Mishmash Naturals Shark Tank India Episode Review

Mishmash Naturals appeared on Shark Tank India Season 5, Episode 23, with founders Kanika Singh Chopda, Labdhi Chopda, and Aditi Chaturvedi from Raipur seeking ₹50 lakh for 2% equity (₹25 Crore valuation) but left with no deal after all Sharks backed out citing multiple concerns.

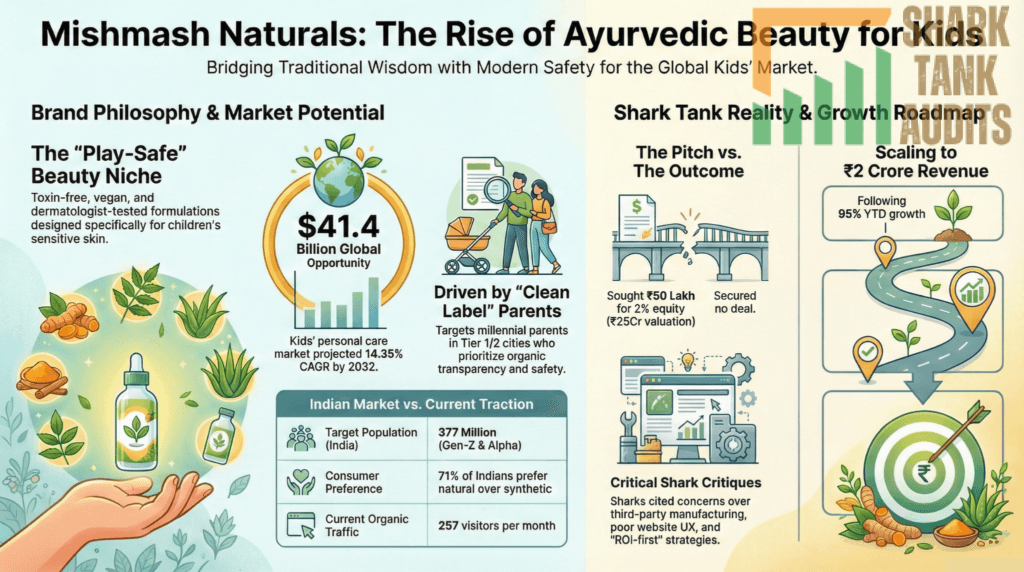

Positioned as India’s first Ayurvedic toxin-free beauty/personal care brand for children aged 3-14, the venture was inspired after Kanika’s daughter suffered adverse reaction to adult cosmetics during school function, offering vegan cruelty-free dermatologist-tested products (Ayurvedic Play Safe Makeup Set with natural beetroot/sunflower wax ingredients, sunscreen, shampoo, lotion, body wash, hair oil) free from parabens/sulfates/artificial fragrances, growing from ₹22 lakh (FY24-25) to ₹43 lakh YTD projecting ₹2 Crore (FY25-26) with 90% sales from website and prior ₹2.4 Crore funding from Inflection Point Ventures and IIT Delhi Angels Network with 257 monthly organic visitors. Sharks criticized extensively—Vineeta questioned “ROI-first vs consumer-first” approach and third-party manufacturing undermining formulation uniqueness, Anupam challenged improper market size analysis, Namita expressed dissatisfaction with packaging and website UX, and Kanika found pricing/margins unimpressive.

Operating in kids’ personal care market valued at $14.17 billion (2024) projected to reach $41.42 billion by 2032 (14.35% CAGR) with children’s cosmetics growing 6.33% CAGR within $30-35 billion Indian BPC industry by 2030 amid rising “Sephora Kids” phenomenon and 377 million Gen-Z/Alpha population (ages 3-14), Mishmash targets millennial/Gen-X parents (28-45, ₹1 lakh+ monthly dual-income households) in Tier 1/2 cities prioritizing “clean labels” and ingredient transparency as 71% of Indian consumers prefer natural over synthetic beauty products.

Website Information

- Website:- Mishmash Naturals

- Build on Shopify

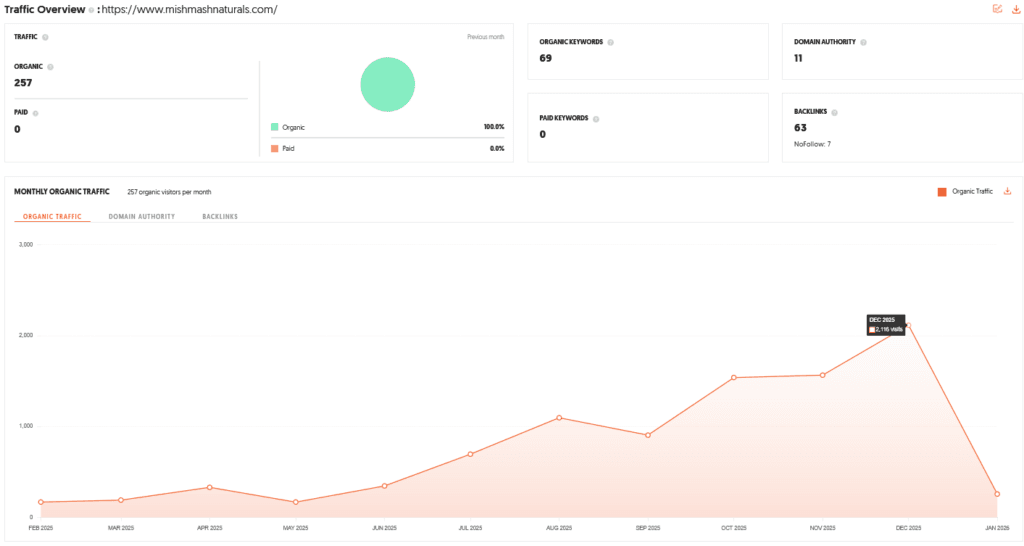

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 257 visitors per month

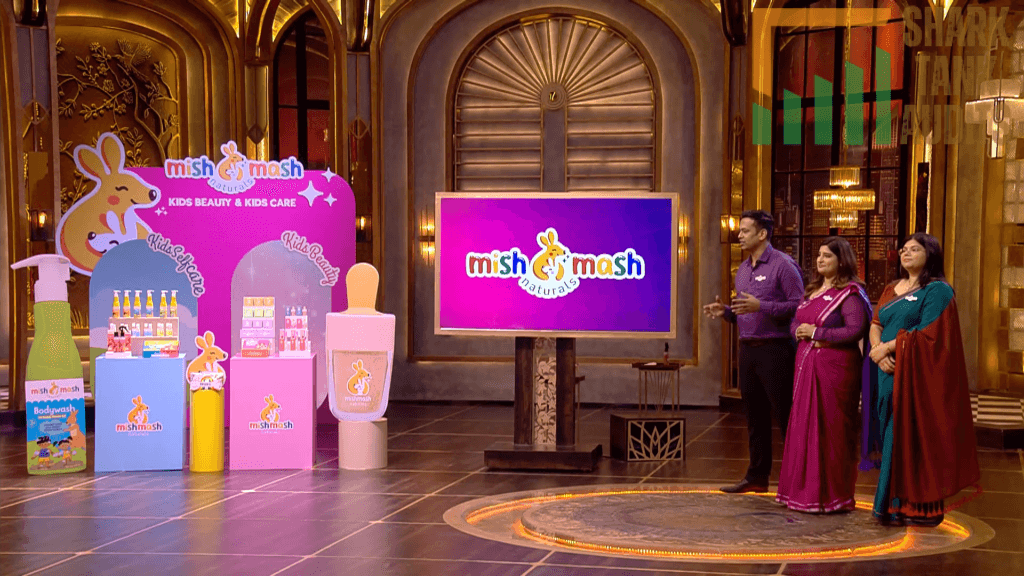

Founders of Mishmash Naturals

- The brand was founded in Raipur by Kanika Singh Chopda, Labdhi Chopda, and Aditi Chaturvedi.

- The inspiration for the venture was deeply personal; after Kanika’s daughter suffered an adverse reaction to adult cosmetics used during a school function, the trio identified a significant gap in the Indian market for safe, kid-centric beauty and skincare products.

Brand Overview of Mishmash Naturals

- Mishmash Naturals is positioned as India’s first Ayurvedic, toxin-free beauty and personal care brand specifically formulated for children aged 3 to 14. The brand emphasizes a “clean” philosophy, offering products that are vegan, cruelty-free, and dermatologist-tested.

- Every formulation is free from parabens, sulfates, and artificial fragrances, bridging the gap between traditional Ayurvedic wisdom and modern safety standards.

Shark Tank India Appearance and Ask for Mishmash Naturals

- Appearing in Season 5, Episode 23 (aired February 4, 2026), the founders sought to secure an investment of ₹50 Lakhs for 2% equity, valuing the company at ₹25 Crores.

- They aimed to utilize the platform to highlight the underappreciated niche of children’s beauty and to scale their ecosystem of “play-safe” products.

Season and Episode Air Date

- Season: 05

- Episode: 23

- Episode Air Date: Wednesday, 04 February, 2026

Product Overview of Mishmash Naturals

The brand moves beyond “miniature adult products” to create age-appropriate formulations. Their portfolio includes:

- The Ayurvedic Play Safe Makeup Set: Featuring blush, eyeshadow, lip balms, and glosses made from natural ingredients like beetroot and sunflower wax.

- Ayurvedic Sunscreen: Specifically designed for delicate, young skin.

- Personal Care Range: A comprehensive line including shampoo, lotion, body wash, and hair oil tailored for sensitive, growing bodies.

Investor Reactions to Mishmash Naturals

The Sharks expressed several critical concerns that led to their withdrawal:

- Vineeta Singh: Critiqued the “ROI-first” vs. “Consumer-first” approach and questioned the uniqueness of formulations since manufacturing is handled by a third party.

- Anupam Mittal: Challenged the market size analysis, suggesting the brand’s understanding of the growth potential was improper.

- Namita Thapar: Expressed dissatisfaction with the packaging and the user experience of the brand’s website.

- Kanika: Was unimpressed by the current pricing structure and financial margins.

Customer Engagement Philosophy of Mishmash Naturals

- Mishmash Naturals focuses on building parental trust through transparency.

- Their philosophy centers on “play-safe beauty,” ensuring that children can explore self-expression without the risks associated with adult chemicals.

- They maintain a direct connection with their audience, with 90% of their sales coming directly from their own website.

Product Highlights of Mishmash Naturals

The brand’s financial and quality benchmarks include:

- Revenue Growth: Scaled from ₹22 Lakhs in FY24-25 to ₹43 Lakhs YTD.

- Funding History: Previously raised ₹2.4 Crores in cumulative funding from Inflection Point Ventures (IPV) and the IIT Delhi Angels Network.

- Safety Standards: Use of mild, botanical materials like shea butter and beetroot, combined with rigorous dermatological testing.

Future Vision for Mishmash Naturals

- Despite the lack of a Shark Tank deal, Mishmash Naturals aims to reach a projected revenue of ₹2 Crores for FY25-26.

- Their roadmap involves enhancing distribution channels, improving unit economics, and expanding their product line to become the definitive leader in the Ayurvedic personal care space for the 3–14 age demographic.

Deal Finalized or Not for Mishmash Naturals

- No deal was finalized.

- Despite the impressive growth and the unique market segment, all Sharks chose to back out.

- The brand left the tank without an investment from the panel, though the founders remained optimistic about the brand’s visibility and future outside the show.

| Category | Details |

|---|---|

| Website | Mishmash Naturals |

| Website Platform | Shopify |

| SEO Performance | Poor SEO performance; improvement needed |

| Organic Traffic | ~257 visitors/month |

| Founders | Kanika Singh Chopda, Labdhi Chopda, Aditi Chaturvedi |

| Founder Location | Raipur, India |

| Founder Inspiration | Child’s adverse reaction to adult cosmetics |

| Problem Identified | Lack of safe, kid-specific beauty & skincare in India |

| Brand Positioning | India’s first Ayurvedic, toxin-free kids’ beauty brand |

| Target Age Group | Children aged 3–14 years |

| Brand Philosophy | “Play-safe beauty” with complete ingredient transparency |

| Product Ethics | Vegan, cruelty-free, dermatologist-tested |

| Free-From Claims | No parabens, sulfates, artificial fragrances |

| Shark Tank Season | Season 05 |

| Episode Number | Episode 23 |

| Episode Air Date | Wednesday, 04 February 2026 |

| Shark Tank Ask | ₹50 Lakhs for 2% equity |

| Implied Valuation | ₹25 Crores |

| Pitch Objective | Scale children-centric beauty ecosystem |

| Core Product Strategy | Not “mini adult products” – age-appropriate formulations |

| Flagship Product | Ayurvedic Play Safe Makeup Set |

| Makeup Ingredients | Beetroot, sunflower wax, botanical pigments |

| Other Key Products | Ayurvedic sunscreen, shampoo, lotion, body wash, hair oil |

| Skin Safety Focus | Designed for delicate, developing skin |

| Primary Sales Channel | D2C Website |

| D2C Contribution | ~90% of total sales |

| Revenue FY 24–25 | ₹22 Lakhs |

| Revenue YTD Growth | ₹43 Lakhs |

| Previous Funding Raised | ₹2.4 Crores |

| Investors (Pre-Shark Tank) | Inflection Point Ventures, IIT Delhi Angels |

| Vineeta Singh’s Concern | Third-party manufacturing, lack of uniqueness |

| Anupam Mittal’s Concern | Market sizing & growth assumptions |

| Namita Thapar’s Concern | Packaging, website UX/UI |

| Kanika Tekriwal’s Concern | Pricing and margin structure |

| Shark Verdict | All Sharks opted out |

| Deal Status | ❌ No Deal |

| Customer Engagement Philosophy | Build parental trust via safety & transparency |

| Core Trust Driver | Founder’s real-life parenting story |

| Indian BPC Market Size | $30–35 Billion by 2030 |

| Ayurvedic Preference | 71% Indian consumers prefer natural products |

| Kids Personal Care Market | $14.17B (2024) → $41.42B (2032) |

| Kids Market CAGR | 14.35% |

| Children’s Cosmetics CAGR | 6.33% |

| Gen Z + Alpha Population (India) | ~377 million |

| Primary Buyer Persona | Parents (Ages 28–45) |

| Income Segment | ₹1 Lakh+ monthly household income |

| Geographic Focus | Tier 1 & Tier 2 cities |

| Psychographic Traits | Health-conscious, social-media active parents |

| Marketing Core Idea | Mother-to-mother community storytelling |

| Content Strategy | GRWM reels, safe-play demonstrations |

| Digital Innovation | Skin compatibility quiz (zero-party data) |

| SEO / GEO Focus | Conversational & voice-based queries |

| Marketplace Expansion Plan | FirstCry, Amazon Launchpad, Nykaa Kids |

| Quick Commerce Plan | Zepto / Blinkit for daily-use SKUs |

| Key Advantage | First-mover in Ayurvedic kids’ beauty |

| Founder Strength | High trust due to personal story |

| Retention Potential | Strong due to personal care SKUs |

| Key Challenges | Third-party manufacturing dependency |

| Operational Risk | High CAC in niche category |

| Brand Weakness Identified | Packaging & website experience |

| Manufacturing Mitigation | Hybrid model with proprietary formulations |

| Branding Mitigation | Premium, sustainable-luxe redesign |

| FY 25–26 Revenue Target | ₹2 Crores |

| Year 2 Expansion | “Mishmash Juniors” (Ages 10–14) |

| Year 3 Expansion | Middle East & SE Asia |

| Subscription Strategy | Restock & Save for shampoos & oils |

| Tech Roadmap | AR Try-On (Virtual Mirror) |

| Strategic Partnerships | Preschools & kids activity centers |

| Long-Term Vision | Category leader in Ayurvedic kids’ personal care |

Mishmash Naturals Shark Tank India Business Plan

1. Market Potential in India for Mishmash Naturals

India is currently one of the fastest-growing markets for specialized personal care. As of 2026, the beauty and personal care (BPC) industry is projected to reach $30–$35 billion by 2030.

- The “Sephora Kids” Phenomenon: A rising global and domestic trend where children and pre-teens are engaging with complex skincare and beauty routines earlier, driven by social media.

- Ayurvedic Renaissance: With 71% of Indian consumers preferring natural beauty products over synthetic ones, the “Ayurvedic” tag of Mishmash Naturals serves as a powerful trust-builder.

- Health-Conscious Parenting: In urban India, parents are increasingly moving away from “mass-market” chemicals, with a 100% growth rate seen in niche D2C brands that prioritize ingredient transparency.

2. Total Addressable Market (TAM) for Mishmash Naturals

The opportunity for Mishmash Naturals spans across baby care and teen cosmetics.

- Kids’ Personal Care Market: Valued at approximately $14.17 Billion in 2024, expected to reach $41.42 Billion by 2032 with a CAGR of 14.35%.

- Children’s Cosmetics Segment: This niche is growing at a CAGR of 6.33%, with parents increasingly seeking “play-safe” alternatives to adult makeup.

- Gen-Z & Alpha Influence: India has the largest population of Gen-Z and Gen-Alpha (approx. 377 million), with children aged 3–14 representing a significant portion of this discretionary spending power.

3. Ideal Target Audience and Demographics for Mishmash Naturals

The brand’s primary purchaser is the parent, while the consumer is the child.

- Primary Audience: Millennial and Gen-X parents (Ages 28–45) in Tier 1 and Tier 2 cities (Raipur, Mumbai, Delhi, Bengaluru).

- Demographic Profile: Dual-income households with a monthly income of ₹1 Lakh+, who prioritize “clean labels” and organic certifications.

- Psychographics: Parents who are active on Instagram/YouTube, concerned about skin allergies (as seen in the founder’s story), and value “educational play” over pure aesthetics.

4. Marketing Strategy for Mishmash Naturals

The core strategy must transition from “functional selling” to “community-led storytelling.”

- The “Mother-to-Mother” Loop: Leveraging the founders’ personal story to build a community of “Mishmash Moms” who share safe-play tips.

- Safety First: Highlighting Dermatologist-tested and Toxin-free labels as non-negotiable brand pillars.

- Trial & Experience: Offering mini-kits (Ayurvedic Play Safe Makeup Set) to lower the barrier for first-time buyers.

5. Content and Digital Marketing Strategy for Mishmash Naturals

Given the 2026 digital landscape, the focus must shift from keywords to Generative Engine Optimization (GEO).

- Short-Form Video (Reels/Shorts): “Get Ready With Me” (GRWM) videos featuring children using the Mishmash Naturals makeup set in a playful, safe environment.

- Interactive Quizzes: A “Skin Compatibility Quiz” on the Shopify site to capture zero-party data, helping parents choose the right shampoo or sunscreen.

- SEO & GEO Overhaul: Optimizing for voice and conversational AI queries like “Is Ayurvedic makeup safe for a 7-year-old?” to improve the current low organic traffic (257 visitors/month).

6. Distribution Strategy for Mishmash Naturals

To scale from ₹43 Lakhs YTD to ₹2 Crores, the brand needs an omnichannel presence.

- D2C Website (Shopify): Maintain as the primary hub (currently 90% of sales) for high-margin retention and data.

- E-commerce Marketplaces: Aggressive expansion on FirstCry, Amazon (D2C Launchpad), and Nykaa Fashion (Kids section).

- Quick Commerce (Q-Commerce): Partnering with Zepto or Blinkit for high-frequency items like sunscreen and shampoo in metro clusters.

7. Advantages and Challenges for Mishmash Naturals

| Advantages of Mishmash Naturals | Challenges for Mishmash Naturals |

| First-mover advantage in “Ayurvedic Kids Beauty.” | Third-party manufacturing dependency (concern from Vineeta Singh). |

| Strong personal founder story (Trust Factor). | High Customer Acquisition Cost (CAC) in the niche. |

| High retention potential through personal care range. | Criticisms regarding packaging and website UI/UX. |

8. Success Factors and Mitigation Strategies for Mishmash Naturals

- Why it can succeed: The brand solves a “pain point” (safety) rather than a “vanity point.”

- Mitigation for Manufacturing: Moving toward a hybrid manufacturing model where proprietary formulations are owned and audited by the brand to satisfy investor concerns.

- Mitigation for Packaging: Re-branding to a more premium, “sustainable-luxe” aesthetic to appeal to high-spending urban parents (addressing Namita Thapar’s critique).

9. Future Business and Roadmap for Mishmash Naturals

- Year 1 (2026): Focus on Unit Economics and SKU rationalization. Target: ₹2 Crore Revenue.

- Year 2: Launch of “Mishmash Juniors” (Ages 10–14) specifically for adolescent skin changes.

- Year 3: International expansion into the Middle East and SE Asia markets where “Ayurveda” has high export value.

10. Roadmap to Increase Valuation for Mishmash Naturals

To justify and exceed the ₹25 Crore valuation, the brand must focus on these levers:

- Subscription Model: Introduce a “Restock & Save” subscription for shampoos and oils to increase Customer Lifetime Value (LTV).

- Tech Integration: Implement AR Try-On (Virtual Mirror) on the website so kids can “try” the eyeshadows safely before parents purchase.

- Strategic Partnerships: Collaborating with premium preschools and activity centers for “clean beauty workshops,” turning the brand into a lifestyle choice.

Mishmash Naturals Shark Tank India Episode Review