True Diamond Shark Tank India Episode Review

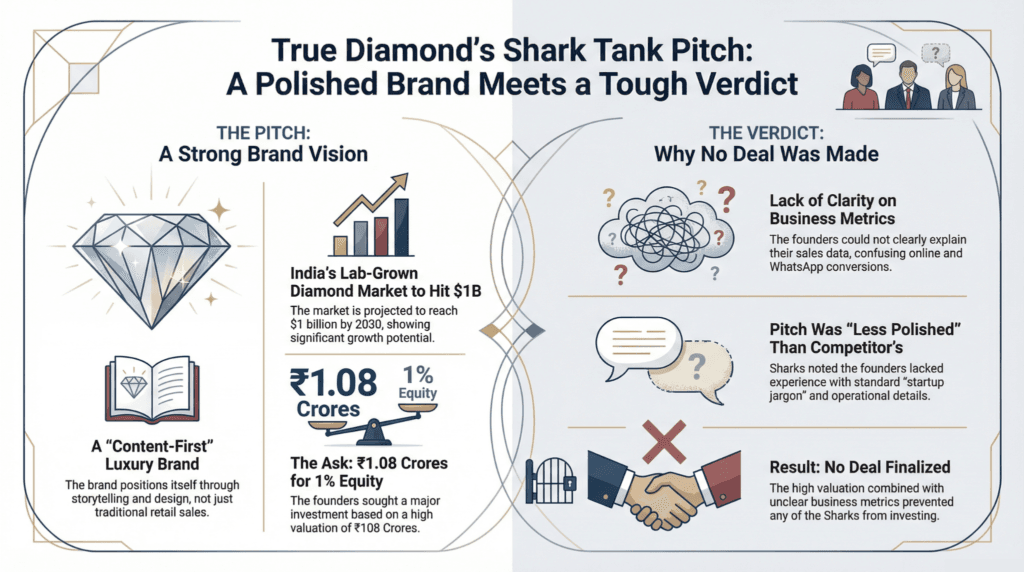

True Diamond appeared on Shark Tank India Season 5, Episode 5, in a “Battle of the Bling” match-off against Emori, with founders Darayus Mehta and Parin Shah seeking ₹1.08 Crore for 1% equity (₹108 Crore valuation). They left with no deal due to unclear business metrics despite likable personalities and beautiful products.

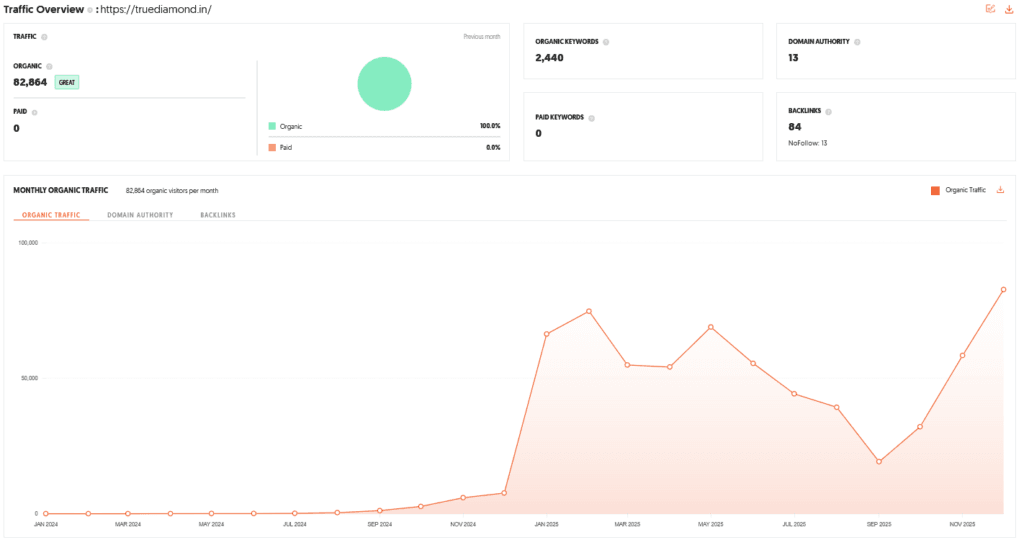

True Diamond is a content-first, design-led lab-grown diamond brand with 82,864 monthly organic visitors founded by corporate professionals. Showcasing signature pieces like “3 Lovers Ring” and “Stairway to Heaven,” they target design-conscious millennials (22-40) valuing ethical luxury. Aman Gupta engaged them in a “True or False” game debunking LGD myths, while Namita showed interest. However, Sharks criticized confusion between “online sales” and “WhatsApp conversions,” finding the pitch less polished than competitor Emori. Despite strong design vision and SEO performance, their lack of startup metric clarity and operational articulation prevented investment in the growing Indian LGD market ($400M in 2024, projected $1B by 2030).

True Diamond Website Information

- Website:- True Diamond

- Build on Shopify

- Great SEO Performance.

- ORGANIC TRAFFIC: 82,864 visitor per month.

True Diamond Founders

- The brand was represented by Darayus Mehta and Parin Shah.

- Both founders come from a corporate background, which was reflected in their sincere and professional demeanor.

- They were praised by the Sharks for their candidness and charm, though they were noted to be relatively new to the specific “startup jargon” often expected in the Tank.

True Diamond Brand Overview

- True Diamond is a luxury lab-grown diamond brand that positions itself as a “content-first” and design-heavy player in the jewelry industry.

- Unlike traditional jewelers who focus solely on retail volume, True Diamond emphasizes storytelling and aesthetic innovation.

- The brand aims to bridge the gap between high-fashion luxury and sustainable, ethically sourced lab-grown diamonds.

True Diamond Shark Tank India Appearance & Ask

- True Diamond appeared in Season 5, Episode 5 (aired in early January 2026) in a special “Battle of the Bling” MATCH OFF segment, competing with Emori.

- They were pitted against a competitor brand, Emori, to showcase different approaches to the lab-grown diamond market.

- The Ask: The founders sought an investment of ₹1.08 Crores for 1% equity, valuing the company at ₹108 Crores.

True Diamond Season and Episode Air Date

- Season: 05

- Episode: 05

- Episode Air Date: Friday, 09 January 2026

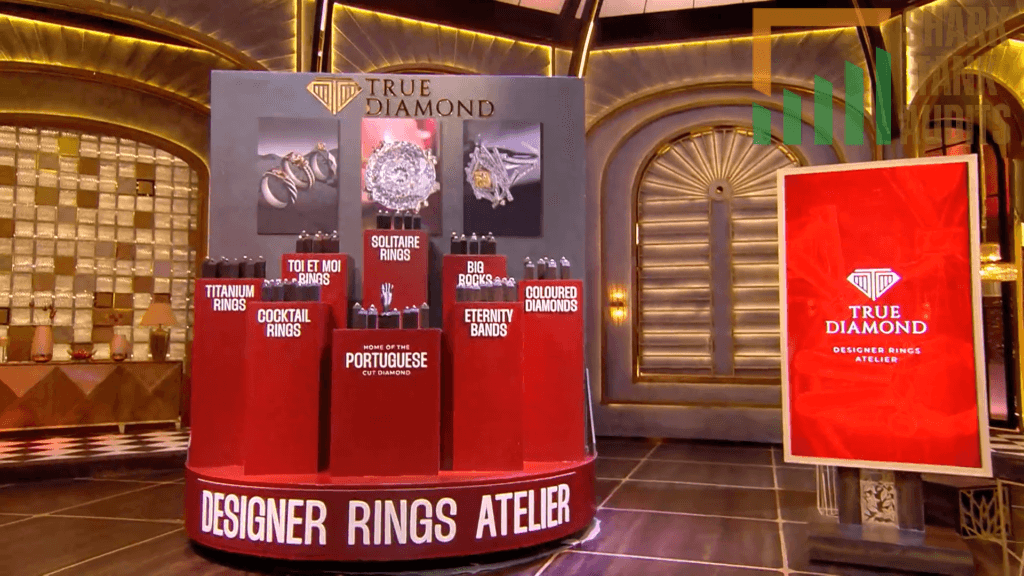

True Diamond Product Overview

- True Diamond focuses on intricate, high-concept jewelry designs that leverage the versatility of lab-grown diamonds.

- During the pitch, the founders showcased their ability to create premium-looking pieces that appeal to a younger, design-conscious demographic that values both ethics and elegance.

True Diamond Product Highlights

The founders highlighted two signature creations during their presentation:

- 3 Lovers Ring: A unique design symbolizing deep personal connections.

- Stairway To Heaven: A design-heavy piece that showcased the brand’s commitment to “art you can wear.”

True Diamond Investor Reactions

The Sharks had a polarized reaction to the pitch:

- Aman Gupta: Engaged the founders in a “True or False” game to debunk myths about lab-grown diamonds, specifically focusing on their resale value and authenticity compared to mined diamonds.

- Namita Thapar: Showed significant interest in the brand, though some viewers and fellow Sharks questioned if her interest was driven more by the founders’ personalities than the business’s current scalability.

- General Critique: The Sharks criticized the founders for their lack of clarity on business metrics. Specifically, they were confused by the brand’s definition of “online sales” versus “WhatsApp conversions” and noted that the pitch was less “polished” than their competitor’s.

True Diamond Customer Engagement Philosophy

- True Diamond follows a “content-first” philosophy.

- They believe that in the modern era, jewelry is sold through storytelling and digital engagement rather than just shelf space.

- Their strategy involves using digital content to educate consumers about the benefits of lab-grown diamonds while building an emotional connection through design.

True Diamond Future Vision

- The future vision for True Diamond is to become a dominant design house in the lab-grown diamond sector.

- Despite the hurdles faced during the pitch, the founders expressed a sincere passion for the industry.

- Their goal is to refine their operational strategy and coaching on startup metrics to scale their design-led model into a major retail and e-commerce force.

True Diamond Deal Finalized or Not

- No deal was finalized.

- While the Sharks found the founders likable and the products beautiful, the lack of clarity regarding business operations and the high valuation compared to their current metrics prevented an investment.

| Parameter | Details |

|---|---|

| Website | True Diamond |

| Platform Built On | Shopify |

| SEO Performance | Excellent |

| Organic Traffic | ~82,864 visitors per month |

| Brand Name | True Diamond |

| Brand Category | Luxury Jewellery / Lab-Grown Diamonds |

| Brand Positioning | Content-first, design-led luxury |

| Founders | Darayus Mehta & Parin Shah |

| Founder Background | Corporate professionals |

| Founder Impression | Sincere, charming, professional |

| Startup Experience | Relatively new to startup metrics language |

| Brand Philosophy | Storytelling-driven luxury |

| Core Product | Lab-grown diamond jewellery |

| Sustainability Angle | Ethical, conflict-free diamonds |

| Shark Tank Appearance | Season 05 |

| Episode Number | Episode 05 |

| Episode Air Date | Friday, 09 January 2026 |

| Special Segment | “Battle of the Bling” Match-Off |

| Competing Brand | Emori |

| Investment Ask | ₹1.08 Crore |

| Equity Offered | 1% |

| Valuation Asked | ₹108 Crore |

| Pitch Focus | Design, storytelling, aesthetics |

| Product Design Style | High-concept, artistic |

| Signature Product | 3 Lovers Ring |

| Signature Product | Stairway to Heaven |

| Target Customer | Design-conscious younger buyers |

| Product Perception | Premium, fashion-forward |

| Shark Reaction – Aman Gupta | Myth-busting LGD resale & authenticity |

| Aman’s Strategy | “True or False” challenge |

| Shark Reaction – Namita Thapar | Showed strong interest |

| Viewer Observation | Interest partly founder-driven |

| General Shark Critique | Weak clarity on business metrics |

| Metric Confusion | Online sales vs WhatsApp conversions |

| Pitch Comparison | Less polished than Emori |

| Customer Engagement Model | Content-first |

| Sales Philosophy | Emotion + education over retail push |

| Digital Focus | Storytelling through visuals |

| Founder Strength | Design vision |

| Founder Weakness | Operational articulation |

| Deal Finalized | ❌ No |

| Reason for No Deal | Valuation + metric clarity issues |

| Founder Passion | Strong commitment to LGD industry |

| Market Size (India LGD – 2024) | ~$400 Million |

| Market Projection (2030) | ~$1 Billion |

| Industry Growth Rate | 12–15% CAGR |

| LGD Share of Urban Sales | ~8–10% |

| Indian Diamond Market (2025) | ~$18.12 Billion |

| TAM | Indian diamond & luxury jewellery market |

| SAM | Urban Millennials & Gen Z |

| Market Opportunity | Low diamond ownership (<10%) |

| Primary Demographic | Ages 22–40 |

| Buyer Psychology | Value-conscious luxurists |

| Key Buyer Segment | Working women & young couples |

| Use Case | Self-gifting & affordable solitaires |

| Content Strategy | Myth-busting + education |

| SEO Strength | 80k+ organic visitors |

| SEO Content Type | Design guides & sourcing blogs |

| Social Commerce | Instagram + WhatsApp |

| Conversion Channel | Visual storytelling |

| Distribution Model | Online-first (D2C) |

| Physical Expansion Plan | Experience lounges |

| Target Cities | Mumbai, Delhi, Bangalore |

| WhatsApp Sales | Major conversion driver |

| Key Operational Gap | Attribution & CRM clarity |

| Product Expansion Plan | Everyday luxury (₹20k–₹50k) |

| Export Opportunity | US & EU LGD markets |

| Manufacturing Advantage | India as LGD hub |

| Core Advantage | Identical to mined diamonds |

| Design Advantage | Creative freedom |

| Ethical Advantage | Green luxury |

| Major Challenge | Resale perception |

| Business Challenge | Metric standardization |

| Competitive Pressure | Titan beYon, Emori |

| Mitigation Strategy | Buy-back / upgrade policy |

| Operational Fix | Hire startup-focused COO |

| Long-Term Vision | Become a global LGD design house |

| Overall Assessment | Strong brand vision, weak execution clarity |

True Diamond Shark Tank India Business Plan

True Diamond India Business Potential: Market Stats & Facts

The Indian market represents one of the most fertile grounds for True Diamond due to shifting cultural norms and economic drivers.

- Market Valuation: The India Lab-Grown Diamond market was valued at approximately $400 million (₹3,452 Cr) in 2024 and is projected to reach $1 billion by 2030.

- Growth Rate: The industry is witnessing a CAGR of 12% to 15%, significantly outperforming the natural diamond segment.

- Consumer Shift: Luxury consumers are increasingly treating LGDs as “fashion luxury,” with the category making up nearly 8-10% of urban diamond jewelry sales in India.

True Diamond Total Addressable Market (TAM)

The TAM for True Diamond encompasses the broader Indian jewelry and luxury segments:

- Total Diamond Market (India): Projected at $18.12 billion in 2025.

- Serviceable Addressable Market (SAM): Urban millennials and Gen Z buyers in Tier 1 and Tier 2 cities who are currently contributing to a 20-25% festive sales surge in lab-grown diamonds.

- Market Penetration Opportunity: With diamond ownership in India still under 10%, True Diamond has a massive headroom for growth as it positions itself as an affordable alternative to the $10 billion natural diamond market.

True Diamond Ideal Target Audience & Demographics

The brand’s design-heavy pieces, like the Stairway to Heaven, specifically target:

- Primary Demographic: Urban Millennials and Gen Z (Ages 22–40).

- Psychographics: “Value-conscious luxurists” who prioritize ethical sourcing, sustainability, and unique aesthetics over traditional “investment” value.

- User Profile: Working women buying “self-gift” jewelry and young couples looking for high-carat engagement rings at 30-50% lower costs than natural stones.

True Diamond Content & Digital Marketing Strategy

Because True Diamond is “content-first,” its digital strategy is the engine of its growth:

- Story-Led Education: Using video content to debunk myths (as discussed with Aman Gupta) regarding resale value and diamond authenticity.

- SEO Dominance: Leveraging its 80k+ organic traffic by creating long-form “Design Guides” and “Sourcing Transparency” blogs.

- Social Commerce: Utilizing Instagram and WhatsApp as primary conversion funnels. The brand specializes in high-quality visual storytelling that positions jewelry as “art you can wear.”

True Diamond Distribution & Omnichannel Strategy

To scale, True Diamond must bridge its online success with physical touchpoints:

- Online-First (D2C): Maintaining the Shopify store as the primary global storefront.

- Experience Centers: Small, high-design physical “lounges” in metros (Mumbai, Delhi, Bangalore) where customers can feel the “Bling” before purchasing via the app.

- WhatsApp Sales Channel: Refining the conversion metrics from WhatsApp chats to finalized sales to provide the clarity the Sharks requested.

True Diamond Future Vision & Roadmap to Increase Valuation

The path to the ₹108 Crore valuation (and beyond) involves three key pillars:

- Metric Standardization: Implementing robust CRM tools to track customer lifetime value (LTV) and clear attribution for digital sales.

- Product Expansion: Moving beyond rings/pendants into “Everyday Luxury” collections priced at the ₹20k–₹50k “sweet spot.”

- Global Export: Leveraging India’s status as a global LGD manufacturing hub to export True Diamond designs to the US and EU markets, where LGD adoption is already over 50%.

True Diamond Advantages & Challenges

| Advantages | Challenges |

| Identical Quality: 100% chemically, physically, and optically the same as mined diamonds. | Resale Concerns: Consumer perception regarding the lack of high resale value for LGDs. |

| Design Innovation: Freedom to create bold designs like the 3 Lovers Ring. | Operational Clarity: Needs better tracking of “Online” vs. “WhatsApp” conversion data. |

| Ethical Appeal: Zero-conflict, sustainable “Green Luxury.” | Intense Competition: Facing giants like Titan’s beYon and established startups like Emori. |

True Diamond Mitigation Strategies for Success

- Transparency Policy: Offer a clear buy-back or upgrade policy to mitigate consumer fear regarding resale value.

- Strategic Coaching: Hiring a “Startup-focused” COO to handle the business metrics, allowing the founders to focus on their core strength: Brand Vision and Design.

True Diamond Shark Tank India Episode Review