Pistabarfi Shark Tank India Episode Review

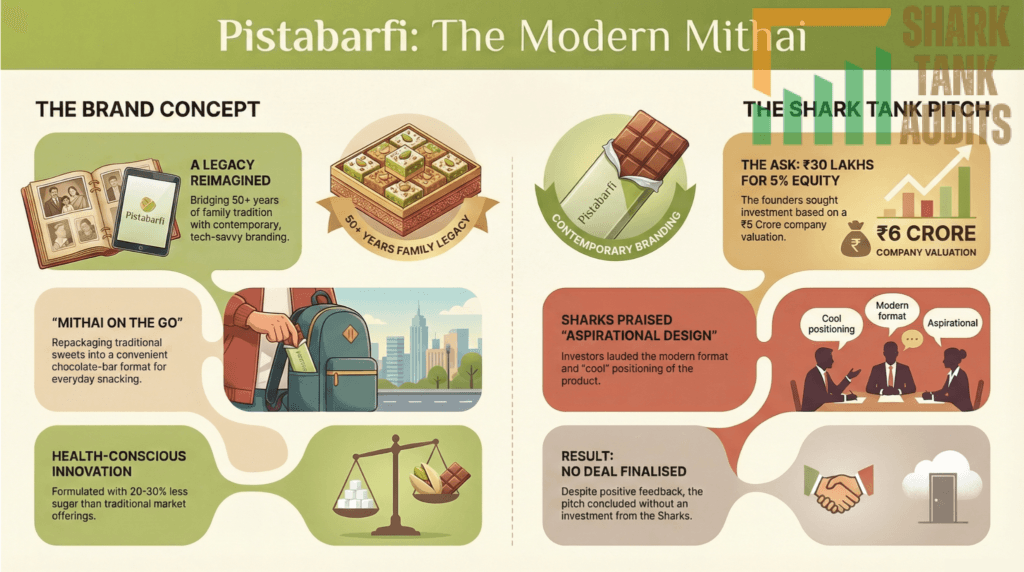

Pistabarfi appeared on Shark Tank India Season 5, Episode 7, with founders Tanay and Harshit Agarwal seeking ₹30 lakh for 5% equity (₹6 Crore valuation). Pistabarfi is a Mumbai-based premium sweets brand founded in September 2021 by third-generation entrepreneurs reviving their grandfather’s 1968 sweet shop. They offer traditional mithai as chocolate-like bars with 20-30% less sugar, targeting Gen Z and health-conscious families. Despite positive feedback, they left with No Deal.

Pistabarfi Website Information

- Website:- Pistabarfi

- Build on Shopify

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 2504 visitor per month.

Pistabarfi Founders

- Tanay Agarwal co-founded the Mumbai-based cloud kitchen business Pistabarfi with his brother, Harshit Agarwal.

- They revived their grandfather’s traditional sweet shop legacy, using a modern, design-forward approach to sell classic Indian sweets

- As third-generation entrepreneurs, they carry forward a family legacy that dates back to a sweet shop established in 1968.

- Their pitch demonstrated a blend of heritage-driven storytelling and modern business acumen.

Pistabarfi Brand Overview

- Launched in September 2021, Pistabarfi is a premium Indian sweets brand that bridges the gap between deep-rooted tradition and contemporary consumer habits.

- Based on a legacy of over five decades, the brand has transitioned from a traditional storefront to a tech-savvy online platform, targeting a global audience with high-quality, consistent, and heritage-rich confectionery.

Pistabarfi Shark Tank India Appearance & Ask

- Pistabarfi was featured in Season 5, Episode 7, titled “Tradition Meets Innovation,” which aired on January 13, 2026.

- The founders sought an investment of ₹30 Lakhs for 5% equity, valuing the company at ₹6 Crores.

Pistabarfi Season and Episode Air Date

- Season: 05

- Episode: 07

- Episode Air Date: Tuesday, 13 January 2026

Pistabarfi Product Overview

- Pistabarfi offers a “design-forward” reimagining of Indian mithai.

- The core product is traditional sweets presented in a chocolate-like bar form, making them convenient for “on-the-go” consumption.

- The portfolio includes premium pista-based sweets, assorted packs, and specialized gifting boxes available in various sizes to cater to both personal cravings and large-scale celebrations.

Pistabarfi Investor Reactions

- The Sharks reacted positively to the brand’s innovation in packaging, noting that the chocolate-bar format is a standout feature for modernizing the Indian mithai market.

- They lauded the founders for their “aspirational design” and their ability to position a traditional product as a “cool” snack.

- However, the session was also a lesson in balanced business decision-making, as the Sharks evaluated the scalability of the model.

Pistabarfi Customer Engagement Philosophy

- The brand focuses on a Gen Z and modern family-centric approach.

- Their philosophy centers on maintaining the “originality” of the sweet while ensuring the experience is premium.

- By prioritizing purity, hygiene, and attractive packaging, they aim to make mithai a part of everyday life rather than just a seasonal indulgence.

Pistabarfi Product Highlights

- Health-Conscious: Contains 20–30% less sugar than traditional market offerings.

- Texture & Taste: Known for a soft, mouth-melting texture with a rich, balanced flavor profile.

- Modern Format: Marketed as “Mithai on the go” to compete with global chocolate brands.

- Versatile Gifting: Options range from compact everyday packs to premium boxes designed for corporate gifting, weddings, and festivals.

Pistabarfi Future Vision

- The founders envision moving Indian sweets away from being strictly festive or wedding-bound purchases.

- Their goal is to establish Pistabarfi as a contemporary global brand that offers the same brand recognition and accessibility as international chocolate giants, ensuring traditional Indian flavors reach a worldwide audience with a modern touch.

Pistabarfi Deal Finalized or Not

- No deal was finalized.

- Despite the sharks’ appreciation for the product innovation and the brand’s narrative, the pitch concluded without an investment from the Sharks.

| Particular | Details |

|---|---|

| Website | Pistabarfi |

| Platform Built On | Shopify |

| SEO Performance | Poor SEO performance |

| SEO Status | SEO improvement needed |

| Monthly Organic Traffic | 2,504 visitors |

| Founder Name | Tanay Agarwal |

| Co-Founder | Harshit Agarwal |

| Founder Location | Mumbai, India |

| Business Model | Cloud kitchen |

| Family Legacy | Third-generation sweet business |

| Legacy Origin Year | 1968 |

| Inspiration Source | Grandfather’s traditional sweet shop |

| Founder Strength | Heritage storytelling with modern acumen |

| Brand Launch Date | September 2021 |

| Brand Positioning | Premium Indian sweets brand |

| Core Brand Philosophy | Tradition meets modern design |

| Target Market | Global and Indian consumers |

| Retail Evolution | Traditional store to tech-savvy online brand |

| Shark Tank Season | Season 05 |

| Shark Tank Episode | Episode 07 |

| Episode Title | Tradition Meets Innovation |

| Episode Air Date | Tuesday, 13 January 2026 |

| Investment Ask | ₹30 Lakhs |

| Equity Offered | 5% |

| Valuation Sought | ₹6 Crores |

| Core Product Concept | Design-forward Indian mithai |

| Product Format | Chocolate-like bar |

| Consumption Use Case | On-the-go snacking |

| Product Categories | Pista sweets, assorted packs, gifting boxes |

| Gifting Sizes | Personal to large celebrations |

| Shark Feedback | Positive on packaging innovation |

| Packaging Innovation | Mithai in bar format |

| Design Appreciation | Aspirational and modern |

| Market Positioning | Traditional sweet as a cool snack |

| Scalability Concern | Evaluated by Sharks |

| Customer Philosophy | Gen Z and modern family focus |

| Brand Value Focus | Originality with premium experience |

| Quality Focus | Purity, hygiene, premium packaging |

| Consumption Goal | Everyday indulgence |

| Sugar Reduction | 20–30% less sugar |

| Taste Profile | Soft, mouth-melting texture |

| Flavor Profile | Rich and balanced |

| Competitive Framing | Competes with global chocolates |

| Gifting Applications | Corporate, weddings, festivals |

| Long-Term Vision | Make mithai a global contemporary brand |

| Category Expansion Goal | Move beyond festive-only sweets |

| Global Aspiration | Match international chocolate brands |

| Deal Status | No deal |

| Reason for No Deal | No investment finalized |

| Market Size Projection | $25 Billion by 2026 |

| Industry Type | Indian sweets and savory market |

| Industry Shift | From unorganized to organized |

| Organized Market Growth | 16% CAGR |

| Health Trend | Lower sugar preference |

| Consumer Preference | Permissible indulgence |

| Brand Sugar Advantage | 20–30% lower sugar |

| Heritage Advantage | 50+ years authenticity |

| Consumer Trust Metric | 61% prefer authentic brands |

| Total Addressable Market | ₹84,300 Crore |

| Serviceable Market | ₹27,647 Crore |

| Target Obtainable Market | ₹2,500+ Crore |

| Primary Audience | Gen Z (18–27 years) |

| Gen Z Preference | Instagrammable sweets |

| Secondary Audience | Health-conscious families |

| Family Age Group | 28–45 years |

| Urban Focus | Tier 1 cities |

| Gifting Buyer Segment | Corporate HRs and wedding planners |

| Core Brand Narrative | Mithai bar |

| Content Focus | Aesthetic food visuals |

| Social Platforms | Instagram, TikTok |

| Influencer Strategy | Fitness and lifestyle influencers |

| SEO Weakness | High competition keywords |

| SEO Fix Strategy | Long-tail keywords |

| Paid Marketing | Meta and Google Ads |

| Festive Ad Timing | 45 days before festivals |

| Conversion Fix | Improve site speed |

| Store Optimization | Quick Buy buttons |

| Primary Sales Channel | D2C website |

| Quick Commerce Strategy | Blinkit, Zepto |

| Retail Expansion | Airports and premium stores |

| Export Markets | UAE, USA, UK |

| Key Innovation | Mess-free mithai bar |

| Brand Trust Factor | Family legacy |

| Operations Model | Mumbai cloud kitchen |

| Shelf Life Challenge | Short shelf life |

| Shelf Life Solution | Modified atmosphere packaging |

| Cost Challenge | High pistachio prices |

| Cost Mitigation | Bulk sourcing contracts |

| Competitive Pressure | Haldiram’s, Bikanervala |

| Differentiation Strategy | Low sugar + modern format |

| Year 1 Goal | Fix SEO and reach ₹10 Cr ARR |

| Organic Traffic Goal | 25,000 monthly visitors |

| Year 2–3 Plan | Subscription boxes |

| Expansion Cities | 5 major metros |

| Year 5 Goal | Global expansion |

| Exit Possibility | Acquisition or IPO |

| Valuation Multiple Shift | Sweet shop to D2C brand |

| Revenue Multiple Target | 5–8× revenue |

Pistabarfi Shark Tank India Business Plan

1. Pistabarfi: Market Potential & Business Landscape (India 2026)

- Sector Growth: The Indian savory and sweets market is projected to hit $25 Billion by 2026.

- Organized Shift: While 90% of the sweet industry was historically unorganized, the organized segment is growing at a 16% CAGR, as consumers shift toward branded, hygienic products like Pistabarfi.

- The “Health-Indulgence” Gap: 55% of urban Indian households now prefer sweets with 25–75% less sugar. Pistabarfi’s 20–30% lower sugar content perfectly captures this “permissible indulgence” trend.

- Legacy Advantage: As a third-generation brand (est. 1968), Pistabarfi possesses the “authenticity” that 61% of Indians prioritize over Western snacks.

2. Pistabarfi: Total Addressable Market (TAM) & Stats

- TAM (Total Addressable Market): The overall Indian confectionery and traditional sweets market is valued at approx. ₹84,300 Crore.

- SAM (Serviceable Addressable Market): The organized packaged sweets segment, valued at ₹27,647 Crore by 2033, represents Pistabarfi’s primary expansion zone.

- SOM (Serviceable Obtainable Market): Targeting the premium, D2C, and gifting segment (approx. 10–12% of the organized market), Pistabarfi aims for a niche worth ₹2,500+ Crore.

3. Pistabarfi: Ideal Target Audience & Demographics

- Primary Audience (The “Aspirational Gen Z”): Ages 18–27; value “Instagrammable” aesthetics; 50% want their mithai to look photogenic.

- Secondary Audience (The “Modern Health-Conscious Family”): Ages 28–45; urban dwellers in Tier 1 cities; seeking “guilt-free” treats for children and elderly.

- Gifting Segment: Corporate HRs and Wedding Planners looking for premium, “on-the-go” alternatives to traditional bulky boxes.

4. Pistabarfi: Marketing & Content Strategy

- The “Mithai Bar” Narrative: Position Pistabarfi not as a “box of sweets” but as a “snackable bar,” competing directly with premium chocolate brands like Ferrero Rocher or Lindt.

- Visual Content: High-fidelity “Aesthetic Food Porn” videos for Instagram/TikTok focusing on the “mouth-melting” texture and premium ingredients.

- Influencer Collaboration: Partner with fitness influencers (highlighting lower sugar) and lifestyle vloggers (highlighting the “cool” packaging).

5. Pistabarfi: Digital Marketing & SEO Recovery Plan

- SEO Overhaul: Pivot from “Pista Barfi” (high competition) to long-tail keywords like “Low sugar premium Indian sweets” and “Gifts for Gen Z foodies.”

- Performance Marketing: Run Meta/Google Ads targeting “Wedding Gifting” and “Corporate Festive Gifts” 45 days prior to major festivals (Diwali, Holi, Rakhi).

- Conversion Optimization: Improve the Shopify store’s load speed and implement “Quick Buy” buttons to reduce the current organic bounce rate.

6. Pistabarfi: Distribution & Omni-Channel Strategy

- D2C Focus: Use the Shopify website as the primary high-margin channel.

- Quick Commerce (Q-Comm): Partner with Blinkit/Zepto for “Instant Cravings” (crucial for Gen Z who prioritize convenience).

- Premium Retail: Shop-in-shop models in high-end airports (Mumbai/Delhi) and luxury grocery chains (Nature’s Basket).

- Global Exports: Target the Indian diaspora in UAE, USA, and UK via specialized export-quality vacuum packaging.

7. Pistabarfi: Advantages & Success Factors

- Innovation: The “Bar” format solves the messiness of traditional mithai.

- Trust: 50+ years of family heritage provides a moat against “new-age only” brands.

- Supply Chain: Cloud kitchen model in Mumbai keeps overheads low while maintaining quality control.

8. Pistabarfi: Challenges & Mitigation Strategies

| Challenge | Pistabarfi Mitigation Strategy |

| Short Shelf Life | Use modified atmosphere packaging (MAP) to extend freshness without preservatives. |

| High Ingredient Costs | Bulk sourcing contracts for premium pistachios to hedge against commodity price spikes. |

| Intense Competition | Double down on the “low sugar” and “modern format” USP to remain distinct from Haldiram’s or Bikanervala. |

9. Pistabarfi: Future Business Roadmap & Valuation Growth

- Phase 1 (Year 1): Fix SEO, scale monthly organic traffic from 2,500 to 25,000, and hit ₹10 Cr ARR.

- Phase 2 (Year 2-3): Launch “Subscription Boxes” for monthly healthy snacking; expand to 5 major metro cloud kitchens.

- Phase 3 (Year 5): International expansion and potential acquisition/IPO.

- Valuation Lever: Transitioning from a “Sweet Shop” multiple (2-3x EBITDA) to a “D2C Brand” multiple (5-8x Revenue) by proving high customer retention and digital scale.

Pistabarfi Shark Tank India Episode Review