Truth & Hair Shark Tank India Episode Review

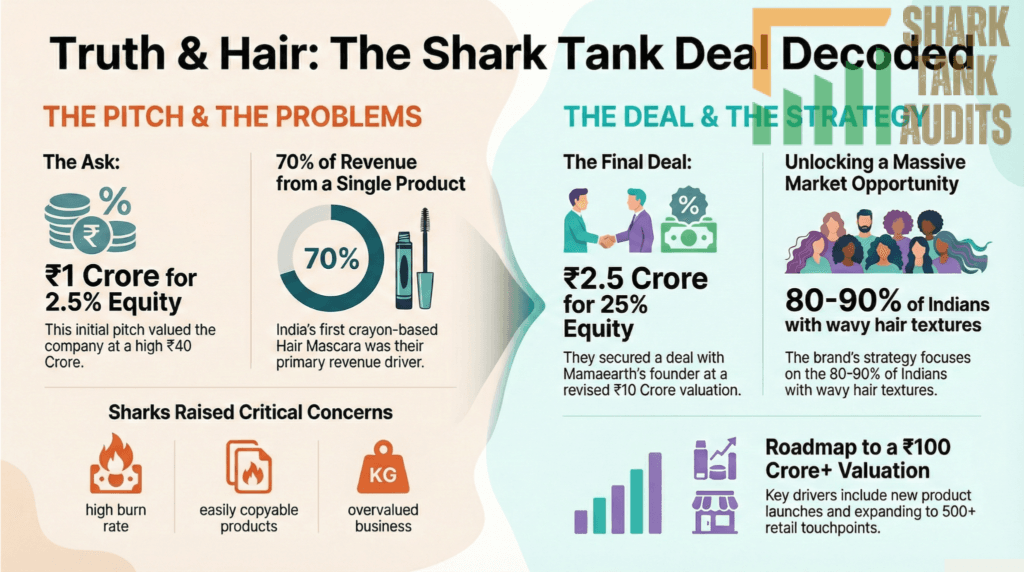

Truth & Hair appeared on Shark Tank India Season 5, Episode 8, with founders Soumya Alakh (trichology expert, 7 years experience, founder of India’s early curly hair marketplace NYNM) and Shailesh Singh seeking ₹1 Crore for 2.5% equity (₹40 Crore valuation) and closed a deal for ₹2.5 Crore for 25% equity (₹10 Crore valuation) with Shark Varun Alagh (Mamaearth founder). The Gurugram-based “hair beauty” brand focuses on instant styling solutions rather than traditional cleansing, with their Hair Mascara (India’s first crayon-based root touch-up) generating 70% of revenue. Targeting 80-90% of Indians with wavy hair textures, they offer products like Flyaway Wand for frizzy baby hairs and plan to launch Hair Glitter and Hair Gloss

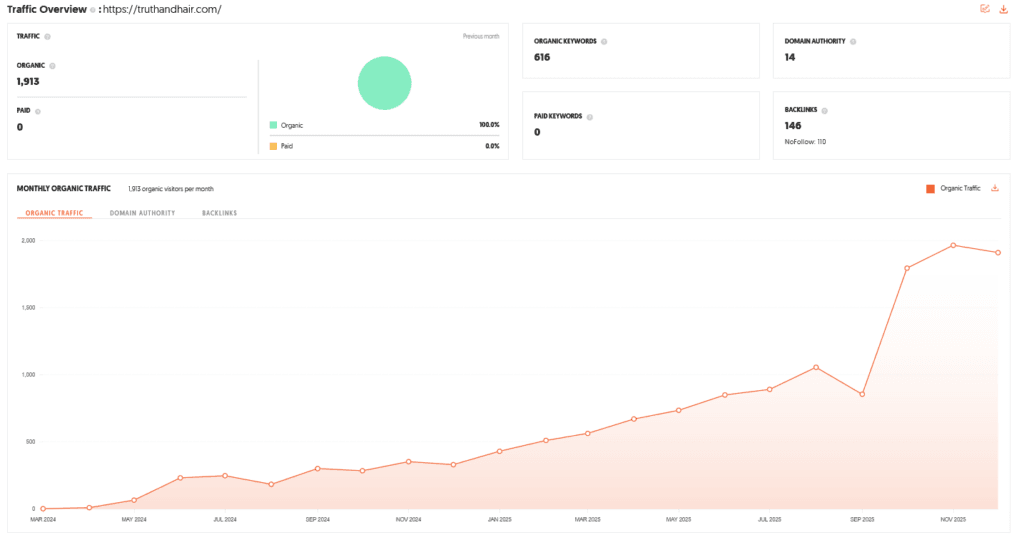

Truth & Hair Website Information

- Website:- Truth & Hair

- Build on Shopify

- Average SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 1913 visitor per month.

Truth & Hair Founders

The brand was founded by the husband-wife duo, Soumya Alakh and Shailesh Singh.

- Soumya Alakh: A trichology expert with 7 years of industry experience. She previously founded “NYNM” (Naturally You), one of India’s early marketplaces for curly hair.

- Shailesh Singh: An “all-rounder” co-founder who transitioned from a corporate career at Genpact to entrepreneurship to build the brand alongside Soumya.

Truth & Hair Brand Overview

- Truth & Hair is a Gurugram-based hair care and beauty brand that focuses on the “hair makeup” and “hair styling” niche.

- Unlike traditional brands that focus solely on cleansing (shampoos), Truth & Hair positions itself as a beauty-first brand.

- Their goal is to provide instant solutions for common hair concerns, such as frizzy flyaways and grey roots, saving customers both time and money compared to expensive salon treatments.

Truth & Hair Product Overview & Highlights

The brand focuses on innovative, texture-based, and aesthetic hair solutions.

- Hair Mascara: India’s first crayon-based root touch-up tool for instant grey coverage. It currently accounts for 70% of the brand’s total revenue.

- Flyaway Wand: A specialized wand designed to instantly slick back frizzy baby hairs for a polished look.

- Hero Product (Volume): While the mascara drives revenue, the founders consider their Hair Mask to be a core hero product.

- Future Pipeline: The founders are developing “Hair Glitter” (non-sticky formula), “Hair Gloss,” and a unique dry shampoo.

Truth & Hair Shark Tank India Appearance & Ask

- The founders appeared on Shark Tank India seeking ₹1 Crore for 2.5% equity, valuing the company at ₹40 Crores.

- They highlighted their transition from a niche curly hair marketplace to a broader “hair beauty” brand targeting the 80–90% of Indians with wavy hair textures.

Truth & Hair Season and Episode Air Date

- Season: 05

- Episode: 08

- Episode Air Date: Wednesday, 14 January 2026

Truth & Hair Investor Reactions

The Sharks had mixed feelings regarding the business’s current stage:

- Positive Feedback: Viraj Bahl praised the packaging, noting that it stands out and looks premium. Vineeta Singh acknowledged Soumya’s long-standing credibility in the curly hair community.

- Concerns over Scalp/Moat: Namita Thapar felt the products were “easily copyable” and that the brand lacked a “moat” (competitive advantage).

- Early Stage Skepticism: Kunal Bahl pointed out that since 70% of sales come from a single product (mascara) launched only months ago, the business felt like a “three-month-old company” rather than an established brand.

- Financials: The Sharks noted high “burn” (losses) and a high valuation relative to their projected annual revenue of ₹4–4.5 Crores.

Truth & Hair Customer Engagement Philosophy

- The brand’s philosophy is rooted in identifying neglected hair textures.

- They shifted from a “Curly Hair” focus to a “Wavy Hair” focus because the founders realized that while most Indians have wavy hair, most products are marketed either for straight or curly hair.

- They aim to engage customers by treating hair care as a part of a daily beauty and makeup routine rather than just hygiene.

Truth & Hair Future Vision

- The founders envision Truth & Hair becoming a leader in the “Hair Beauty” category.

- Their roadmap includes moving beyond basic care into high-glamour styling products like hair glitters and glosses.

- By leveraging Soumya’s expertise in trichology, they aim to continue launching R&D-backed formulations that bridge the gap between clinical hair care and cosmetic beauty.

Truth & Hair Deal Finalized or Not

- Yes, a deal was finalized. Initially, the founders did not show interest in the high equity asks.

- However, after negotiations regarding the brand’s valuation and the need for strategic expertise:

- Final Deal: Varun Alagh (Founder of Mamaearth) invested ₹2.5 Crores for 25% equity.

- The deal closed at a ₹10 Crore valuation, significantly lower than the initial ₹40 Crore ask, but securing a strategic partner in the personal care industry.

| Item | Details |

|---|---|

| Website Name | Truth & Hair |

| Website Platform | Built on Shopify |

| SEO Status | Average SEO performance, improvement needed |

| Organic Traffic | 1,913 visitors per month |

| Founder 1 Name | Soumya Alakh |

| Founder 1 Background | Trichology expert with 7 years of experience |

| Founder 1 Previous Venture | Founder of NYNM (Naturally You), curly hair marketplace |

| Founder 2 Name | Shailesh Singh |

| Founder 2 Background | Ex-Genpact professional turned entrepreneur |

| Founder Structure | Husband–wife founding team |

| Brand Location | Gurugram, India |

| Brand Category | Hair care, hair makeup, and hair styling |

| Brand Positioning | Beauty-first hair solutions, not just cleansing |

| Core Problem Solved | Instant solutions for frizz and grey roots |

| Key Differentiator | Salon-like results at home |

| Flagship Product | Hair Mascara (crayon-based root touch-up) |

| Revenue Contribution | Hair Mascara contributes ~70% of revenue |

| Secondary Product | Flyaway Wand |

| Hero Product (Founder View) | Hair Mask |

| Product Innovation | Texture-based, aesthetic hair solutions |

| Future Product Pipeline | Hair Glitter, Hair Gloss, Dry Shampoo |

| Shark Tank Ask | ₹1 Crore for 2.5% equity |

| Initial Valuation | ₹40 Crores |

| Target Market Shift | From curly hair to wavy hair (80–90% Indians) |

| Investor Feedback (Positive) | Packaging praised by Viraj Bahl |

| Founder Credibility | Soumya recognized by Vineeta Singh |

| Investor Concern | Products seen as easily copyable |

| Moat Concern | Lack of strong competitive advantage |

| Revenue Concentration Risk | Heavy dependence on one product |

| Financial Observation | High burn rate |

| Projected Annual Revenue | ₹4–4.5 Crores |

| Customer Philosophy | Hair as part of daily beauty & makeup routine |

| Hair Texture Focus | Wavy and frizzy hair types |

| Brand Vision | Leader in “Hair Beauty” category |

| R&D Strength | Trichology-backed formulations |

| Deal Status | Deal finalized |

| Final Investor | Varun Alagh (Mamaearth) |

| Final Investment | ₹2.5 Crores |

| Final Equity | 25% |

| Final Valuation | ₹10 Crores |

| Market Size (India BPC) | $21.5B (2025), growing to $43.85B |

| High-Growth Segment | Hair styling & hair makeup |

| Wavy Hair Opportunity | 80–90% of Indian population |

| TAM (Hair Care India) | ~$4.28 Billion |

| SAM (Hair Beauty Segment) | ₹600–₹1,000 Crores |

| Revenue Target (3–5 yrs) | ₹50–₹100 Crores |

| Primary Audience | Women aged 22–45 |

| Secondary Audience | Gen-Z & Millennials (18–30) |

| Key Use Cases | Grey coverage, flyaway control, occasions |

| SEO Focus Keywords | Instant grey root touch-up, flyaway wand |

| Content Strategy | Before vs After demonstrations |

| Expert Content | Trichology-led education by founder |

| Influencer Focus | Wavy-hair micro influencers |

| Core Sales Channel | D2C via Shopify |

| Marketplaces | Nykaa, Amazon, Tira |

| Quick Commerce | Blinkit, Zepto |

| Salon Strategy | Carry-home products in premium salons |

| Key Advantage | First-mover in hair makeup in India |

| Strategic Edge | Varun Alagh’s FMCG expertise |

| Founder–Market Fit | Strong domain credibility |

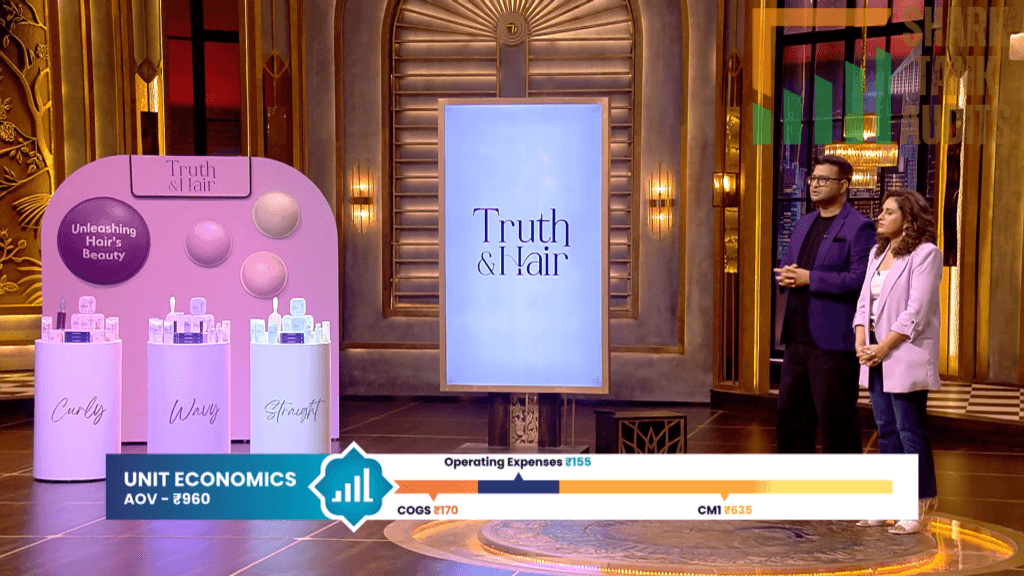

| Key Challenge | High EBITDA loss (~-48%) |

| CAC vs AOV Issue | ₹620 CAC vs ₹600 AOV |

| Inventory Risk | Stock-outs of Hair Mascara |

| Moat Risk | Easy replication by FMCG brands |

| Growth Strategy | Bundling to increase AOV & LTV |

| Supply Chain Plan | Manufacturing optimization |

| Revenue Diversification Goal | Reduce mascara dependency |

| Product Expansion Focus | Wedding & festive hair beauty |

| Margin Target | CM2 +15–20% |

| Long-Term Retail Goal | 500+ premium retail touchpoints |

Truth & Hair Shark Tank India Business Plan

1. Truth & Hair: Business Potential in India (Facts & Data)

- India’s Beauty Inflection Point: The Indian beauty and personal care (BPC) market is valued at approximately $21.5 billion in 2025 and is projected to grow to $43.85 billion by 2033 (CAGR of 9.3%).

- Segment Growth: While the traditional shampoo market is large (~₹8,500 Cr), the hair styling and makeup market is the high-growth frontier. The temporary hair color and “quick-fix” segment is growing at a CAGR of 17.4%, far outpacing generic cleansers.

- The Wavy Hair Opportunity: 80–90% of Indians have a wavy hair texture. By moving from a “Curly” focus to a “Wavy & Styling” focus, Truth & Hair has unlocked a massive, underserved demographic.

2. Truth & Hair: Total Addressable Market (TAM)

- TAM (Total Market): The Indian hair care market is estimated at $4.28 billion (₹35,000+ Cr) in 2025.

- SAM (Serviceable Market): The hair styling and “hair beauty” niche is valued at roughly ₹600–₹1,000 Cr, but it is currently under-penetrated.

- SOM (Target Share): Truth & Hair aims to capture the premium urban “hair makeup” segment, targeting a ₹50–₹100 Cr revenue within 3–5 years by dominating the root touch-up and flyaway wand categories.

3. Truth & Hair: Ideal Target Audience & Demographics

- Primary Demographic: Women aged 22–45 living in Tier-1 and Tier-2 cities (Mumbai, Delhi, Bangalore, etc.).

- Key Archetype – The Time-Strapped Professional: Busy women who need “salon-like” results at home for grey coverage or sleek styling but lack the time for 3-hour salon visits.

- Key Archetype – The Occasion Stylist: Gen-Z and Millennials (18–30) who use “hair makeup” for weddings, parties, and social media content (glitter, gloss).

- Hair Profile: Specifically targeting those with wavy or frizzy textures looking for specific styling control rather than just “cleanliness.”

4. Truth & Hair: Digital Marketing & Content Strategy

- Search Engine Optimization (SEO): Truth & Hair currently sees ~1,900 monthly organic visitors. The strategy must shift to “intent-based” keywords like “instant grey root touch up,” “best flyaway wand India,” and “hair makeup for wavy hair.”

- The “Problem-Solution” Content Hook: Use short-form video (Reels/YouTube Shorts) to show the “Before vs. After” of the Hair Mascara and Flyaway Wand.

- Educational Content: Leverage Soumya’s Trichology background to create “Ask the Expert” segments, building trust through science-backed hair health advice.

- Influencer Strategy: Collaborate with “Wavy Hair” influencers (not just the top 1% but micro-influencers) to demonstrate product application on diverse Indian hair textures.

5. Truth & Hair: Distribution Strategy

- D2C-First (Shopify): Continue using the Shopify website for data collection and high-margin sales.

- E-Marketplaces: Focus on Nykaa, Amazon, and Tira. These platforms are the primary search engines for beauty in India.

- Quick Commerce (Blinkit/Zepto): Essential for “instant” products like hair mascara. If a woman notices grey roots before a meeting, she needs the product in 10 minutes.

- B2B / Salon Partnerships: Placing the Flyaway Wand and Mascara in premium salons as “carry-home” beauty essentials.

6. Truth & Hair: Advantages & Challenges

Advantages:

- First-Mover in Hair Makeup: India’s first crayon-based root touch-up gives Truth & Hair a distinct identity.

- Strategic Investor: Having Varun Alagh (Mamaearth) provides access to a world-class supply chain and distribution playbook.

- Founder-Market Fit: Soumya’s 7 years of specialized hair experience provides high credibility.

Challenges:

- High Burn Rate: Current EBITDA is ~-48%. Bridging the gap from a ₹620 CAC (Customer Acquisition Cost) to a ₹600 AOV (Average Order Value) is critical.

- Moat Protection: As Namita Thapar noted, these products are easy to copy by larger FMCG giants.

- Inventory Risks: Being out of stock for hero products (Mascara) leads to customer churn.

7. Truth & Hair: Success Drivers & Mitigation Strategies

| Potential Risk | Mitigation Strategy for Truth & Hair |

| Low Barrier to Entry | Build a strong community/brand identity around “Wavy Hair” that competitors can’t easily replicate with a single SKU. |

| High Marketing Costs | Shift to a “Routine-Based” model (Bundling Shampoo + Mask + Styling) to increase AOV and LTV (Lifetime Value). |

| Supply Chain Gaps | Use the investment to build buffer stock and optimize manufacturing with partners like Vedic Cosmetics. |

8. Truth & Hair: Future Vision & Valuation Roadmap

To increase valuation from the Shark Tank deal (₹10 Cr) to a potential ₹100 Cr+ Series A, Truth & Hair must:

- Reduce Revenue Dependency: Shift from 70% mascara dependency to a balanced mix (30% Mascara, 30% Styling, 40% Routine Care).

- Product Expansion: Launch the “Hair Glitter” and “Hair Gloss” to own the “Festival/Wedding Beauty” niche in India.

- Achieve CM2 Positive: Move from -7% to +15-20% Contribution Margin by optimizing performance marketing and increasing repeat purchase rates (>30%).

- Omnichannel Presence: Reach 500+ premium retail touchpoints (Modern Trade) to move beyond purely digital-native limitations.

Truth & Hair Shark Tank India Episode Review