Shark Tank India Season 5 Episode 7 Review

Episode 7 of Shark Tank India Season 5 marked a return to the traditional multi-pitch format after two consecutive face-off episodes, delivering an eclectic mix of businesses spanning heritage foods, sustainable aquaculture, and cutting-edge AI technology. The episode showcased the full spectrum of Indian entrepreneurship—from third-generation family businesses modernizing traditional sweets to fisheries experts building the “Blue Economy,” and young tech founders navigating the AI revolution in search optimization. With pitches ranging from nostalgic mithai bars to biotech formulations for shrimp farmers, Episode 7 demonstrated that Shark Tank India’s appeal lies in its diversity, bringing together businesses that would never otherwise share the same stage but all represent critical pieces of India’s entrepreneurial ecosystem.

Episode Summary

Total Pitches: 3

Successful Deals: 2

Total Investment Made: ₹1.6 Crore

Featured Sharks: Anupam Mittal, Kunal Bahl, Namita Thapar, Aman Gupta, and others

Pitch 1

Pistabarfi Shark Tank India Episode Review

Pistabarfi appeared on Shark Tank India Season 5, Episode 7, with founders Tanay and Harshit Agarwal seeking ₹30 lakh for 5% equity (₹6 Crore valuation). Pistabarfi is a Mumbai-based premium sweets brand founded in September 2021 by third-generation entrepreneurs reviving their grandfather’s 1968 sweet shop. They offer traditional mithai as chocolate-like bars with 20-30% less sugar, targeting Gen Z and health-conscious families. Despite positive feedback, they left with No Deal.

Pitch 2

Corel Lifecare Shark Tank India Episode Review

Corel Lifecare, a specialized biotech startup operating in the “Blue Economy,” appeared on Shark Tank India (Season 5, Episode 7) seeking ₹1.2 crore for 2% equity. Founded by fisheries expert Abhijeet Naohate alongside Nikhilesh Hajare and Rohit Patel, the company develops advanced bio-formulations designed to improve water quality and increase yields for fish and shrimp farmers. The Sharks were highly impressed by the founders’ deep domain expertise and their existing network of 1,500 farmers and 120 “connect partners.” Ultimately, the brand secured a deal of ₹1.2 crore for 8% equity, partnering with Anupam Mittal and Kunal Bahl, who will provide the branding and supply chain expertise needed to scale their lab-to-farm ecosystem nationwide.

Pitch 3

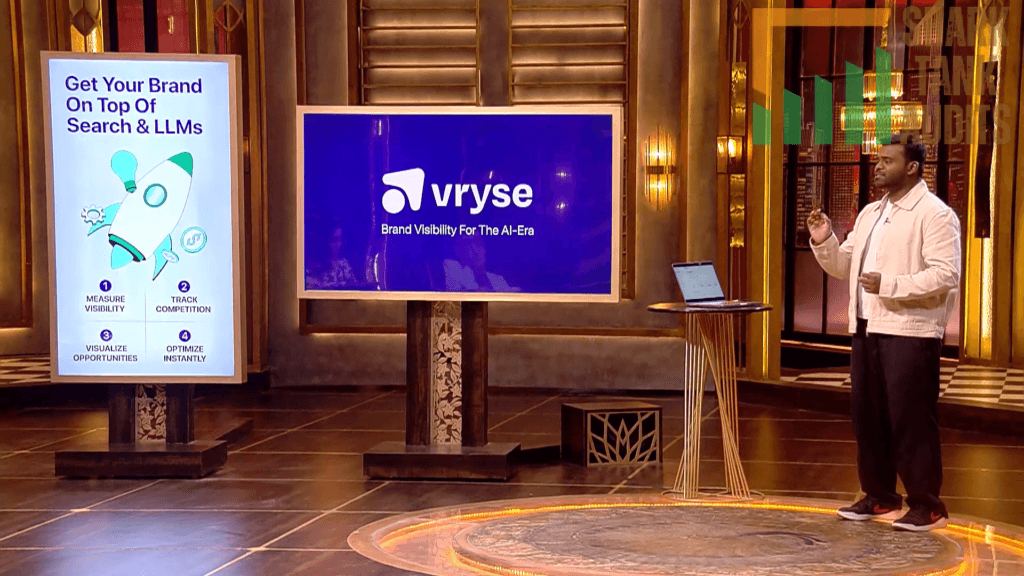

Vryse Shark Tank India Episode Review

Vryse, an AI-driven SEO growth engine, appeared on Shark Tank India (Season 5, Episode 7) with a pitch led by young entrepreneur Ashish Kamathi. Seeking ₹40 Lakhs for 2% equity at a ₹20 Crore valuation, Kamathi presented Vryse as a specialized B2B SaaS platform that helps brands navigate the shift from traditional search engines to AI-led search visibility (Generative Engine Optimization). While the Sharks raised concerns regarding the platform’s long-term defensibility against tech giants, Anupam Mittal saw the value in Vryse’s unified dashboard and technical SEO audits. Ultimately, a deal was finalized as Anupam Mittal invested ₹40 Lakhs for 10% equity, a significant increase in stake that secured the startup both the capital and the mentorship needed to scale its AI optimization framework.

Episode Highlights:

- Sector diversity: Heritage foods, biotech aquaculture, and AI SaaS all in one episode

- Generational entrepreneurship: Third-generation sweet makers modernizing 1968 legacy

- Blue Economy spotlight: First aquaculture biotech pitch showcasing underserved agricultural sectors

- AI search revolution: GEO (Generative Engine Optimization) entering mainstream entrepreneurial conversation

- Domain expertise premium: Fisheries experts with farmer networks commanding serious valuation

- Youth and ambition: Young founder tackling tech giants in AI search optimization

- Dramatic equity revisions: Corel (2% to 8%) and Vryse (2% to 10%) showing Sharks’ negotiation leverage

- Two-Shark collaboration: Anupam and Kunal partnering on Corel for complementary expertise

Key Lessons:

- Heritage and nostalgia alone don’t guarantee investment—market positioning and differentiation matter

- Deep domain expertise in underserved sectors (aquaculture) attracts serious investor interest

- Existing customer networks (1,500 farmers) provide validation and reduce go-to-market risk

- In emerging tech sectors (AI search), expect significant equity dilution due to defensibility concerns

- Youth and technical competence can secure investment even when facing tech giant competition

- Modernizing traditional businesses (sweets) requires more than just health tweaks—fundamental repositioning needed

- B2B SaaS for niche use cases (SEO/GEO) can find investors if addressing clear pain points

Strategic Patterns:

- Expert-founder fit: Corel’s fisheries expert founders perfectly matched to aquaculture biotech opportunity

- Risk pricing: Vryse’s 5x equity increase reflected defensibility concerns in AI-dominated space

- Market validation: Corel’s 1,500 farmer network proved market need beyond pitch deck claims

- Positioning gaps: Pistabarfi struggled to differentiate in crowded sweets market despite innovation

Market Context:

- Blue Economy: India’s aquaculture sector represents massive opportunity with traditional farmers needing modern solutions

- AI Search Evolution: Shift from traditional SEO to Generative Engine Optimization (GEO) creating new B2B SaaS opportunities

- Heritage modernization: Growing trend of next-gen inheritors reviving family businesses for contemporary consumers

- Health-conscious sweets: Competitive market with multiple players attempting sugar reduction in traditional mithai

Episode Narrative Arc: Episode 7’s structure—heritage story without deal, specialized domain expertise securing significant investment, young tech founder getting funded despite risks—captured entrepreneurship’s unpredictable nature. Sometimes the most emotionally compelling stories (family legacy) don’t convert to investment, while technical expertise in unsexy sectors (fish farming biotech) commands premium valuations. The episode reminded viewers that investor decisions balance heart and head, with proven domain expertise and market validation ultimately outweighing nostalgic narratives.

Leave feedback about this

You must be logged in to post a comment.