Nootie Shark Tank India Episode Review

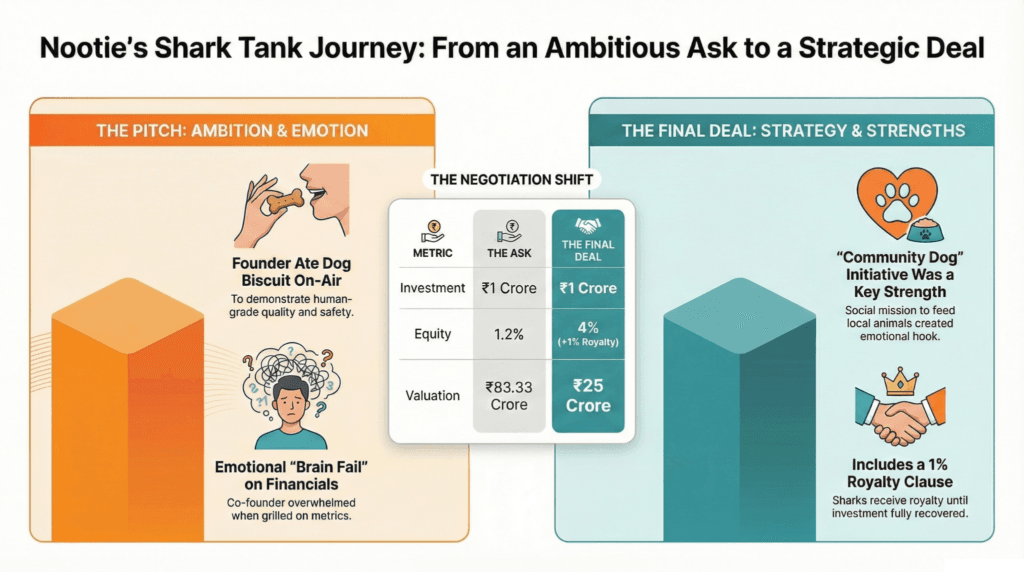

Nootie appeared on Shark Tank India Season 5, Episode 6, in a “Face-Off” against Smylo, with founders Akshay, Karan, and Anil Mahendru seeking ₹1 Crore for 1.2% equity (₹83.33 Crore valuation). After an emotional pitch where Akshay struggled with financial metrics, they closed a deal for ₹1 Crore for 4% equity with 1% royalty until recovered (₹25 Crore valuation) with Sharks Namita Thapar and Anupam Mittal.

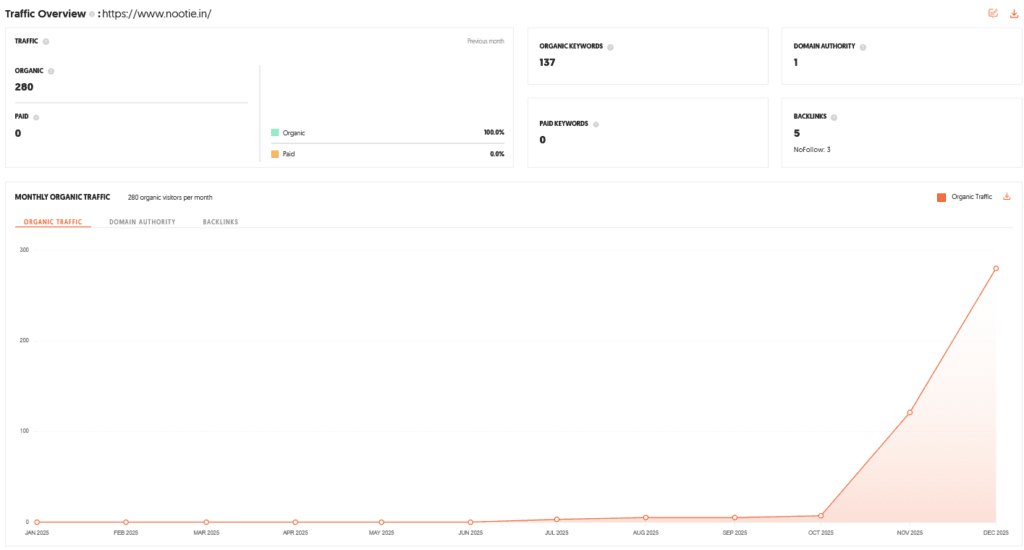

Nootie Website Information

- Website:- Nootie

- Build on Shopify

- Poor SEO Performance, SEO Improvement Needed.

- ORGANIC TRAFFIC: 280 visitor per month.

Nootie Founder

- The brand is a family-led venture founded by Akshay Mahendru, Karan Mahendru, and Anil Mahendru.

- During the pitch, Akshay took the lead in defending the brand’s vision.

- He displayed a deeply personal connection to the business, describing himself as a “mama’s boy” and becoming visibly emotional due to the high stakes of the platform and his passion for the pet care industry.

Nootie Brand Overview

- Nootie is a Delhi-based pet care brand that operates as a “house of brands.”

- Unlike many modern startups that focus solely on e-commerce, Nootie is built on a foundation of eight physical retail stores across Delhi that were operational before the brand’s inception.

- They aim to provide an all-encompassing solution for pet owners, ranging from food to hygiene.

Nootie Shark Tank India Appearance & Ask

The founders presented their business to Sharks Anupam Mittal, Namita Thapar, Vineeta Singh, Kunal Bahl, and Varun Alagh.

- The Ask: Rs 1 crore for 1.2% equity.

- Valuation Sought: Rs 83.33 crore.

- Key Moment: The pitch became high-intensity when the founders were grilled on their financial metrics, leading to an emotional “brain fail” for Akshay.

Nootie Season and Episode Air Date

- Season: 05

- Episode: 06

- Episode Air Date: Monday, 12 January 2026

Nootie Product Overview

- Nootie offers an extensive catalog of pet products designed to be affordable and high-quality.

- To demonstrate the safety of their “human-grade” ingredients, one of the founders actually ate a portion of their dog biscuit during the pitch.

- Their inventory includes everything from nutritional meals to grooming accessories, heavily influenced by demand trends on quick-commerce platforms.

Nootie Investor Reactions

The Sharks had mixed reactions to the business model:

- Strategic Concerns: Varun Alagh was critical of the founders’ admission that they were “not good marketers” and that they added products simply because quick-commerce apps requested them.

- Empathy: When Akshay became overwhelmed by the numbers, Anupam Mittal and Varun Alagh offered comfort, acknowledging the pressure of the environment.

- Admiration: Namita Thapar was particularly impressed by their social consciousness regarding stray animal welfare.

Nootie Customer Engagement Philosophy

- The founders follow a philosophy of “community care.”

- They strictly refer to street animals as “community dogs” rather than strays, arguing that these animals are integral parts of the neighborhoods they live in.

- Their engagement is built on empathy and accessibility, ensuring that even those with limited means can afford to feed local animals.

Nootie Product Highlights

- Community Dog Biscuits: A standout product priced at Rs 10 (sold via Swiggy Instamart), specifically designed for feeding community dogs without a high profit motive.

- Pricing Advantage: Their primary differentiator is a low-price point, which they achieve despite not manufacturing the goods themselves.

- Omnichannel Reach: A rare combination of legacy brick-and-mortar stores and modern quick-commerce distribution.

Nootie Future Vision

- The Mahendru family envisions Nootie becoming a household name in pet care by maintaining their “house of brands” strategy.

- While the Sharks advised them to be more selective to build a stronger brand identity, the founders aim to continue scaling by listening to market demands and providing “human-grade” nutrition at prices the average Indian consumer can afford.

Nootie Deal Finalized or Not

- Yes, a deal was finalized. While the Sharks initially pushed back on the valuation and the lack of brand focus, two Sharks saw potential in the founders’ grit and sales figures.

- Final Deal: Rs 1 crore for 4% equity with Shark Namita Thapar & Anupam Mittal.

- Royalty: 1% royalty until the investment amount is recovered.

- Final Valuation: Rs 25 crore.

| Particular | Details |

|---|---|

| Website | Nootie |

| Organic Monthly Traffic | 280 |

| Founders | Akshay Mahendru, Karan Mahendru, Anil Mahendru |

| Founder Background | Family-led venture |

| Pitch Lead | Akshay Mahendru |

| Founder Personality Highlight | Described himself as a “mama’s boy” |

| Emotional Moment | Akshay became emotional during the pitch |

| Brand Location | Delhi, India |

| Business Model | House of brands |

| Retail Presence | 8 physical retail stores across Delhi |

| Pre-brand Foundation | Stores were operational before brand inception |

| Core Offering | End-to-end pet care solutions |

| Product Range | Pet food, hygiene, grooming, accessories |

| Shark Tank India Sharks | Anupam Mittal, Namita Thapar, Vineeta Singh, Kunal Bahl, Varun Alagh |

| Initial Ask | ₹1 crore |

| Equity Asked | 1.2% |

| Valuation Sought | ₹83.33 crore |

| Key Pitch Moment | High-intensity financial questioning |

| Pitch Challenge | Founder faced a “brain fail” on numbers |

| Product Positioning | Affordable and high-quality pet products |

| Ingredient Claim | Human-grade ingredients |

| Product Demonstration | Founder ate dog biscuit on-air |

| Product Development Driver | Quick-commerce demand trends |

| Investor Reaction Type | Mixed reactions |

| Strategic Concern | Weak marketing capability |

| Concern Raised By | Varun Alagh |

| Marketing Approach Criticism | Products added based on quick-commerce requests |

| Emotional Support By | Anupam Mittal and Varun Alagh |

| Social Impact Appreciation | Focus on stray animal welfare |

| Appreciation By | Namita Thapar |

| Customer Philosophy | Community care |

| Terminology Used | “Community dogs” instead of strays |

| Social Belief | Community dogs are part of neighborhoods |

| Accessibility Focus | Affordable feeding options for all |

| Highlight Product | Community Dog Biscuits |

| Highlight Product Price | ₹10 |

| Sales Channel | Swiggy Instamart |

| Profit Motive | Low-profit, social-driven |

| Pricing Advantage | Low price point |

| Manufacturing Model | Third-party manufacturing |

| Distribution Strength | Omnichannel presence |

| Offline Channel | Legacy brick-and-mortar stores |

| Online Channel | Quick-commerce platforms |

| Future Brand Vision | Become a household pet care name |

| Long-term Strategy | Continue house of brands approach |

| Shark Advice | Be more selective with products |

| Scaling Approach | Listen to market demand |

| Nutrition Focus | Human-grade nutrition |

| Deal Status | Deal finalized |

| Initial Shark Pushback | Valuation and brand focus |

| Investing Sharks | Namita Thapar and Anupam Mittal |

| Final Investment | ₹1 crore |

| Final Equity Given | 4% |

| Royalty Clause | 1% until investment recovery |

| Final Valuation | ₹25 crore |

| Industry Trend | Pet humanization |

| Market Size Projection | $7 billion by 2028 |

| Industry Growth Rate | ~20% CAGR |

| Competitive Edge | Legacy retail experience |

| Pet Population Projection | 58.7 million by 2028 |

| India Pet Market Value | ₹35,000 crore |

| Target Segment | Urban mid-premium |

| SAM Share | ~70% of pet food sales |

| SOM Target | 5–8% of organized urban market |

| Primary Audience | Urban Millennials and Gen Z |

| Pet Perception | Pets viewed as children |

| Income Target | ₹10L+ annual household income |

| Geography Focus | Tier 1 and Tier 2 cities |

| Community Segment | Local feeders and animal lovers |

| Content Strategy | Educational empathy |

| Video Content Focus | Ingredient testing |

| Social Proof Strategy | User-generated content |

| Performance Marketing | Meta & Google Ads |

| Target Keywords | Affordable dog food, grain-free treats |

| Influencer Strategy | Pet influencers and rescue activists |

| Distribution Model | Omnichannel flywheel |

| Offline Usage | Experience centers and micro-fulfillment |

| Quick Commerce Platforms | Blinkit, Zepto, Instamart |

| Delivery Promise | 10-minute delivery |

| D2C Strategy | Subscription-based repeat purchases |

| Key Advantage | Retail data and experience |

| Pricing Strength | Affordable quality products |

| Emotional Brand Hook | Community dog initiative |

| Major Challenge | Market saturation |

| Big Competitors | Nestlé Purina, Reliance |

| Brand Risk | Commodity perception |

| Supply Chain Risk | Third-party dependency |

| Success Driver | Emotional storytelling + sales volume |

| Financial Mitigation | Hire CFO / Shark guidance |

| Strategic Mitigation | Core brand with extensions |

| Valuation Growth Goal | ₹100 crore+ |

| Phase 1 Plan | Supply chain optimization |

| Phase 1 Timeline | 0–12 months |

| Phase 2 Expansion | Mumbai and Bangalore |

| Phase 2 Timeline | 12–24 months |

| Phase 3 Innovation | Pet-tech and subscriptions |

| Phase 3 Timeline | 24–36 months |

Nootie Shark Tank India Business Plan

1. Business Potential in India for Nootie

The Indian pet care market is currently undergoing a “humanization” revolution.

- Market Growth: The industry is projected to reach $7 billion by 2028, growing at a CAGR of ~20%.

- The “Nootie” Edge: As a family-led venture with eight legacy stores, Nootie is uniquely positioned to capture the shift from unbranded home-cooked meals to packaged nutrition.

- Quick Commerce Explosion: With platforms like Swiggy Instamart and Zepto growing at 95% YoY, Nootie’s early adoption of these channels provides a massive first-mover advantage.

2. Total Addressable Market (TAM) for Nootie

- TAM (Total Addressable Market): India’s pet population is expected to reach 58.7 million by 2028. The total market value for pet products and services is estimated at ₹35,000 crore ($4.2B) in 2026.

- SAM (Serviceable Addressable Market): Nootie targets the urban mid-premium segment, which accounts for ~70% of total pet food sales.

- SOM (Serviceable Obtainable Market): By focusing on the Delhi-NCR region initially and expanding via e-commerce, Nootie can realistically target 5–8% of the urban organized pet care market.

3. Ideal Target Audience and Demographics for Nootie

- Primary Audience: Urban Millennials (33%) and Gen Z (16%) who view pets as “children” rather than “animals.”

- Income Bracket: Households with an annual income of ₹10L+, primarily residing in Tier 1 and Tier 2 cities.

- The “Community Care” Segment: Socially conscious individuals and local feeders who purchase Nootie’s Rs 10 community dog biscuits.

4. Marketing & Content Strategy for Nootie

- Content Strategy:Nootie should focus on “Educational Empathy.”

- Short-form Video: Behind-the-scenes of “human-grade” ingredient testing.

- Social Proof: User-generated content of pets enjoying Nootie treats.

- Digital Marketing Strategy: * Performance Marketing: Targeted Meta/Google ads for keywords like “affordable dog food” and “grain-free pet treats.”

- Influencer Outreach: Partnering with “Pet-fluencers” and animal rescue activists to build brand trust.

5. Distribution Strategy for Nootie

Nootie employs an omnichannel “Flywheel” model:

- Offline Hubs: Using its 8 existing Delhi stores as experience centers and micro-fulfillment hubs.

- Quick Commerce: Aggressive stocking on Blinkit, Zepto, and Instamart for 10-minute delivery.

- D2C Website: Offering subscription models for repeat purchases of Nootie staples.

6. Advantages and Challenges for Nootie

| Advantages of Nootie | Challenges for Nootie |

| Legacy Knowledge: Years of retail data from physical stores. | Market Saturation: Fierce competition from giants like Nestlé (Purina) and Reliance. |

| Pricing Power: High-quality products at an affordable entry point. | Brand Identity: Risk of being seen as a “commodity” rather than a premium brand. |

| Social Credit: Strong emotional hook with “community dog” initiatives. | Supply Chain: Dependence on third-party manufacturing. |

7. Success Factors and Mitigation Strategies for Nootie

- Why Nootie will succeed: The blend of high sales volume and emotional brand storytelling (the “mama’s boy” founder and community focus) creates a “sticky” brand.

- Mitigation for “Brain Fail” (Financials): Nootie must hire a dedicated CFO or utilize the expertise of Sharks Anupam and Namita to streamline unit economics and reporting.

- Mitigation for Strategy Focus: Move from a “House of Brands” to a “Core Brand with Extensions” to prevent resource dilution.

8. Future Vision and Roadmap to Increase Valuation for Nootie

To move from a Rs 25 crore valuation to Rs 100 crore+, Nootie should follow this roadmap:

- Phase 1 (0-12 Months): Optimize the Nootie supply chain and launch 3 “hero” products to build brand recall.

- Phase 2 (12-24 Months): Geographical expansion into Mumbai and Bangalore markets using a “dark store” model.

- Phase 3 (24-36 Months): Integrate Pet-Tech (tracking health via app) and subscription services to build high-margin recurring revenue.

Nootie Shark Tank India Episode Review