030 (26.3% CAGR) within global $23.82 billion market (2026) and India’s $144.48 billion digital transformation market (2026, SMEs 21.1% highest growth) where India leads global enterprise AI adoption (80% rate, 2026) with 74% exploring “Agentic AI” versus simple rule-based chatbots, Voxturn targets 63 million registered MSMEs (specifically 47% already adopting digital sales platforms) in real estate/EdTech (high-ticket requiring instant qualification) and e-commerce/BFSI (high-volume inquiries/payment reminders) among decision makers (founders/sales directors/CTOs 28-50) in Tier 1/2 cities spending ₹2 lakh+/month on telecalling, aiming to eliminate “lead leakage” from delayed follow-ups amid contact centers projected to save $80 billion globally by 2026 through AI implementation.

Episode Summary: The Verdicts

Episode 26 was a roller coaster of emotions and financial scrutiny, showcasing the harsh reality that a “good product” doesn’t always equal a “fundable business.” While the Sharks were eager to support Indian roots, they remained laser-focused on unit economics and long-term defensibility.

The Scoreboard

| Pitch | Brand | Ask | Deal Status | Key Takeaway |

| Pitch 1 | Panda’s Box | Various | ₹1.2 Cr Deal | Secured funding from Aman & Namita with a mandate to “Indianize” the brand identity. |

| Pitch 2 | The Bindi Project | ₹50 Lakh | No Deal | High margins and passion couldn’t overcome Sharks’ fears of limited scalability. |

| Pitch 3 | Voxturn AI | ₹1 Crore | No Deal | A crowded AI market and lack of a unique “moat” left the founders empty-handed. |

Final Thoughts

The standout moment of the night was undoubtedly Panda’s Box, which managed to bridge the gap between traditional values and a scalable business model. Conversely, The Bindi Project and Voxturn AI served as cautionary tales; the former being “too niche” for the Sharks’ appetite, and the latter being “too common” in an era where AI startups are emerging daily. This episode underscores a vital lesson for Indian entrepreneurs: Passion gets you into the Tank, but a clear “USP” (Unique Selling Proposition) and scalability get you the cheque.

Leave feedback about this

You must be logged in to post a comment.